JARAMA/iStock via Getty Images

Investment Thesis

REITs typically provide high dividends plus the potential for moderate, long-term capital appreciation. As a result, they are often considered by investors as a reliable source of income and a potential hedge against inflation. Their dividends are substantial because they are required to distribute at least 90% of their taxable income to their shareholders annually. The biggest risk to REITs is when interest rates rise. In a rising-rate environment, investors typically opt for safer income plays, such as U.S. Treasuries. As a growing number of central banks around the world are signaling a tightening in monetary policy over the next couple of months, I believe the rewards for investing in REITs are tilted downwards. In this article, I will review the Global X SuperDividend REIT ETF (NYSEARCA:SRET) which provides exposure to a basket of the highest yielding REITs in the world.

Strategy Details

The Global X SuperDividend REIT ETF tracks the performances of the Solactive Global SuperDividend REIT Index. SRET accesses 30 of the highest yielding REITs in the world, potentially increasing a portfolio’s yield. Moreover, the fund makes distributions on a monthly basis, providing a regular source of income.

If you want to learn more about the strategy, please click here.

Portfolio Composition

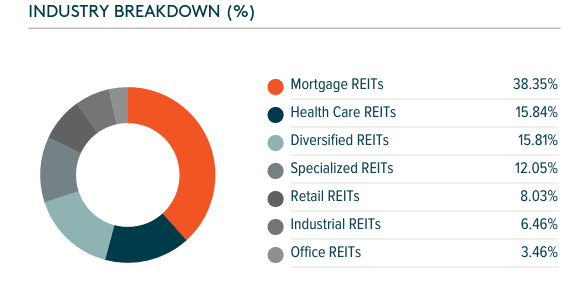

From the sector allocation chart below, we can see the fund places a high weight on Mortgage REITs (representing around 38%), followed by Health Care REITs (accounting for ~16%) and Diversified REITs (representing around 16% of the fund). The largest three sectors have a combined allocation of approximately 70%. Furthermore, over 50% of assets are invested in cyclical real estate, such as retail, industrial, or mortgage, that is vulnerable to changes in the economy.

Global X ETFs

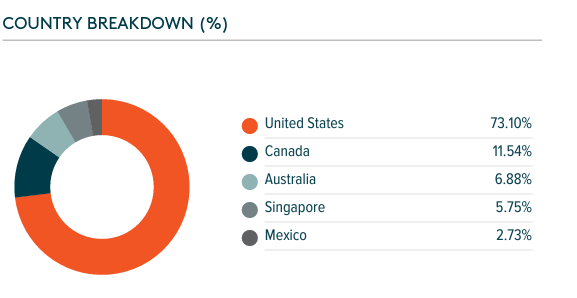

If we look at the geographical allocation, the fund is mostly invested in the United States, which represents ~73% of total assets, followed by Canada and Australia. Over 85% of assets are invested in North America, which makes SRET’s performance highly correlated to the state of real estate in this particular market.

Global X ETFs

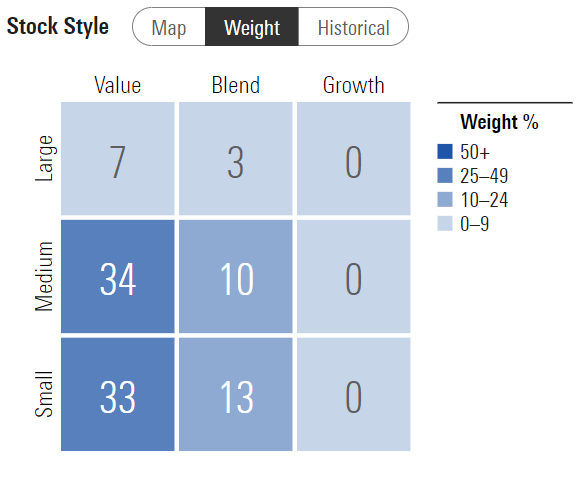

SRET invests over 34% of the funds into mid-cap value issuers, characterized as mid-sized companies where value characteristics predominate. Mid-cap issuers are generally defined as companies with a market capitalization between $2 billion and $8 billion. The second-largest allocation is small-cap value equities. It is interesting to see that this ETF allocates approximately 90% of the funds to small- and mid-cap issuers, which generally have a longer runway to compound returns over time than large-cap issuers. At the same time, small- and mid-cap stocks generally have a higher beta, which makes them more volatile compared to the market. I think it is important to see if you are comfortable with a higher level of volatility before purchasing SRET.

