cagkansayin

Skyrocketing inflation has led to several aggressive Federal Reserve interest rate hikes these past few months, with more on the way. Several readers and subscribers have asked me for my thoughts on said hikes, and for their implications for bond funds and bond investors. I’ll be covering these topics in this article, focusing on the implications for high-yield corporate bond funds.

Higher Interest Rate Implications – Summary

Higher interest rates mean newly issued bonds have higher rates, while older bonds maintain their original, lower rates.

Higher interest rates decreases demand for older, lower-yielding, bonds, leading to lower bond prices, resulting in capital losses for bond investors. This has been the case for most bond funds these past few months, as expected.

These losses should prove temporary, as bonds must always be repaid in full at maturity, even when market prices go down. As such, investors should expect moderate capital gains for most bond funds in the coming years.

Higher interest rates should lead to dividend hikes and higher yields on most bond funds, as lower-yielding, older bonds mature, and are replaced by higher-yielding, newer alternatives. Said process has already started, with most bond funds seeing strong dividend growth these past few months, but could take years to finalize.

Higher interest rates increases expected capital gains and dividends for most bond funds, so total returns are higher as well.

Higher interest rates cause some short-term pain for bond investors, but the long-term impact is incredibly positive. As such, rising interest rates are a net positive for bond funds, and these are materially stronger investment opportunities today than before interest rates rose.

Interest Rates for High-Yield Corporate Bonds

There are many important interest rates out there, including the Federal Funds rate, LIBOR, inflation break-even rates, and more. All rates matter, but some are more important than others, and some are more relevant to specific asset classes than others.

