Vertigo3d/iStock via Getty Images

With varying tax treatment and product-specific nuances, it is important for investors to understand the different types of MLP investments, their trade-offs, and how those compare to directly owning individual MLPs. Rounding out this series on the tax advantages of MLPs and considerations for MLP investment products, today’s note provides a brief overview of two more vehicles for gaining MLP exposure and discusses how investors can choose the right product to suit their needs.

As a reminder, VettaFi is not an accounting firm or tax consultant, and this piece does not constitute tax advice. For details specific to your situation and investment, please consult your tax advisor.

Gaining MLP exposure through RICs

Most investment funds are structured as Regulated Investment Companies (RICs), which function as pass-throughs and avoid taxes at the fund level. RICs cannot own more than 25% MLPs, and as a result, these funds tend to have lower yields than C-Corp funds that are predominantly MLPs (read more on C-Corp funds). The difference in the ten-year average yield for an index of MLPs and an index that is 25% MLPs and 75% midstream corporations is 210 basis points.(1)

Despite a lower yield, RICs provide other advantages including minimal tracking error and diversification. However, investors should ensure their investment objectives align with the 75% non-MLP holdings, which could be US and Canadian midstream corporations, utilities, other energy companies or even other income-oriented equity investments. With the consolidation of MLPs by their C-Corp parents, investors may prefer RIC mutual funds or ETFs to gain broad exposure to midstream companies, including names like Kinder Morgan (KMI) or ONEOK (OKE) that would not be in an MLP-only fund.

Investment options outside of funds: exchange-traded notes

Outside of the funds defined by the Investment Company Act of 1940 (40 Act Funds), another option for gaining MLP exposure is through exchange-traded notes (ETNs). ETNs are unsecured debt obligations of an issuer, which agrees to pay a specified return typically based on an index. Energy infrastructure ETNs often track an index of MLPs, but there are ETNs based on indexes with MLPs and C-Corps. ETNs can be leveraged, magnifying the return on the index in either direction.

The key advantage of ETNs is little to no tracking error, but the drawbacks include exposure to the credit risk of the issuing bank and the fee coming out of the coupon, lowering the yield. Additionally, coupons are taxed at ordinary income rates, and ETNs do not provide the tax-deferred income associated with direct investment in an MLP or a C-Corp fund.

Choosing the right investment for your needs

Selecting the right MLP investment for a certain situation depends on a few variables, including the investors’ tolerance for a Schedule K-1, the type of account, and the primary investment objective. For a US taxable investor(2) comfortable with filing K-1s and state taxes and willing to do research to choose individual MLPs, the most tax-efficient way to own MLPs is to buy them directly. That said, many investors prefer the conveniences of accessing the MLP space through a product for the diversified exposure and 1099 tax reporting.

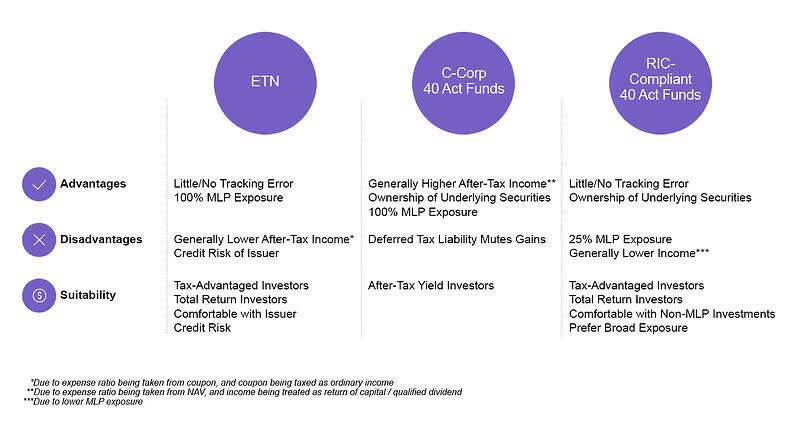

When choosing among MLP products, it is important to understand the nuances of each option. The graphic below highlights the pros and cons of each vehicle, as well as suitability considerations. For an investor wanting to maximize after-tax yield, a C-Corp fund is likely to be most appealing. Given that these typically provide tax-advantaged income, they are best suited for a taxable account. Longer holding periods allow investors to maximize the benefits of tax-deferred income from C-Corp funds.

For investors that primarily want total return or that expect significant capital appreciation, a RIC or ETN may be better options given little or no tracking error and relatively lower yields, although the income is still generous compared to many equity investments. Because coupons are taxed at ordinary income rates, ETNs are better suited for tax-advantaged accounts.

Investors that are most concerned with having exposure to both MLPs and energy infrastructure corporations will probably prefer a RIC. Investors should ensure the portion of the portfolio that is not MLPs is providing their desired exposure and fits with their risk tolerance. There are some ETNs that track indexes with MLPs and C-Corps, but these tend to be less common.

Bottom Line

Understanding the tax benefits of MLPs and the nuances of MLP investment products is key to energy infrastructure investing and making the optimal allocation to meet an investor’s needs.

| Disclosure: © Alerian 2022. All rights reserved. This material is reproduced with the prior consent of Alerian. It is provided as general information only and should not be taken as investment advice. Employees of Alerian are prohibited from owning individual MLPs. For more information on Alerian and to see our full disclaimer, visit http://www.alerian.com/disclaimers. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment