felixmizioznikov/iStock Editorial via Getty Images

Investment Thesis

Leading high-end specialty retailer RH (NYSE:RH) reported a “mixed” report card on the surface. The company met consensus estimates on adjusted earnings but missed on revenue. CEO Gary Friedman also provided “brutally honest” commentary about its recent challenges that spooked some RH investors.

Despite the recent scare, we think the market has already incorporated RH’s expected challenges well ahead of FQ4’s earnings card. Notably, investors have been rotating out of stocks with massive gains from the pandemic bottom, including RH stock. Consequently, RH stock has fallen 55% at writing from its August highs.

However, these investors miss the point that RH remains a solidly profitable stock that has consistently improved operating leverage. In addition, we believe its robust FCF yields offer defensive exposure in the challenging macro environment.

Therefore, we rate RH stock at Buy.

RH’s FQ4 Earnings Call Was Brutally Honest, And We Like It

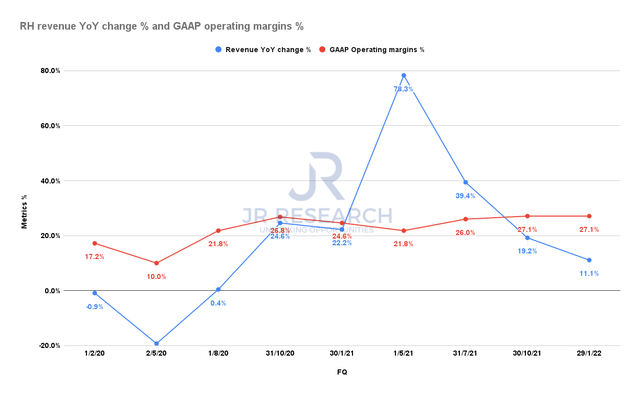

RH revenue change and operating margins % (S&P Capital IQ)

RH reported revenue of $902.7M in FQ4, up just 11.1% (below consensus estimates of $931.3M). However, its GAAP operating margins remained robust and consistent. Despite the challenging macro environment, it posted an operating margin of 27.1%, in line with FQ3’s performance. Notably, RH has demonstrated operating leverage gains, which validated its pricing leadership and superb P&L discipline.

Notably, the company’s FQ1 guidance spooked the market, as RH highlighted that it saw a moderation in demand since the start of the Russia-Ukraine conflict. Friedman articulated (edited):

We believe it is prudent to remain conservative until demand trends return to normal. The softness is implied in our guidance.

But we saw our business soften since the beginning of the conflict, and the market volatility followed. So you’ve got a lot of news and a lot of noise out there, compounded by war.

And we saw our business slow by about 10 to 12 points, and it’s been relatively consistent during that period. When would it return to normal? Not sure. How aggressive is the Fed going to be? Not sure.

There are things we know, and I don’t mean to be a pessimist, but history would tell us that 4 to 5 times the Fed raises interest rates over a sustained period, we have a recession. And I don’t need to tell you guys that math. That is just the fact. (RH’s FQ4’21 earnings call)

Still, RH Remains Solidly Profitable

As mentioned, the company issued a relatively tepid FQ1 revenue guide. RH estimates an increase of 7-8% YoY. But, investors should also note that management was clear it telegraphed conservative guidance. Furthermore, management didn’t expect the weakness to be structural. RH remains optimistic that all these disruptions shall pass and urge the long-term view. Friedman highlighted (edited):

Again, these are all temporal issues. Whether it’s the war, the inflation, and stuff like that, none of this is permanent.

So we’re playing for the long term, and we’re trying to make really good, big decisions that kind of change kind of the vector of the direction that we’re going.

And I think we’ve made some really good ones. I think that’s why we’ve got an operating model that’s a lot better than the next best person. And we have really big moves we’re making right now that can increase that vector and accelerate our performance significantly more.

We don’t sit here and say, “Oh, we made a 25% operating margin. We think this is the best we’ve ever done. So it’s not going to get any better.” We think it’s going to get a lot better.

Investors can certainly count on it. RH guided for an FY22 adjusted operating margin of 25-26% despite the deceleration in topline growth. Notably, it’s broadly in line with FY21’s 25.6%. Moreover, investors should consider implied macro weakness in its guidance, coupled with an international expansion plan. Management highlighted that there could be some near-term margins compression from its early international ramp. However, it expects to gain leverage over the medium term.

Therefore, given the highly challenging business environment that RH is in right now, we applaud management for its ability to continue guiding robust profitability.

Why RH Stock Is A Buy

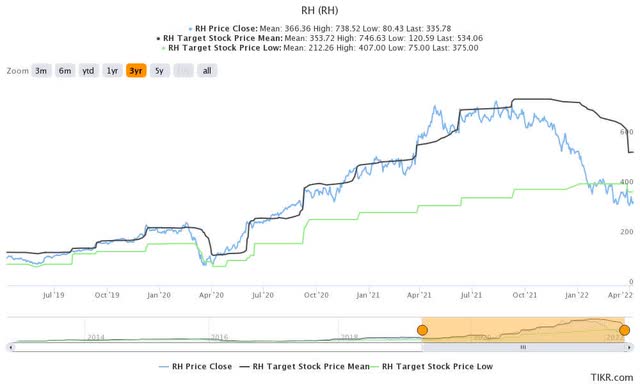

RH stock NTM FCF yield % and NTM normalized P/E (TIKR) RH stock consensus price targets Vs. stock performance (TIKR)

Furthermore, RH also has robust free cash flows, which could be a defensive shield in a challenging macro environment. RH last traded at an NTM FCF yield of 8.3%, well above its 5Y mean of 7.3%. In addition, its NTM normalized P/E of 13x is also well below its 5Y mean of 20.3x. Notably, it’s also trading well below the S&P 500’s NTM P/E of 19.6x (as of April 8, 2022).

Also, the specialty retail industry’s P/E of 7.4x is well below its 10Y mean of 16.5x. Therefore, the value compression in RH stock has already occurred well ahead of an “impending” recession.

We concur that RH stock could be in the penalty box for a while with no clear near-term catalysts in sight. However, its well-battered valuation and highly robust FCF yields are too attractive to ignore.

Consequently, we rate RH stock at Buy.

Be the first to comment