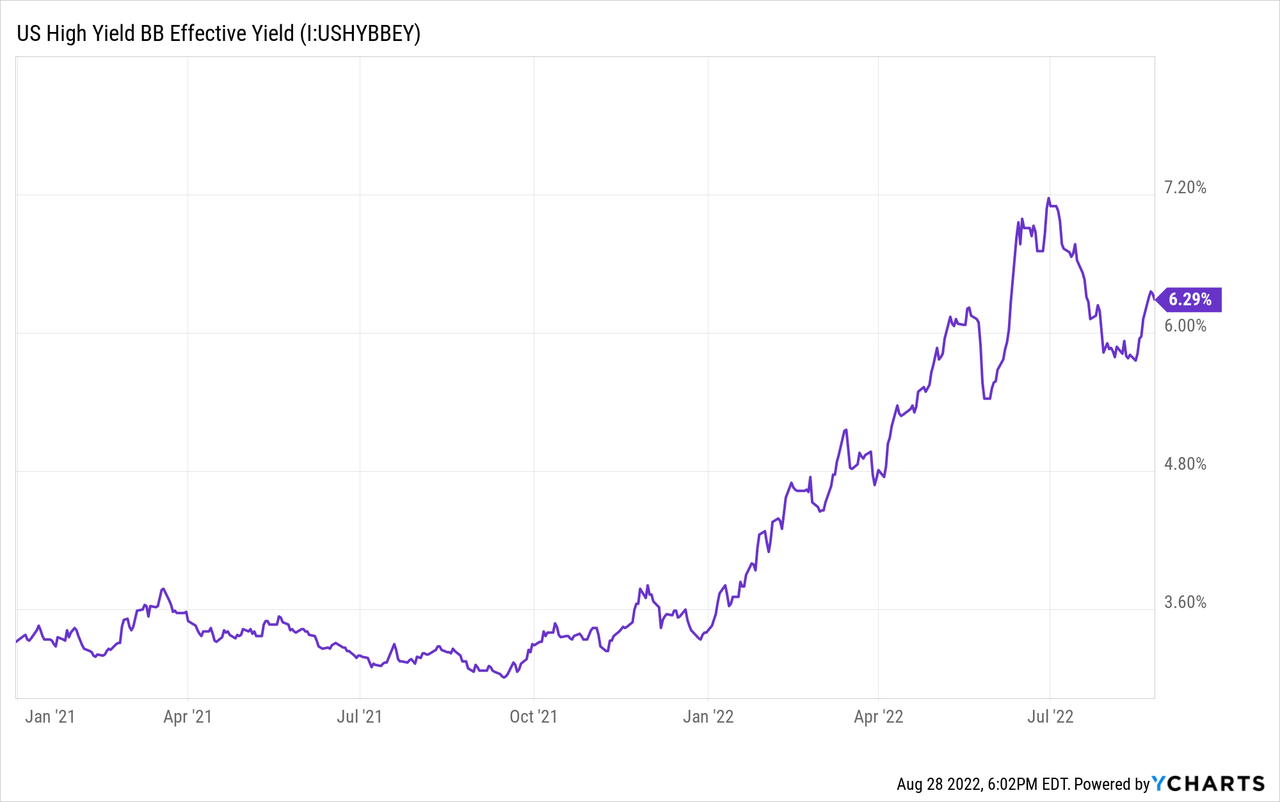

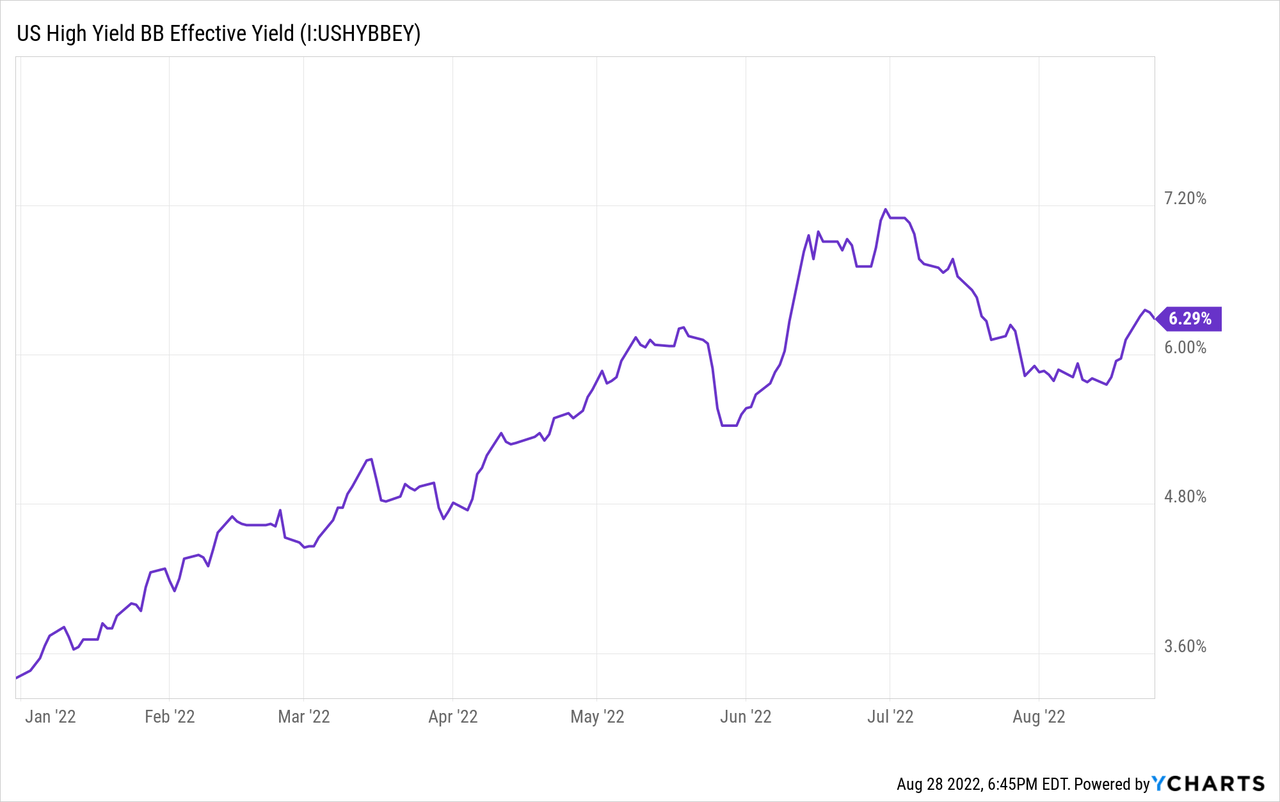

For high-yield corporate bond funds, it is the interest rate on non-investment grade corporate bonds that matters the most. These vary by credit rating, maturity, and other characteristics, but there are several time series out there that standardize / average out these issues. Below, interest rates for BB-rated corporate bonds, an important benchmark in this segment.

