Nastassia Samal

Introduction

On 15 February 2022, Intel (INTC) and Tower Semiconductor (NASDAQ:TSEM) announced an all-cash agreement worth $5.4B under which Intel pays $53 per share to acquire Tower. A week later, Investing Grandfather wrote a nice piece here on Seeking Alpha analyzing this merger arbitrage opportunity. This article revisits this analysis in light of market action over the seven months since. My thesis is that this deal has sweetened significantly during this time and now presents an excellent opportunity for a nice payoff with an acceptable level of risk.

Recap of Previous Analysis

I will not attempt to re-state very much of the aforementioned analysis by Investing Grandfather, but a couple key points do bear repeating. First, for those unfamiliar with the concept of merger arbitrage in general, a nice primer is available here. The main idea is that the stock of the to-be-acquired company often trades somewhat below the agreed acquisition price between during the period between deal announcement and deal closure. The idea of merger arbitrage received a bit of a revival in the popular investing press this spring and summer as a consequence of Elon Musk’s highly publicized acquisition agreement – now very much on the rocks – for Twitter (TWTR). This situation represents a poignant reminder that these opportunities carry risk.

There are three key questions to apply to any given merger arbitrage opportunity:

- What is the probability that the deal will close on the terms originally announced?

- What are the most likely range of outcomes if the deal falls through?

- How long will it take?

Regarding the first question, IG’s article pointed to Julian Klymochko’s note, “A Practitioner’s Guide to Merger Arbitrage” which references a statistical study concluding that 94% of US deals successfully closed, 87% on the terms agreed, with 6% revised up and 1% revised down. For simplicity, I will follow IG’s lead and neglect the possibility of a revision and simply assume that if the deal does close, it will be at $53/share with a finite risk that it falls through completely. The remainder of this article will focus on the first two questions: the interaction between the probability of deal closure (at $53) and range of outcomes if the deal falls through.

A Brief Word on Timing

Regarding the third question above on timing, IG references a 2019 Gartner article stating that 106 days is the average duration for midsize deals ($500M to $5B). It is worth noting that as of this writing we are 223 days and counting for the subject deal. Having said that, this deal, at $5.4B is slightly above the midsize range. The Gartner piece said that large deals (more than $25B) take an average of 279 days to close. Clearly the Tower deal is quite a bit smaller than this. That said, this deal has a couple elements of complexity that lead me to expect the time to close to be on the long side. First, Tower is a non-US company, headquartered in Israel, operating semiconductor foundries in three countries: Israel, the US, and Japan (through a 51% ownership stake in TPSCo, the other 49% of which is owned by Nuvoton Technology Corporation Japan. Furthermore, the semiconductor industry has become a geopolitical hot button over the last two years. It is important to note that the three countries involved are all on relatively friendly terms. Nonetheless, given these complexities, my base case would be for a longer-than-normal timeline to close this deal to allow for the international stakeholders to proceed through their regulatory due diligence. Said differently, the fact of the deal not yet closing, in the absence of significant news on the topic, is not overly concerning.

Probabilities and Expected Values

In poker, the concept of “pot odds” provides a framework for dealing with the uncertainty of whether a player should call to remain in a hand in the hopes of improving their hand with the cards still to be dealt. For example, let us suppose that a player believes he is currently losing, but has a chance of improving to a winning hand once all the cards have been dealt. Further, suppose that there is a $400 pot to be won and that by calling once for $100 he can stay in the game until the end (for simplicity, assume that this decision of whether or not to call is the only decision to be made left in this hand of play). The player’s pot odds correspond to the expected value of the hand, i.e., the ratio of the cost of the call to the value of the pot (hence, the $100 call divided by the $400 pot equates to 25% pot odds). Thus, if his odds of winning the hand are better than 25%, the pot odds are in his favor and statistically, he should call. This same logic can be applied to a merger arbitrage opportunity such as the Tower-Intel deal.

