Ian Tuttle

Introduction

Roblox Corporation (NYSE:RBLX) is a gaming platform and metaverse company. It is a game engine that allows users to create games as well as play games made by others. The fact that users can both create content as well as consume the content of others is what makes it both a platform and a metaverse company. Roblox monetizes its platform in several ways, primarily through purchases of its proprietary currency “Robux,” which can be spent on content as well as real-world cloud computing assets such as virtual server space. Additionally, it embeds advertisements within its ecosystem and licenses its intellectual property for merchandise.

As of this article, 11/9/2022, Roblox is down 12.67% in pre-market trading in the wake of its Q3 2022 earnings release. This article will look into its latest results and determine the direction that the company is headed, including commentary on applicable nuances that apply to its business.

Earnings & Cash Flow Metrics

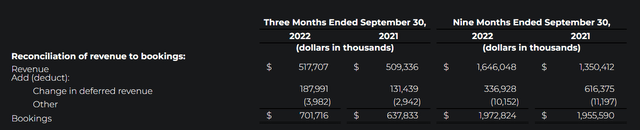

Since Roblox is a platform company wherein a portion of users delivers value to the rest. It distinguishes between Bookings and Revenue. The Bookings metric represents the gross economic activity across its platform, while revenue is the portion that goes to the company itself. Other platform companies such as Uber make the same distinction within their accounting statements.

As to the latest earnings release, Bookings on Roblox beat expectations by $12.47M. Bookings were $701.7M, which was 10% higher YoY and notably 15% higher on a constant currency basis, likely affected by the strongly appreciating US dollar. Revenue came in at $517.7M, a mild uptick of 2% YoY. EPS came in below analyst expectations at -$0.50, which was $0.16 worse than consensus.

ir.roblox.com Q3 2022 Financial Results 11.9.22

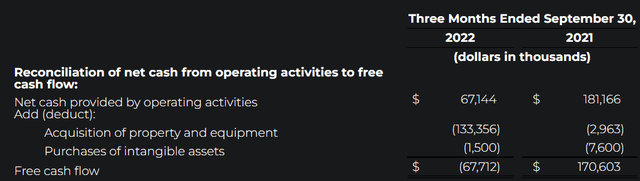

Cash from operations was $67.1M, with free cash flow at -$67.7M.

ir.roblox.com Q3 2022 Financial Results 11.9.22 ir.roblox.com Q3 2022 Financial Results 11.9.22

The firm has a strengthened cash position YoY.

Going back to cash flow, what is immediately interesting to see is that this is a company that was already able to generate free cash flow during Q3 2021 – $170M to be exact.

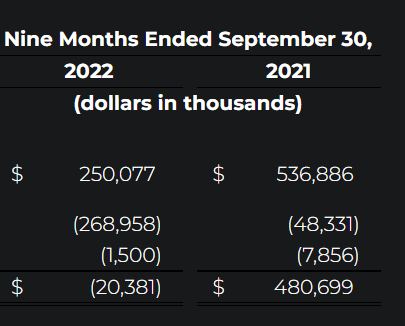

Broadening our scope, we see that the firm actually generated significant free cash flow of $481M during the first 9 months of 2021:

ir.roblox.com Q3 2022 Financial Results 11.9.22

Since “cash is king,” this allows us to look at other financial metrics in a different light. It is evident that for this past quarter, the firm could have been cash flow positive but wasn’t due to investments that it was making for its long-term growth – the property and equipment as well as intangible assets line items.

This is a common story with technology companies, albeit it is more common for them to have never had a cash flow positive quarter. Roblox looks that much better because it is in control of its cash situation but appears to be prioritizing long-term growth.

These investments seem to make sense as the platform/user metrics are robust – a leading critical indicator for any technology company. As per the earnings release, ADAU’s (Average Daily Active Users) increased 24% YoY, with total hours spent on the platform up 20% YoY.

Conclusion

Cutting through the accounting complexity inherent to a business such as this one, I am focused on two things: capacity to generate cash flow, and platform metrics. Roblox has already proven that it can generate positive cash flow, and its platform metrics are indeed robust. While earnings may have been a disappointment this time around, this is not a company that appears to be prioritizing short-term results.

This is a company that is still in growth mode, and it appears to be doubling down on that through its significant investments. With over $2B in annual revenue, it isn’t a small company – but clearly management believes there is market share remaining. Again, the platform metrics corroborate this view. The concern here is the mixed revenue picture, which does not appear consistent or rapidly growing. Hopefully, these additional investments can change this part of the equation for the better.

Synthesizing all of this, I believe the market has repriced Roblox Corporation through too short-term of a lens. A large software company such as this one with ongoing double-digit user growth, as well as the proven capacity to generate cash flow, is rare to find. It appears to be setting itself up for maximum profit generation long term.

If and when Roblox Corporation revenue numbers begin to tick up significantly, that will be a leading indicator of what is to come – significant and sustained profit generation. Overall, I am cautious but see just enough to rate Roblox Corporation a buy for the long-term.

Be the first to comment