gorodenkoff

A Quick Take On Rimini Street

Rimini Street, Inc. (NASDAQ:RMNI) reported its Q3 2022 financial results on November 2, 2022, missing expected revenue and EPS estimates.

The company provides independent software system support for large software platforms used by enterprises worldwide.

Until the company’s business, foreign exchange and legal risks are reduced and we gain further visibility into the firm’s future financial results, I’m on Hold for RMNI.

Rimini Street Overview

Las Vegas, Nevada-based Rimini was founded in 2005 to provide organizations with independent support services for major software platforms.

The firm is headed by president and CEO Seth Ravin, who was previously a Vice President at SAP, Saba and PeopleSoft.

The company’s primary offerings include support services for these platforms:

-

SAP

-

Salesforce

-

IBM

-

Microsoft

-

Oracle

-

Open source DBs.

The firm acquires customers through its direct sales and marketing efforts and through partner referrals.

Rimini has clients across all major industry verticals.

Rimini Street’s Market & Competition

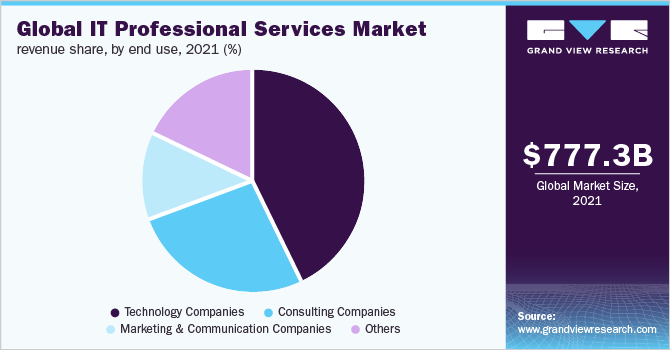

According to a 2021 market research report by Grand View Research, the overall market for IT professional services was an estimated $777 billion in 2021 and is forecast to reach $2.0 trillion by 2030.

This represents a forecast CAGR of 11.2% from 2022 to 2030.

The main drivers for this expected growth are a growing demand for automation to create operational efficiencies as more companies move to cloud-based systems.

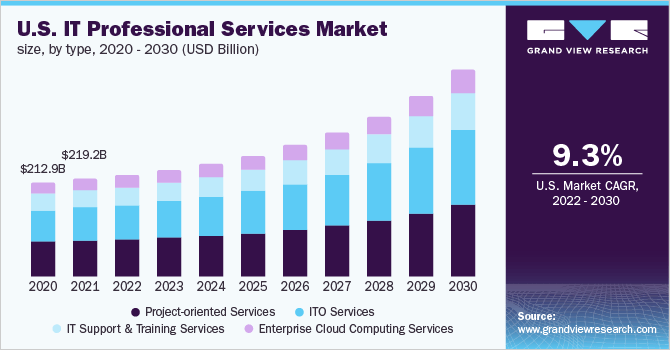

Also, below is a chart showing the historical and projected future growth trajectory of the entire IT professional services market in the U.S., by sector:

US IT Professional Services Market (Grand View Research)

Note that the IT Support and Training Services market is the second-smallest sector within the entire industry.

The chart below shows the global market divided by end user type:

Global IT Professional Services Market (Grand View Research)

