mattjeacock/iStock Unreleased via Getty Images

As a kid, I enjoyed playing Monopoly. While there were many reasons why – including because it was all about building a real estate empire – the fact that I was so good at it didn’t hurt.

All that winning made me greedy for more.

With that said, I even liked the boardgame back when I first started to play it with my dad… where I was constantly going bankrupt. Sometimes that was because I spent my money too quickly on ill-planned properties. Other times, it was because I kept landing on the wrong spaces.

But what I learned through both the losing and the winning is that Monopoly isn’t just about chance. Yes, there are dice involved and you can’t control how they roll.

But that doesn’t mean it’s not intensely more about strategy – how to amass a fortune in real estate and collect rent.

I think I was around 10-years-old when I noticed how my dad would always collect hotels. Remember that, in the game, you start out with (green) houses and then move up to (red) hotels.

Perhaps because my grandfather owned motels, my dad would rapidly build his Monopoly empire with the equivalent. The board was always filled with hotels, while I would build my Monopoly wealth with houses, utilities, and railroads.

And, more often than not, he would win and I would lose.

There’s Diversification and Then There’s Diversification

To be clear, there’s a lot to be said for the diversification my 10-year-old self was trying to apply.

As I tell my students at NYU, it’s a core investment tenet to spread exposure across different asset classes. And it’s perhaps especially recommended for long-term investment strategies such as retirement accounts.

Yet diversification can be done well, or it can be done poorly. You can hold a diversified portfolio of tech stocks, owning both large-cap and small-cap companies. Maybe even a few startups.

Yet when tech stocks come under pressure, your entire portfolio will suffer the consequences.

Likewise, you could be diversified across sectors, holding not just tech stocks but also financials, metals, utilities, energy companies and more. But how much allocation do you give to each grouping? And are you being careful about which businesses you buy up within them?

Apparently, my 10-year-old style of diversification wasn’t enough to win.

Now, obviously, the game of Monopoly is a lot less complex than real life. Even so, my dad clearly had a valid strategy that I learned a lot from.

It took me years to understand exactly what that strategy was, admittedly. And I don’t just mean I realized it after I was grown up and through college and operating in the real world.

Unfortunately, I first suffered a near-bankruptcy event well into adulthood… after getting married… and having kids.

I wish I could say I had that “Eureka!” moment well before that point, but it just didn’t happen that way. Eventually though, I did realize why my Dad did what he did in our real estate games.

And it’s stuck with me ever since.

Realizing the Real Value of a Monopoly

Here’s my path to realization in a nutshell.

When I finished college many moons ago, I wanted to learn the wealth creation process by getting my hands dirty. Literally.

By that, I mean I became a developer, which allowed me to learn all facets of commercial real estate – from site acquisition, to leasing, to construction, to finance, to management.

All put together, I discovered how to create value “from the ground up.” And I still utilize so much of that information today.

But then 2008 happened, allowing me to see that there was a whole lot more information I could have been and should have been taking in as well. After everything was said and done, I ended up learning one of the most valuable lessons of my life.

If you owned real estate in 2008, you know exactly what that means.

Now, going back to Monopoly, there was no “Go to Great Recession” card I could have pulled when playing with my Dad. So I had no experience in navigating the global financial meltdown, real or otherwise.

But as I reflect back on my life now – including my first global pandemic, the real estate crisis before that, and the lessons from my dad before that – it’s all crystal clear…

He knew that the key to winning was scale. Not just with a few hotels, but with an entire board filled with red-colored buildings.

Or, as the boardgame suggests, a monopoly.

Build Your Own Real-Life Monopoly REIT Portfolio

So how do you achieve your own real estate investment trust monopoly?

I’d say with examples like the following five that could help you become rich like Rockefeller.

The very same Rockefeller who founded Standard Oil Company in 1870, which was dismantled in 1911 for violation of antitrust laws. Clearly, he would have been good at playing Monopoly.

