adamkaz/E+ via Getty Images

A big journey over a short time, Rithm Capital (NYSE:RITM) started as a mortgage servicing rights operator about 10 years ago. It has since morphed from a third party managed REIT (Fortress) to an internally managed REIT that originates, services and trades residential and commercial mortgages as well as related businesses like title insurance. RITM is growing, not just assets, but business lines.

Since transitioning away from Fortress and changing its name from New Residential, RITM has come to view the refreshed investment landscape as a whole new world. They are sort of recreating Fortress in miniature, which makes sense – do what you know.

Opportunistic acquisitions like Caliber are powering RITM’s expansion into an almost 360 degree mortgage origination and servicing business for consumers and businesses. To quote CEO Michael Nierenberg:

“Just on the Caliber transaction to give everybody a sense closed August of 2021, the return on equity to date, including all the origination gains, losses and MSRs where we booked that is a 29% IRR. Just to give you a metric to point out.”

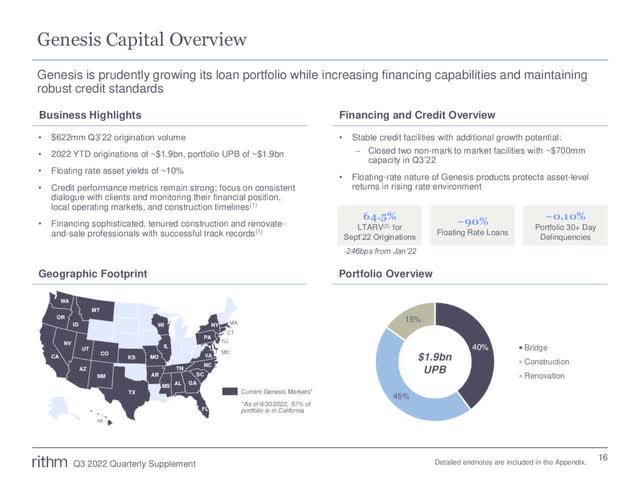

One of its more recent deals, Genesis Capital, originates in the commercial mortgage sector:

RITM Q3 ’22 Investor Presentation (RITM Capital)

But that’s not all folks, RITM is working to manage 3rd Party capital for fees and create private equity pools to invest in other areas. Again Michael Nierenberg said:

“If you take a step back, we’ve always managed third-party capital, whether in our lives as we go back to our so-called fortress days. As you think about the world today, our equity, our book value is 12% and change. Our stock trades $8 and change today.

So a big discount to book. And one of the things that we take a step back and look at what are the opportunities for us to deploy capital and how do we think about that capital deployment? So we are going to leverage our expertise, I would say, in financial services. If you look at the team, there’s – and I mentioned this earlier in the call, there’s a ton of experience that we have in-house. We just announced the Senlac deal with David Welsh and his team.”

Strengths, Weaknesses, Opportunities and Threats (SWOT)

We admire entrepreneurial management in general. Hiring folks to just mind the store only harvests assets; we prefer managers who:

- Take managed risks,

- Evaluate results; and

- Grow the good ones.

RITM has yet to prove it can diversify successfully only because it’s so new as a standalone entity. So let’s do an old-fashioned SWOT analysis to get a sense for its changing future.

Strengths

1. Naturally hedged businesses outside of owning mortgages – Mortgage Servicing Rights (MSRs) gain value when new mortgages are out of favor and origination is losing money. The opposite happens when new mortgages are in favor.

2. Seasoned management with seasoned assets are always a plus – We have that here. We credit management with repositioning the portfolio more effectively than many others as interest rates took off earlier this year:

“how we’re positioned in the current market. Inflation continues to rear its head. So how – what we’re going to do remain defensive, $1.8 billion of cash and liquidity, make sure all of our fixed rate assets are hedged. And then at some point, we’ll pivot when the Fed signals that they’re going to either slowdown their rate increases and/or we think that the mortgage basis will tighten.”

Further:

“As we think about the housing market, with home prices likely to continue a slight decline, we have lowered our LTVs and tightened our underwriting guidelines. On the single-family rental business, Adoor, we stopped acquiring units with the belief that we will be able to deploy capital at higher cap rates as we go forward. There will be an opportunity for us to increase and acquire units as home prices decline and cap rates increase.”

And finally:

“Our MSR portfolio remains unhedged, and our positive duration assets across the company have been hedged for rate risk. We have $12 billion today of custodial deposits. And as the Fed continues to increase rates in the short end, we will continue to see more interest income as it relates to those deposits.