Rimini Street’s Recent Financial Performance

-

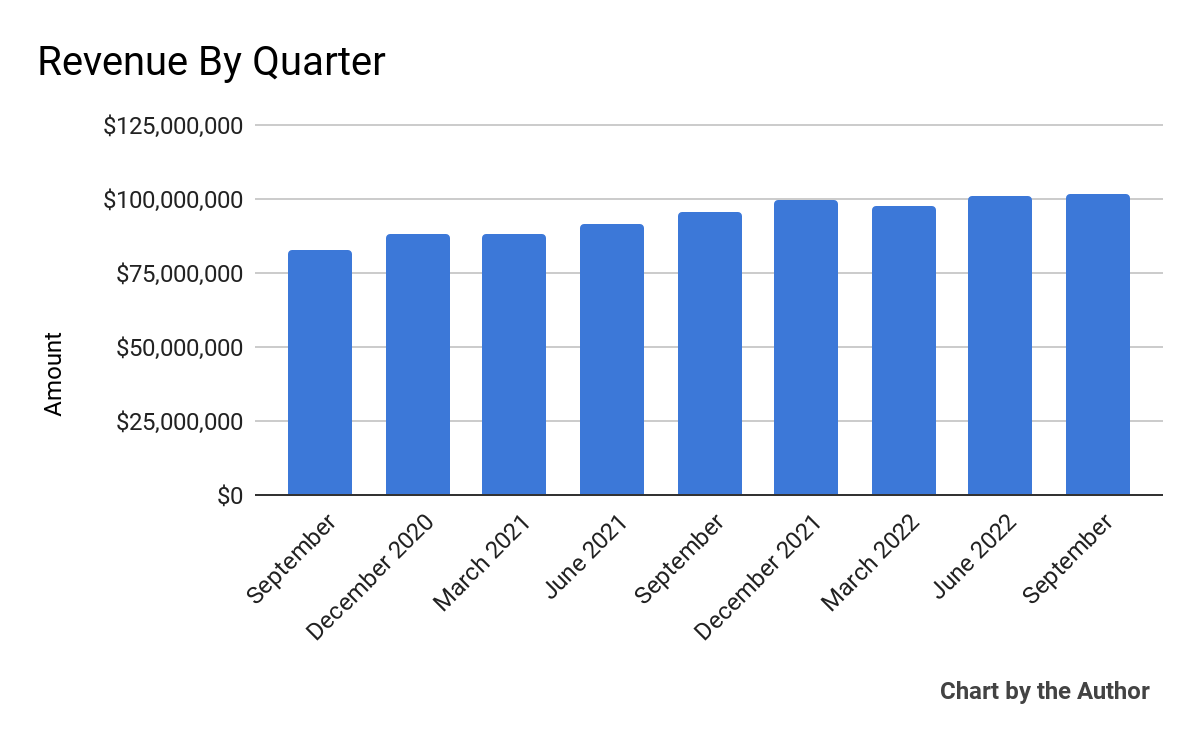

Total Revenue by quarter has essentially plateaued in recent quarters:

9 Quarter Total Revenue (Seeking Alpha)

-

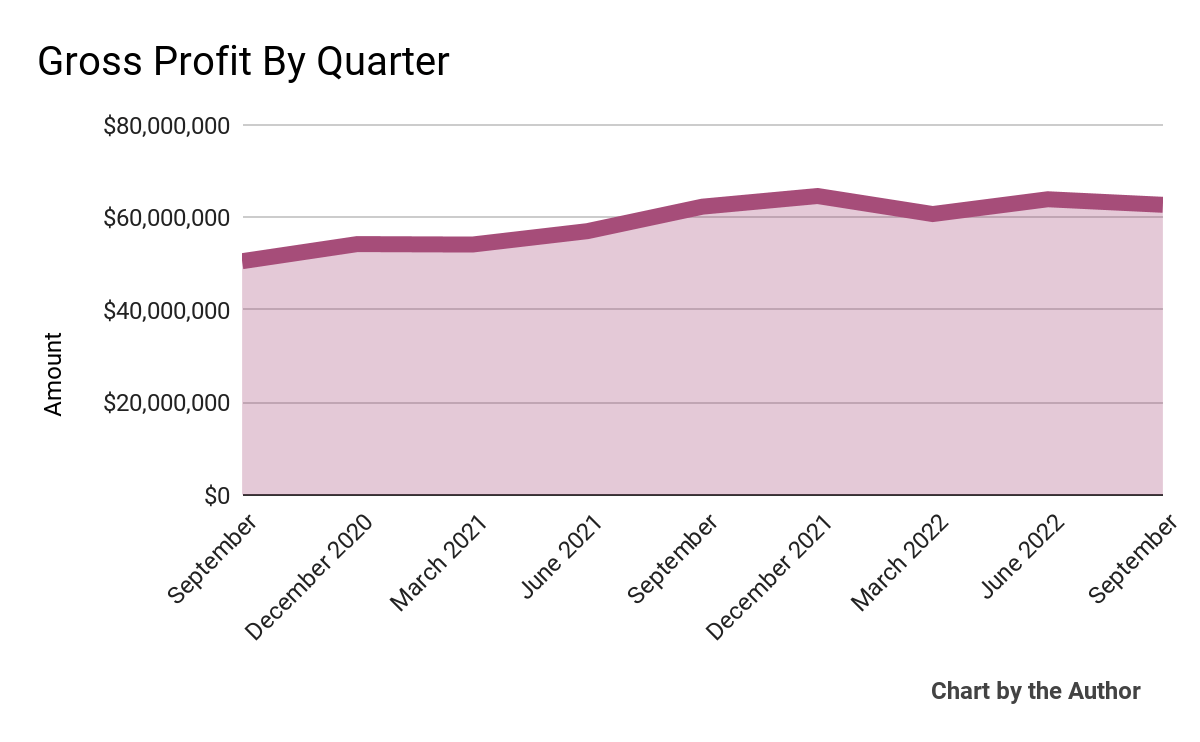

Gross Profit by quarter has followed a similar trajectory to Total Revenue:

9 Quarter Gross Profit (Seeking Alpha)

-

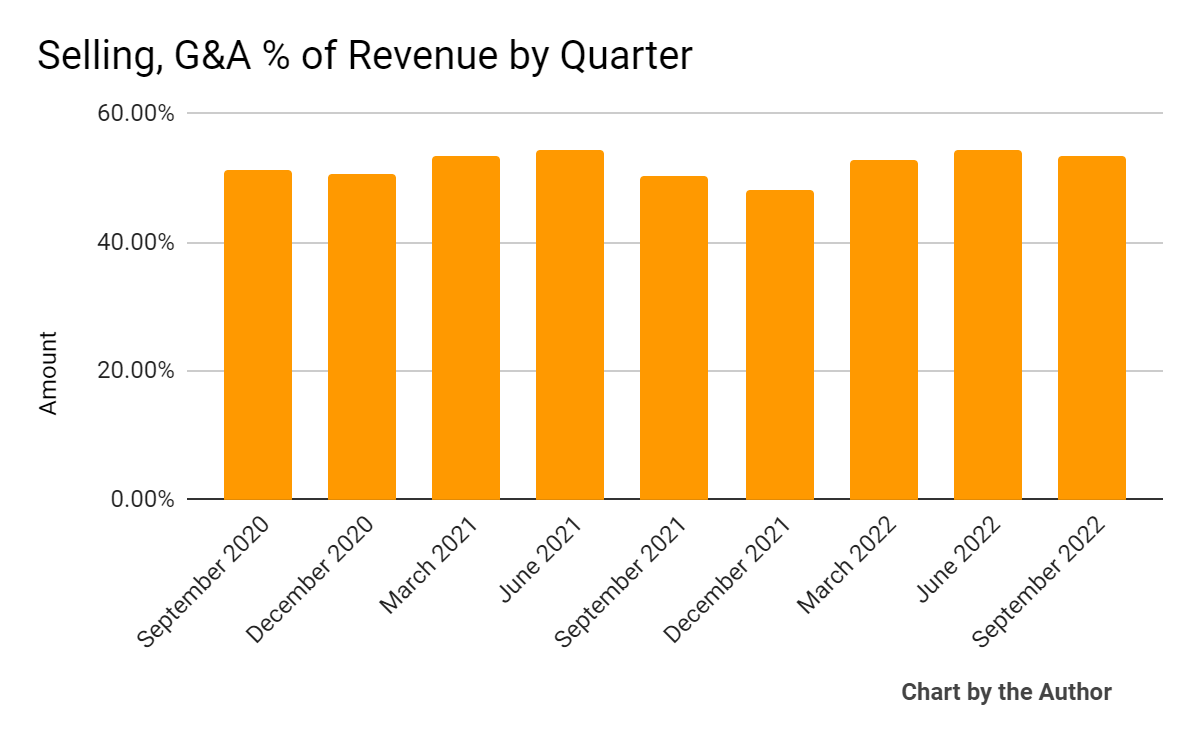

Selling, G&A expenses as a percentage of total revenue by quarter have remained contained within a range:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

