Michael M. Santiago

Rivian Automotive, Inc. (NASDAQ:RIVN) reaffirmed its forecast for 2022 for a production of 25K electric-vehicles. Positive business momentum has resulted in a 79% retracement of Rivian Automotive’s stock price from its 52-week low.

The stock remains appealing at its current valuation, owing to reduced supply-chain risks and Rivian Automotive’s substantial cash reserves. While rapidly ramping up production, the stock trades at only 2.5x sales, ex-cash.

Rivian’s Business Is Moving In The Right Direction

Rivian Automotive made rapid progress in growing its business in the second quarter, whether measured by pre-orders or production volume. Rivian Automotive has succeeded in creating strong sales upside in the near term as it grows its order book and produces a greater number of electric-vehicles due to production progress.

Rivian had 98K pre-orders on its books as of June 30, 2022, an increase of 8K since the last update in May. So far, Rivian Automotive’s March 20% price increase for its various EV models has had no effect on pre-orders.

This is good news for Rivian Automotive investors because concerns about inflation and rising EV prices could be used to justify a lower valuation of the company’s stock.

Rivian Automotive is making progress in scaling production and delivering electric-vehicles to its customers as a result of a strong booking situation.

Rivian Automotive produced 4,401 electric-vehicles and delivered 4,467 EVs in 2Q-22. Because of excess production in the second quarter, the higher delivery number in 2Q was possible. Rivian Automotive has now produced over 8000 electric-vehicles since its inception.

Rivian Automotive also reiterated its forecast of 25K electric-vehicles leaving its factories this year. This means that the EV company anticipates being able to produce approximately 9K electric-vehicles on average in the third and fourth quarters, which is more than double the production volume in 2Q-22.

I believe we will see a larger increase in production near the end of the year as Rivian Automotive fine-tunes and calibrates its production lines. Only by achieving this average level of production will Rivian Automotive be able to meet its production target, indicating that management is clearly optimistic that supply-chain risks are no longer as significant as they were at the start of the year.

A Lot Of Potential, If You Can Bear The Losses

Rivian Automotive’s sales are expected to improve as production ramps up, but profits are unlikely to materialize for investors in the near term.

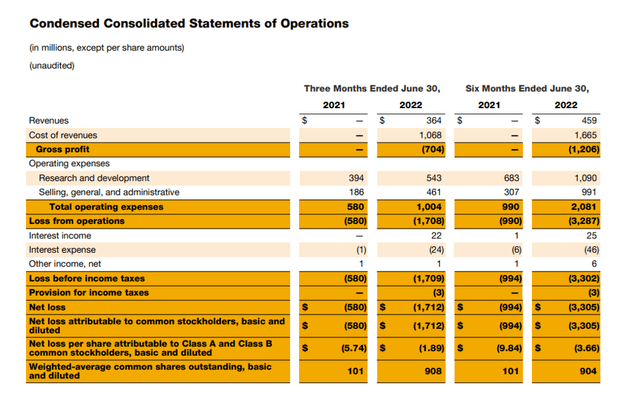

The electric-vehicle company lost $1.0 billion, or $9.84 per share, in the first six months of 2022, but these figures are misleading. Only this year have investors seen a significant increase in production numbers and pre-orders, indicating that the future will be far more exciting than the past.

Rivian Automotive is aggressively investing in production capacity, and I expect the EV company to produce 100,000 electric-vehicles per year by 2024.

I am not aware of any other electric-vehicle company that has been able to achieve such rapid scaling of EV production in such a short period of time.

Condensed Consolidated Statements Of Operations (Rivian Automotive)

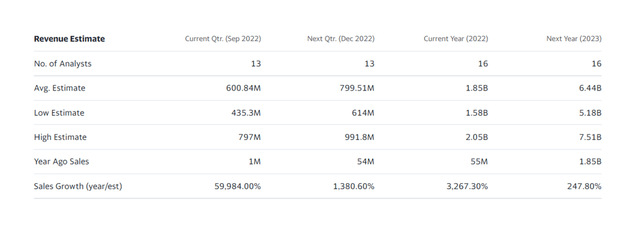

The market continues to forecast a 248% increase in sales to $6.44 billion next year. Assuming an average EV sales price of $85K, the market expects 76K electric-vehicles to be produced. I believe that increasing output is ambitious, but not impossible.

Even with a slightly lower sales volume of $6.0 billion, Rivian Automotive has an appealing stock valuation. After deducting $14.9 billion in cash, the cash-corrected market value is $16.1 billion, with a sales multiple of 2.7x. Even after RIVN has risen 79% from its lows, the sales multiple for an EV company expected to grow sales 248% next year is low enough to warrant a stock purchase.

Revenue Estimate (Rivian Automotive)

Why Rivian Automotive Could See A Lower Valuation

Rivian Automotive’s business advanced in the second quarter, and executives reaffirmed the EV company’s production guidance for 2022.

Rivian will produce approximately 25K electric-vehicles this year, demonstrating that supply-chain risks are not worsening. A deteriorating supply-chain situation for electric-vehicle parts, on the other hand, may put Rivian’s 2022 production guidance at risk.

My Conclusion

Rivian Automotive has recovered from its 52-week low of $19.25 and has increased by 79% since then. Having said that, I believe the company is on the right track in general, and the stock price trend is pointing in the right direction.

Sales are expected to increase significantly in 2023 as production capacity expands, and the company’s pre-order status demonstrates that inflation is not (yet) slowing demand for Rivian Automotive’s electric-vehicles.

Rivian Automotive’s ex-cash valuation is very reasonable, so I believe RIVN has the potential for a higher valuation.

Be the first to comment