metamorworks/iStock via Getty Images

Company Overview

Renalytix (NASDAQ:RNLX) is focused on improving the clinical management of kidney disease in order to enhance patient outcomes and drive significant savings on healthcare expenditures. The company’s KidneyIntelX solution is a first-in-class in vitro diagnostic technology that uses a proprietary algorithm to provide a unique patient risk score based on a variety of data inputs such as verified blood-based biomarkers, inherited genetics, and individualized patient data from electronic health records. This patient risk score allows clinicians and healthcare systems to forecast progressive kidney function decline in patients with chronic kidney disease, or CKD, allowing them to optimize the allocation of treatments and clinical resources to those patients who are most at risk. Management believes KidneyIntelX is the first machine learning enabled in vitro diagnostic test with the ability to identify patients at risk of progressive kidney function decline, while in the earlier stages of kidney disease, when costs and outcomes can be better controlled. RNLX debuted on the public markets in 2021 and is an emerging growth company that is currently in the process of commercializing its technology and solutions.

Investment Case

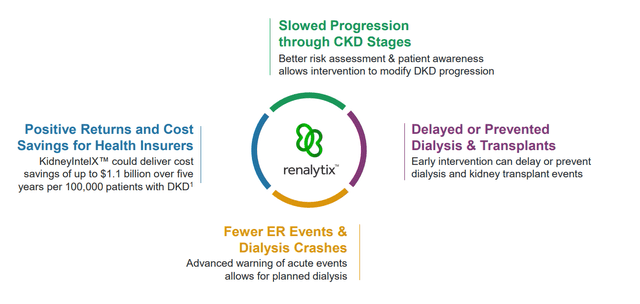

Although Renalytix is very early in its corporate lifecycle, there are strong reasons investors will want to keep RNLX on the watchlist. In the United States alone, Medicare spends over $120 billion annually treating CKD. This massive spend excludes additional expenses that private insurers, individuals and other groups may be covering. To help highlight the value of KidneyIntelX, the company partnered with Boston Healthcare Associates to develop a health economic model analyzing the cost and care pathway for patients with kidney disease at all stages and to quantify the potential cost savings of implementing and utilizing KidneyIntelX. According to the study, KidneyIntelX would generate a positive return for health insurers in 12-24 months and deliver a cost savings of up to $1.1 billion over five years per 100,000 patients with kidney disease. These savings result from the fact that RNLX’s solutions are more proactive vs. reactive, and produce more detailed and actionable results than traditional approaches. Current diagnostic approaches include simple blood and urine tests, imaging solutions and biopsies if needed for advanced cases. KidneyIntelX is winning over users because it provides results that help maintain kidney health, reduce kidney decline, reduce crash dialysis starts (a huge cost burden in the medical industry), reduce hospitalizations and optimize healthcare resources around the best treatment plans for patients. The figure below highlights some of the benefits of the KidneyIntelX approach.

The journey for RNLX is truly just beginning. While there are an estimated 37 million Americans living with CKD, not all of them require advanced treatments like dialysis to avoid kidney failure. Using its advanced machine learning pattern recognition algorithm, RNLX helps healthcare providers make decisions and evaluate treatment plans that can slow down the progression of CKD. KidneyIntelX helps medical professionals evaluate which patients truly need dialysis or transplants and then determines treatment options for patients with less severe forms of CKD, thus optimizing costs throughout the value chain. Globally, the company estimates that as many as 850M people have some form of CKD. Factoring in these international markets, the long-term opportunity for RNLX is truly massive.

“Network effects” are in play for RNLX as well. Management believes that as the company captures more data around kidney disease and function, that it will also be able to treat other kidney conditions. Consider the following recent commentary from RNLX’s quarterly earnings call –

“Finally, we were extremely pleased to report earlier this week that through our real world evidence framework, we are on target to assemble the most up to date and diverse serial collection of over 30,000 biologic assessments and data from more than 5,000 unique patients. In conclusion, leveraging all of the above, we are currently evaluating several potential product solutions to add to our portfolio and income streams. Specific programs are underway for the expansion of KidneyIntelX intended use to target patients from underserved high risk groups, such as those of African ancestry.” Source: Quarterly Earnings Call

