bjdlzx

(This article was in the newsletter on September 17, 2022 and has been updated as needed.)

Ring Energy (NYSE:REI) is in a different business than is much of the industry. This company has acreage that is considered conventional by most standards whereas much of the industry is considered unconventional. In fact, you hardly hear about conventional techniques to produce oil.

The difference between conventional and unconventional is not all that much. It is even less when one considers that “modern completion techniques” can be used when drilling a conventional opportunity. Probably the biggest difference that is apparent to investors is the cost of the wells. Long-time readers know that the wells are a good half-million or more cheaper (than many unconventional wells) and the reserves are long-lived with a different decline curve.

Even though initial flow rates are considered low compared to unconventional wells, the decline rates often make up for the low start to produce a decent amount of cash flow in the beginning months of production.

Sample Of Characteristics

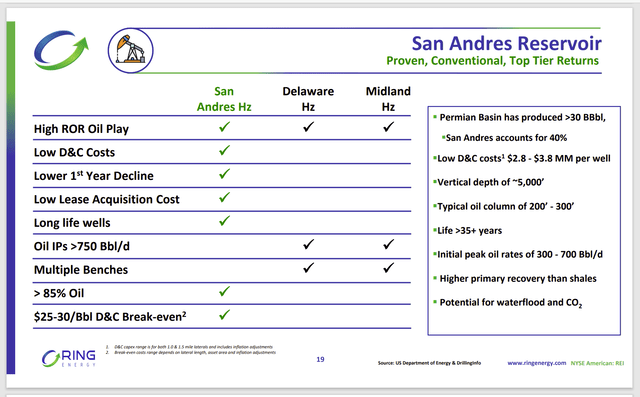

Some of the differences between what one usually sees, and the characteristics of this opportunity can be gleaned from the two slides shown below:

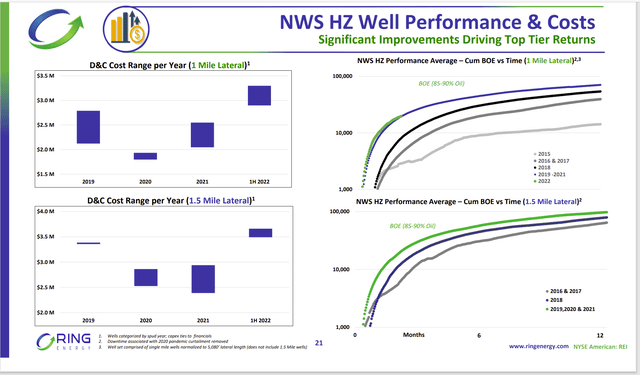

Ring Energy Northwest Shelf Well Performance And Cost (Ring Energy Presentation At 2022 Enercom Denver Conference August 8, 2022) Ring Energy Comparison Of Conventional Business With Unconventional Areas (Ring Energy Presentation At 2022 Enercom Denver Conference Presentation August 8, 2022)

Any well that produces nearly 100,000 barrels of oil in the first year (or nearly that in this case) is going to be a very profitable well in a whole lot of basins. When you then consider the cheap well costs combined with the favorable decline rate, then management has found a very profitable opportunity.

Similarities To Acquisition

Like the properties already owned, the acquisition of Stronghold represents a conventional opportunity. Since I originally wrote the article, the acquisition has been completed.

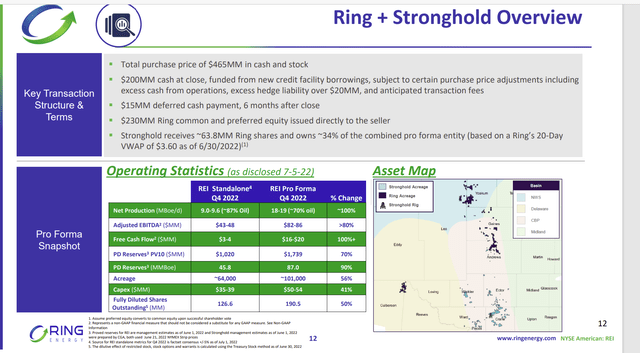

Ring Energy Pro Forma Presentation Of Acquisition (Ring Energy Presentation At 2022 Enercom Denver Conference Presentation August 8, 2022)

