JJ Gouin

In order to have such a large and complex economy like what we have in the modern era, you need a tremendous amount of energy as fuel. Fuel takes many different forms, but one of the more common involves the production and use of ethanol. It should stand to reason, then, that there would be a large number of companies dedicated to producing this product for the various end users that need it. One fairly small company in this market that is worth some attention is REX American Resources (NYSE:REX). With a market capitalization of $520.6 million, REX American Resources is not particularly robust in size. But the company has a tremendous amount of cash on hand and shares are trading at levels that are fundamentally appealing. Unfortunately, anything related to the energy space is bound to be volatile in nature. And this is no exception here. But for investors who don’t mind the volatility and who are drawn to this market specifically, this enterprise might be a reasonable prospect to consider.

A niche energy firm

According to the EIA (Energy Information Administration), the most common use of ethanol is as fuel ethanol that’s mixed with various grades of finished motor gasoline. In fact, approximately 97% of all gasoline sold in the US has some amount of ethanol in it. The end goal here is that it can be used to enhance the octane rating of gasoline, which reduces the risk of explosion. In short, it helps to make gasoline, even low-grade gasoline, safer to use. There are other reasons to have ethanol in our gasoline as well. As an example, it also makes the burning of gasoline environmentally more friendly by reducing the amount of harmful pollutants that get added to the plan that’s ozone. Another great benefit to ethanol production is that it’s renewable. While in Brazil, ethanol is largely produced from sugar cane, in the US it is produced from corn. For the U.S. market alone, it was estimated that ethanol production totaled 15 billion gallons in 2021, up 1.2 billion gallons compared to what was seen in 2020, but still below the 15.8 billion gallons sold the year prior to the pandemic. That year, the industry consisted of 208 plants spread across 25 states that had a combined annual capacity of 17.7 billion gallons.

When it comes to REX American Resources specifically, the company essentially acts as an owner of specific energy assets. As of the end of its latest fiscal year, for instance, the business owned 75.8% of One Earth Energy, LLC and 99.7% of NuGen Energy, LLC. It also owns between 5.7% and 10.3% of other ethanol production facilities under the Big River Resources, LLC umbrella. At the end of the 2021 fiscal year, the three entities that the company owned controlled a combined six ethanol production plants. Collectively, they shipped 699 million gallons of ethanol during their latest fiscal year, with REX American Resources’ ownership interests totaling 282 million of those gallons. Just like when talking about other energy companies, what matters most in determining profitability is the spread between the cost of production and the cost of sale of the product in question. In the case of the ethanol industry, this involves the price per bushel of grain, with each Bush or expected to produce at least 2.8 gallons of denatured ethanol, and the price per gallon of ethanol when sold. Management calls this the ‘crush spread’.

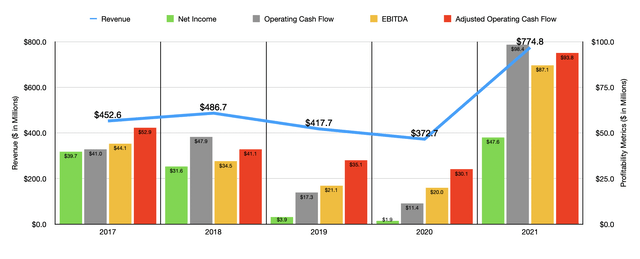

Historically speaking, REX American Resources has been subjected to a fair degree of volatility. Between 2017 and 2019, revenue ranged between a low point of $417.7 million and $486.7 million. In 2020, sales plunged to $372.7 million before spiking to $774.8 million in 2021. From 2020 to 2021, the company benefited from a variety of factors. For instance, the average selling price per gallon of ethanol net of any hedges the company had in place jumped from $1.30 to $2.21. At the same time, the gallons of ethanol that it was entitled to that were sold jumped from 217.1 million to 277.8 million. These two changes were instrumental in pushing ethanol sales for the company up from $284.2 million to $613.6 million in the course of just one year. In addition to that though, the company benefited from dried distillers’ grains revenue jumping from $71.8 million to $125 million as the average selling price per ton of dried distillers’ grains grew from $144.73 to $197.86. Part of this increase was also driven by a rise in the tonnage of dry distillers grains sold from 495,915 to 631,818. And on top of that, the company also saw non-food grade corn oil revenue climb from $15.1 million to $38.9 million. This was driven by a near doubling and the average selling price per pound of non-food grade corn oil from $0.26 to $0.50 and by the quantity of it sold rising from 58.9 million pounds to 77.2 million pounds.