As we look at our – the credit, the environment or where we are with home prices, again, lowering LTVs at origination to protect from declining home prices and housing uncertainty. From a financing perspective, 100% of our portfolio away from the agency business has non-daily mark-to-market funding or financing.”

We see the focus on:

- Reducing mark-to-market exposure for financing stack stability;

- Increasing 3rd party fee income by leveraging in-house expertise;

- Increasing the assets through in-house origination loans; and

- Keeping commercial loans either floating rate or match hedged for interest rate risk.

Entering what we forecast are the final phases of interest rate increases by the Federal Reserve, we see a nimble REIT taking advantage of the best opportunities in the mortgage market from origination to Agency securities – wherever they see the best risk/return profiles.

Weaknesses

1. Non-Agency assets carry more risk and right-sizing business units can be a challenge. Although RITM is nimble, moving fast costs money, too. Laying people off, hiring new workers, these frictional costs can degrade margins quickly if staff turnover is high.

2. Mortgage origination is way down despite the uptick last month in new build housing sales. Again, redundancies and right-sizing facilities not only costs money, it detracts from performance in the short term.

3. The biggest weakness for Rithm, from a common stock perspective, is simply being a mortgage REIT.

What do we mean? The common equity doesn’t organically grow in a business where so much of the cash flow has to be paid out by law at precisely the wrong times. Consider the current leg of the interest rate cycle where rates are searching for a top.

In that world, asset values are falling (whether marked-to-market or not) while interest rate hedges are paying lots of income to help offset declining asset values. In that period, do you really want to pay out 80% of REIT income that includes the cash from the hedges, or do you want to use that extra income to buy new, cheaper mortgage assets to hold? Buying those mortgages instead of paying out the fat dividend would have two key benefits: (1) keeps the overall asset base higher and (2) keeps leverage from tipping over.

No one wants to pay those dividends today, but they have to. It often forces mREITs to sell secondary equity just to keep leverage in a favorable ratio to equity because so much cash is bleeding out.

That crippling requirement alone makes the common uninvestable for a buy and hold strategy through an entire interest rate cycle. It does make it attractive, though, when rates are stable to slowly falling – a moment we forecast will appear in this particular cycle based on its current shape.

Opportunities

Several pop up rather quickly since RITM changed to an internally managed REIT:

- Greater investment flexibility – As a 3rd party managed REIT, there wasn’t incentive to explore new avenues and muscle for RITM because Fortress could launch a new vehicle for greater profit and fees instead.

- Increase Fee Income without having to finance new assets – Taking advantage of management expertise, market positioning and relationships can create more supporting income and return on capital than buying new mortgages.

- To own a vertically integrated homebuying experience for issues like inspections and title insurance creates expertise at most levels for opportunistic acquisitions – Far less risky than starting greenfield ventures while taking advantage of market dynamics at all stages of the interest rate cycle (there is always some level or origination happening and RITM is committed to being there).

- To raise and manage private capital pools – Other managers like Starwood do this quite profitably and I am assuming RITM will have a Chinese Wall to manage conflicts of interest.

Threats

1. Asset Quality – RITM has consciously reduced its Agency mortgage holdings – the highest quality mortgages available. We see this as a modest threat in view of the tight housing inventory, but not something we are worried about:

“how we think about the housing market, we are bearish, just to be clear, we do think home prices will continue to come down. We do think there’s going to be a floor due to supply and the good underwriting that’s occurred over the course of the past number of years. And then finally, when you look at homeowners today that have locked in at lower mortgage rates, whether that be 2%, 2.5%, there won’t be a need for folks to turn around and sell their homes.”

2. Origination being so beaten down, we do see the threat for a price war if mortgage loan buyers develop an appetite for risky floating rate mortgages -We could revisit pressure that helped create the 2008 disaster, but right now companies like RITM have moved in the exact opposite direction by requiring more equity on these loans rather than less. We rate this threat as very low today.

3. Falling rates cause MSR investments to lose – As people prepay mortgages to refinance or move to a new home, the MSRs lose value. This will happen and will be offset by gains in origination activity. Not a big threat.

SWOT Conclusions

RITM is adding muscle to position itself for the rate turn. Then, we forecast RITM will step on the gas pedal as origination sparks back to life. The primary advantages we see are:

- Flexibility to deploy capital to the best mortgage sectors within management’s expertise;

- Naturally hedged loan related activities (MSR and origination hedge each other);

- Leveraging experience and expertise to create “asset light” income streams like 3rd party management and private equity pool management.