But before I provide you with these five sweet REITs, be sure to still practice responsible diversification. Make sure not all your eggs are in one basket. Spread your hard-earned capital across numerous REITs and other asset classes such as:

As for REITs, our first pick is Digital Realty (NYSE:DLR.PK). A powerful data center consolidator, it owns 280 data centers in 26 countries across six continents.

As I explained in a recent article:

“The long-term growth trends that drive demand for its cloud computing facilities cannot be attacked by inflation, Fed policy, or consumer spending trends. More importantly, with the world on the cusp of upgrading to 5G wireless communications technologies, demand for data storage will accelerate in the years to come.”

The fact is that DLR’s wide-moat advantages – scale and cost of capital – continue to drive its earnings and dividend growth. That dominance is further validated by the company’s 10% compound annual growth rate (‘CAGR’) in core funds from operations (FFO) per share since 2005 and its steady dividend growth over 16 consecutive years.

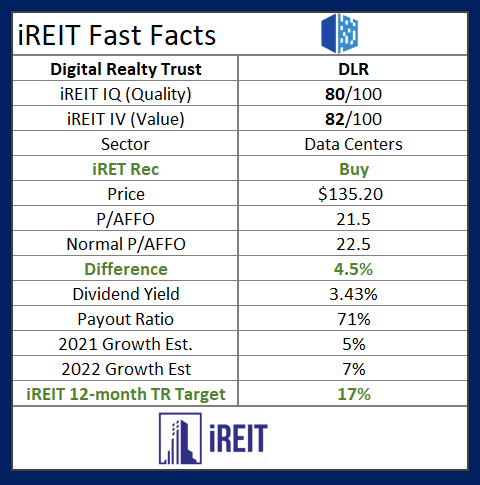

iREIT

DLR is a definitive Buy right now at $135.20. Its price to adjusted FFO (AFFO) is 21.5x against a three-year average of 22.5x. And its dividend yield is 3.4%.

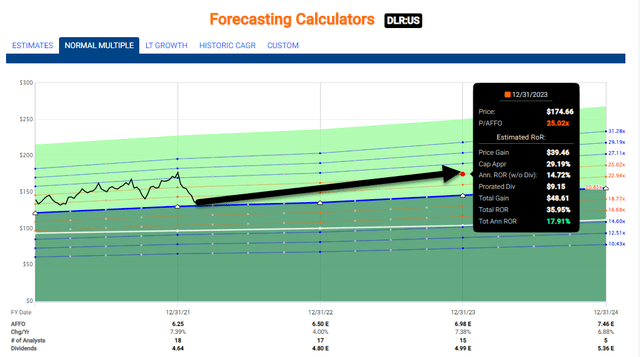

As viewed below, we forecast shares to return around 17% annually as this seventh-largest U.S. REIT continues to scale the globe.

FAST Graphs

American Tower Is Another Great Property to Buy

Next up is American Tower (AMT), another dominating technology-based pick. It owns 219,000 tower sites and is the most geographically diversified tower REIT around.

The company features 20% exposure to India and Brazil, two of the fastest-growing wireless data markets in the world. And by 2025, analysts expect AMT to have 235,000 global telecom towers.

Returns on capital are just 3% for a new U.S. tower with a single tenant. But once all three large carriers are involved, those returns jump to as much as 24% and generate 83% gross margins.

AMT also enjoys a 1%-2% annual churn rate because it’s hard for rivals to undercut it on price.

Recently, it completed the $10.1 billion acquisition of CoreSite and its 25 global data centers. As I recently explained:

“AMT expects COR to be a key part of its expanding data center strategy that could give it an entirely new world to conquer and extend its rapid growth runway for years or even decades to come.”

This company is one of the world’s fastest-growing REITs. And analysts expect its dividend to grow at about 16% annually in the coming years.

It tends to raise its dividend 2%-3%, with the most recent hike being 6%.

Analysts expect AMT to keep growing at its 10-year growth rate, potentially due to its data center move. We expect growth of 8%, which would be similar to the last three years.