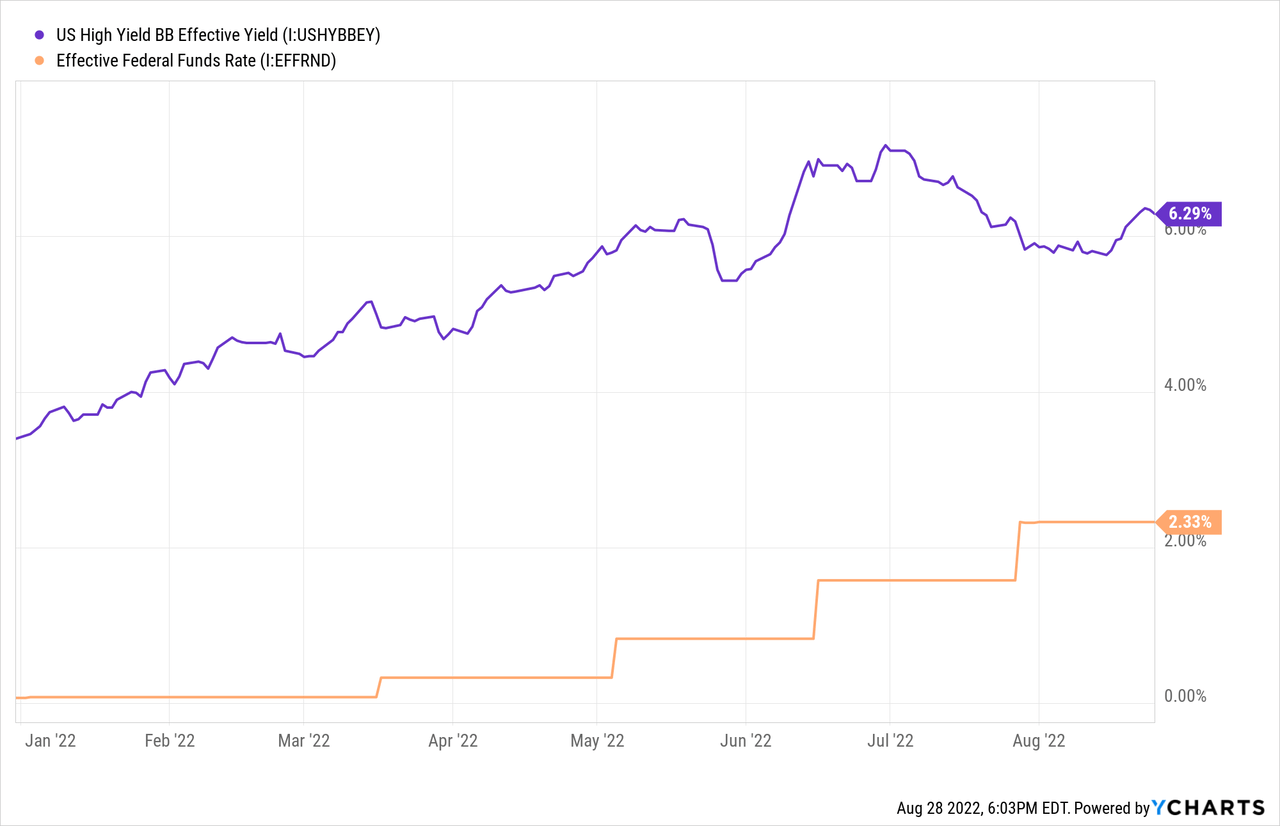

First factor is the Federal Funds rate. Fed hikes rates, interest rates go up across the board, and high-yield corporate bonds are no exception. Expectations of Fed hikes matter too, as investors tend to anticipate Fed movements months in advance, and bond prices move accordingly. As an example, this year the Fed started to hike in March, but bond prices started to increase in January.

