Kevin Frayer/Getty Images News Rio Tinto logo (Rio Tinto)

Operational update from Q3

On 17th October, Rio Tinto Group (NYSE:RIO) delivered their update of the operational results up to September 2022.

Shipments of iron ore from their main production site Pilbara were stable at 234.3 million tons for the first 9 months this year. It is only 1% less than the previous year.

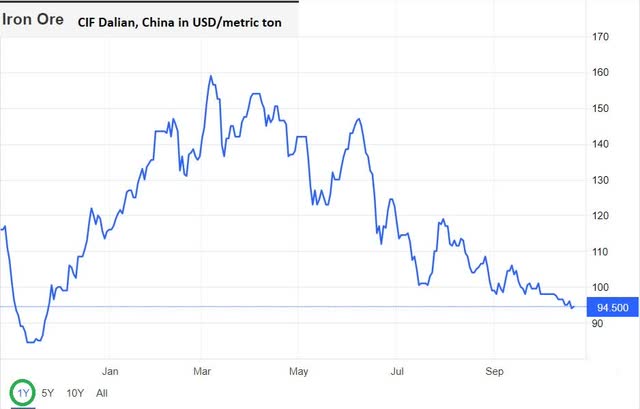

However, we have seen lower demand from China, which we will explain later. Here is how the spot price has gone so far this year for the delivery of iron ore to Dalian in North China.

Price of iron ore CIF Dalian, China (Trading Economics)

It is important to bear in mind that the big buyers in China buy as much as 80% of their iron ore on long-term contracts, so the spot prices are not what RIO gets for all the iron ore they ship. Prices do get smoothed out.

Another way to smooth out prices is that they keep a large inventory in China, which can balance out the volatility with. Their inventory there as of the end of September was 5.5 million tons

To further cement their relationship with Chinese buyers, RIO has entered a joint venture with China Baowu Steel Group Co. Ltd to develop their Western Range iron ore project in the Pilbara, investing $2 billion to develop the mine.

The annual capacity of 25 million tonnes will help sustain production of the Pilbara Blend, with construction expected to begin in early 2023 and first production anticipated in 2025.

Despite inflation, RIO is guiding for an average 2022 unit cost of $19.5 to $21.0 per tonne range.

Where does China go from here?

The 20th congress of the Chinese Communist Party has just ended.

The rhetoric from Xi Jinping’s speech was heavy on ideology which sounded like it was taken out of Mao Tse Tung’s speeches, and light on concrete steps they have in plan to revive the economy.

With few indications as to what he had in plan for the economy, the stock market in Hong Kong reacted on Monday morning by dropping 6%.

An important piece in improving the economy is how they are going to tackle China’s falling real estate market. We will get to why this is so important later.

President Xi’s speech mostly focused on policy goals related to national security, the environment, and the importance of becoming self-sustained, particularly when it comes to technology.

With regards to their so-called “dynamic” Zero-Covid policy, as most politicians would do, the message was mostly about how well they had handled things in the past and no indication as to how they will deal with the pandemic going forward. The draconian way it has been handled in the past does seem to continue.

In a recent article in SCMP, Weifeng Zhong, a fellow at George Mason University, summed up President Xi’s speech well by saying:

The truth is there’s nothing to see here. China’s party congress is the country’s most important political event because of its symbolic value, not any practical functions.”

Understandably, there are concerns about the near-term outlook for the global demand for iron ore.

China’s real estate sector, which is struggling, has accounted for as much as one-third of the nation’s GDP and also roughly one-third of the steel produced.

There is a need for some government support and intervention to stabilize the real estate market in China. Until this is done, it is unlikely that we will see any major positive shift in demand over the next few months.

The government wants to balance this carefully, as they clearly want to discourage speculation in the market, which has been rampant in the past. On the other hand, there is a real need to provide better housing for millions of families there. One example is that some provincial governments are taking over thousands of empty apartments, converting them into low-cost housing for the poor.

They also support banks to assist developers in finishing projects so that those that have stopped servicing mortgages on unfinished apartments will resume servicing those loans,

The fortunes of the real estate market are so important because it has been a pillar of China’s growth for decades.

It is not only the steel industry that is dependent upon it, but the construction industry is a large industry, employing 53.7 million people, according to Statista.

Local governments also rely heavily on income from land sales.

Furthermore, for the retail industry to do well, it needs positive consumer confidence from Chinese households, whose wealth and economic well-being are closely tied to their investment in properties.

As the Rhodium Group pointed out in its latest report on China, a distressed property sector, in other words, has much broader implications: it is a systemic problem that risks destabilizing the entire economy.

Conclusion

What happens in China is important for Rio Tinto.

Last year, China purchased nearly 70% of the world’s iron ore exports, spending about $180 billion.

However, I do believe they share my view that China, like other countries, goes through economic cycles. It is unlikely that they will reverse their fortunes, although it is a potential risk.

Chinese companies have been complaining over the last couple of years that iron ore is too expensive. In order to try to gain some bargaining advantage, a central purchasing organization called China Mineral Resources Group was established in August this year purportedly with the aim of guaranteeing the supply of critical minerals. It is yet to be seen if this will, in fact, lower the prices much.

Rio Tinto is still my choice for exposure to the resource sector. They have, in my opinion, an enviable margin on their iron ore, a great geographical advantage of proximity to China, a stellar balance sheet, and good management.

My past Buy call continues and since I do not know when to call a bottom of a market, I do from time to time add to my position

Be the first to comment