EXTREME-PHOTOGRAPHER/E+ via Getty Images

Co-produced with Treading Softly

Being a millionaire is a lofty goal that many aim to achieve. More people become millionaires in their 401-Ks than using other routes. 401-Ks are by design structured to encourage savings, and for those savings to be retained for retirement.

Fidelity – the nation’s largest 401-k administrator – reported approximately 442,000 millionaires as of the end of 2021. We know the market has hammered balances since then, however, this is a record number of 401-k millionaires for their system. To be counted, a simple method is deployed, any account with a balance above $1 million is counted. Simple, straightforward, unbiased. I enjoy it when people keep things simple.

So if you reach such a great milestone, how much real-world income does that equate to? If we deploy the age-old guide rule of 4% withdrawals annually, it equates to $40,000. Not an exciting amount for someone sitting on $1 million, right? I agree. However, it’s designed to ensure a stable and “safe” cash flow to live 30-plus years in retirement.

An orderly dismantling of one’s assets.

It’s this idea that I vehemently oppose. I also think it’s the reason over 50% of Americans struggle to save adequately for retirement. Why scrimp and save, to have a measly $40,000 annually to live on?

We’re going to discuss two picks that can generate the same level of income as that 401-k millionaire is set to get, with fewer capital savings required. When they celebrate that milestone, you can internally celebrate besting their income much sooner.

These two picks together would only take $400,000 to match their income. That’s 40% of what they saved! If you had $1 million in your account and an average portfolio yield matching these two picks, you’d generate approximately $100,000 annually, over 100% more than their income stream! Plus, you are not dismantling your savings to pay for your retirement.

I doubtless have to mention that two picks do not constitute an intelligent income portfolio. High Dividend Opportunities teaches its members to follow the Rule of 42 – maintaining at least 42 unique income-generating securities in their portfolio as a means of protecting their income flow.

Let’s dive in!

Pick #1: ACRE – Yield 12%

Ares Commercial Real Estate Corporation (ACRE) is a commercial mortgage REIT that is managed by Ares Management Corp (ARES). ACRE announced a secondary offering in May, creating an excellent buying opportunity. Whenever a REIT I hold issues a secondary, I buy first and ask questions later. Why? Because I would rather invest in a growing company than a shrinking one!

REITs are required by the IRS to distribute the majority of their taxable income. While equity REITs (REITs that own real estate directly) have the advantage of depreciation shielding their cash flow from taxes, mortgage REITs do not. An equity REIT might only need to payout 40-60% of its actual cash flow to meet its IRS obligations. A mortgage REIT doesn’t have that advantage. The difference between taxable income and cash flow for ACRE is much closer, so dividend payout ratios of 80-100% of cash flow are much more common.

If a company can’t retain much capital, how can it grow? By issuing a “secondary offering”. ACRE sold 7 million new shares for approximately $14.95/share, roughly a 3% premium to book value. This will increase ACRE’s share count while providing new capital for ACRE to invest in new opportunities.

Over the past couple of months, the price of loans has been decreasing. What does that mean? It means that new loans being written today are being issued with higher yields. When you just booked over $100 million in new equity to invest, that is a good thing!

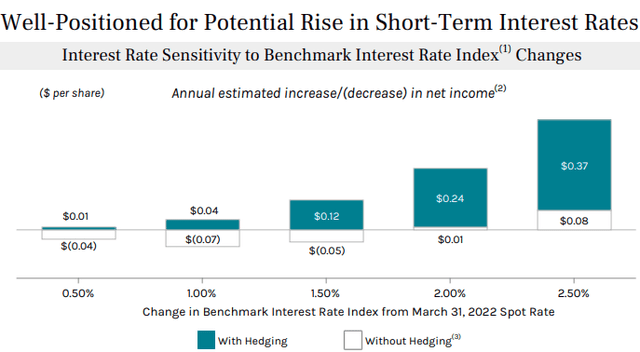

What makes ACRE particularly attractive is its positioning to benefit from rising interest rates immediately.

First Quarter 2022 Earnings Presentation

ACRE is at the point where every move up in 30-day LIBOR/SOFR is money in the bank. If the Fed raises 150 bps (its March outlook), that would add $0.03/quarter to earnings. If the Fed goes crazy and raises to 3% by year-end like Fed Futures are predicting, earnings go up nearly $0.10/quarter.

The benchmark that ACRE is using for this chart is based on the 1-month LIBOR as of March 31st. Since that date, LIBOR is already up 0.68%, so since the end of Q1, ACRE’s earnings are going up.

ACRE is a fantastic option for those looking to hedge against an aggressive Fed. You can collect over 12% today, a high yield even if interest rates stopped rising. If interest rates rise, there is room for dividend growth.

Pick #2: AGNC – Yield 14%

AGNC Investment Corp (AGNC) is a mortgage REIT that invests in “agency” MBS. Agency MBS is a unique investment because they are bundles of mortgages that are guaranteed by the “agencies”, Fannie Mae and Freddie Mac. If a borrower defaults, the agency will buy the mortgage back at face value.

Since there is near zero credit risk, agency MBS prices tend to be closely tied to U.S. Treasury prices. Over the past year, we’ve seen MBS decline a bit more dramatically than Treasury prices. The 4% coupon MBS has declined from $107 to a low of $98.67. (Source: Mortgage News Daily)

In the world of the relatively tame agency MBS, this 8% decline is a “crash”. In recent weeks, prices have rebounded a bit, but are still much cheaper than we’ve seen since the world was introduced to COVID.