Merger Arbitrage Pot Odds

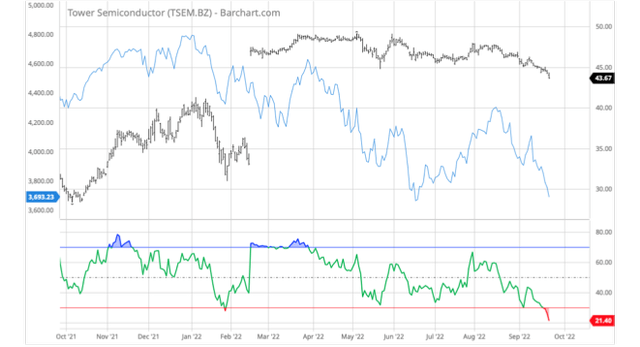

To estimate the expected value of this opportunity, we need to revisit question #2 from above and establish a working estimate of the value of TSEM in the event that the acquisition falls through. It is overly simplistic to assume that TSEM would revert back to its price just before the acquisition was announced given how tumultuous the broader market has been in the ensuing period. A much better approach is to start with TSEM’s price before the deal was announced and use the stock’s beta to estimate what its price would be today based on the current benchmark value. The figure below shows the 2-year daily chart of TSEM and the S&P 500.

TSEM (black, rhs) and S&P 500 (blue, lhs) 2-Year Daily Chart (barchart.com)

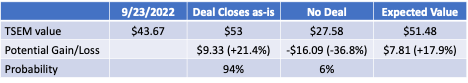

According to Seeking Alpha, TSEM’s 60-month beta is 1.04. Hence, if the benchmark (the S&P 500) rises 10% in a month, we should expect TSEM to rise 10.4%. Unfortunately for stock investors, the S&P 500 is down 16.1% from 14 Feb so we should expect a 16.7% drop in TSEM’s price, all else being equal. With this downside estimate, we can now estimate the expected value and analyze the risk/reward profile of this opportunity. Using Klymochko’s notional 94% likelihood that the deal goes through as announced. The result is a healthy ~18% gain.

Table 1: Expected Value Analysis (part 1) (Author’s Calculations)

For now, I’ll leave it at an exercise for the reader to make an assumption about the likely time remaining before the deal closes and convert this gain into an annualized return.

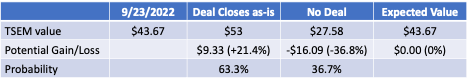

This implies that the market is being quite pessimistic about this deal. We can quantify just how pessimistic, by applying the same logic, but solving for the probability that is implied by a TSEM expected value equal to the recent closing price.

Table 2: Expected Value Analysis (part 2) (Author’s Calculations)

Is this a rational probability to assign? My thesis is that it is not. As mentioned previously, this opportunity is certainly not without risk given that a ~37% loss could be expected in the event that the deal falls through. It is worth noting, however, that this risk is essentially uncorrelated from broad market action. Therefore, from a portfolio-management perspective, TSEM should theoretically have a beta of nearly zero (resulting from the small probability that the deal falls through).

As a sanity check on whether the market price of TSEM reflects a rational probabilistic assessment on the likelihood of the deal closing, I checked a couple other data points since the deal was announced. The most-instructive of which is TSEM’s recent high which occurred on 5/4/2022 at $49.12. Applying the above logic to this day (when the S&P 500 closed at 4,300.17), we would arrive at an 81% probability of the deal closing. This is still too low relative to Klymochko’s data presented earlier, but the more-important point is that there has been little to no material news on this topic that would lead one to believe that it makes sense for the market to imply an 81% probability on 5/4 and then a 63% probability on 9/23. This smells like a market inefficiency ripe for the picking.

Conclusion

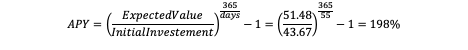

Given the current market turmoil, I have been managing my portfolio beta carefully. It is quite challenging in this environment to find opportunities with a good ROI while trying to keep beta low. But regardless of one’s attitude toward portfolio beta, I trust anyone spending time reading articles on this platform, is, at a minimum, seeking alpha. I believe the TSEM acquisition by Intel provides an expected alpha of 18% (unannualized). How much longer might we have to wait to realize this return? If we assume a 279-day closing period, equal to Gartner’s reported average for a $25B+ deal, the deal would close just 55 days from Monday 9/26/2022, i.e., on 11/21/2022 (Happy Thanksgiving). And while I earlier eschewed annualizing this return, it’s too juicy to leave unsaid.

Annualized Percentage Yield (Author’s Calculation)

For those of us playing this opportunity, let’s hope that Intel’s board hasn’t been hanging out with Elon Musk lately.

Be the first to comment