Prostock-Studio/iStock via Getty Images

For those of you who have followed my work, this is a change I decided to make for several reasons. The articles require quite a bit of manual work to update spreadsheets and track dividends coming into the accounts. In recent years I have added more charts/graphs with the hope that it adds value for readers and provides clarity for what I am trying to do.

In the process of doing this, I have made it harder for myself to continue producing consistent articles and ensure that the quality doesn’t suffer. Here are some additional reasons for separating out trades in their own article.

- If I have a week where no trades take place I can simply skip writing this article because there is no point in providing an update if nothing happens.

- My articles currently talk about trades done as long as 60 days ago, for example, if I do a trade on the 1st of June but the article gets published at the end of July. Producing a separate article allows me to provide actionable trades that are more likely still within a buy/sell range after seven days.

- My articles have gotten way too long. A busy month can result in a 4,000+ word article and that distracts from the purpose of the updates.

I would love to receive feedback in the comments about things you like, don’t like, or even ideas that I haven’t yet considered/thought of. Constructive feedback is something I truly appreciate and many of my regulars can attest to the fact that I try to follow up on these ideas whenever possible. Many of the images in my articles are the direct result of tracking that feedback.

September Article

I have included the link for John and Jane’s Retirement Account article published for the month of September at the end of this article.

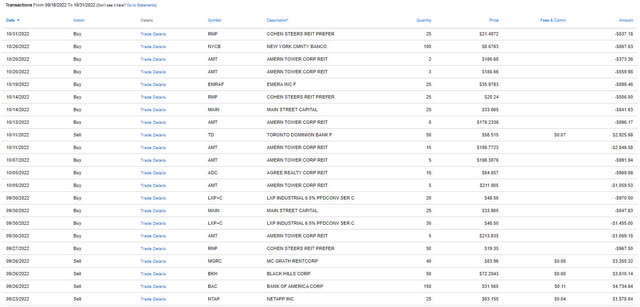

September 18th – October 31st Trades

My original goal was to write these articles more regularly but that has been a challenge going into the winter months with my outside project list continuing to get longer. I originally planned for articles every two weeks or so and I failed miserably with this article being almost six weeks since the last one.

Taxable Account

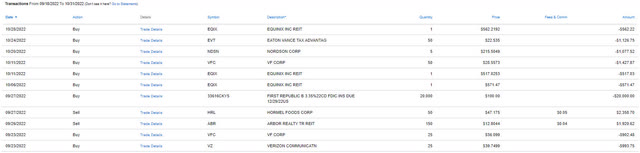

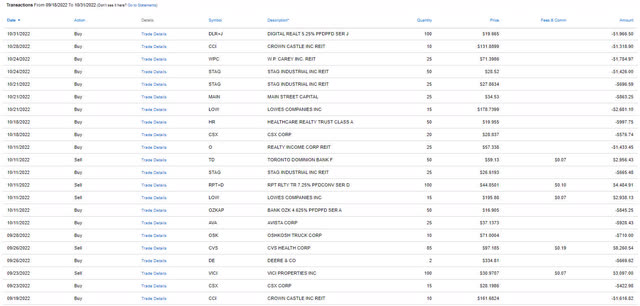

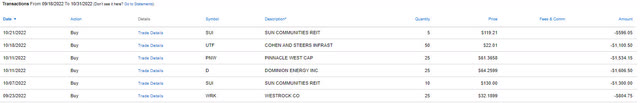

2022-10-31 – Taxable Account Transactions (Charles Schwab)

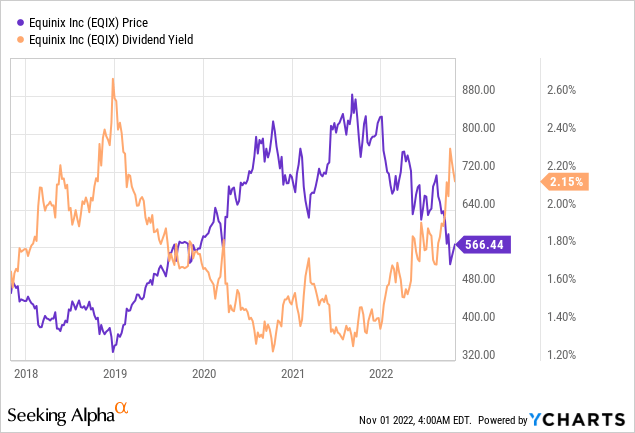

Equinix (EQIX)

We have been adding EQIX one share at a time (literally) with three more purchases when shares moved below the $600/share range. There have been a few sell-rating articles released over the last few months but with a large market share, EQIX is not the company I would recommend betting against. With that said, I believe that the long-term upside is there even though we are likely going to see a period of stagnant price appreciation.

Nordson (NDSN)

In my recent article Nordson: The Dividend King That Continues To Outperform I outline why it is one of (if not my favorite) dividend kings. NDSN is one of the best-performing industrial stocks on the dividend king list and it outperforms on a number of metrics. It is still a great time to establish a position but those looking for maximum value will want to look for a price point of $210-$215. If shares become available at $200/share then consider this an extremely strong buy.

NDSN – FastGraphs 2022-11 (FastGraphs)

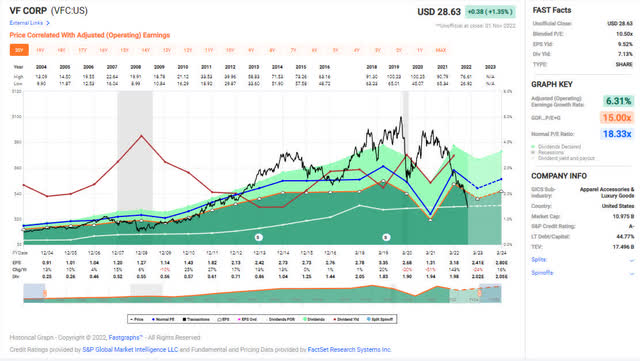

V.F. Corporation (VFC)

VFC’s stock price performance has been absolutely terrible and has seen a number of setbacks with guidance adjusted multiple times. Q2-2022 report wasn’t anything to celebrate but it also didn’t represent a company that is falling apart at the seams. It’s really important to consider that the last time VFC traded at these prices the stock also had a P/E Ratio is the mid to upper teens (15x-20x) whereas the new P/E Ratio is sitting at 10.5x which hasn’t been seen in the last 20 years. We made a large add because honestly the risk is worth the reward and collecting a dividend that has been raised for 50 consecutive years at a 7% yield sounds like a good deal while we wait for earnings to normalize.

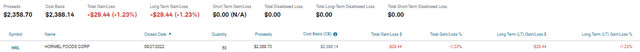

Hormel (HRL)

We sold the higher cost portion of HRL to add more funds to cash that were subsequently reinvested in a short-term brokered CD at 3.35% for 3 months. We continue to hold a modest position in HRL but the reality is that the upside presented is limited and the yield of a brokered CD is more than 100 basis points higher. We are likely to continue liquidating lower yield stocks with limited upside over the next several months in favor of brokered short-term CDs.

HRL – Realized Gain-Loss 2022-9 (Charles Schwab)

Arbor Realty (ABR)

ABR has been one of the best performing stocks in John and Jane’s Taxable account and until now I have been a strong proponent of accumulating more shares. With housing markets strained from rising interest rates the risk in this sector is looking significantly higher and investors need to acknowledge that the 11.3% yield comes with significant risk. We sold the higher cost portion of shares leaving us with a low average cost per share of $7.79. I would consider investing more in ABR on major pullbacks but with the cracks in the economy showing and the uncertainty ahead for inflation we felt the need to pullback on this high yielder.

ABR – Realized Gain-Loss 2022-9 (Charles Schwab)

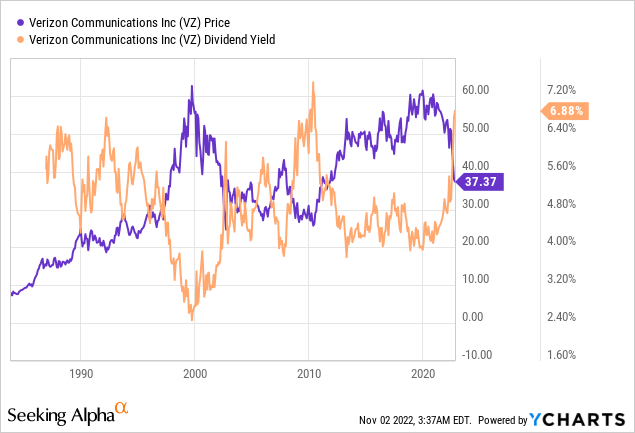

Verizon (VZ)

The mid-$40/share range has been a strong resistance point for years and moving below this puts the stock price in the same territory as we saw during the financial crisis. VZ’s subscriber issues have been a major contributor to the recent price drop but the stock bounced off recent lows of $35/share with positive industry outlook for subscriber growth. At a 7% yield the stock is definitely worth considering at these levels.

Jane’s Traditional IRA

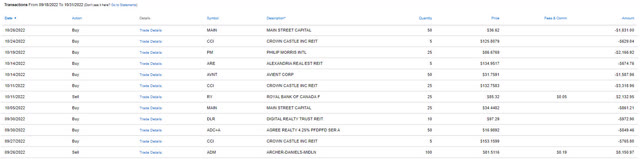

2022-10-31 – Jane Traditional IRA (Charles Schwab)

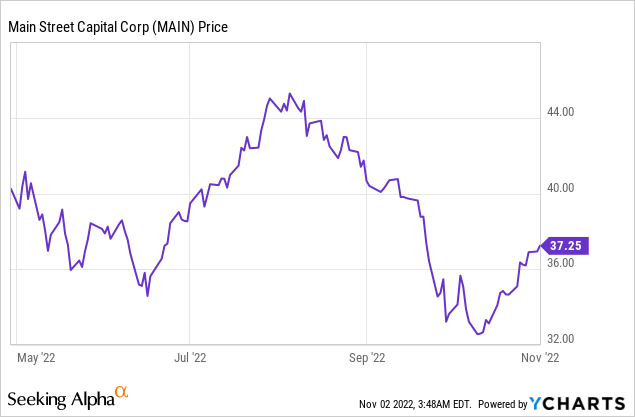

Main Street Capital (MAIN)

MAIN is one of my favorite stocks and we accumulated a handful of shares before and after record NII was announced in Q3-2022. MAIN has (for the most part) always treated at a substantial premium over NAV but this is been justified through its outperformance when it comes to nearly every significant metric. The company is in the process of increasing its monthly dividend payout while reducing the size of the supplemental dividends that have traditionally been awarded twice a year. The upside for the stock price is starting to disappear and we do plan on selling higher-cost shares (in the upper $30/share and lower $40/share range) as we get closer to these breakeven prices.

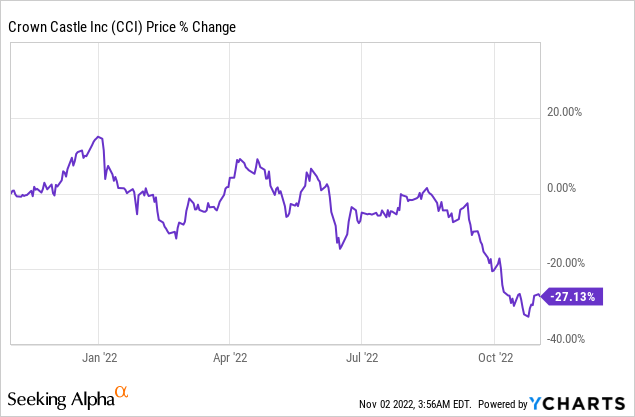

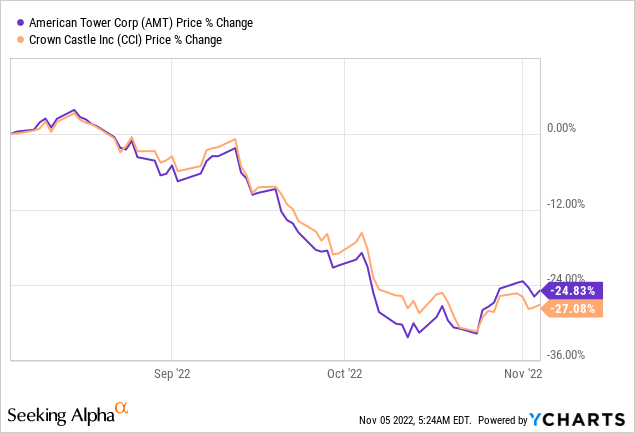

Crown Castle (CCI)

We continue to add shares in both John and Jane’s retirement accounts after the stock price plummeted from 52-week-highs all the way down to three-year-lows. The Q3-2022 earnings report projects strong site rental revenues and AFFO of $7.63 for FY-2023. The company also raised its dividend by 6.5%. CCI’s dividend yield of 4.7% makes it a compelling investment with good opportunity for future price appreciation.

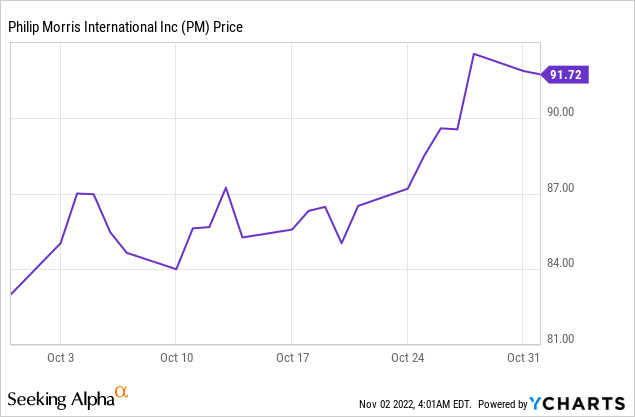

Philip Morris (PM)

PM’s stock price has touched on its 52-week-lows as concerns about the Swedish Match (OTCPK:SWMAY) merger came into question with PM needing to raise its bid to complete the transaction. On October 24th it was noted that EU regulators planned to give the transaction a green light and its stock price moved up swiftly. We like accumulating shares in the low $90/share range and selling when they reach triple-digits.

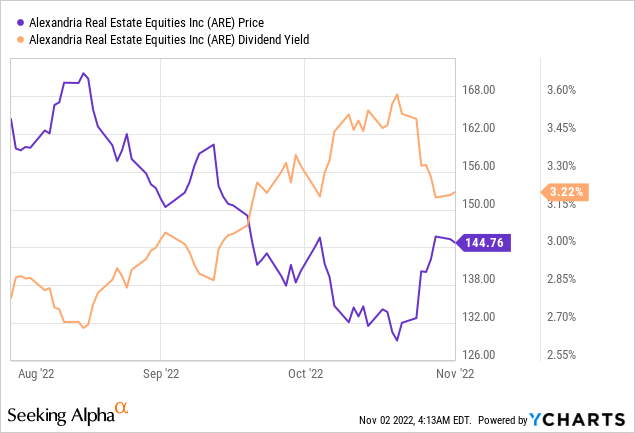

Alexandria Real Estate

We previously doubled the size of the ARE position in the $160/share range and the stock price soon plummeted back to its 52-week-lows. ARE is strongly positioned to overcome many of the challenges over the next few years with the ability to increase rents and maintain a well-balanced debt maturity schedule (no maturities until 2025 and a weighted average interest rate of 3.52%). We will be looking to accumulate more on the dips and implement our normal approach which is to sell higher-cost shares in exchange for the lower-cost shares we purchased. The stock when trading above a 3.25% yield looks very compelling.

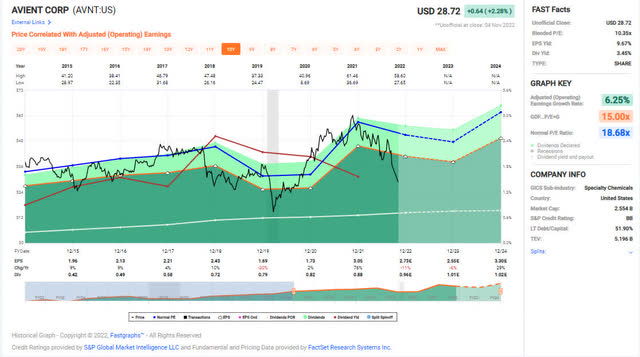

Avient (AVNT)

AVNT announced a major setback in Q3-2022 figures and slashed FY-2022 guidance from $3.50/share down to $2.70/share. These figures were primarily setback by “economic weakness in Europe and COVID-19 lockdowns in Asia” along with future concerns about rising interest rates in the United States and reduced consumer demand. The actual results from Q3-2022 were right in line with these updated expectations and AVNT still felt compelled to offer a 4% dividend increase. For borrowers willing

AVNT – FastGraphs – 2022-11 (FastGraphs)

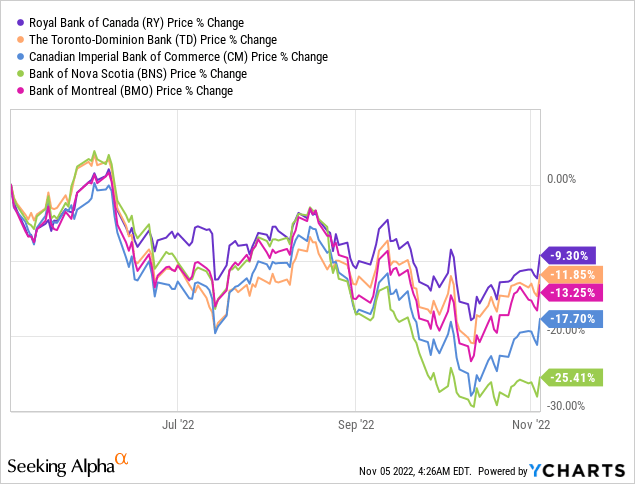

Royal Bank of Canada (RY)

We have opted to trim back some of our Canadian Bank holdings and even though this was done at a price that was lower than we would have liked it represented the high-cost portion of shares and we are in a time where having those funds available as cash makes more sense. We still have a modest position in RY but would be more likely to purchase stock from one of the Canadian banks that have been more beaten down (BNS share price is down almost 3x as much in the last six months).

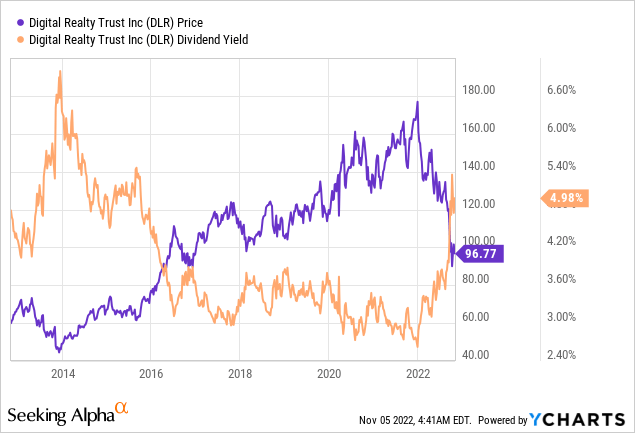

Digital Realty (DLR)

Investors have fled from data center REITs in recent months and the once-beloved DLR is one of the casualties. The landscape is extremely competitive and rising interest rates are taking a bite out of earnings at an accelerated pace. It was only months ago that investors drove up the price to nearly $180/share as other REITs like CyrusOne (CONE) and QTS Realty (QTS) were purchased by private equity. The fact that the share price has fallen nearly 50% represents a large drop and now generates a yield greater than 5% is enough for us to start building up a low-cost position.

We do not have plans to purchase more shares of the common stock at this point but have put money towards increasing holdings of the preferred shares.

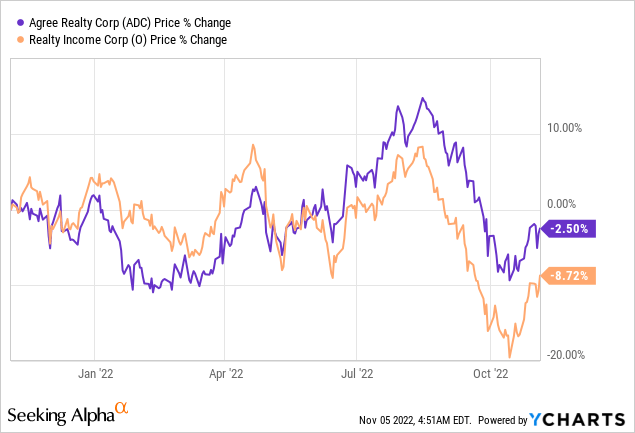

Agree Realty Preferred Series A (ADC.PRA)

Agree Realty (ADC) shares have held up well over the last several months and have performed better than Realty Income (O) which is often seen as the gold standard of Retail REITs. When ADC.PA is trading at its coupon price the yield would be a measly 4.25% which is why the share price has continued to decline heavily since the beginning of the year. At the current price, the additional yield is approximately 50% higher and the shares pay monthly which is a less common feature to find for preferred shares.

Archer-Daniels-Midland (ADM)

I recently wrote the article Archer-Daniels-Midland: There Are Better Places To Invest Your Money which describes why we made a significant cut to the size of the ADM holdings. Even though the stock price has risen since the article was written I still stand by what I wrote and see shares as being significantly overvalued.

Jane’s Roth IRA

2022-10-31 – Jane Roth IRA Transactions (Charles Schwab)

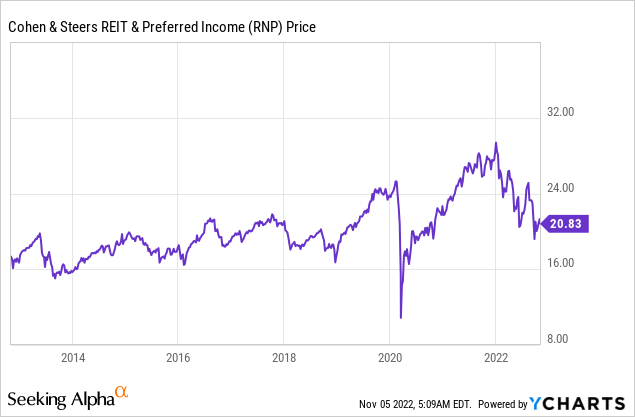

Cohen & Steers REIT and Preferred and Income Fund (RNP)

As shares drop, we have continued to add in tranches, and the recent announcement of a year-end special dividend is something that we won’t balk at. RNP is heavily focused on US REITs which have benefitted from a particularly strong dollar when compared to other currencies that are experiencing significant challenges.

New York Community Bancorp (NYCB)

When we made our initial purchase it was noted that the share price had been negatively impacted by challenges with closing the Flagstar Bancorp (FBC) merger and the stock saw a recent bump after receiving regulatory approval on October 28th. This acquisition is extremely important for growth and gives NYCB access to a whole boatload of low-cost deposits which is something that financial institutions will really struggle with over the next few years.

Other key factors to remember, NYCB is trading at the high end of its dividend yield and its payout ratio has improved to the point where its dividend is much more sustainable than it was a few years ago and it was able to do this by growing its loan portfolio.

American Tower (AMT)

We continue to add in small tranches and the strategy has paid off because we were able to replace our high-cost $250/share position with shares at the 52-week-low. AMT and CCI have become significant components of Jane’s Retirement Portfolio but I currently favor AMT at the moment because it has more conservative payouts and a stronger history of growth (and this is reflected in the higher dividend yield offered by CCI).

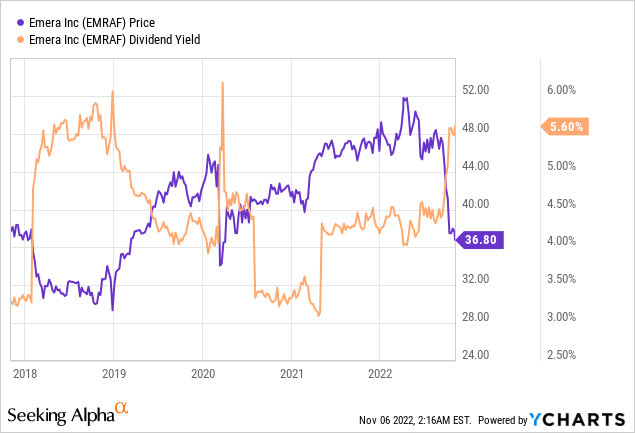

Emera (OTCPK:EMRAF)

Shares of EMRAF have not been in a buy range for approximately 2.5 years so the recent drop definitely caught my attention. The dividend yield is pushing its 5-year highs which is also another indicator that this is a reasonable entry point. Capital spending has increased significantly over 2021 as the company continues to push for its net-zero C02 emissions by 2050. Even their short-term goals are ambitious by making large reductions in CO2 emissions (these gains are primarily from closing coal-fired power plants). A small dividend increase of 4% was recently announced. With the US dollar currently at its peak pricing relative to other currencies investors looking to diversify might find EMRAF to be a good fit.

Toronto Dominion Bank (TD)

Much like the summary for RY, we sold shares of TD because we wanted to add to our cash reserves and this was a good position to reduce because it represented the high-cost portion of Jane’s holdings.

Agree Realty

As mentioned previously, common stock of ADC has performed quite well but we were able to snag shares as the price closed in on its 52-week-low. We will consider adding more shares in the future specifically when the price is under $65/share.

Lexington Industrial Trust Preferred Series C (LXP.PC)

LXP.PC has always been a high quality preferred trading at or close to its coupon rate. We hold this in the Roth IRA as a long-term holding because it is likely that the shares won’t be sold and with their non-callable status it can continue paying a strong 6.5% yield in perpetuity.

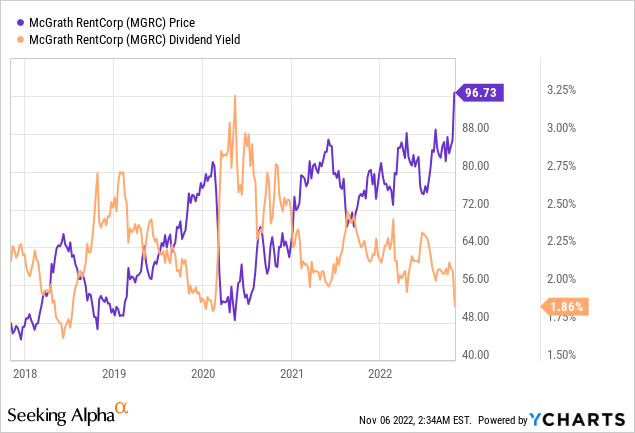

McGrath RentCorp (MGRC)

MGRC falls in the same category as ADM where we decided to eliminate the position because of the extremely low yield paying roughly half of the yield that we can find on the brokered CD. The stock price has increased substantially since we decided to sell but we still stand by the decision to sell even though we really like MGRC’s business model.

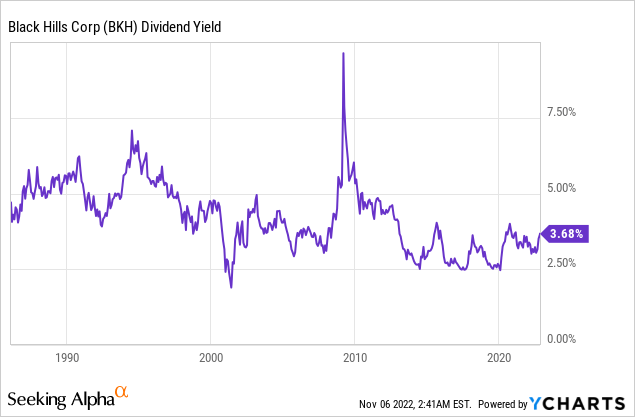

Black Hills (BKH)

BKH has a 50 year history of consecutive dividend increases which makes it one of the strongest utility names in the industry (specifically when it comes to consistency). As the market began to fall at the end of September we decided to eliminate the position because we saw more downside to the stock price due to rising interest rates. Additionally, stock is historically trended at a yield of 4% or less which is what we can currently find for brokered CDs without the volatility. I have concerns that many utilities will continue to see pressure on the stock price as a result of rising interest rates and alternative investments. We would definitely consider establishing a position is BKH in the future but we want to wait for a much more conservative entry point. Previous dividend yields suggest this is a likely scenario.

Bank of America (BAC)

We reduced the size of Jane’s BAC holding to add to cash reserves and eliminate some of the higher cost shares.

NetApp (NTAP)

The NTAP position was reduced to build more cash reserves and eliminate a higher-cost portion of the position.