While the opportunities for RNLX are significant to say the least, the company is also demonstrating signs of adoption progress since going public in mid-2021. The company landed a 10-year federal government contract covering CKD patient testing for the Veterans Health Administration systems. Additionally, RNLX now has 180 primary care physicians outside of the VHA using KidneyIntelX. Management offered the following view during last quarter’s earnings call –

“There are now currently an estimated 180 primary care physicians outside of the Veterans Health Administration System using KidneyIntelX today, a number we plan to grow significantly through the remainder of the calendar year. The combination of partnered hospital distribution, the Veterans Health Administration launch and increasing visibility on broad insurance payment provides the fundamentals necessary to drive KidneyIntelX volume growth in 2022, 2023 and 2024.” Source: Quarterly Earnings Call

So far, RNLX had landed 22 private insurance coverage contracts and also entered into agreements with 31 state Medicaid programs. Medicare has also established a national pricing of $950 per reportable result for KidneyIntelX. Although the company has yet to land coverage from a national healthcare insurance provider, it appears this is only a matter of time given the strong momentum and proven results RNLX’s solutions are generating. Further evidence of the company’s adoption progress can be seen in its partnership with the Mount Sinai Health System –

“Our company was founded through a collaborative effort with Mount Sinai Health System, one of our significant shareholders and our partner for the first clinical roll-out of KidneyIntelX. Mount Sinai Health System encompasses the Icahn School of Medicine at Mount Sinai and eight hospital campuses in the New York metropolitan area. Our collaborative clinical research studies with Mount Sinai utilize the Mount Sinai BioMe biobank. BioMe is designed to enable researchers to conduct genetic, epidemiologic, molecular and genomic studies using research specimens from consented participants, which are linked with each participant’s de-identified health information. All BioMe participants have consented to allow their de-identified data and samples to be used for research purposes. As of January 2020, the BioMe biobank had over 52,000 participants. For KidneyIntelX, this has allowed us to conduct rapid prospective validation of our platform using samples banked at “time zero” (i.e. time of sample collection), prior to the occurrence of progressive kidney function decline. In September 2020, we announced the initiation of clinical testing at the Mount Sinai Health System, and in September 2021, we announced the planned scale-up of testing with a targeted testing run rate of 300 DKD patients per week with approximately 6,000 eligible patients to be tested.” Source: Company Annual Report

Beyond adoption, the business sounds ready to scale too. Management has made several references to the salesforce being in place to drive revenue growth in 2022. RNLX also believes it has the manufacturing and distribution capacities in place to scale efficiently as opportunities expand. Additionally, in March, RNLX had a successful FDA inspection of their New York City lab and have now achieved CAP accreditation and ISO certification for both its Salt Lake City and New York City laboratories.

The final piece of the growth puzzle for RNLX is FDA approval. Here again, the company has been proactive –

“We voluntarily chose to go through FDA because this is a new category of diagnostic tests, and we very much believe in achieving regulatory approval. But I want to make it very clear that the number one risk factor by a long shot is how do you get insurance coverage and how do you get payment, because that is what drives revenue. Ultimately, that’s what creates the capital environment for us to finance a large marketing national marketing, and then eventually an international marketing strategy.” Source: Company Annual Report

Investment Risks

Although there are a significant number of strong growth drivers for RNLX, investors need to consider that the company is still very early stage (almost pre-revenue) and faces strategic, operational, financial and competitive risks. Perhaps the largest risk facing the company at the moment is its customer concentration. In 2022 and perhaps into 2023, it appears the company will be largely dependent on the VHA and Mount Sinai Health Systems for revenue. Although these business partnerships appear strong, any negative developments with either customer are likely to have significant impacts on this stock. The concentration also makes it hard to project future growth and financial results, since much is dependent on how quickly these customers engage and ramp up their usage of KidneyIntelX.

Although management certainly deserves praise for the development of KidneyIntelX and the company appears to have “built a better mouse trap” both direct and indirect competition may be coming in the next 3 – 5 years. As noted in the company’s annual report, there are a number of corporations targeting this market.

“We face competition from clinical reference laboratories and diagnostics manufacturers, including large diagnostic laboratories such as Quest Diagnostics Inc. and Laboratory Corporation of America Holdings (LabCorp) and large diagnostics manufacturers such as Thermo Fisher Scientific Inc., Danaher Corporation, Roche Holding AG, Abbott Laboratories, Bio-Rad Laboratories, Inc., Ortho Clinical Diagnostics NV and Siemens Healthineers AG, all of which have widespread brand recognition and market penetration and substantially greater financial, technical, research and development and selling and marketing capabilities than we do. We also face competition from data analytics companies that have developed technology-based or artificial intelligence-based approaches to healthcare applications and medical devices and that currently or in the future may develop diagnostic or prognostic products focused on kidney disease” Source: Company Annual Report

Additionally, while RNLX is pursuing patents, there are no guarantees the company succeeds in getting these patents and defensibility is also to be determined.

Insurer coverage will be one of the areas that potential investors will need to keep an extremely close watch on. Right now, the company doesn’t have coverage with any national healthcare payors (though they hope to land at least 1 provider this year). Additionally, if RNLX doesn’t receive a Medicare coverage determination, they would be forced to rely on private insurance coverage, which would greatly decrease the market opportunity for KidneyIntelX. Considering the number of older persons dependent on Medicare, it’s easy to see how this situation could potentially lead to drastic operational and financial problems for the company.

Management has also noted that delays in US approval processes and adoption could greatly hamper the International opportunity available to RNLX. The company is hoping that successes in the US will help fund global growth opportunities and also speed approval time with International regulatory bodies since proof of concept will have been demonstrated in the US.

Finally, for its multiplex biomarker assays, RNLX is dependent on a single supplier for the assay reagents and associated materials. Given current global supply chain issues and the general macroeconomic environment, this risk is another watch item.

Financial Overview

RNLX has a very limited operating history. The company filed for incorporation in 2018 and commenced full operations in 2019, though much of its early operating history was around R&D, product development and related buildouts. The first true attempts at commercialization began in 2021 and as such it’s not surprising to see trailing twelve-month revenue of just $2.4 million. It’s also not surprising that the overall financial picture is rather limited at the moment given the company’s history. However, a brief walk-through of the financials is informative.

As of 12/21 the company had $39M of cash reported on the balance sheet. Additionally, on 3/31, RNLX announced that it had raised an additional $30M of cash via a convertible bond offering. With this raise, management believes it has enough cash on hand to fund the next 2 years of operations. Potential investors will want to keep an eye on dilution, both from the convertible offering as well as from future raises which a growth company such as RNLX will likely need to continue to expand globally.

From a working capital standpoint, RNLX’s receivables and payables balance both appear manageable. Payable balances have increased slightly in recent quarters but not materially enough to cause concern.

Net Income and Free Cash Flow are both negative today and will likely remain this way over the next 2 years while the company is in growth mode. At this time, we think analyst consensus estimates are more informative given the growth nature of the company. For 2022, analysts expect revenue of $8.3M. The growth story really picks up in 2023 however, with analysts expecting revenue to nearly quintuple to $40.5M. Currently, Wall Street has assigned RNLX 1 strong buy, 2 buy and 1 hold recommendations.

Valuation and Recommendation

With limited financials and operating history, it’s a difficult exercise to assign a valuation to RNLX. As a starting point, we’ll use a Price-to-Sales approach vs. forward revenue. Today, the company trades at a market capitalization of $280 million. Compared to 2023 revenue of $40.5M, this is a valuation of 6.9x. Considering next year’s revenue growth of 386%, the 6.9x multiple seems reasonable. In my view, the real question is about how accurate the consensus projections may be. Leaving some room for uncertainty and cutting analyst revenue projections to $25M in 2023, the multiple jumps to 11.2x. Given the longer-term growth profile of the business, these are reasonable valuations and RNLX can be considered a buy for anyone with a 3+ year investment horizon. As with any company at this stage of its corporate lifecycle, there will likely be ups and downs along the way. However, RNLX has developed transformative medical technology and appears to be down the path of obtaining key customer wins and regulatory approvals. The business itself is also largely recession resistant, since treating CKD is not linked to economic cycles. Coupled with the overall market opportunity discussed earlier, RNLX could be a multibagger if management can successfully navigate the risks ahead.

Be the first to comment