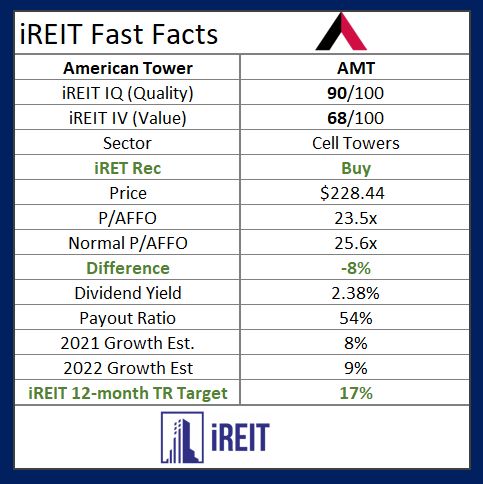

iREIT

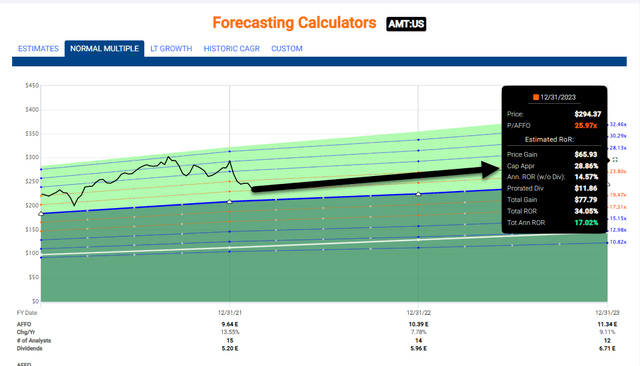

In short, AMT is another definitive Buy at $228.44 with a 23.5x p/AFFO compared to a three-year average of 26.4x. Its dividend yield is 2.3%, and we forecast shares could return 17% over the next 12 months.

FAST Graphs

We Just Rolled 7 and Landed on VICI

We like gaming subsector-focused net-lease REIT VICI Properties (VICI) just as much. Since listing in 2017, it’s grown at a rapid clip – from $690 million in earnings before interest, taxes, depreciation, and amortization (EBITDA) to $2.6 billion at year’s end 2021 pro forma.

More recently, the Nevada Gaming Commission gave final approval for Las Vegas Sands’ (LVS) sale of The Venetian Resort Las Vegas to affiliates of Apollo. This should mean that VICI’s sale-leaseback of the real estate beneath it will occur any day now, almost a year after its first agreed to the purchase.

The real estate will cost it $4 billion. It’s initial yield is 6.25% and the initial lease term is 30 years, with two 10-year renewal options.

Closing this transaction has taken a few months longer than expected. Yet we’ve never doubted that it validates VICI’s growth thesis.

Capitalization rates for top-tier gaming assets have now been established at sub-6%. And the inflation protection VICI negotiated in this deal is better than in most long-term net-lease transactions.

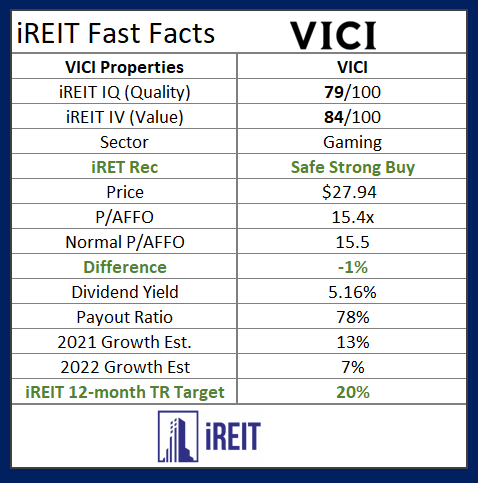

iREIT

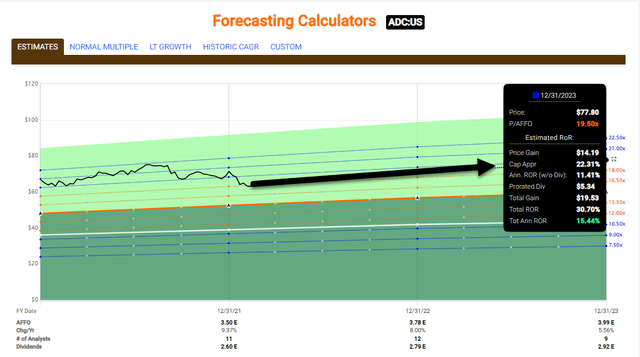

VICI remains a high-conviction (safe, strong) buy at $27.92 with a p/AFFO of 15.4x. That’s still much cheaper than blue-chip peers like Realty Income (O) and Agree Realty (ADC), which trade at a blended p/AFFO of 18.0x.

VICIs dividend yield is 4.3% and, based on historical relevance and future catalysts, we suspect it will continue to boost its dividend by over 7% annually. We model shares to return 20% annually.

FAST Graphs

The Monthly Dividend REIT Is Well Worth Buying

Next up on the playing board is Realty Income (O), a proven consolidator. It’s become King Kong of the net-lease subsector by maintaining a cheap cost of capital and advancing its scale.

O is an S&P 500 company and one of the top 10 global REITs based on market cap. Plus, it plans to become a top five REIT by continuing to consolidate the $12 trillion net-lease addressable market.

This week, it released its Q4 earnings, which “topped the average analyst estimate.” We also find that it invested a record $2.6 billion, bringing 2021 property-level acquisitions to $6.4 billion – another record for the company.

Of course, there also was its Vereit acquisition, and the spinoff of their combined office assets into Orion Net Lease (ONL).

O kept its per-share guidance for 2022 AFFO at $3.88-$4.05 vs. the consensus of $3.94. Speaking of that metric, it increased 5.9% year-over-year to $3.59 in 2021.

Realty Income is one of 65 companies in the elite S&P 500 Dividend Aristocrats Index. And it’s generated a 4.4% compound annual dividend growth rate since 1994 with 114 dividend increases.

This predictable growth has resulted in a 15.5% compound annual total shareholder return since it went public in 1994.

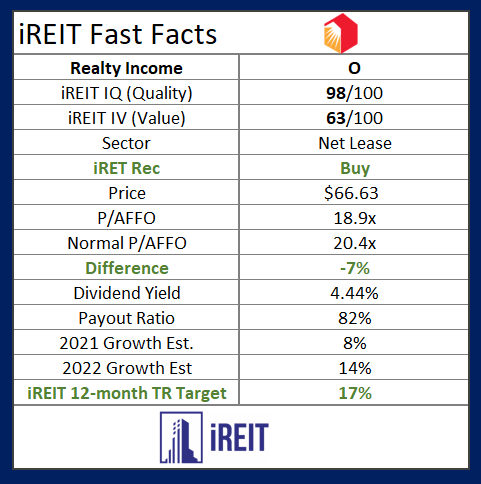

iREIT

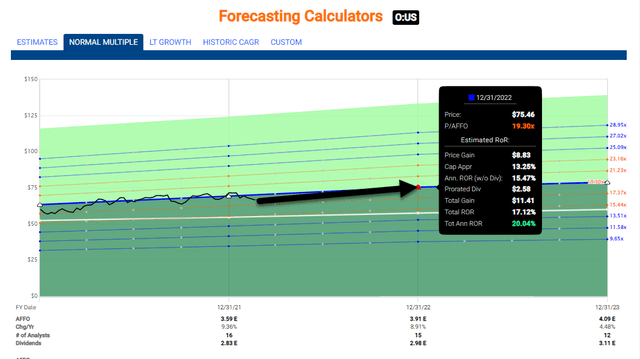

O is trading at a margin of safety at $66.63. Its p/AFFO is 18.3x compared to a 20.1x three-year average. And its dividend yield is 4.4%.

We maintain a Buy and forecast shares to return 17% over the next 12 months.

FAST Graphs

Simon Says

Our last roll of the dice is Simon Property Group (SPG), a world-class mall landlord that is managed by one of the best CEOs on the planet. As you know, I interview CEOs every week in REIT-dom, and I don’t take these words lightly.