John’s Traditional IRA

2022-10-31 – John Traditional IRA Transactions (Charles Schwab)

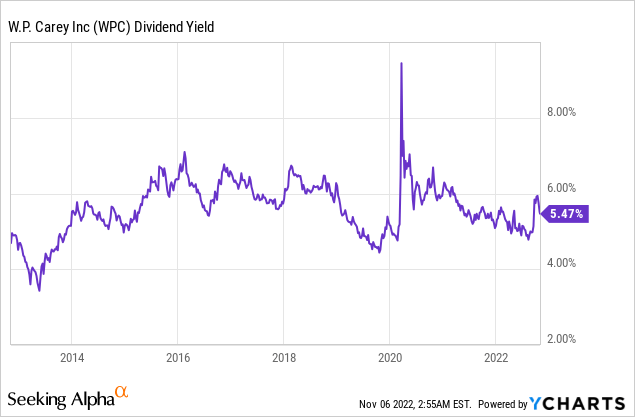

W.P. Carey (WPC)

Shares of W.P. Carey have been flying high for quite some time and have recently pushed up to $90/share. We typically will add to this position unless shares are under $70/share, however the purchase price of $71.40/share was attractive enough given that WPC results have been quite strong and was confirmed by its Q3-2022 earnings beat and FY-2022 guidance increase.

Shares of WPC are most attractive when trading at a dividend yield of 6% or higher.

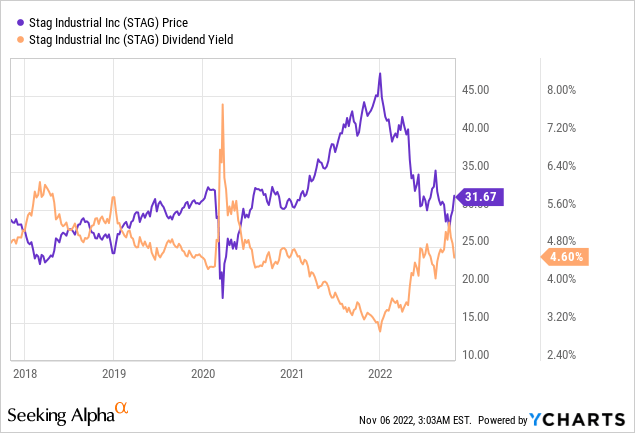

STAG Industrial (STAG)

Similar to WPC, STAG at the high-end of its value range and has steadily fallen since January 2022 and reach a 52-week-low which is close to where we decided to add shares to the already sizable position. Q3-2022 earnings were strong and deftly provided the catalyst to get the share price trending in a positive direction. John already has a full position in STAG so we won’t consider adding more unless we see the share price drop below $28/share.

Lowe’s (LOW)

We were able to snag another 15 shares of Lowe’s stock under $180/share which has served as a reliable marker for when to add shares. We will likely set a limit trade for the 10 high-cost shares and then wait for the prices to move lower. I am becoming much more cautious on home-improvement stocks like Home Depot (HD) and Lowe’s because rising interest rates combined with lower housing sales will have a negative impact on borrower’s ability to draw equity out from their home for home-improvement purposes.

Healthcare Realty (HR)

Since closing on the acquisition of Healthcare Trust of America (HTA) HR’s stock price has plummeted (it’s not the only REIT that has suffered recently) even though the combined entity is now the largest Medical Office Building REIT in the United States. HR will be paying a quarterly dividend of $.31/share per quarter or $1.24/share annually and at the current price represents a substantial dividend yield of 6.34%. John currently has a more than full position in HR so unless the share price drops considerably we won’t be adding more to this position. Fastgraphs shows that the current P/AFFO of 14X is a bargain compared to its 10-year average of 20.8X.

HR – FastGraphs – 2022-11 (FastGraphs)

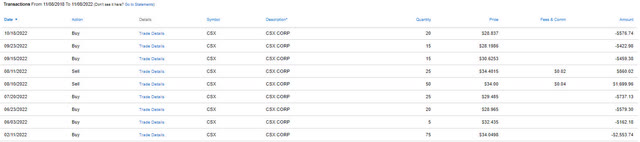

CSX (CSX)

In the previous trade update I noted that John sold a large chunk of CSX but did this when shares were peaking at $34/share. I even mentioned that the reason for selling was because I expected shares to become available at a much more attractive price in the future. That hunch paid off as shares dropped to their 52-week-low so John was able to accumulate more shares with a cost basis less than his current holdings. As shares move higher again we will consider trimming John’s position again because I expect shares will become more attractive again.

CSX – Recent Buy And Sale Prices (Charles Schwab)

Realty Income (O)

Realty Income continues to perform well so when the share price dropped to its 52-week-low we decided it was time to buy more shares. The stock price has since moved higher when it announced increased guidance for FY-2022 FFO. We would need to see the stock price drop below its 52-week-low before we would consider adding more to this position.

RPT Realty Preferred Series D (RPT.PD)

John has collected a substantial amount of dividend income from RPT.PD but with many preferred shares experiencing downward pressure we decided that it was in John’s best interest to liquidate the shares and lock in the gain of $1,450 and reinvest those funds in other undervalued shares.

Bank OZK Preferred Series A (OZKAP)

Bank OZK (OZK) has demonstrated consistent dividend growth and has one of the best track records among all financial institutions. With that said, the current dividend yield associated with the common stock is just under 3% while preferred shares are yielding 7.33% and available at a substantial discount to the $25 coupon price. I have been in OZK’s camp even when the stock price plummeted to less than $20/share but the current environment of rising interest rates and the potential for higher loan loss provision has the potential to challenge OZK’s growth – especially when it comes to its Real Estate Specialty Group (RESG) Portfolio. OZKAP is a much more attractive play at this point in time especially for someone like John who relies on the dividend income.