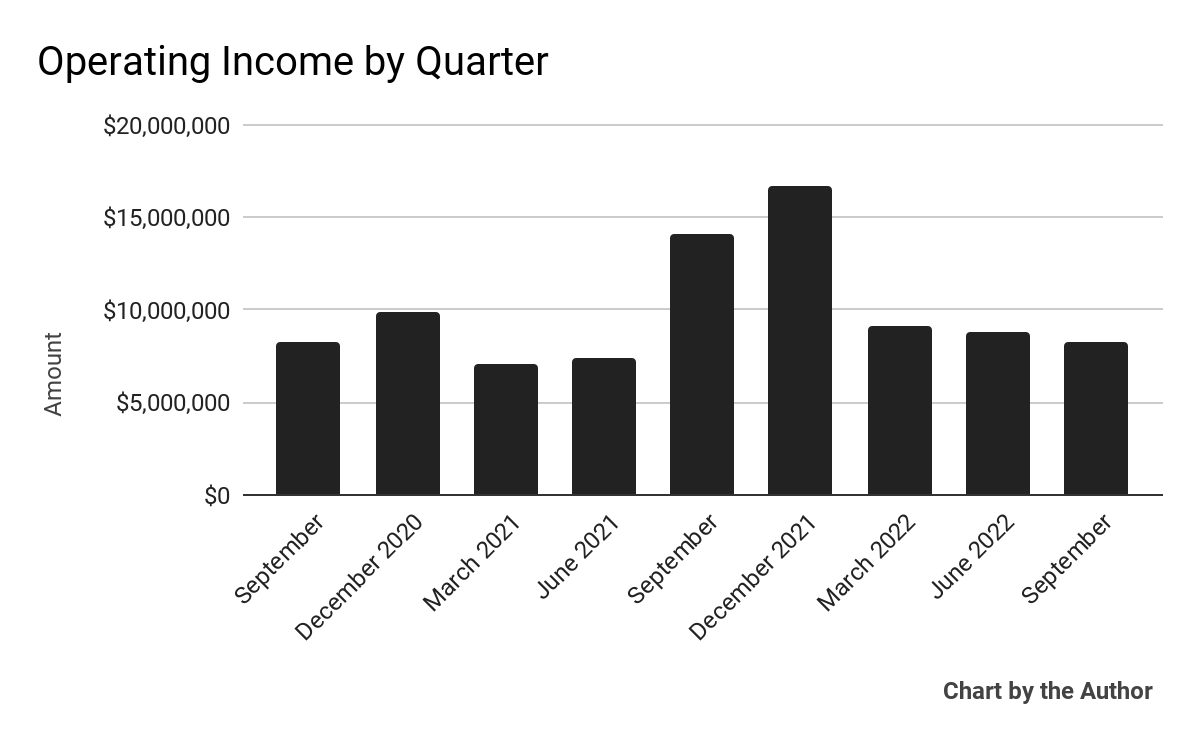

Operating Income by quarter has dropped in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

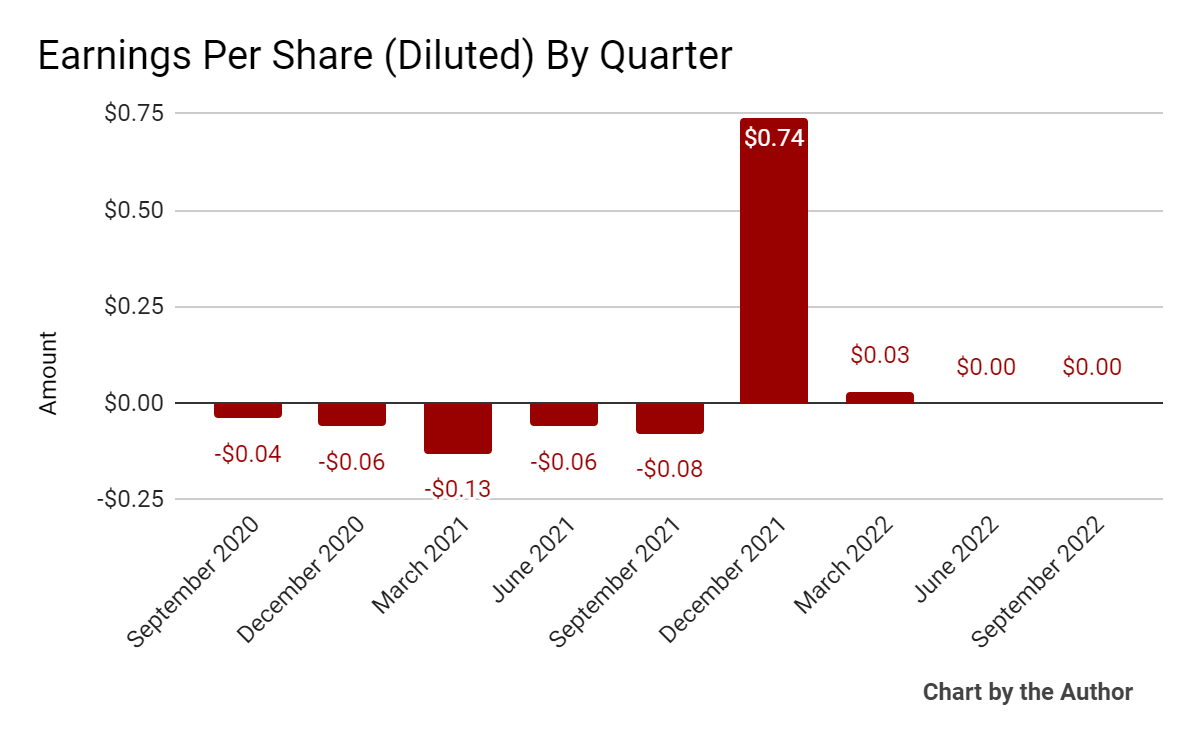

Earnings per Share (Diluted) have remained at breakeven in the past two quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP.)