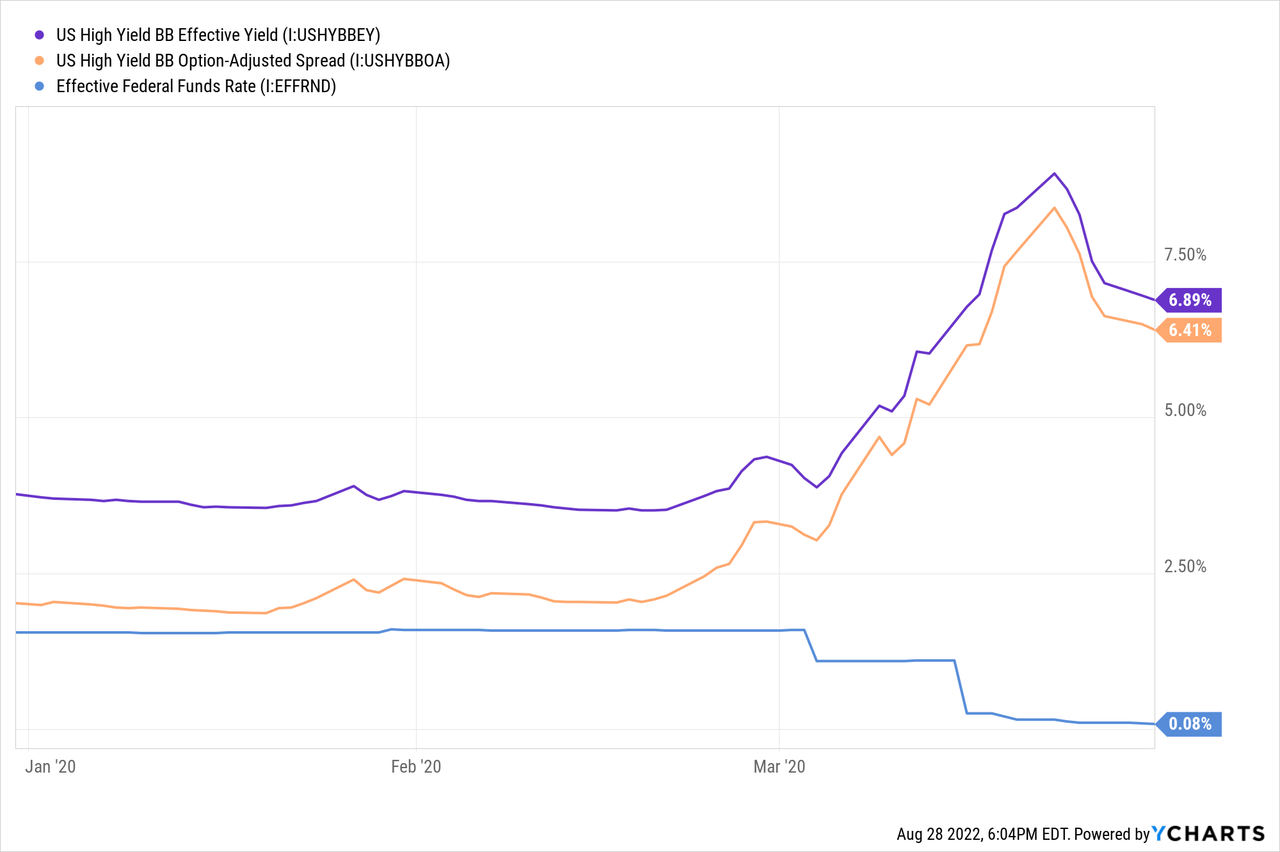

As an example, high-yield corporate bonds yields skyrocketed in early 2020, the onset of the coronavirus pandemic, as investors feared a recession, and higher default rates. Yields increased even as the Fed slashed rates.

For high-yield corporate bonds, both benchmark interest rates and interest rate spreads matter. With this in mind, let’s have a look at the impact of rising interest rates on these securities.