The disadvantages we see are:

- Continued interest rate rises challenge origination and financing margins by having to pay for expensive hedges on fixed rate assets outside of the MSR portfolio;

- Big ambitions from a small base can lead to distracted management. These businesses are highly leveraged and dynamic – focus is even more essential when not just managing a portfolio of Agency mortgage securities; and

- Owning the common stock for a full interest rate cycle is unattractive.

Under The Hood

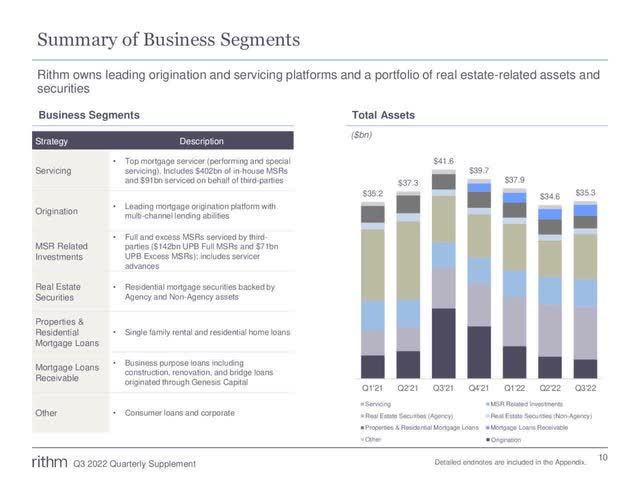

RITM manages the following portfolio:

RITM Q3 ’22 Presentation (RITM Capital)

The major segments are:

- MSRs

- Non-Agency Mortgage Securities and Loans

- Origination

- Other assets like Consumer Loans and Corporate Mortgages

This is a complex portfolio that is largely complementary in that it covers many mortgage sectors. Having the ability to move capital where it can be best deployed is a tremendous advantage when used wisely.

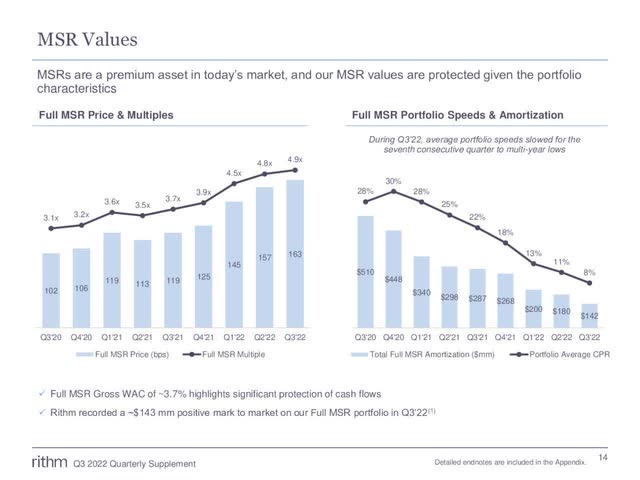

MSRs

These are simply the rights to handle the payments and other issues between the mortgagees and the mortgage holders. The only interest rate exposure is whether the expected life of any mortgage being serviced is shorter or longer:

RITM Q3 ’22 Presentation (Rithm Capital)

We expect this is a great time to own MSRs as people are stuck in their homes with few better alternatives than to pay the mortgage and smile. We predict rates, while having risen like an Artemis 1 rocket, are most likely to drift lower like a hang glider. Owning MSRs is great for this part of the cycle and why RITM isn’t hedging these assets.

Non-Agency Mortgage Securities and Loans

Whether originated or acquired, we see this portfolio as having great value. While Agency risk is the best, we see the low supply of single family housing plus relatively high construction costs keeping this risk relatively low.

From RITM’s Q3 10-Q:

“Housing activity, including both home-purchase and refinance mortgage origination volumes, continued to slowdown during the third quarter of 2022 as a result of elevated mortgage rates. Longer-term borrowing costs for households were generally higher. The increase in mortgage rates has resulted in residential real estate prices peaking, and our expectation is that home prices will begin to decrease. However, we believe that homeowners are better positioned to weather a decrease in home prices compared to the mid-2000s given mortgage debt growth has significantly lagged growth in house prices, leaving households with substantial equity cushions. Moreover, for much of the past decade, most new mortgage debt had been added by borrowers with prime credit scores. Conventional 30-year rates increased to 6.1% as of September 30, 2022 compared to 5.5% as of June 30, 2022. The Mortgage Bankers Association estimates full year 2022 production volume of $2.3 trillion, down from full year 2021 volume of $4.4 trillion. Furthermore, 33% of 2022 volume is estimated to be refinance volume compared to 57% in 2021.”