David Simon is a prime-time example of why I always place my bets on the horse and the jockey. On the Q4-21 Simon (the CEO) said,

“We generated nearly $4.5 billion in funds from operation in ‘21 or $11.94 per share. The $4.5 billion is a record amount for our Company for the year, and coming off a difficult year of 2020, these results are a testament to our relentless focus on operations, cost structure, active portfolio management, smart investments coupled with coherent strategy.”

The mall juggernaut has navigated the pandemic with a steady hand, for example, the company amended and extended its $3.5 billion revolving credit facility with a lower pricing grid for five years, and issued $2.75 billion of senior notes €750 million notes, completed the refinancing of 25 property mortgages for a total of $3.3 billion at an average interest rate of 3.14%.

A-rated with $8 billion of liquidity means this REIT pick is a fortress landlord and to reward investors, the company paid out $2.7 billion in cash common stock dividends last year. The latest announced dividend was $1.65 per share, a year-over-year increase of 27%.

SPG guided 2022 FFO of $11.50 to $11.70 per share which, as we informed iREIT on Alpha members, “appears to be a year of opportunity and cautious optimism for given improved leasing and sales, earnings upside potential and a discounted valuation.”

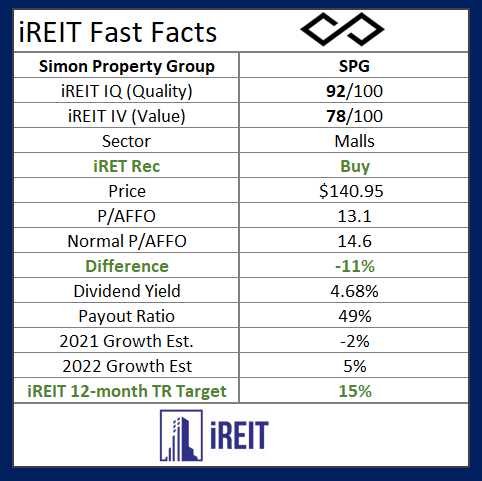

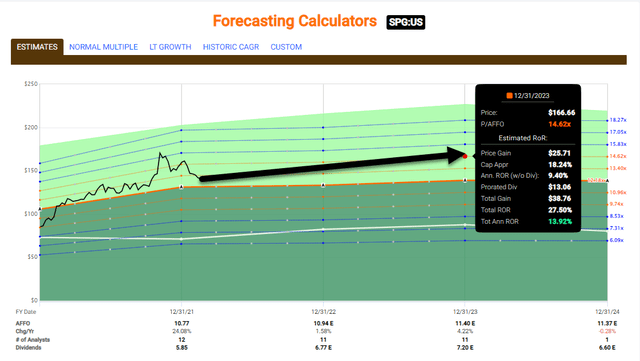

iREIT

SPG shares now trade at $140.95 with a P/AFFO of 13.1x (three-year average is 14.6x) and the dividend yield is 4.7%. We see 15% upside – annual total return potential – and that’s our conservative estimate, recognizing that the CEO is known for under-promising and over-delivering.

FAST Graphs

In Conclusion…

Do any of you have Montell Jordan’s song “This Is How We Do It” on your iTunes song list? I do…

This is how we do it…All hands are in the air…And wave them from here to there…If you’re an OG mack or a wannabe player…You see the hood’s been good to me…

Well folks, this is exactly how we do it at iREIT on Alpha.

Just like my dad taught me – and I later learned in life – the key to winning the game is to focus on buying quality merchandise when it’s on sale. And all five of these REITs represent high-quality consolidators that will continue to scale…

Generate steady earnings…

Offer predictable dividend growth…

And produce above-average total returns.

I wish my dad were still alive so he could see how I was able to learn from my mistakes – no longer chasing yield or abusing leverage – and, most importantly, recognize how to create real money using bricks and mortar to win my version of REIT monopoly.

Thank you, Dad!

Brad Thomas

Author’s Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment