xijian

The second quarter of 2022 saw ReneSola (NYSE:SOL) miss its earnings per share (EPS) target by $0.03 at -$0.01 on revenue of $8.21 million. According to the Q2 2022 earnings report, the revenue miss was due to delays in the closure of the U.S product sales. Consequently, the earnings growth of 134.29% (QoQ) was primarily d riven by the energy production from China’s IPP assets. There has been a stark difference between the U.S and China as far as inflation is concerned. In August 2022, China’s producer price inflation fell to an 18-month low of 2.3% (YoY) while in the US, inflation is at a peak of 8.3%. Consensus estimates indicate that it could last well into 2023 if not longer.

Thesis

ReneSola may find it hard to close the year 2022 at 3 GW of energy production despite indicating an improved renewable energy policy from both the US and Europe. The company is targeting its mid-to-late stage pipeline to grow to 5 GWs before the end of 2024 but it has not reached 1 GW in any of its projects. It is true that there has been a surge in demand for renewable energy in parts of Europe despite the tight supply situation and the high PPA prices. ReneSola hopes to capitalize on this increase to augment revenue and create shareholder value. However, despite having a cash balance above $200 million, ReneSola has been incurring net losses since the quarter ending on December 2021.

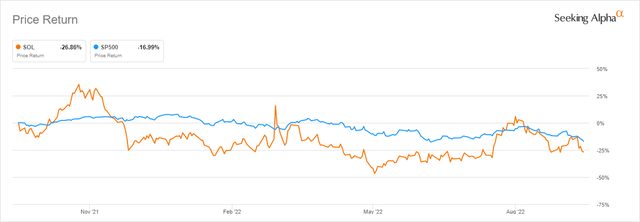

ReneSola’s share price has shrunk 26% (YoY) following the negative trend of the S&P 500 at -16.99% (YoY).

ReneSola’s cash position has declined to 27.31% (YoY) from the quarter ending on June 30, 2021, to the quarter ending on June 30, 2022. The company hopes that the cash balance will stagnate at around $200 million if it does not carry out mergers & acquisitions (M&A) or share repurchase programs. Also, while there was a 134% increase in revenue (QoQ), ReneSola’s sales have declined since the quarter ending on December 31, 2021, where it stood at $22.5 million. It hit its peak as of Q4 2019 at $26.5 million and it has been unable to replicate this figure again. We can understand that this increase occurred during pre-Covid times when there were no lockdowns, especially in China. However, gross profit was highest in the quarter ending on June 30, 2021, at $11.3 million with revenues at $18.5 million indicating market resilience and the success of post-Covid economic recovery interventions. I believe that the management needs to rework its investment strategy to lower costs of revenues while increasing overall earnings.

Segments of Operations

ReneSola collects its revenue mainly through developing solar power projects, contracting engineering & procurement (E&P) services, and selling electricity. It has operations in the U.S, Poland, China, Germany, Italy, France; Hungary, and in the U.K. Despite having solar projects in the U.S since 2015, it is yet to fully monetize its project portfolios- especially the utility-scale and community solar projects.

ReneSola Q2 2022 Earnings Results

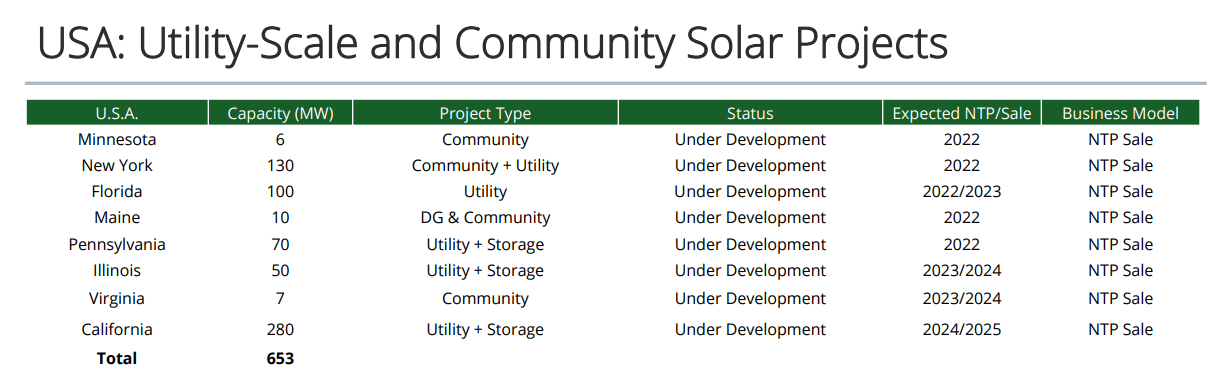

According to ReneSola’s U.S solar utility-scale project portfolio list, up to 653 MW worth of power is yet to be commercialized. Up to 316 MW has notice of commercialization by the end of 2022. However, it has been more than 5 years since the projects were commenced and the company is yet to begin monetization.

In Poland, ReneSola stated that it had sold 175 MW of solar projects awarded through auctions. The company recorded sales from auctions conducted from 2016 through 2021. The number of MW sold is less than the expected projects still under development. Up to 705 MW of power is still under development with the contractual period for commercialization expected as late as 2024 (considering the projects will only be ground-mounted).

In the UK, ReneSola has sold 127 MW of solar power. It has successfully developed 16 portfolios while operating 4.3 MW. Still, up to 235 MW is under development with the expected RTB sale set between 2023 and 2024. However, ReneSola will need more than 1,800 acres in the UK to establish this development. Data from Solar Energy UK indicates that approximately 6 acres are needed for every megawatt (MW) of power intended for production. Further, the current ground-mounted solar projects cover an estimated 230 square meters of land in the UK, which is less than 0.06 acres, or below 0.1% of the UK land.

It is essential to note that the UK’s planned 235 MW solar power production is the fourth largest mid-to-late stage project pipeline by ReneSola. This pipeline totals 2,404 MW against the company’s current operating assets (in China and the U.S) which stand at 186 MW. In my view, the operating assets fall below the required output level needed to sustain solar power production to the tune of 1 GW by the end of 2023. Likely, the company will not have attained the 3 GW output even by the end of 2023.

In further consideration of these apparent low production levels, Covid19-related challenges including the shutdowns made ReneSola lower its initial target concerning China’s independent power plants. In its Q2 2022 earnings call, the company explained that its earlier target of 100 MW was untenable and a target of 50 to 70 MW was also out of reach. In H1 2022, the company did 6 MW and is hoping to add 30 MW by the end of 2022. Ultimately, the development in China will determine the speed with which the company will add power supply. Overall, the company is targeting a range of 30 to 40 MW in China by end of H2 2022 depending on the demand levels.

By the end of August 2022, about 12% of China’s total GDP was affected by Covid19 controls with millions of people placed under lockdowns. Planned factory maintenance coupled with the lockdowns will affect China’s energy demand level into 2023. These curbs will thus affect power production including ReneSola’s planned target output by end of H2 2022.

Risks to the Upside

Russia’s war in Ukraine has seen power costs soar since Q1 2022, especially natural gas prices in countries such as Germany. In September 2022, Russia slowed down its supply of natural gas on the Nord Stream 1 pipeline in what analysts believe to be a retaliation against the West’s support for Ukraine. Among other interventions made by Germany was to increase its supply of renewable energy to avert the crisis. About 12.2% of the European Union’s electricity was generated from solar power in this summer period. This power saved the EU about€29 billion since it did not come from natural-gas burning plants. Further, this summer alone has seen solar generation rise 28% to 99.4 terawatt hours from 77.4 terawatt hours in the EU.

ReneSola has two ground-mounted solar projects in Germany totaling 40 MW under development. The company expected RTB/ sale for these projects by the end year 2023. In Hungary, the company is developing a total of 102 MW with commercialization set for 2023. Overall, ReneSola is developing approximately 1.595 MW of power in the EU with the commercialization of the pipelines set before 2024. Already it has a storage pipeline of 240 MW in Europe. With Europe increasing its demand for solar power and other renewable energy, we may see ReneSola fast-tracking its power generation and project development process.

I believe that ReneSola may be willing to sell part of its European projects to expand its liquidity into 2023. Towards the end of August 2022, RWE (OTCPK:RWEOY) acquired Alpha Solar, a Polish developer with a solar project capacity of 3 GW. In Poland, ReneSola has approximately 705 MW of power and it has already sold 175 MW from 2016 through 2021. The company is one of the largest project developers in the region and thereby may be a beneficiary of the auction success through which it has been able to access projects. The only challenge here would be the fact that ReneSola has not yet attained a gigawatt pipeline in any mid-to-late stage project.

Bottom Line

ReneSola expects to ride on the high energy demand and the high PPA price in Europe and the U.S. However, the company’s cash reserves of about $200 million may be inadequate to sustain its liquidity requirements into 2023 considering its project development pipeline. In my opinion, ReneSola may be open to selling part or whole of its stake in notable European countries such as Poland to raise its cash levels. Still, most of its projects are far from development and I believe it will take longer to even reach a 1 gigawatt solar pipeline to meet its power supply needs. Further, Covid19 curbs in China have reduced power demand due to factory shutdowns and it may affect revenues in H2 2022. For these reasons, we propose a sell rating of the stock.

Be the first to comment