Hispanolistic

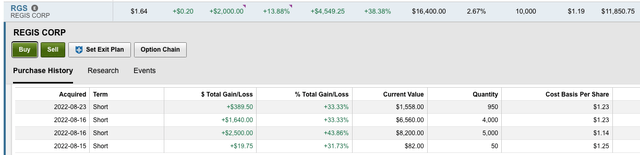

(I originally wrote up and recommended Regis Corp. (NYSE:RGS) to my group, Second Wind Capital, on August 16, 2022 (before the bell), with shares then trading around $1.20. On August 23, 2022, Regis reported its Q4 FY 2022 results, and after reviewing those results and listening to the conference call, at least in my view, the turnaround thesis was confirmed.)

Regis Corp. is the poignant example of why I spend the vast majority of time as a small cap value investor/ speculator. Generally speaking, and more so for micro-caps, but certainly also true for many small caps, especially with market capitalization sub $250 million, you have very limited sell side coverage and very limited market awareness. In many scenarios, there is good reason for the lack of market interest or awareness as there isn’t a compelling investment case. However, from time and time, and I would argue somewhat infrequently, you discover a company at an inflection point, that has a catalyst, and that offers compelling upside relative to its risk profile.

On August 15, 2022, in my view the entire investment thesis changed on Regis and the stock moved from untouchable and dancing on bankruptcy’s door, at least the equity, to a compelling turnaround.

The key catalyst was Regis found a White Knight, in its existing lender, Bank of America, by pulling off an amazing refinancing at terms I would have thought unthinkable given the then tiny market capitalization and its recent history of generating significant operating losses, as the company was acutely impacted by Covid.

Specifically, Regis had a $295 million credit facility set to expire on March 26, 2023. In other words, its debt was current, which is a scenario every management team wants to avoid at all costs, as it makes your equity un-investable. Post this amazing refinancing, Regis was able to extend the maturity date of its debt from March 26, 2023 to August 31, 2025. The new loan consists of a $180 million term loan and a $55 million revolver. Remarkably, the absolute level of interest was very reasonable given Regis’ huge Covid driven operating losses.

The Sixth Amendment replaces the current utilization-based interest rate margins applicable to borrowings with a margin that is subject to annual increases. The margin applicable to Term SOFR Loans (as defined in the Credit Agreement) will initially be 3.875%. Effective March 27, 2023, the margin will increase to 6.25%, of which 4.25% will be paid currently in cash and 2.00% will be PIK interest (added to the principal balance and thereafter accruing interest). Effective March 27, 2024, the margin will increase to 7.25%, of which 4.25% will be paid currently in cash and 3.00% will be PIK interest. The margin applicable to Base Rate Loans (as defined in the Credit Agreement) will be 100 basis points (1.00%) less than the margin applicable to Term SOFR Loans.

Moreover, in exchange, for an excess cashflow sweep that will be earmarked for principal pay downs, BofA greatly reduced the minimum liquidity and cash on hand requirements. This will enable Regis with both the time and runway to execute its turnaround plan. And with a turnaround plan already in fight, and executed by a new management, a team well equipped to pull this off, all of a sudden, this equity is interesting.

What Regis Corp. Does

Regis Corporation is a large franchise operator of over 5,500 salons, as of June 30, 2022. The salons operates under the store banners of Supercuts, SmartStyle, Cost Cutters, First Choice Haircutters and Roosters. The salons operate in the value segment of the industry and offer haircutting, styling, hair coloring, and related services. The salons also sells hair care and beauty related products.

As of June 30, 2022, there were 5,395 franchised locations and 105 company owned stores as well as 76 locations where Regis corporate maintains a non-controlling interest.

Rear View Mirror Losses

Regis Corporation is a business severely impacted by Covid and the associated lockdowns. Its salons were forced to be closed for a period of time, similar to many other small businesses, and with so many people working from home and some people afraid to go out and about during Covid, even when the salons opened back up, traffic was way down. Compounding the problem was that many hair stylists left the business as they needed a steady and reliable income to survive and others took advantage of the generous government unemployment benefits and took extended sabbaticals courtesy of those enhanced unemployment benefits. As this business is driven by attracting, training, and retaining talented stylists, it was the perfect storm for Regis and its operating losses spiraled.

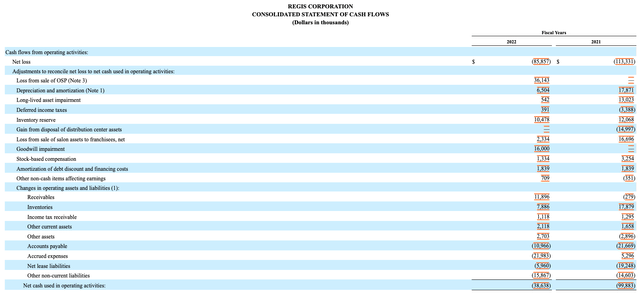

Operating losses from operations were $99.9 million in FY 2021 and $38.6 million in FY 2022, respectively (Regis’ fiscal year FY 2022 ended June 30, 2022).

Given these operating losses, Regis had to tap its revolver for liquidity and to stay in business.

Stock Prices Are About The Future

Given the difficult circumstances, about five months ago, and Regis has been adding talent to its team, a new management team was brought in. The new team is quite capable and doing all of the right stuff. The CEO, Matt Doctor, and team, shared its compelling strategic business plan during its August 23, 2022 conference call.

The company has intentionally shrunk its company owned stores from nearly 300 to 105 and has been laser focused on reducing its balance sheet liabilities. The company has also moved away from its wholesale products business and outsourced that to Sally Beauty (SBH). Although the company’s debt looks high, with its operating leases, this debt and rent payments are made by the franchisee and just passed through.

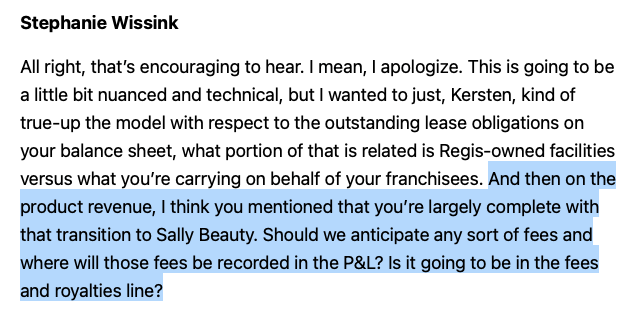

On its Q4 FY 2022 conference call, Jefferies’ analyst, Stephanie Wissink, asked about Regis completing its transition from its own wholesale product segment to Sally Beauty. Moreover, she inquired about the fee they expect receive from Sally Beauty. Regis’ CFO answered the first part of the question, but ducked the fee they will earn from directing that much business to Sally Beauty. That said, this simplifies the business and reduces balance sheet working capital and time management needs to spent on the product side of the business.

Regis Corp. Q4 FY 2022 Conference Call

On the Q4 FY 2022 conference call, the management team discussed a number of key initiatives and investments the company is making in the business to reignite growth, drive traffic, and ultimately help franchisees become more successful, which in turns helps Regis corporate earn more royalties and fees, as same store sales grow.

Areas of low hanging fruit are smartly spending on marketing as the company and its banners already have great awareness, but they need targeted marketing and an enhanced loyalty program rather than telling tens of millions of customers about a brand they already know very well.

Here is a good excerpt from the Q4 FY 2022 conference call explaining the smarter strategy.

Shifting gears to our marketing efforts. One piece of this that I mentioned was a focus on recruitment marketing to drive our talent brand and attract stylists. The other is driving customer traffic. We announced yesterday the hiring of our new marketing head, Michelle DeVore, and we cannot be more excited that Michelle is joining our team. Her background in digital marketing, retention, and loyalty, is exactly the focus that we need for short to medium term tactics to drive traffic, as well as laying the foundation for broader lifecycle marketing, CRM, and loyalty efforts. Michelle’s knowledge of the beauty industry, combined with her experience with franchisees and the Zenoti platform from her days at European Wax Center, bring the right combination of skills at the right time for Regis. And while Michelle, who I have no doubt, will be shaping the direction of our marketing function over the coming months, changes have already started. I mentioned on our last call that our approach to marketing is shifting, and we have engaged a specific agency partner to aid in this transition. Historically, our ad funds have either been, one, used in a dispersed manner, and or two, heavily weighted towards expensive top-of-funnel awareness. Currently, our brands have awareness. What we need is to drive decisions. We are in the process of shifting our ad fund dollars to more middle and bottom funnel performance marketing, things like paid search, promotions and loyalty programs, and increased advertising for local spending.

