kanawatvector

Rental properties are a highly popular method for compounding wealth and building a lucrative passive income stream that can fund early retirement. Over the past decade – and especially over the past two years – rental properties have been on a tremendous run. This was partially due to the fact that the Federal Reserve has kept interest rates artificially low – particularly in the housing sector – by building up a massive balance sheet of mortgages.

In early January, the Mises Institute reported that:

Runaway house price inflation continues to characterize the U.S. market. House prices across the country rose 15.8% on average in October 2021 from the year before. U.S. house prices are far over their 2006 Bubble peak, and remain over the Bubble peak even after adjustment for consumer price inflation…Unbelievably, in this situation the Federal Reserve keeps on buying mortgages. It buys a lot of them and continues to be the price-setting marginal buyer or Big Bid in the mortgage market, expanding its mortgage portfolio with one hand, and printing money with the other…The Federal Reserve now owns on its balance sheet $2.6 trillion in mortgages. That means about 24% of all outstanding residential mortgages in this whole big country reside in the central bank, which has thereby earned the remarkable status of becoming by far the largest savings and loan institution in the world.

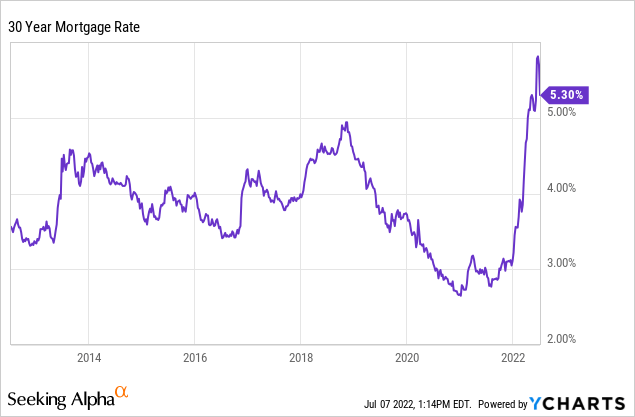

Now, with the Federal Reserve pivoting towards unwinding its balance sheet, mortgage rates have soared to levels not seen in quite some time:

When you combine record-high home prices with spiking mortgage rates and the increasing likelihood of a recession, sellers are increasingly incentivized to move their homes while buyers are becoming increasingly hesitant to sign for higher and higher monthly mortgage payments.

On top of that, rental property investors – who in the past made a killing off of purchasing homes with only 20%-30% down and then reaped enormous cash on cash returns thanks to cheap 30-year mortgages – are now seeing spreads between mortgage rates and cap rates all but fall to 0%, making rentals a much less lucrative source of cash flow.

At the same time as there is a much weaker outlook for home price appreciation and rental property cash flow potential is also drying up, high yielding stocks have gone on sale thanks to a sharp pullback in the stock market this year. As a result, the value proposition for passive income seekers has shifted decisively in favor of high yield stocks. With cap rates on most houses at 5% or less, investors can get similar or greater yields on a number of high quality investment grade stocks right now. In this article, we will share two areas where we are finding these wonderful passive income securities and some of our top picks at the moment.

Passive Income Idea #1: Midstream Energy

Midstream businesses (AMLP) are our favorite passive income opportunity right now for several reasons.

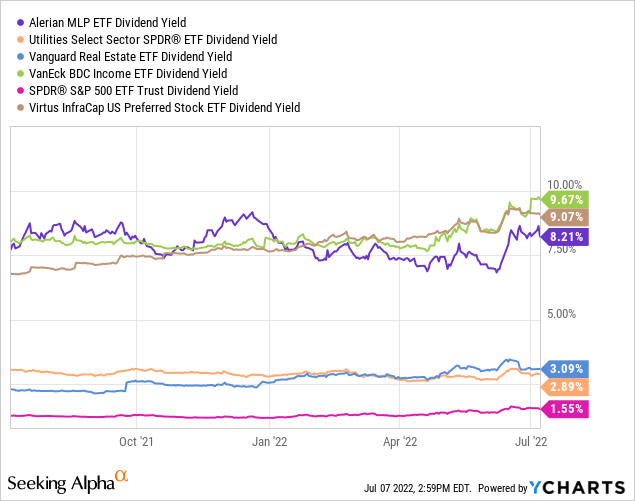

First and foremost, as a sector they offer some of the most attractive yields in the market today, greatly surpassing traditional income sources like utilities (XLU) and REITs (VNQ) while nearly matching preferred equity (PFFA) and business development companies (BIZD):

If you are looking to get passive income, it is hard to beat the midstream sector. While BDCs and preferred equities offer higher yields on average, BDCs typically have tight dividend coverage ratios, are not very recession resistant, and their dividends are taxed as ordinary income. Meanwhile, preferred equities are fixed income instruments, so they lack any growth potential.

In contrast, midstream businesses these days have higher investment grade credit ratings than BDCs, have much greater recession resistance, have much higher distribution/dividend coverage ratios, and also benefit from more favorable distribution/dividend tax treatment. On top of that, thanks to retaining an increasing amount of free cash flow, these businesses are also investing in growth projects and buying back equity, fueling per unit/share growth on a level that typically exceeds both BDCs and certainly preferred securities.

Some of our favorite picks in the sector right now include K1 issuing MLPS like Energy Transfer (ET), Enterprise Products Partners (EPD), and Plains All-American (PAA). We also like several 1099 issuing C-Corps like Enbridge (ENB), Kinder Morgan (KMI), and Plains (PAGP). All of these businesses are investment grade, are retaining a considerable amount of cash flow, and are growing their distributions/dividends at a strong pace.

Passive Income Idea #2: Triple Net Lease REITs

While triple net lease REITs are off to a rough start this year due to rising interest rates, we believe that this picture will reverse itself in the next year or two. A recession appears inevitable for the U.S. economy and will very likely force the Federal Reserve to slash interest rates once again. Once this happens, the defensiveness and high yields of triple net lease REITs will suddenly become very popular, leading to multiple expansion once again.

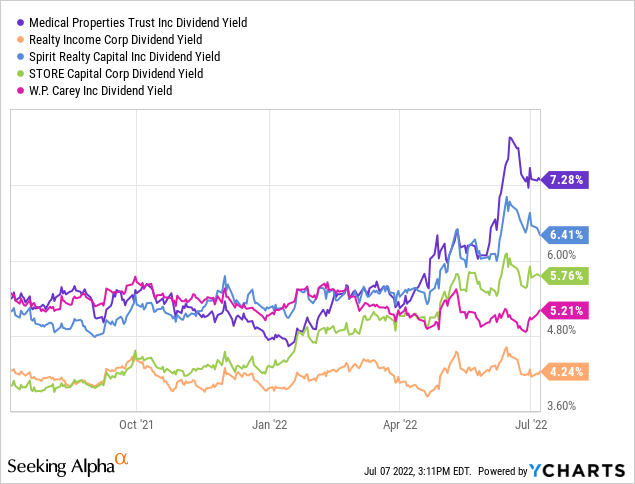

As a result, we believe now is an ideal time to buy the sector while valuations are discounted and passive income yields are elevated. There are numerous attractive opportunities in the sector with yields ranging from mid 4% for industry gold-standard Realty Income (O) to mid 5% for high quality sleep well at night REITs like STORE Capital (STOR) and W.P. Carey (WPC). Then on the high yield end of the spectrum we get a less proven but still investment grade high yielder like Spirit Realty Capital (SRC) yielding in the mid 6% range and hospital pureplay Medical Properties Trust (MPW) offering an inflation resistant 7.3% dividend yield:

Our three top picks in the sector right now are STOR, SRC, and MPW as we believe each is strong enough to weather an economic storm while offering compelling current yield, long-term dividend growth potential, and even some meaningful multiple expansion in the event that interest rates decline once again.

Investor Takeaway

Investors who invested in rental properties this past decade have made significant profits on their investments thanks in large part to substantial support from the Federal Reserve. However, macroeconomic forces are now aligning increasingly against the sector, leading us to look elsewhere for attractive risk-adjusted passive income. In triple net lease REITs and midstream energy businesses, investors can lock in passive income yields that match or even exceed that which is offered by rental properties at present with much less risk (due to diversification and contract structures) and greater long-term risk-adjusted growth and appreciation potential.

Be the first to comment