Rising Interest Rates – Impact on Bond Prices

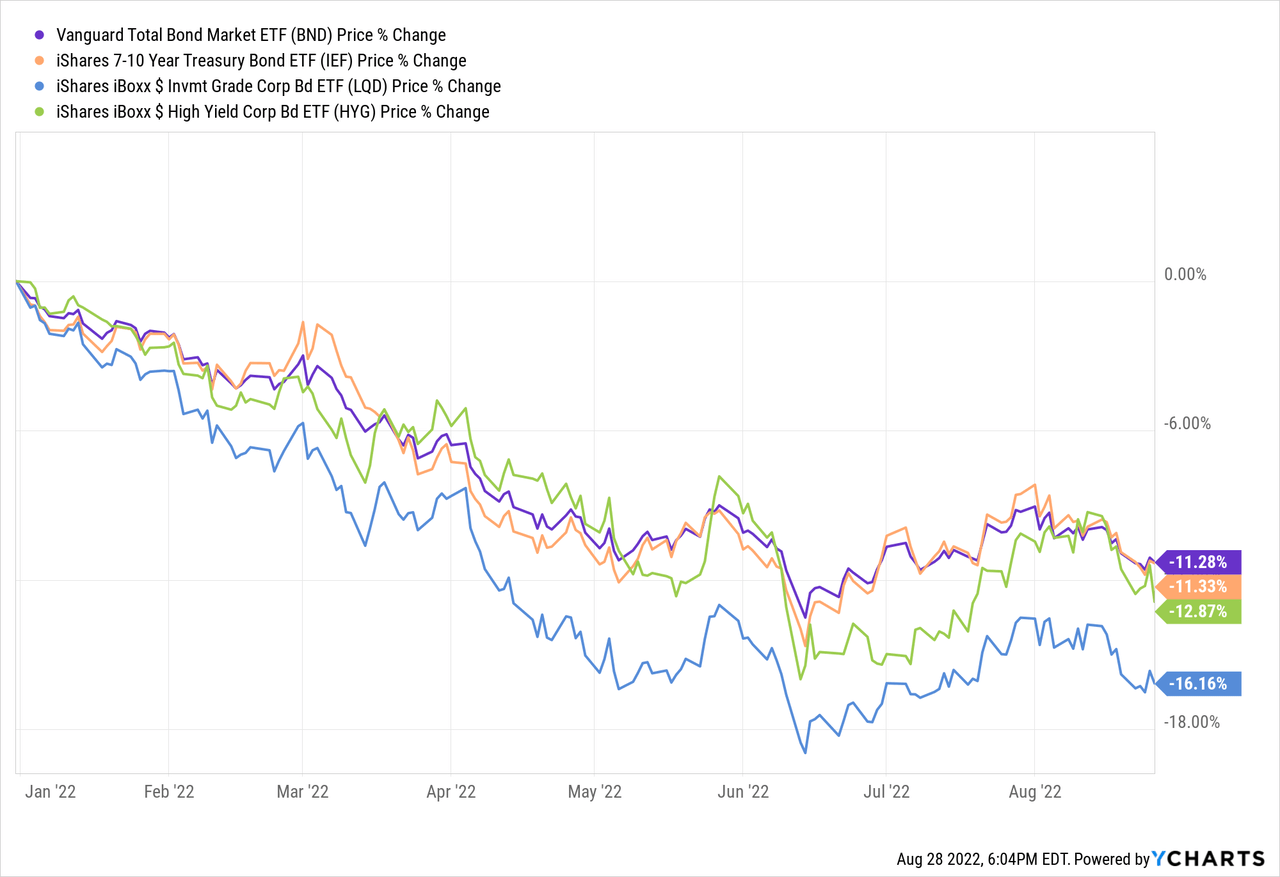

Rising interest rates reduce bond prices, leading to lower share prices for most bonds and bond funds, and capital losses for their shareholders.

The reasons for the above are quite simple.

Most bonds pay fixed interest rate payments throughout their tenure. Market conditions may change, but the interest rate on the bonds remain the same. When interest rates rise, older bonds maintain their original rates, while newer bonds must be issued with the newer, higher rates. As rates rise, investors sell their older, lower-yielding bonds, and use the proceeds to invest in newer, higher-yielding alternatives. Selling pressure causes bond prices to decrease, with amounts determined by duration. In general terms, short-term bonds see comparatively small price decreases, as short-term bonds can be quickly replaced with newer alternatives. The opposite is true for longer-term bonds.

So, higher interest rates should lead to lower bond prices / bond fund share prices.

ETFs tend to be diversified, and rarely engage in aggressive investment, trading, or distribution policies. As such, bond ETFs should move in-line with their benchmark asset class, and should have seen lower share prices as interest rates rose. This has been the case YTD, as expected.

CEFs are a bit more complicated, especially high-yield corporate bond CEFs. Said CEFs invest in bonds, so these funds should have experienced sizable capital losses from rising interest rates too, with a small complication. CEFs tend to be leveraged. Leverage means more assets, which means more losses when asset prices go down (because you have more assets which are going down in price). Leveraged funds must also make continuous interest and capital payments to service their debt, which is sometimes difficult, sometimes pricey, to do when asset prices are down. During particularly severe downturns, leveraged funds are legally and contractually required to sell a portion of their assets to pay back their debt. Forced asset sales at fire-sale prices are almost always disastrous for a fund, sometimes lead to irrecoverable losses and underperformance, and are to be avoided at all costs.

Considering the above, high-yield corporate bond CEFs should see above-average losses during a period of rising interest rates. Significant, disastrous losses and forced asset sales are possible, if not terribly likely: the current downturn has simply not been all that severe, so far at least.