Pro-Forma Financials and Valuation

The pro-forma balance sheet:

As of June 30, 2022, Regis has $17 million of cash $180 million of term loan debt. On June 30, 2022, Regis sold its old and really weak legacy point of sales system, Opensalon Pro, to Zenoti. The company received $13 million on June 30, 2022, but will receive up to an additional $26 million depending on adoption by franchisees.

On June 30, 2022, the Company sold its Opensalon Pro (OSP) software-as-a-service solution to Soham Inc. for a purchase price of $20.0 million in cash plus up to an additional $19.0 million in cash contingent upon the number of salons that migrate to Soham’s Zenoti product as their salon technology platform. The Company received $13.0 million in proceeds in June 2022. The remaining $7.0 million of the purchase price is subject to holdbacks including $4.0 million of the proceeds retained in escrow to be paid upon completion of the Company’s refinancing, $1.0 million once the Company ends its arrangement with its former third-party salon technology provider in December 2022 and $2.0 million of proceeds held back until general indemnity provisions are satisfied within 18 months from closing. As a result of the sale, the Company classified the OSP business as discontinued operations in the financial statements as discussed in Note 3 to the Consolidated Financial Statements in Part II, Item 8, of this Form 10-K.

(Source: Regis FY 2022 10-K (page 30))

On the Q4 FY 2022 conference call, the company noted the new Zenoti systems is vastly superior to Opensalon Pro and the cost of the product, at the franchisee level, is very similar, yet it has much better functionality and should make it easier for franchisees to run their businesses.

See below how management described upgrading to Zenoti.

To put it bluntly, we had some functionality gaps with OSP. And given there was a better platform in the market already with Zenoti, it no longer made sense for us to continue to invest money in a technology business when we can provide our franchisees a better solution overnight.

By partnering with Zenoti, we accomplished many things. First and foremost, getting a best-in-class technology platform to our franchisees in a timely fashion, and becoming the right catalyst for our digital initiatives and engagement with our salons. Not only that, but they receive a more robust platform at the equivalent monthly fee to OSP, in addition to minimal to no switching costs. Another benefit is, the sale provides Regis with a return on its investment in OSP and cash to delever.

Source: Regis Q4 FY 2022 Conference Call

So we are looking at $163 million of net debt, but RGS can earn up to another $26 million from Zenoti, which will be earmarked to pay down debt. So debt, could get down to a pro-forma $140 million.

The pro-forma cash flow statement:

To understand the P/L, Regis no longer has to spend Capex to run its Point of Sales system, and they have outsourced the product business, to Sally Beauty. There are only 105 company owned stores and management said they will be out of those stores by the end of FY 2024 and that FY 2023 operating losses for company owned stores will get cut in half. Therefore, all we have left is a business that earns royalties and fees and that has SG&A and interest expense. Given the massive recent operating losses, the company will have lots of operating loss carried forward and won’t have to pay much tax on future operating income.

Therefore, we only need to think about the absolute level of system-wide sales and its future trajectory and then think about royalties and fees.

Regis Q4 FY 2022 Earning Release

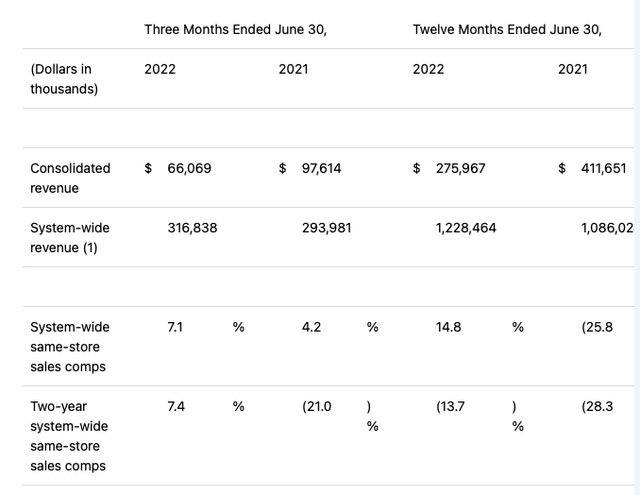

Regis’ Q4 FY 2022 system-wide revenue was $316.8 million and Royalties were $17.23 million and Fees were $2.95 million. So it looks like total royalties and fees are about 6.3% (give or take one or two tenths of one percent).

We know annual FY 2022 system wide sales were $1.228 billion. If we think they can grow 10% in FY 2023, as the life normalizes with back to office and retired folks feeling more comfortable being out and about in a post Covid world, then this translates to $1.35 billion in pro-forma FY 2023 system-wide revenue.

6.3% x $1.35 billion equals $85 million or royalties and fee income.

Advertising and rent are just passed through. And in FY 2023, the company owned stores should stabilize at closer to breakeven / a modest loss.

On the Q4 FY 2022 conference call, management noted that normalized G&A should land between $60 million and $63 million as the company is investing smartly and aggressively, to make the right investments to drive traffic, attract and retain stylists, and reinvigorate the business and its store banners.

Next, we have interest expense. The debt is SOFR plus 388 Bps through March 26, 2023. So, assuming they earn most of the Zenoti earn-out, pro-forma interest expense should be more than $10 million in FY 2023.

So $85 million of top-line revenue – $61 million of SG&A – $10 million of interest expense gets you to about $14 million of free cash flow. That free cash flow will be earmarked for debt repayment, which in turn will re-rate the equity as the balance sheet risk gets diminished and net interest expense gets reduced as the principal balance of the term loan shrinks.

With 45 million shares outstanding, even at $1.64 per share, we are only talking about a market capitalization of $74 million and pro-forma enterprise value of $214 million (assuming $23 million out of $26 million in Zenoti earn-out fees). Given the strong free cash flow profile, free cash flow that will be earmarked to pay down debt, this should be accretive to the equity in the form of a higher valuation.

Skin In the Game

If you closely read my work then you are well aware I always eat my own cooking. I don’t write articles to earn a small fee from publication dollars. I spent so much time on this stuff because I have capital at risk and I bet my ideas.

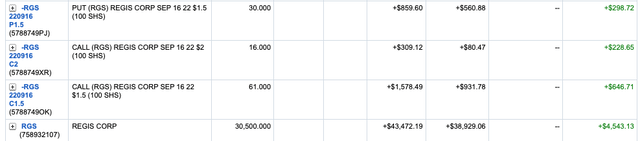

As I noted, I bought and recommended shares of Regis Corp. to my group, Second Wind Capital, on August 16, 2022, at $1.20 per share.

As luck would have it, by August 19, 2022, the stock ran up over $1.60, and I sent a real-time alert to take some profits and wait for the August 23, 2022 results and subsequent conference call.

As luck would have it, a second time, the stock dropped back to $1.20, based on the negative headline numbers, yet the underling results were quite good, and on the morning of August 23, 2022, and we were able to buyback shares.

Putting It All Together

Two weeks ago the conventional wisdom was that Regis Corp. was destined for bankruptcy as large Covid related losses and $180 million of debt had gone current. Without a reasonable refinancing, the equity market was betting bankruptcy was highly likely, hence why its stock was priced at only $0.75 (only a $34 million market capitalization), the week ending August 12, 2022. Lo and behold, Regis found a White Knight, played by Bank of America, and successfully refinanced its debt at highly attractive terms, notably in light of the circumstances. This was and still is a huge catalyst and the equity markets simply under reacted and underappreciated the significance of this refinancing. Hence, why I was happy to swoop in and get long RGS shares, $1.20 per share, despite a big initial percentage move from $0.75 to $1.20.

On August 23, 2022, Regis gave a thorough and well thought out conference call. Management has a sound strategy in place, greatly simplified the business, and is less distracted by running company-owned stores and no longer has to worry about running the technology of OpenSalon Pro or managing the products business. With much better marketing, and smart investments in training, with a focus on attracting and retaining new stylists, traffic and ultimately revenue should follow.

I would argue we have a reasonable shot at this equity approaching to $2 to $2.50 per share based on continued business execution and momentum. Lastly, based on the volume, it appears very few people are aware of this turnaround.

Be the first to comment