The properties are a little further South than is the case for the Ring Energy operations. That is probably not a big deal. What is a big deal is that the combined operations are likely to be far more efficient than they were separately. Plus, the acquisition is far enough South to include stacked plays on the acreage. The benefit of stacked plays may be that vertical wells, even with modern completion techniques, have so far been the go-to way to develop the acreage.

The other thing to notice is the cheap per-acre cost of the purchase price. Even with considerable production, this acreage cost is more than $10K per acre. Permian acreage is often far more expensive even though the low breakeven of this conventional opportunity likely makes this at least as profitable as many Permian wells.

Location costs are often not included in well breakeven price. (Note that Ring Energy management often does include well location costs in the well breakeven calculation shown to investors in the past.) Yet the acreage cost can often materially affect company profitability even if the acreage itself is not depreciated.

A simple example here would be that $10K per acre would add a location cost of $1 million per well to the breakeven calculation if the wells are spaced 100 acres apart. But Permian acreage often changes hands at up to $66K an acre. At that price, 100-acre spacing would add $6.6 million to the well breakeven calculation. There are many wells that really cannot show decent profits when that additional cost is added in.

Because the Permian acreage is so expensive, investors can likely expect some impairment charges during the next downturn when the “lower of cost or market” encourages management to “clear the decks” of all issues that might impair profitability going forward. Ring Energy is unlikely to have huge impairment charges during a downturn because of the low well costs (and accompanying high profitability).

Finance Effects

Management was able to get a new loan that would allow the payment of dividends and stock repurchases once certain loan conditions were met. The current agreement completely forbids either of those.

There was a fear of not meeting adequate (market-demanded) returns for shareholders. That may not be the worst possible thing because there is some decent appreciation potential here that could prove to be more lucrative than returning capital.

The market has long feared the effects of the aborted recovery in 2018 followed by the downturn in 2020 (which came way too soon after the big oil price drop in 2015). There was simply too much speculation in 2018 caused by an assumed return to conditions that existed closer to 2010 than was the case in 2018. Clearly, that is not going to happen in the current situation. Much of that speculative money suffered enough losses to stay out of the current recovery. As long as that remains the case (and only lenders or investors familiar with the industry remain), then the current recovery will likely track a lot of other recoveries with a far slower business cycle.

The ability of management to use a fair amount of stock helps to lower financial leverage immediately. The main idea would be that production roughly doubles while debt only goes up by (approximately) the amount of the $200 million cash requirement. That lower amount of debt for roughly the same amount of production will enhance badly needed free cash flow before the consideration of synergies from the acquisition.

The Future

The acquisition itself is considered accretive. This means that per share amounts should improve quarterly while financial leverage declines. The main issue not decided is the number of wells that the newly combined company should be drilling and completing. Management is maintaining the same number as before the acquisition for the time being.

The company recently initiated a one-rig program. Ostensibly, a two-rig program for the combined company might be intuitive. But investors need to remember that decline rates are different here for new production. Therefore, a full-time two-rig program may not be necessary for satisfactory market-approved growth.

The key here is that management is speeding up the deleveraging process while doing that with some very cheap locations that are extraordinarily profitable.

Most managements will be more aggressive about the hedging program once it is clear that the leverage is declining and will continue to decline. This management is not an exception. But the stock will lag until ratios are conservative at much lower than current commodity prices. For those investors that are patient, this stock should treat investors well over a five-year period.

The presence of Warburg Pincus on the board is likely to help with the value-enhancing future that this acquisition likely predicts. Management did well to get through a very unexpected fiscal year 2020. Now it needs to navigate the deleveraging process as well as the market-demanded returns to shareholders. Investors can expect this management to “figure it out” while providing decent annual returns.

Be the first to comment