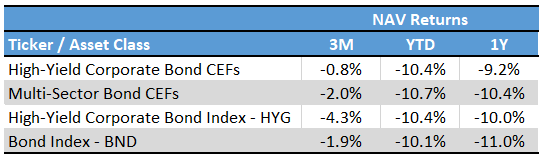

During the past few months, applicable CEFs have seen above-average NAV losses, as expected. Losses have not been high enough to worry about forced asset sales, at least not in a material capacity, for the average / most funds. Table below is from Cefdata, I’ve included both high-yield bond CEFs, as well as multi-sector bond CEFs, which tend to focus on high-yield bonds as well.

Cefdata.com – Chart by author

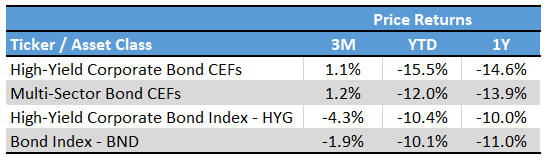

On a more negative note, price returns have been materially weaker, due to widening discounts.

Cefdata.com – Chart by author

In any case, rising interest rates should have led to declining share prices for most high-yield corporate bond CEFs, as was indeed the case.

Rising Interest Rates – Impact on Bond Fund Income and Yields

Rising interest rates increase a fund’s distribution yield in two key ways.

