gorodenkoff/iStock via Getty Images

Introduction

What are the implications for Treasuries trading of the increasing risk in the market as the Fed begins to tighten policy and sell off much of its Treasury portfolio? A partial remedy is to expand retail traders’ access to the liquid on-the-run Treasuries market. The market for seasoned Treasuries is less liquid and less useful to retail risk managers, especially to hedgers on the short side of the market.

The long-term problem with Treasury market liquidity is the dealers’ withdrawal from active market-making. This dealer conservatism stems from post-Financial Crisis regulations requiring Treasury dealers to increase the capital supporting their Treasury inventories. The new regulations introduced a supplementary leverage ratio, increasing the amount of capital dealers must set aside.

The logical response to this reduced government securities dealer participation in the inside market is to expand access to retail traders without direct dealer involvement. However, providing easy retail access to the Treasury market will require added safeguards. The article considers a way forward.

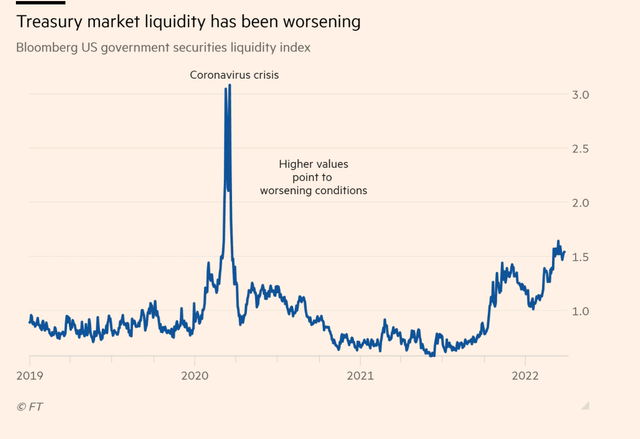

The coming shortage of liquidity in the Treasury market

Dealer’s withdrawal from Treasuries market-making. Today’s T-bill market is starting to show stretch marks as the Fed prepares to increase the policy rate, read here and here. The articles warn that falling liquidity in the T-bill market will result in rate explosions upward, as the Fed’s inventories fall. The graph displays recent increases in volatility.

Financial Times

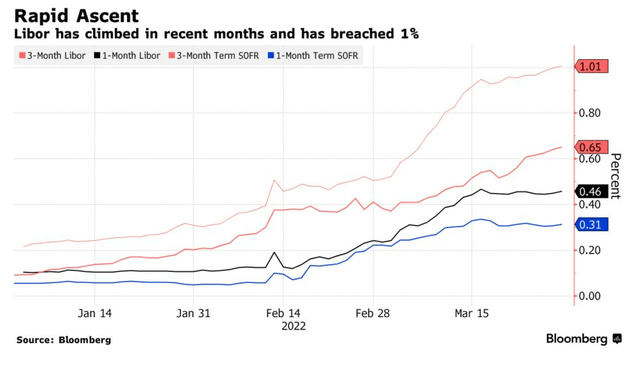

LIBOR’s end. The regulator’s decision to end LIBOR compounds the problem of rising volatility. The three-month index that risk managers used over the past 40 years to price untraded financial instruments and to hedge risk in the short-term unsecured credit market will disappear from market usage at the end of the year.

The alternative to LIBOR advanced by market regulators is the secured overnight financing rate (SOFR). The graph below displays the problem with using SOFR to replace LIBOR during a period like the present when an inflation-induced increase in credit risk dominates short-term debt pricing.

Bloomberg

As the graph indicates when credit conditions become more challenging, the spread between credit risky debt and credit-riskless Treasury debt increases. Risk-free SOFR fails to capture added credit risk.

LIBOR markets provided retail access via CME Group’s Eurodollar futures market. With the end of LIBOR there will no longer be a liquid index or debt instrument that gives market access to retail traders.

The logical fallback is retail access to the inside Treasury market for short-term T-bills. There is no such access today.

A liquid three-month retail market for on-the-run Treasury term debt still fails to capture increasing credit risk, but it does capture forecasts of future short-term market conditions that term SOFR does not.

SOFR and LIBOR. The short-term debt market has grudgingly accepted the government-regulator-inspired LIBOR replacement, 3-month SOFR in arrears, thus far. The well-known drawbacks of 3-month SOFR in LIBOR’s role are

- SOFR is a risk-free rate, with no credit adjustment.

- SOFR is an overnight rate and has no yield curve from which to forecast the future of the cost of credit.

To form a three-month credit risky rate, users make ad hoc adjustments, or rely on the deeply flawed methods of SOFR’s adjustment-in-arrears. In other words, there is no objective market measure of the credit-risky cost of term credit.

