g-stockstudio/iStock via Getty Images

Early retirees have perhaps the most demanding investment needs of anyone, particularly in today’s economy. As a retiree, they first and foremost need a lucrative passive income stream that can fully cover their daily living expenses with enough margin of safety on top of that to cover any other unplanned expenses that may crop up as well as account for misfortunes that may hit portions of their portfolio, thereby reducing the passive income stream.

On top of that, with inflation at four-decade highs, they need not only sufficient income for today, but they also need that income stream to grow at a high rate in order to sustain their purchasing power.

Last, but not least, they need to be invested in a basket of high quality securities that can enable them to sleep well at night knowing that their passive income stream is unlikely to be meaningfully reduced anytime soon.

While finding a combination of high yield, high growth, and high quality are understandably difficult to find, thanks to the sharp recent pullback in equity markets, there are several of these opportunities today. In this article, we will discuss four of our favorite stocks that meet each of these criteria. All of these securities offer ~6% yields or greater at present (a 6.51% average yield between all four of them), are expected to grow their dividends at an average rate of 18.55% in 2022, and boast strong investment grade credit ratings and solid business models. As a result, investors should be able to ride out the wave of increased volatility in the stock market (SPY) today and instead remain calm and let the dividends flow. Here they are:

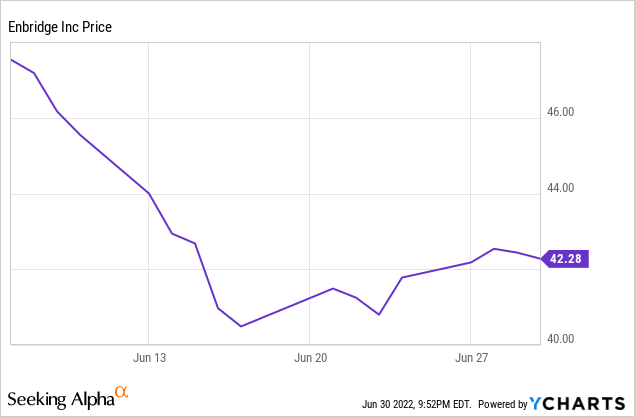

#1. Enbridge (ENB)

Midstream energy giant ENB has a phenomenal track record as a dividend growth machine, having increased its dividend for 27 consecutive years. Over the past five years alone it has grown its dividend at a 9.5% CAGR, superior to the current rate of inflation. Add to that its current yield well north of 6% and investors have one of the most unbeatable combinations of current yield and inflation-beating income growth in the market today.

Furthermore, even if a recession were to hit ENB is very well positioned. It boasts a sector-leading BBB+ credit rating with one of the largest and best diversified asset portfolios in the industry. Perhaps even better is the fact that it generates utility-like cash flows thanks to the fact that 98% of its cash flows are linked to either take-or-pay, fee-based, or hedged contracts with 95% of its counterparties being either investment grade or equivalent.

The vast majority of ENB’s pipeline cash flows are also linked to inflationary indexes, so inflation should actually serve as a tailwind for the business. Moving forward, management has guided for 5-7% distributable cash flow per share growth through 2024 and should be able to sustain a similar growth rate for many years to come thanks to its numerous opportunities for high return, low risk organic growth projects and rapidly growing renewable energy portfolio. In fact, if inflation remains elevated along with energy commodity pricing, we expect ENB to reach the high end or even exceed that guidance range.

Given the conservative 1.6x dividend coverage ratio, inflation-linked cash flows, and strong balance sheet, ENB should be able to continue growing its dividend in line with or in excess of inflation for many years to come.

Now looks like a good time to add ENB after its recent share price pullback:

#2. Energy Transfer (ET)

Another giant midstream player, ET offers even more compelling current yield (over 8% distribution yield) and growth potential (between 2022 and 2024, the distribution is expected by analysts to grow at a 25% CAGR). On top of that, it is arguably the cheapest midstream business in its sector despite boasting an investment grade credit rating.

It also has a well-diversified asset base with EBITDA being sourced from 5 different business segments and none contributing more than 27% to expected 2022 adjusted EBITDA. Furthermore, ~90% of its expected 2022 adjusted EBITDA is set to come from fee-based contracts, giving it a very stable cash flow profile. With 20% market share of worldwide NGL exports, ET also has an exciting organic growth business that could enable it to grow its distribution at a solid clip for years to come.

#3. Blackstone (BX)

BX is the world’s largest alternative asset manager with nearly $1 trillion in assets under management, an extremely impressive track record, an A+ credit rating, and one of the best business networks in the world that leads to superior deal flow.

The company is able to grow the business at extremely high rates of return on equity, has an asset-lite balance sheet, and pays out its considerable and fast growing free cash flow to shareholders as dividends. As a manager of long-dated funds holding some of the world’s best real estate, infrastructure, and private equity assets who commands considerable pricing power, BX is a truly wonderful business to own. This year it is expected to grow its dividend payout by nearly 20% and follow that up with 11% growth in 2023, making it a great inflation-beating dividend growth stock that also happens to sport a current dividend yield of ~6%.

While other peers like Brookfield Asset Management (BAM) and KKR (KKR) look attractively priced here as well and boast track records and scale that are almost as impressive, neither offers the high dividend yield and rapid dividend growth that BX does.

#4. STORE Capital (STOR)

Last, but not least, Warren Buffett-endorsed (BRK.A)(BRK.B) STOR has proven to be a very stable and solid dividend grower that offers a current yield of ~6%. With a well-diversified triple net lease portfolio, STOR weathered the COVID-19 shutdowns very well and its dividend payouts and even dividend growth did not skip a beat.

While it has only gone public since the Great Recession, its triple net lease peers like Realty Income (O), W. P. Carey (WPC), and National Retail Properties (NNN) weathered that challenging economic storm with ease and actually continued to grow dividends throughout the recession, so we have high confidence that well-run and investment grade STOR will be able to do the same should we be on the verge of another painful recession today.

In the meantime, the dividend is expected to grow at ~6% this year, putting it in a good spot to nearly offset inflation this year and likely outgrow the inflation rate over the long-term as it has done thus far since inception.

Investor Takeaway

Early retirees likely find the current environment challenging, especially if their journey to financial independence was charted using passive index funds like SPY or Invesco QQQ ETF (QQQ). However, with stock prices experiencing soaring volatility and the threat of recession growing by the day, investors living off of passive income might want to chart a different course.

By putting your retirement livelihood in the hands of stable businesses that pay out high current yields while also showing strong potential for growing those distributions at rates that meet or exceed inflation for the foreseeable future, you can plot a safer and frankly smarter course that will also likely lead to total return outperformance. At High Yield Investor, we are taking this approach and are filling our portfolio with dozens of securities similar to those outlined in this article.

Be the first to comment