As volatile as revenue has been, you would also be correct in guessing that profit figures have been volatile for the company as well. This much can be seen in our initial chart in this article. Last year though, profits spiked to $47.6 million. Other profitability metrics also came in strong. Operating cash flow hit an all-time high of $98.4 million while the adjusted figure, which ignores changes in working capital, hit $93.8 million. Meanwhile, EBITDA for the year had $87.1 million, coming in significantly higher than the $20 million reported the same time last year.

Author – SEC EDGAR Data Author – SEC EDGAR Data

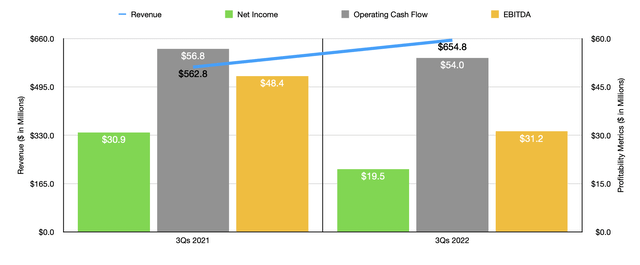

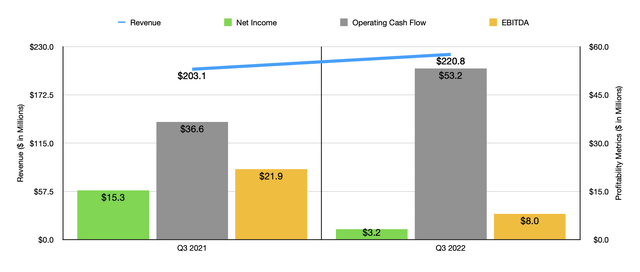

So far in 2022, results for the company have been impressive. For the first nine months of the 2022 fiscal year, sales of $654.8 million beat out the $562.8 million reported the same time last year. Even in the latest quarter, sales of $220.8 million came in higher than the $203.1 million reported in the third quarter of 2021. Investors were particularly excited by that third quarter earnings release, as evidenced by the fact that shares of the company spiked about 18% for that day. This enthusiasm came as revenue topped expectations by nearly $10.3 million. On the bottom line, things have been a bit more difficult. Although revenue for the company rose nicely year over year, net income in the first nine months of 2022 hit $19.5 million. That’s down from the $30.9 million reported the same time last year. Operating cash flow declined from $56.8 million to $54 million, while EBITDA shrank from $48.4 million to $31.2 million. We saw similar weak but mixed results in the latest quarter alone as well. Net income was only $3.2 million compared to the $15.3 million reported one year earlier. But on a per-share basis, the $0.18 in profit generated by the company beat expectations by $0.06 per share.

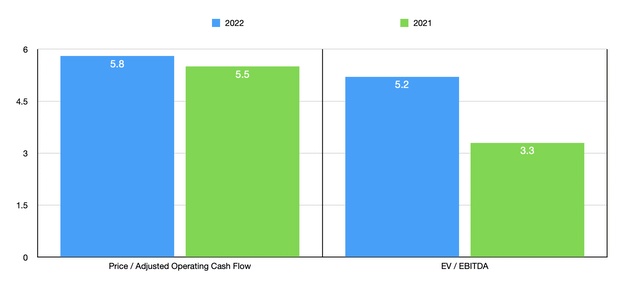

Truth be told, we don’t really know where financial performance will go from here. This is a volatile company with no terribly discernible trend. But if we annualize results experienced so far in 2022, we should anticipate adjusted operating cash flow of $89.2 million and EBITDA of roughly $56.1 million. As you can see in the chart above, this gives the company a forward price to adjusted operating cash flow multiple of 5.8 and a forward EV to EBITDA multiple of 5.2. I also, for context, put the multiples from 2021 in the picture. The company looks a bit cheaper in both regards that way. As part of my analysis, I did compare the company to two similar firms. Both of these can be seen in the table below. But the key takeaway here is that, on a price to operating cash flow basis, the pricing of all three companies is similar, while using the EV to EBITDA approach we end up with one of the two being priced at a very similar point.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| REX American Resources Corporation | 5.8 | 5.2 |

| Alto Ingredients (ALTO) | 5.2 | 5.0 |

| Adams Resources & Energy (AE) | 5.0 | 0.5 |

Takeaway

Based on all the data provided so far, I must say that I have found myself to be fairly impressed with REX American Resources. These days, I tend to prefer companies that are more stable in nature. But from a value-oriented perspective, this is definitely an interesting prospect. I do acknowledge that volatility will be normal in this space moving forward. But add on top of this the fact that the company has $291.1 million in cash compared to no debt, and I cannot help but to rate the enterprise a soft ‘buy’ at this time.

Be the first to comment