Morningstar

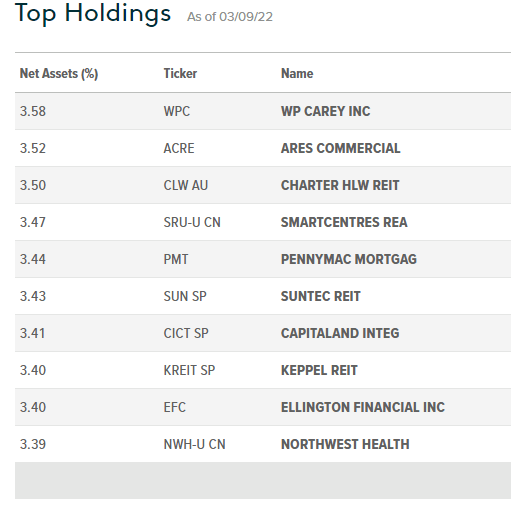

The fund is currently invested in 30 different stocks. The top ten holdings account for 34.54% of the portfolio, with no single stock weighting more than 4%. Overall, I would say the fund is well-diversified across constituents. However, the correlation of returns tends to increase in periods of financial stress, and real estate is no exception.

Global X ETFs

Since we are dealing with equities, one important characteristic is the portfolio’s valuation. According to data from Global X ETFs, the fund currently trades at a forward price-to-book ratio of ~1. SRET is, therefore, cheaper than a plain vanilla S&P 500 ETF. However, I believe cheaper doesn’t necessarily mean better in this case. If we take the last 2 major pullbacks in US equities during Q4 2018 and Q1 2020, SRET had a higher drawdown than the S&P 500.

Is This ETF Right For Me?

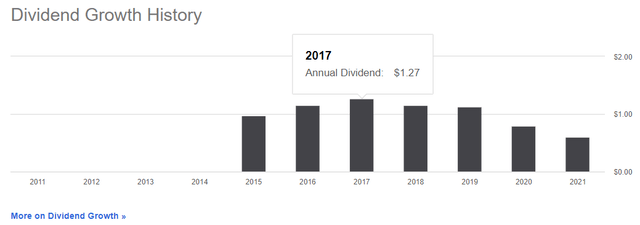

SRET has a distribution yield of 6.5%. Given the high yield, this ETF is popular with dividend investors looking for a monthly source of income. That said, you should keep an eye on the dividend growth history, which clearly shows a negative trend since 2017. As a dividend investor, the last thing you want is your monthly dividend payment to start shrinking.

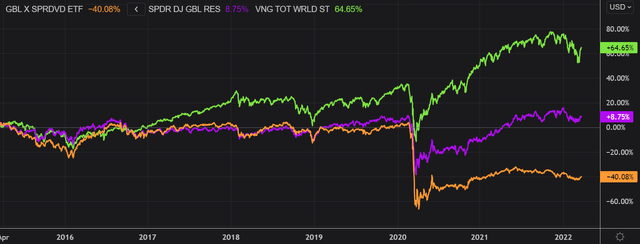

I have compared below SRET’s price performance against the performance of the SPDR DJ Wilshire Global Real Estate ETF (RWO) and the Vanguard Total World Stock ETF (VT) over the last 5 years to assess which one was a better investment. Over that period, SRET clearly underperformed RWO and VT. The underperformance was the highest during periods of financial stress such as in early 2016 and early 2020. Since its inception, SRET underperformed VT by a 104 percentage points margin. The divergence in performance between the 2 ETFs really started to widen after the March 2020 crash and SRET never reached its pre-COVID highs ever since. To put SRET’s performance into perspective, a $100 investment 7 years ago into this ETF would now be worth ~$60. This represents a compound annual growth rate of -7% excluding dividends, which is a terrible absolute return.

I personally think that SRET is suitable for investors that want to get short-term exposure to the real estate market while earning a monthly dividend. However, I believe SRET is too volatile and the drawdowns are too severe to hold it over a long period of time.

Key Takeaways

SRET provides exposure to a basket of high-yielding REITs. SRET has a distribution yield of 6.5%. Given the high yield, this ETF is popular with dividend investors looking for a monthly source of income. In terms of valuation, SRET is cheaper than a plain vanilla S&P 500 ETF based on the dividend yield and the price-to-book ratio. However, I believe cheaper doesn’t necessarily mean better in this case. The fund has consistently underperformed peers and equity ETFs since inception, which makes SRET a high-risk, low reward investment in my opinion.

Be the first to comment