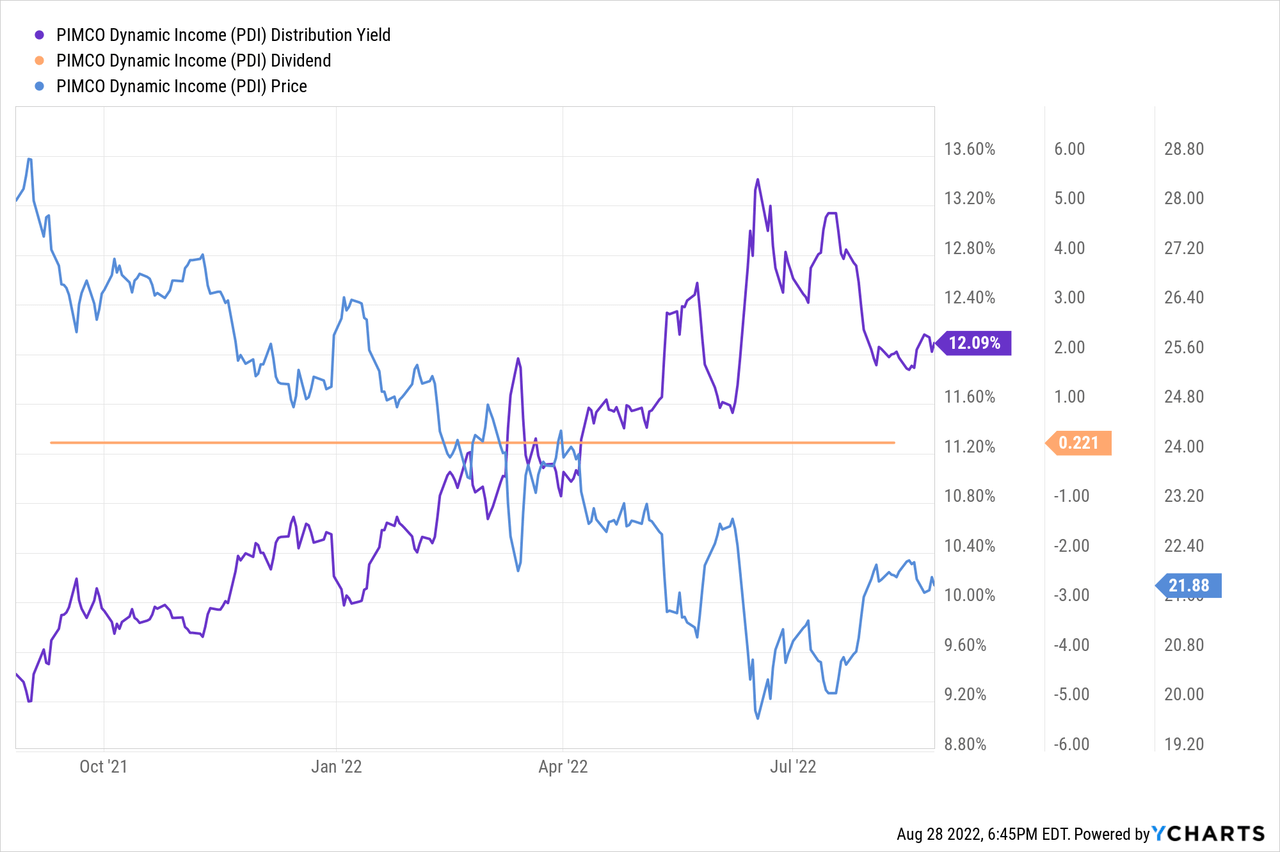

First, rising interest rates lead to lower share prices, which increase distribution yields even as the distributions themselves remain the same. As an example, we have the PIMCO Dynamic Income Fund (PDI)

The effect above is quick, significant, and incredibly beneficial for prospective investors, wishing to initiate a new position in high-yield corporate bond funds. This effect is of no benefit for investors who bought these funds before interest rose, as the cost basis and yield-on-cost for these investors remains the same.

Second way rising interest rates increase a fund’s distribution yield, is through increasing the interest rate on the fund’s underlying holdings, and hence the fund’s underlying generation of income. Most funds distribute any and all income to shareholders as distributions, so higher income will generally lead to higher distributions, and hence higher yields. Non-investment grade corporate bonds have seen their yields rise by about 2.4% these past few months, so expect funds focusing on these securities to see their distribution yields increase by the same amount.

This process takes time, as funds must wait until their older, lower-yielding bonds mature before replacing them for newer, higher-yielding securities. Based on average high-yield corporate bond maturities, the process could take more than a decade to completely play out, but should be mostly finished in no more than five years.

For most bond funds, the process has almost certainly already started, although it is somewhat difficult to tell in the case of CEFs. These funds generally have managed distribution policies, so managers have a lot of discretion as regards to fund distributions. Discretion means it is difficult to differentiate between changes in fund fundamentals and management policies. In my opinion, it is too early to tell if bond CEFs have seen significant dividend growth from higher interest rates, but that should almost certainly be the case moving forward.