Avista (AVA)

Shares dropped to a 52-week-low so we used the opportunity to grab more shares. We would need to see the price move even lower after the Q3-2022 announcement with KeyBanc cutting the stock to a sell. Avista is my local utility company and while it’s easy to hate on them the stock has raised its dividend for 19 years straight and will likely be in a holding pattern for the next few years due to limited ability to raise rates to offset inflation and higher borrowing costs. If shares drop into the low $30/share range we would look to add more to the existing position.

Oshkosh Truck (OSK)

Inflation and inventory challenges have been major factors with Q3-2022 earnings for OSK feeling the pinch when it comes to earnings. The good news is that the demand is there because of aging fleets and I expect we should see improvements in the supply chain as we move into 2023. The current backlog of OSK extends into the end of 2023 which is encouraging along with management reiterating expected EPS of $3.50 for FY-2022. Share price has recovered significantly after touching its 52-week low but we will only look to add more on significant weakness in stock price or improvement in the supply chain.

CVS Health (CVS)

CVS has never been a core holding of the portfolio and even though it announced its first dividend increase since the acquisition of Aetna back in December 2021 we decided to eliminate it from the portfolio because the share price gets pretty stagnant around $100/share.

Deere (DE)

The initial position in DE was established after management announced a Q3-2022 earnings miss that was largely attributed to a difficult supply chain situation. The stock price continued to pull back further so we purchased additional shares and then the price skyrocketed back up to $400/share. There is a lot to like about DE but we will wait to add more shares on future weakness.

VICI Properties (VICI)

VICI has performed well since the position was established but we decided to eliminated from the portfolio because of concerns when it comes to inflation. We are concerned that as average household incomes remain the same but prices for goods increase that luxuries like travel, lodging, etc. will suffer. These may do well in the short-term but the long-term consequences will begin to show more as credit card debt piles with borrowers doing everything they can to continue living their current standard of life. We may look at VICI again in the future but only after we get more clarity on how bad the impact will be.

John’s Roth IRA

2022-10-31 – John Roth IRA Transactions (Charles Schwab)

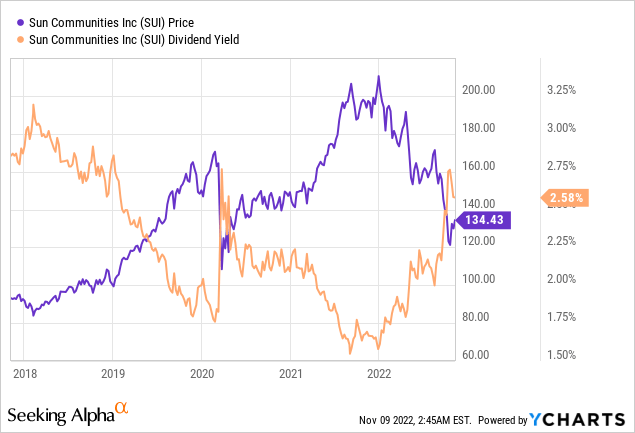

Sun Communities (SUI)

We established John’s position in SUI after a substantial drop in share price (see previous article), even then, this was a little too soon as shares continue to drop to under $120/share before moving back up after they announced in FY-2022 guidance increase that was fueled by a strong Q3-2022 results. Shares are most attractive when the yield is closer to 3% because this has been a rare occurrence over the last five years.

Cohen And Steers Infrastructure Fund (UTF)

Not much to discuss with this one – we plan to continue adding on pullbacks. We don’t expect shares to move into the $28/share range any time soon but we plan to pare back some of the high-cost position near that price point.

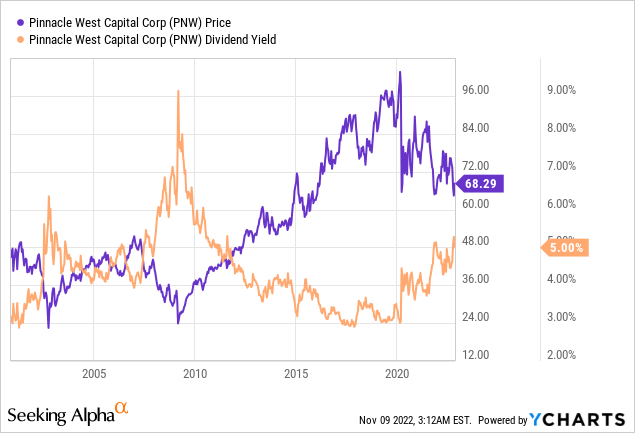

Pinnacle West (PNW)

PNW has experienced its fair share of struggles but the recent earnings announcement was boosted by warmer weather and strong improvement in customer satisfaction ratings. The most recent purchase snagged shares near the 52-week-low and has moved the total position closer to a break-even point. We will look to potentially trim shares if the price reaches $78/share but with rising interest rates I don’t think we will reach that point and may have to consider selling high-cost shares at a small loss. PNW looks like it is trending in the right direction and currently offers a compelling yield of 5% and an 11 year growth streak which is why John is more willing to hold shares over the long term.

Dominion Energy (D)

We recently trimmed John’s holdings of D back in August and then added the same number of shares at a 24% discount to the price we sold at. In the previous article I mentioned that there wasn’t much upside opportunity over $85/share which produced a dividend yield of 3%. I originally mentioned that shares looked more attractive under $75/share which would’ve resulted in a dividend yield of 3.5%. By adding more shares at $65/share John was able to lock in a yield of 4.10%. These transactions also fit within the narrative established by Credit Suisse’s recent announcement to lower D’s price target to $69/share.

WestRock (WRK)

Similar to many of the stocks mentioned before, we purchased shares of WRK as the stock price continued to push its 52-week-low that much lower. While there are concerns about containerboard pricing, WRK is expected to handle these challenges better than its competitors Packaging Corporation of America (PKG) and International Paper (IP). The recent announcement of a 10% dividend increase is also strong evidence of momentum for the stock moving forward.

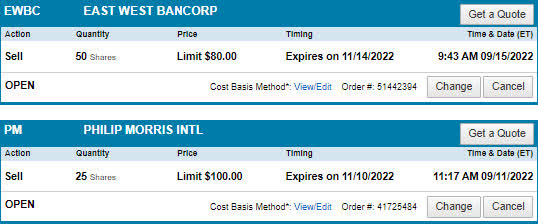

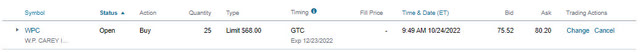

Recent/Pending Limit Trades

We have a number of limit orders that remain open. All of these limit orders are used to address my notes above for reasons we are buying or selling shares in John and Jane’s accounts.

2022-11 – Jane Traditional IRA – Limit Trades (Charles Schwab) 2022-11 – Jane Roth IRA – Limit Trades (Charles Schwab) 2022-11 – John Traditional IRA – Limit Trades (Charles Schwab) 2022-11 – John Roth IRA – Limit Trades (Charles Schwab)

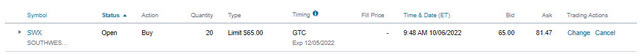

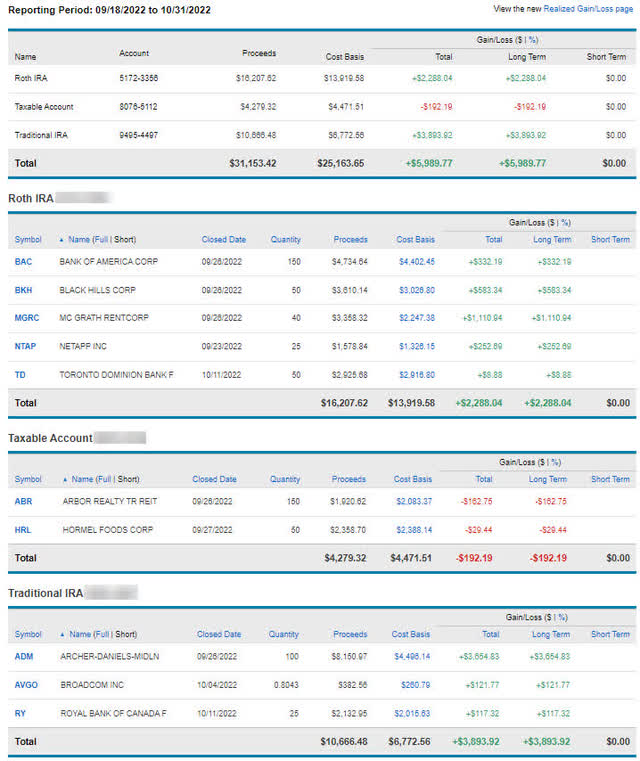

Realized Gain/Loss

As always, my goal is to be transparent and to provide as many screenshots as possible to validate what I am doing. The screenshots below should serve as confirmation as to the reason why we sold certain shares.

Capital Gains – ADM, BKH, CVS, MGRC, and RPT.PD are all stocks that we sold simply because the share price was at a point where we felt compelled to take the gains and redirect the funds to other investments.

Capital Loss/Wash Sales – All remaining stocks fall into this category with the purpose of selling shares were to eliminate a high-cost position. Stocks like MAS, PM, or PNW have slightly larger losses associated with them which was due to the fact that we didn’t see higher upside available and still wanted to reduce exposure to that position.

2022-10-31 – Jane Realized Gain-Loss (Charles Schwab) 2022-10-31 – John Realized Gain-Loss (Charles Schwab)

The images above represent the same window of time as the transactions in this article. This is the realized gain/loss figures for all of John and Jane’s accounts that I am involved with.

Readers should note that John and Jane are more willing to take capital gains in their Traditional IRA or Roth IRA compared to their Taxable Account. With the Taxable Account being primarily investments that are a buy-and-hold, it reduces the amount of shares that are sold. We always do our best to limit John and Jane’s tax exposure.

Conclusion

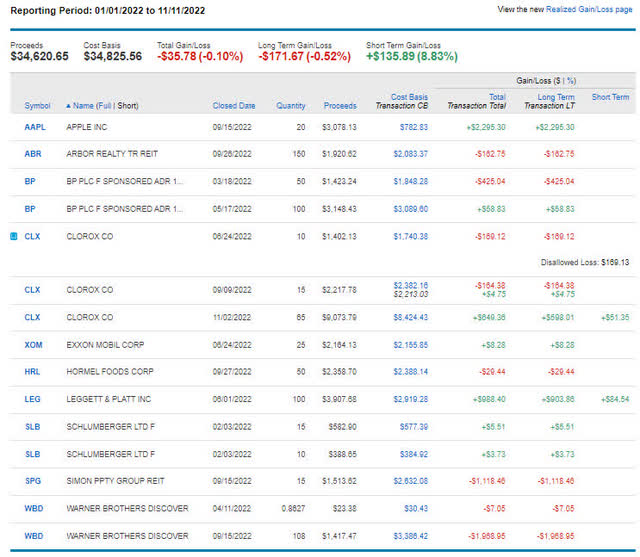

Expanding on the topic of limiting Taxable consequences we have been able to maintain excellent numbers going into the end of the year. The image below represents are shares sold from the Taxable Account in 2022.

FY-2022 – YTD Taxable Realized Gain-Loss (Charles Schwab)

With all of the sales made we have been able to balance out the Taxable Account consequences to the point where it is reporting a small loss of -$35.78 from the sale of shares. This has allowed John and Jane to recycle the capital from stocks that are performing well along with those that are underperforming.

The following link can be used for my previous update – The Retirees Dividend Portfolio: Recent Purchases And Limit Trades Through September 17th

John and Jane are long all stocks mentioned in this article except for those where we eliminated the position altogether.

Be the first to comment