What does this mean for AGNC? On the surface, it means book value is down. After all, agency MBS is the primary asset on its books. AGNC came into 2022 with $82 billion in agency MBS, so an 8% decline in MBS prices is a big headwind. This headwind was partially offset by hedging, but when prices move quickly, hedges are less than perfect.

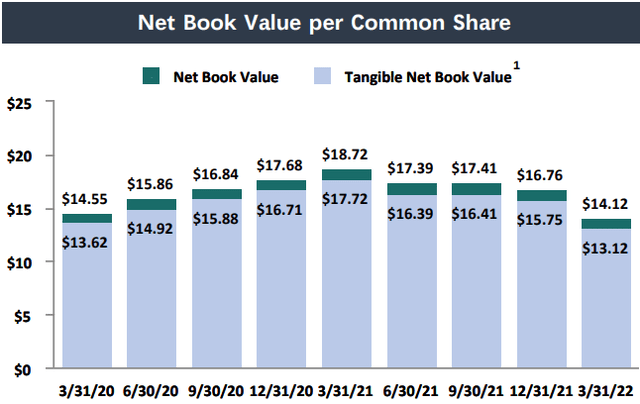

AGNC reported a book value that is the lowest it has been in many years. (Source: Q1 2022 Stockholder Presentation)

Q1 2022 Stockholder Presentation

This has a lot of investors running for the hills. Book value is down! Run!

While others run away, I’m happy to run towards it. Book value was similarly down in March 2020, what happened after that? It went up. AGNC manages to turn a 3-4% yielding investment into 12-14% returns by using large amounts of leverage. As a result, book value is going to move around a lot as prices change. I didn’t panic and sell in March 2020, though many suggested I should. I’m not panicking and selling now, though many say I should. Book value isn’t a worry of mine because it will come back and if I get the notion to sell AGNC, it will be when book value is high, not when it is low!

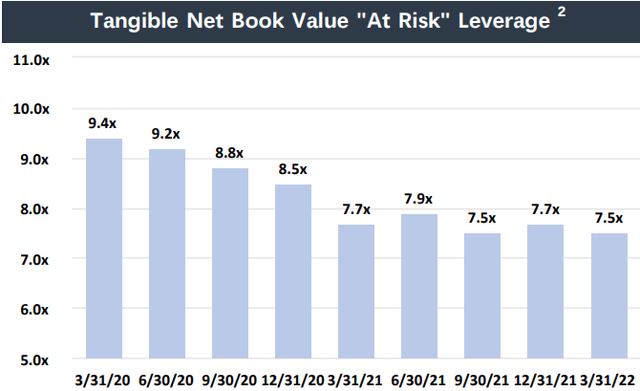

My focus with AGNC has always been the cash flow. I’m buying AGNC for its huge double-digit yield. AGNC’s management was prepared for this crash in MBS prices. After COVID, AGNC allowed its leverage to decline, from 9.4x equity to 7.5x.

Q1 2022 Stockholder Presentation

Some peers like Orchid (ORC) or Ellington Residential (EARN) remained highly levered post-COVID. This allowed them to pay out higher dividends, but now, are being forced to slash those dividends to deleverage when prices are falling. AGNC took a more patient path. Allowing its portfolio to deleverage as mortgages prepaid, and refusing to meaningfully buy MBS when prices were super high. It also means that AGNC has plenty of room to leverage up and back up the truck at extremely attractive MBS prices.

AGNC’s management isn’t looking at the next quarter, they are looking at generating the best returns for the long-term. Last earnings call, CEO Federico said:

Levered returns on production coupon MBS are very attractive on both an absolute basis and relative to past cycles. As such, we believe further MBS weakness, if it occurs, will likely be characterized as an overreaction and will likely represent a compelling investment opportunity for AGNC. The mortgage market also benefits from a self-correcting mechanism in that higher mortgage rates will eventually lead to slower prepayment speeds, lower mortgage origination volume and less runoff on the Fed’s portfolio. In addition, structural changes to the repo market since 2019 have meaningfully improved Agency MBS funding conditions, which is particularly beneficial to levered investors like AGNC.

AGNC’s book value came down, but in exchange, AGNC’s earnings power is higher. AGNC is well-positioned to “buy the dip” and shareholders will be well rewarded for their patience.

Shutterstock

Conclusion

Both ACRE and AGNC are Mortgage REITs, but they focus on very different aspects of that sector.

We can be an income beneficiary from the ignorance and fear of others. While they sell in misunderstanding, or due to the fear generated by frequent traders attempting to make money from your actions.

We hold our place and collect the valuable income generated. Not having to sell a share to pay for our retirements, to pay our bills, to enjoy a nice dinner with family.

Why should anyone dismantle their assets in an orderly fashion to live? They shouldn’t. You don’t have to so, don’t be led to believe you must.

You can retire with a 401-k millionaire’s income stream, with far fewer assets required. Have a million dollars in your IRA or 401-k? You can be earning upwards of $100k annually without lifting a finger.

Sounds good right? I think so. That’s the beauty of income investing.

Be the first to comment