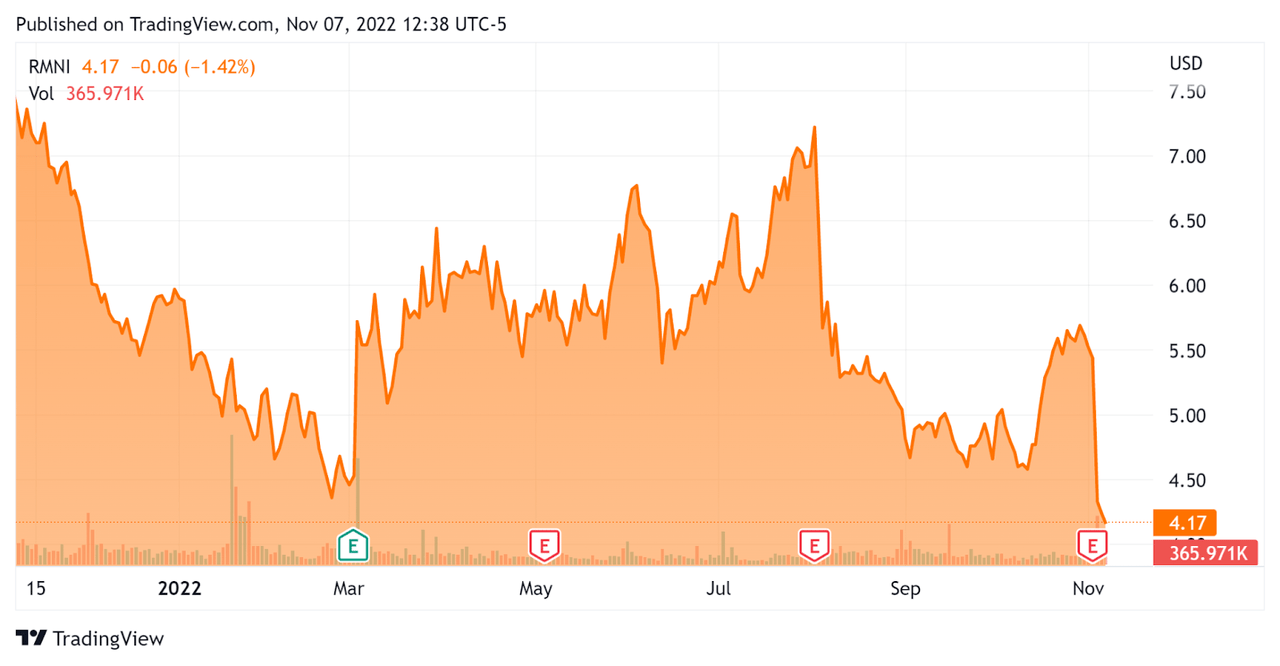

In the past 12 months, RMNI’s stock price has fallen 47.7% vs. the U.S. S&P 500 index’s (SP500) drop of around 19.3%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Rimini Street

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.83 |

|

Revenue Growth Rate |

10.3% |

|

Net Income Margin |

18.2% |

|

GAAP EBITDA % |

1.3% |

|

Market Capitalization |

$373,420,000 |

|

Enterprise Value |

$333,800,000 |

|

Operating Cash Flow |

$55,890,000 |

|

Earnings Per Share (Fully Diluted) |

$0.77 |

(Source – Seeking Alpha.)

Commentary On Rimini Street

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted the firm’s foreign exchange headwinds as negatively impacting its results due to a strong U.S. dollar.

The company’s client base rose by 7.8% year-over-year to more than 3,000 active customers.

However, in the current slowing macroeconomic environment, some of Rimini Street’s clients are freezing or delaying purchase decisions, resulting in slower sales cycles and lower revenue growth for the near term.

In response, management has broadened its service offering cross-selling activities for its existing client base in addition to its new customer efforts.

Its Oracle Corporation (ORCL) legal situation continues, with remaining legal claims and counterclaims expected to begin trial at the end of November 2022. Management expects continued significant litigation costs of around $25 million for the full year of 2022.

As to its financial results, revenue rose 6.6% year-over-year.

The company’s net dollar retention rate was 94%, indicating moderate product/market fit and sales & marketing efficiency.

Billings dropped 32.5% from the previous year’s same period while gross margin dropped to 61.5% compared to 65.1% in the previous year.

Management has seen higher labor costs across all labor categories due to general inflation pressures.

Sales and marketing expenses rose as a percentage of total revenue while operating income dropped slightly sequentially.

For the balance sheet, the firm finished the quarter with cash, equivalents and short term investments of $130 million and debt of $75.6 million.

Over the trailing twelve months, free cash flow was $52.1 million, with only $3.8 million in CapEx.

Looking ahead, management expects full year 2022 revenue to be approximately $405 million, at the midpoint of the range, but did not provide an expected EBITDA figure.

Regarding valuation, the market is valuing RMNI at an EV/Revenue multiple of around 0.83x and its recent revenue & earnings misses sent the stock dropping sharply on the news.

The primary risks to the company’s outlook is the still uncertain outcome of its Oracle litigation as well as slowing customer sales motions as a result of a worsening economic environment and U.S. dollar strength causing Forex headwinds.

Until these various risks are reduced and we gain further visibility into the firm’s future financial results, I’m on Hold for RMNI.

Be the first to comment