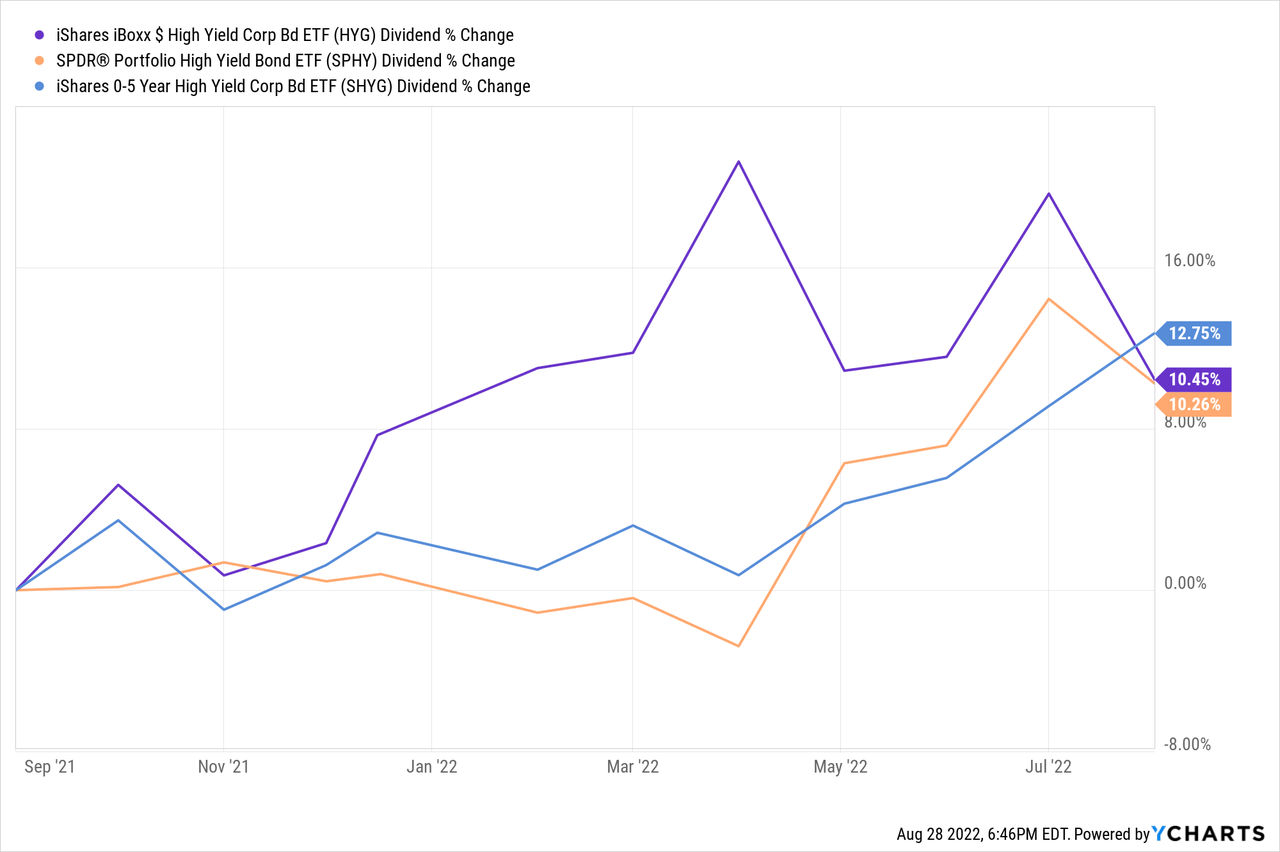

ETFs, on the other hand, almost always distribute any and all income generated to shareholders and nothing else, so their dividends are almost always reflective of their actual generation of income. If ETF dividends go up, that is almost always because income has gone up too, so dividends can be taken as an indication of income. There are exceptions, but there are few and far between. High-yield corporate bond ETFs have seen rising dividends these past few months, so it seems that rising interest rates have already led to increased income for these funds.

As high-yield corporate bond CEFs generate more income, their distributions should grow, benefitting investors. As CEFs generally have managed distribution policies, there is quite a bit of discretion in this process, so I won’t try to forecast or estimate the timing or magnitude of future distribution hikes. Still, I do fully expect CEF distributions to be hiked in the coming months and years.

Rising Interest Rates – Impact on Expected Capital Gains

Rising interest rates reduce bond market prices, but do not reduce the amount that is owed to bond holders and investors. Bonds are debt, and debt must always be repaid in full, regardless of what the market does, regardless of how bond market prices move.

By my estimates, taking into consideration current bond market prices, high-yield corporate bonds should see capital gains of about 10%, in total, in the coming years. High-yield corporate bond CEFs will very likely experience similar capital gains, but the situation will almost certainly vary, and widely.

Some CEFs will choose to distribute these capital gains to shareholders, so said gains might not necessarily lead to rising share prices, but the gains will almost certainly be there, and benefit investors regardless.

Rising Interest Rates – Impact on Expected Long-Term Total Returns

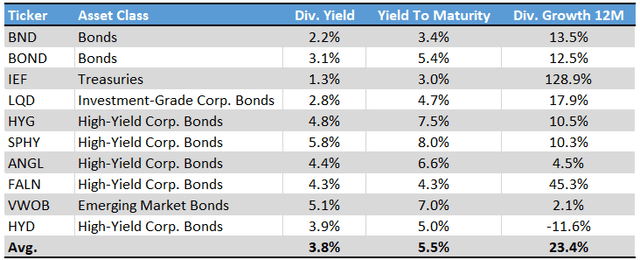

Rising interest rates mean higher capital gains and dividends for bond funds, so expected long-term total returns are higher as well. It is possible to estimate said total returns using a metric called yield to maturity. Figures for some of the more relevant bond ETFs are as follows.

Fund Filings – Chart by author

CEFs sometimes do not report yield to maturity figures, and the metric is a bit more difficult to interpret for these funds, due to their leverage. In any case, considering current bond yields, yields to maturity, and accounting for leverage, expenses and the like, expected returns for most high-yield corporate bond CEFs should be in the 8.0% – 10.0% range.

Conclusion

Higher interest rates led to capital losses and lower share prices for most bond funds in the past.

Higher interest rates should lead to distribution growth, capital gains, and higher total shareholder returns, for said funds moving forward. Income has started to increase, while capital gains and total returns should follow in the coming years.

Higher interest rates cause some short-term pain for bond investors, but the long-term impact is incredibly positive.

In my opinion, and considering the above, bond funds are materially stronger investment opportunities today than they were before interest rates rose. High-yield corporate bond CEFs look particularly attractive under current conditions, due to widening discounts.

Be the first to comment