Manuel Milan/iStock Editorial via Getty Images

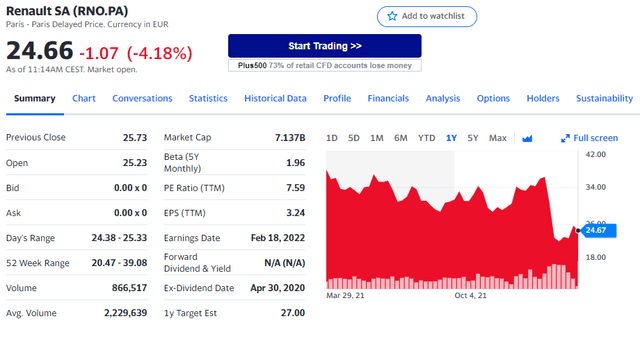

After initiation of coverage with a buy rating in Volkswagen AG (OTCPK: VWAGY) (OTCPK: VLKAF) (OTC: VWAPY), today we provide a deep-dive analysis of Renault (OTC:RNSDF, OTCPK:RNLSY) commenting on its Q4 and FY 2021 and looking at what appears to be the most exposed car automaker in Russia. Before Russia’s invasion of Ukraine, we were not positive on Renault and we were looking at the French automaker as a ‘show me story‘. Currently, with a stock price that fell more than 30% surpassing the loss of its entire Russian market, we firmly believe that management teams will need to show the investor community some positive results, especially regarding profitability. Even if the turnaround case is very compelling and given the fact that Renault is currently trading at the lowest multiple compared to its peers, we initiate coverage with a neutral rating and a target price of 25 euros per share.

Renault stock price 1Y evolution

Q4 and FY 2021 Results

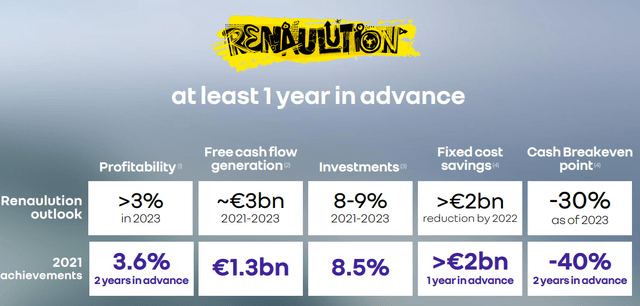

Luca De Meo’s treatment is bearing some fruits. Renault returned to profit in 2021 with a net result of €967 million, thanks in particular to an increase in its sales prices. After a very complicated 2020 and despite the semiconductor shortage, the group recorded sales of €46.2 billion in 2021, up by 6.3% compared to the previous year’s end. The group’s operating margin of 3.6% also exceeded its expectations. It had previously aimed for an operating margin at the same level of 2.8% recorded in the first half of the year so the Renaulution aim of an operating margin of more than 3% in 2023 has been achieved 2 years in advance. Net profits were in positive territory followed by the previous year’s losses of €8.01 billion and a loss of €141 million registered in 2019. Even if the cash flow was positive the group has decided to not propose any dividend payments for 2021.

Other Renaulution goals achieved in advance were:

- Fixed cost reduction of €2 billion compared to 2019 that was implemented one year in advance;

- Reduction of the breakeven point by 40% compared to 2019, carried out 2 years in advance;

- Effectiveness of the new commercial policy that favours value over volumes (5.7 basis point more compared the 2020 results);

- Growth of the Group order book in Europe with over 3 months of sales supported by the attractiveness of the Renault E-TECH offerings;

- Product mix improvement and fleet enrichment, in particular with the launch of the Renault Mégane E-TECH Electric, Renault Austral and Dacia Jogger.

Renault 2021 Financial results

Russian direct and indirect exposure

At the time of its FY release, despite a context that was still impacted by the semiconductor crisis and by the raw material price increases, Renault had estimated to increase its operating margin to at least 4% and to generate automotive operating cash flows of at least €1 billion. Since the Russian invasion, the French automaker has approved the following:

- Renault’s Russian activities have been suspended;

- Concerning its stake in AVTOVAZ which is fully consolidated as a JV (as it owns ~67%), the French car manufacturer is assessing various options.

Renault Group has responsibility for more than 45K employees in Russia. Due to that, Renault Group has to revise its 2022 financial guidance with:

- Operating margin of around 3% (versus the previous indication of ≥ 4%);

- A positive automotive operating free cash flow (versus the previous indication of ≥ €1Bn).

We usually do not comment on politics but it is important to report some facts: “French companies must leave the Russian market” Ukrainian President Zelenskyy announced in a video address, criticising Renault and others for “sponsoring the Russian war machine.” We remind our readers that the French state owns a 15% stake in Renault Group.

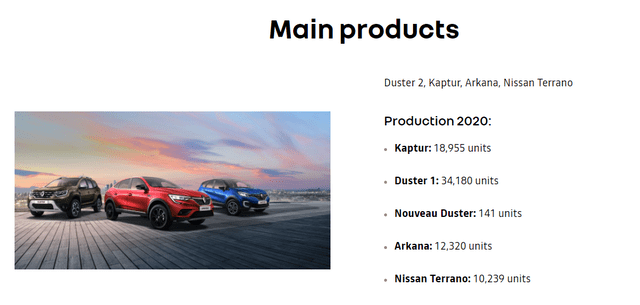

Politics aside and going to the numbers, we see that the Russian market is the 2nd largest market for Renault and it accounts for more than 10% of its total sales. What’s important to note is that almost 40% of Russian vehicle production is (or maybe was?) in Renault’s hands. In one of the last reports published by the French car maker, we see that Russia has been named 53 times. Having checked the report, we estimate that Russia’s sales account for €5 billion and operating profit stood at €300 million.

Out of curiosity, you can check out the video of Renault’s plant in the region.

Renault Moscow Plan main products

Conclusion and Valuation

Compared to the other European players, Renault is less diversified at a geographical level, and we believe that after the 23 March announcement, Renault will fully write down its Russian assets that accounted for €2.2 billion. Since February 23 (up today), the market capitalisation that has been lost is much higher than its Russian equity stake. However, we are wondering if the stock price adjustment has been too severe.

Our internal team was positively impressed by the new management team and by the business improvement reported in its Q4 and FY results. Unfortunately, wartime, geo/vehicle exposure, and new guidance favour other OEMs such as Volkswagen.

If you are interested in our latest automotive coverage, please have a look at:

- Volkswagen: All About The Long-Term Trends

- Ferrari To RACE Again

Be the first to comment