We agree and that logic has underpinned so much of our mREIT preferred stock investing this year.

While the portfolio quality is very high, the fixed rate portion has to be hedged. That creates extra distributable income as values fall. That’s negative for the common stock and very positive for the preferreds (more cash to pay dividends).

Origination

RITM has been a buyer of origination businesses just as/after the value of those businesses plummeted. Whether it’s a clever way to acquire more MSR’s, or right-sizing operations for the tougher economic operating environment, this is a business under pressure.

Pressure not from losses so much as muted activity and profit contribution until the market turns. One might ask, “why not just acquire operations when the market turns?”

Origination is a people business that needs good management. If RITM is retaining key managers, then they should be better positioned to capitalize when the market turns by understanding its operations better than those who wish to jump in. It’s easier to add folks to an existing operation where one knows and trusts the management team.

We will see if this plays out well for RITM. We consider this the riskiest part of their business model, but not a huge threat because many other hybrid REITs acquire their assets without originating the loans.

While we see the logic to vertically integrating mortgage origination, we are not sure there are actual advantages. The mortgage market is deep enough and well understood enough that buyers can quickly and fairly accurately assess the proper value for mortgages purchased in the secondary market.

Other Assets

Primarily commercial mortgages and consumer loans. The commercial mortgages are largely high yield floating rate. This is the second riskiest piece of RITM for us only because we see it outside their expertise in areas like consumer loans.

On the commercial side, risk depends on the quality of acquisitions like the Genesis deal noted above. Commercial mortgages, unlike residences, are far more subject to default and foreclosure – it’s easier for a business to squeeze its way out of a property than someone’s home. While we see this as inherently riskier business, the loan to value can offset that higher risk with more equity cushion in any deal.

While we think unrecorded bank debt is the next bubble to burst, lending secured against a property is usually less risky than most senior corporate debt secured by assets other than real estate. That’s because most commercial real estate typically retains value even if the mortgage is in default. We see this as a medium risk.

Consumer loans make up less than 1% of the portfolio, so we see this as a nuisance asset – probably not worth having or growing. We do not like this risk in general today and given its small size, it is a very small risk.

The Financing Stack

Such a variety of assets and businesses requires differing sorts of financings. As we have discussed above, the MSRs are unhedged because payment speeds have slowed, the fixed rate commercial mortgages are hedged, and floating rate mortgages are match funded by floating liabilities:

| Debt Obligations/Collateral | Outstanding Face Amount | Weighted Average Life (Years) |

Carrying Value |

|||

| Repurchase Agreements: | ||||||

|

Warehouse Credit Facilities-Residential Mortgage Loans |

3,743,336 | 21.4 | 10,296,812 | |||

|

Warehouse Credit Facilities-Mortgage Loans Receivable |

1,077,413 | 0.7 | ||||

|

Agency RMBS(D) |

8,224,352 | 9.9 | ||||

|

Non-Agency RMBS(E) |

612,109 | 5.1 | ||||

| Total Secured Financing Agreements | 13,657,210 | |||||

| Secured Notes and Bonds Payable | ||||||

|

Excess MSRs |

228,497 | 5.9 | ||||

|

MSRs |

4,574,995 | 7.1 | ||||

|

Servicer Advance Investments |

318,590 | 7.8 | ||||

|

Servicer Advances |

2,127,691 | 0.7 | ||||

|

Residential Mortgage Loans |

771,748 | 28.2 | ||||

|

Consumer Loans |

355,211 | 3.3 | ||||

| SFR Properties | 863,029 | N/A | ||||

| Mortgage Loans Receivable | 524,062 | 0.6 | ||||

| Total Secured Notes and Bonds Payable | 9,763,823 | |||||

| Total/ Weighted Average | 23,421,033 | 29,237,694 | ||||

Source: Rithm Capital Q3 2022 Form 10-Q.

All of the liability stacks match well to the assets they are supporting before we consider hedging. More importantly, debt related to securitized off balance sheet assets are non-recourse. We do not see any scary things here.

Overall, we place RITM’s total leverage about 3.5 times equity, or relatively conservative for a mREIT where 4x is the general target.

Securities Analysis

In addition to the common stock, RITM has 4 different flavors of preferred stock:

| Ticker | Type |

Call/ Conversion Date |

Current Dividend | Floating Margin Over 3-Month LIBOR** | Stripped Yield | Current Price | Yield-to-Call |

| NYSE:RITM.PA | FtF* | 8/15/24 | $1.88 | 5.802% | 9.34% | $19.60 | 22.84% |

| NYSE:RITM.PB | FtF | 8/15/24 | 1.78 | 5.640 | 8.86 | 19.44 | 22.90 |

| NYSE:RITM.PC | FtF | 2/15/25 | 1.59 | 4.969 | 8.95 | 17.57 | 23.80 |

|

NYSE:RITM.PD |

Fixed | 1/15/27 | 1.59 | N/A | 8.39 | 18.84 | 15.08 |

Source: SA, EDGAR and my calculations.

*Fixed-to-Floating

**LIBOR ceases in June 2023 to be replaced in most cases by 3-Month Term SOFR plus 26.2 basis points (published by the CME). Currently LIBOR is 27.5 basis points higher.

For some comparison, the RITM common trades at $8.79 per share with a current dividend yield of 11.38%. If we use RITM management’s Q3 2022 book value estimate of $12.10 per share, we would assess the common trading at a 27% discount to its current value. That value is continuing to fall, but let’s assume management preserves varying degrees of that value; and that corresponding stock price is realized by the time of our first call date so we can compare:

| Asset Preservation* | Total Return |

| 95% | 25.84% |

| 90 | 22.86 |

| 85 | 19.75 |

| 80 | 16.49 |

Source: SA and my calculations.

*Assumes no change in the common dividend.

Obviously, if RITM can grow its book value (net asset value), we would expect the common stock to crush the preferred returns. Given the expected interest rate and economic environment, we forecast continued book value declines instead.

Rithm’s 3 FtF preferred stocks all offer impressive yields to call/conversion from about 23% to 24%, very close to the RITM 95% to 90% asset preservation outcomes.

RITM’s fixed rate preferred stock is just not competitive in this race unless rates fall all the way back next year, forcing all the preferreds to par value far faster and giving the RITM.PD its only outcome advantage (we view this outcome as very unlikely).

When we look on a risk adjusted basis, we strongly prefer the FtF preferred stocks for their risk insulation. Variations in income will likely change the common stock’s dividend while rising rates decrease book value – none of that hurts the preferred stocks. Moreover, because the preferreds are cumulative, if for any reason RITM has to skip a preferred dividend, it has to pay all skipped dividends before it can pay any common stock dividend at all. Finally, if leverage tips too heavily the wrong way, Rithm will have to issue secondary equity that dilutes expected common stock returns whereas that cannot happen with the preferred series.

For about the same total return if RITM continues to manage asset values well (it does this by primarily holding non-mark-to-market mortgages), we will take the far safer preferred returns.

Among those preferred securities, the expected yield to call clusters nicely around 23%. The issue here is reinvestment risk in the approximately 6 months between the series A&B conversion versus the series C. Today, we forecast an extra 2% (we forecast the Fed raising rates another full point before stopping) versus the current stripped yield, or $1.00 in extra dividends received before the series C converts. When I adjust for that, I get somewhat lower returns from the FtF 2024 versus 2025 series C.

Bottom line, we see the series B & C as the two best options with the series A a very close third place because we prefer the capital gains in this trade. Which is best depends on one’s view of rates in late 2024 to early 2025 and whether one prefers capital gains (the B has more) to income today. Today, we like built in capital gains, so the series C is our choice to buy.

Conclusions

RITM has greatly transformed in less than a decade. It should sail past the current market issues to emerge a stronger originator, servicer and investor in mortgage securities (that includes whole loans). A combination of market volatility and rising rates challenged the entire sector in 2022 where RITM is better able to preserve its book value by holding mostly non-mark-to-market assets and non-recourse debt in its off balance sheet securitizations (the VIEs).

Market forces that have held housing inventory tight and mortgage underwriting standards relatively high combine to make RITM’s non-agency investment look very good today. Even as housing prices decline over the next two years, improved housing equity keeps the vast majority of these loans from the trouble column.

Given that the common stock and FtF preferreds have similar performance dynamics in today’s market, we would rather hold the lower risk securities while sailing through a recession of any force. All three Rithm FtF preferred stocks offer attractive YTC returns and we chose the series C today for the larger, expected capital gains in early 2025.

Be the first to comment