Direct retail access to the wholesale Treasury market.

Retail access to the on-the-run market. Most high-volume markets have an inside and an outside market. The Treasuries market is no exception. Retail customers can submit orders to dealers to get a piece of the dealer’s share of a new issue, but they have limited direct access to the more liquid on-the-run market.

The on-the-run markets are the most liquid markets for Treasuries. This is a market for forward delivery of Treasuries during the week following the Treasury’s announcement of the intent to deliver a specific bill on the issue date. A more detailed description is here. On-the-run Treasuries trade without margin or other protection from counterparty failure because traders with Government Securities Dealer status enjoy the implicit assurance that the Fed will step in the event of dealer bankruptcy.

Is it possible to expand the population of inside market traders in the Treasury market beyond the small Government securities dealer community? The answer is yes only if we can design a retail market to meet retail investors’ needs without harm to the existing T-bill dealer population.

Retail investors’ unfettered access to a financial market has historically come from the listing of a futures market that trades at the inside spot market price.

In the case of Treasury short term instruments futures have existed historically – most prominently the Chicago Mercantile Exchange’s defunct three-month Treasury bill futures. That market was a qualified success. It was very liquid until the more popular Eurodollar futures market squeezed it into nonexistence.

Protecting the integrity of the on-the-run market. A drawback of the T-bill futures market that may have contributed to its demise was the discomfort for the government when the Chicago Mercantile Exchange listed its contracts before the Treasury announcement of its intention to issue the deliverable spot instrument.

The Treasury felt that a decision not to issue a bill with a trading futures contract that required the issue for settlement would have damaged the spot market as well as the futures market. That issue could be resolved by simply listing an on-the-run T-bill only after the Treasury announcement.

The lessons of existing markets for a retail Treasuries market.

Take the hints that the on-the-run and futures markets provide.

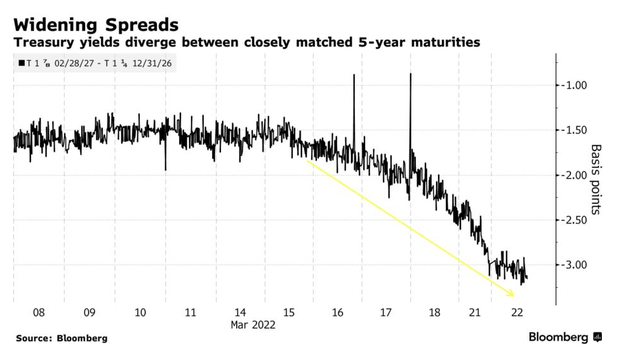

A lesson from the on-the-run market. The need to carry inventories is a burden that drives the cost of market-making higher. The virtual on-the-run market is more liquid than the seasoned issue market. This advantage of the on-the-run market is particularly important right now. The weight of costly inventories of seasoned issues have had a negative impact on the price, resulting in a premium for on-the-run Treasuries. Plainly greater retail access to on-the-run prices would improve the quality of Treasury market prices. The graph displays the current discount on off-the-run Treasury issues, roughly three basis points.

Bloomberg

Second, futures markets provide few traded instruments, concentrating trader interest in a few issues to increase liquidity.

Third, each futures contract trades through only one clearinghouse. This reduces the significance of the information advantage wholesale broker-dealers possess, eliminating all together the possibility of a separate inside market. There is no high frequency traders’ advantage to algorithmic arbitrage between markets. The arbitrage between on-the-run and the retail market will exist, but the more important retail on-the-run leg of the trade would be visible to all.

The attached PowerPoint file displays the details of intra- and inter-market transactions for a hypothetical retail market.

Conclusion.

Retail traders could gain access to wholesale Treasury prices through creation of an exchange that uses the properties of on-the-run and futures markets to create a retail-friendly spot market. Direct access to on-the-run prices through an exchange that can fill retail orders at wholesale-quality prices would be a big step forward in assuring the depth of the Treasuries market.

The coming liquidity crisis in the market for short-term money suggests that now is the time to introduce this market.

Regulators have created chaos in the markets for short-term credit through their heavy-handed insistence on SOFR to replace LIBOR. Market participants – broker-dealers, retail investors, buy-side institutions, retail borrowers, and housing agencies – will pay a heavy price for this regulatory hubris. Commercial banks and other financial institutions will struggle to offer basic credit through mortgages, student loans, and credit cards.

A thriving on-the-run short-term Treasuries market will not replace LIBOR because it will not provide an industry-wide consensus of the cost of risky credit as LIBOR did. But if successful it will provide a model for the creation of a genuine LIBOR replacement.

Be the first to comment