zoranm

Shares of AAV gene therapy pioneer REGENXBIO (NASDAQ:RGNX) have fallen by 30% since my December 2019 update highlighted “picks & shovels” aspect of the story as partnered efforts made considerable progress. On the other hand, shares have risen by 121% from my initial Buy recommendation published in 2016.

With first BLA filing for ophthalmology efforts, together with partner AbbVie (ABBV), on track for 2024 and multiple important data sets expected in the coming year (not to mention the company trying to take on Sarepta Therapeutics in the DMD space), I’m looking forward to revisiting this one and determining how the risk/reward profile has changed.

Chart

Figure 1: RGNX weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see shares bounce around in the $20 to $50 range over the past few years. While they have rebounded from early summer lows, my initial take is that readers interested in the story would do well to patiently accumulate dips ahead of anticipated accelerating clinical momentum over the 2023 to 2025 time period.

Overview

Founded in 2009 with headquarters in Maryland (372 employees), REGENXBIO currently sports enterprise value of ~$800M and Q2 cash position of $682M comfortably providing them operational runway for at least 2 years.

In my prior update, I touched on following keys to our bullish thesis:

- Company was clearly focused on advancing their AAV (adeno-associated virus) based gene therapy pipeline utilizing their NAV technology platform. This widely adopted platform holds exclusive rights to over 100 novel AAV vectors, and the company has over 24 partnered product candidates being developed by third party licensees.

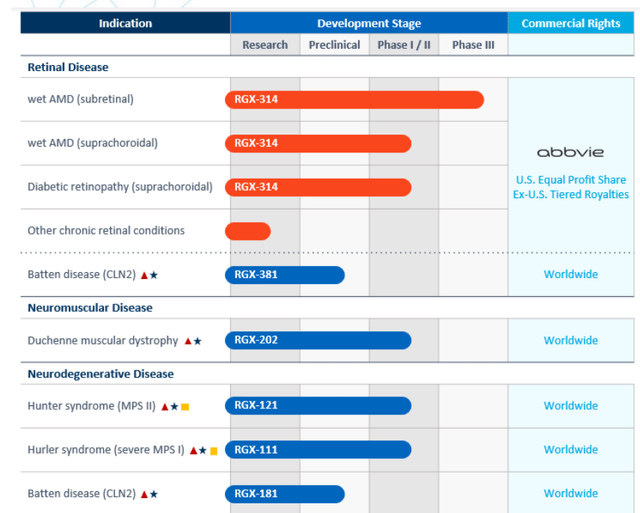

Figure 2: Internal pipeline (Source: corporate presentation)

- Time and again we saw the company ink global license agreements with industry heavyweights such as Biogen, Novartis and Pfizer. These typically involved certain vectors such as AAV8 and AAV9 for specific diseases or indications that REGENXBIO was not pursuing internally. Partners in turn had to provide an upfront payment (sometimes sizeable) in addition to milestones and royalties on sales. Participation in downstream economics in turn helps fund internal development (for example, REGENXBIO wisely chose to monetize a portion of Zolgensma royalties for $200M payment from Healthcare Royalty partners). That agreement started initially with the AveXis AAV9 license agreement (extension gave them another $140M payment as I recall). Core Biotech holding Ultragenyx (RARE) is another key partner for which REGENXBIO’s technology is deeply embedded in its mid to late-stage rare disease pipeline. Likewise, another recent Buy recommendation from me and former ROTY winner Rocket Pharmaceuticals (RCKT) is also using REGENXBIO’s vectors for its lucrative Danon program which could do $2 billion or more in peak sales, considering US + EU prevalence of 15,000 to 30,000 patients.

Figure 3: NAV technology licensees (Source: corporate presentation)

- I stated my opinion of shareholder-friendly management, showcased by its savvy decision to acquire partner Dimension Therapeutics in an all-stock transaction and then refusal to outbid Ultragenyx and overpay. From there, additional validation for NAV platform was realized when Ultragenyx exercised its option to acquire an exclusive worldwide license to NAV Vectors, including NAV AAV9, for the treatment of CDKL5 Deficiency Disorder (CDD).

- We took a deeper look at the prospects of an early-stage study evaluating RGX-314 in wet AMD, noting that while the field is quite crowded, RGX-314 could set itself apart as a one-time subretinal treatment. Current standard of care involved injections every month or every other month with the initial vision gain from therapy declining over time. Regeneron’s (REGN) Eylea was projected to eventually do up to $5 billion in peak sales (gave us a sense of the revenue potential here). Data from an early-stage trial of RGX-314 showed that after six months patients in the third cohort showed evidence of durable RGX-314 protein expression levels (measured from aqueous samples by electrochemiluminescence immunoassay). Consider that in the first three cohorts dose-dependent protein expression was observed along with dose-dependent change in number of required injections. Cohort 3 showed highest protein expression and most reduction in need of VEGF injections (maintenance of retinal thickness and visual acuity was also encouraging). 3 patients in cohort 3 were highlighted as they required no injections over the entire 6 month period. I also described another shot on goal in the eye space via license agreement to Clearside Biomedical’s (CLSD) in-office SCS Microinjector for the delivery of adeno-associated virus-based therapeutics, including RGX-314 delivery to the suprachoroidal space to potentially treat wet age-related macular degeneration, diabetic retinopathy, and related conditions where chronic anti-vascular endothelial growth factor (VEGF) treatment is currently the standard of care. Deal terms were modest, involving a small upfront payment, up to $34 million in development milestones, up to $102 million in sales milestones and mid-single digit royalties on net sales of products incorporating SCS Microinjector.

- RGX-121 for the treatment of pediatric MPS II patients was advancing into an early-stage study and had already received orphan drug plus rare pediatric disease designations. Also, it was a semi-bullish sign that the company inked an agreement with FUJIFILM Diosynth Biotechnologies to beef up its manufacturing capabilities for lead clinical candidates (support late-stage study and commercialization). Other internal indications were making headway as well, including RGX-501 for the treatment of Homozygous Familial Hypercholesterolemia (HoFH). This latter program was eventually discontinued due to unfavorable risk/benefit profile.

As can be seen in Figure 2 above, pipeline has progressed considerably since last time I revisited this name and I’m looking forward to determining how the story has progressed.

Select Recent Developments

On November 9th of last year, REGENXBIO announced closing of its license agreement with AbbVie to commercialize RGX-314 for wet AMD, diabetic retinopathy (DR) and other chronic retinal diseases. REGENXBIO received $370M upfront payment and is eligible to receive up to $1.38 billion in milestone payments. Under the collaboration, REGENXBIO is responsible for completion of ongoing studies and AbbVie will share costs on additional studies including 2nd pivotal trial. AbbVie will lead global development and commercialization, while REGENXBIO will participate in US commercialization efforts (sharing equally in US profits while receiving tiered royalties for ex US sales). I really like this deal, as this is not an indication (highly competitive space) that I would want a company of this size to tackle on its own. Also, REGENXBIO’s management to their credit were able to retain substantial economic participation as opposed to just receiving a small royalty share.

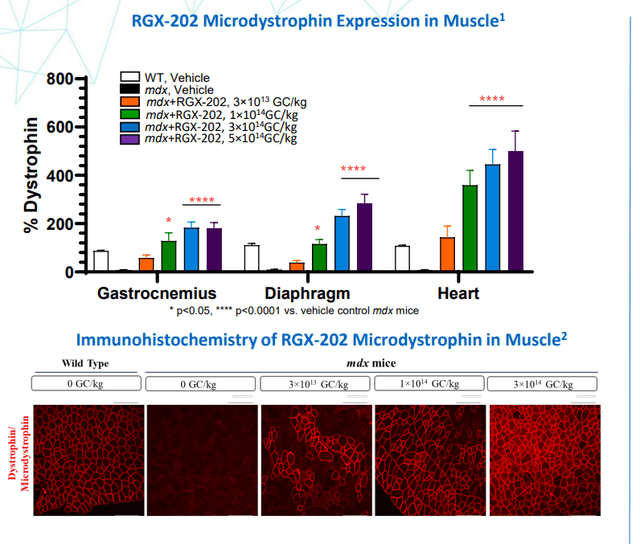

Moving on to January 6th, the company announced clearance of its IND application by the FDA to evaluate RGX-202 (one time gene therapy for the treatment of Duchenne muscular dystrophy or DMD). While one would think Sarepta Therapeutics (SRPT) has a lock on this space with its multi-faceted approach, there is significant clinical differentiation for RGX-202 as it delivers a transgene for a novel microdystrophin that includes the functional elements of the C-Terminal (CT) domain found in naturally occurring dystrophin. Presence of the CT domain has been shown in preclinical studies to recruit several key proteins to the muscle cell membrane, leading to improved muscle resistance to contraction-induced muscle damage in dystrophic mice. Additional design features, including codon optimization and reduction of CpG content, may potentially improve gene expression, increase translational efficiency and reduce immunogenicity. This particular program is designed to support the delivery and targeted expression of genes throughout skeletal and heart muscle using the NAV AAV8 vector and a well-characterized muscle-specific promoter (Spc5-12).

Figure 4: RGX-202 demonstrated robust expression of microdystrophin across skeletal and cardiac muscles (Source: corporate presentation)

The plan for the phase 1/2 AFFINITY DUCHENNE study is to evaluate safety, tolerability and efficacy in six pediatric patients across two dose cohorts consisting of 3 each (1×1014 genome copies/kg body weight and 2×1014 GC/kg body weight). Trial design allows for dose expansion of up to six more patients at each dose level, depending on the signal they are seeing. Given serious adverse events including deaths that have plagued the gene therapy sector, one can appreciate the thorough safety measures in place including comprehensive, short-term, prophylactic immunosuppression regimen to proactively mitigate potential complement-mediated immunologic responses. While it is primarily a safety trial, they will be measuring microdystrophin protein levels in muscle, and strength and functional assessments, including the North Star Ambulatory Assessment (NSAA) and timed function tests. I wouldn’t be surprised if they produce promising early and mid-stage data with this program, at which point they’d be able to pursue a lucrative license agreement with rare-disease focused big pharma or big biotech partner.

On January 10th, the company announced initiation of the ASCENT phase 3 study (second of two pivotal trials) to evaluate RGX-314 in patients with wet AMD. ASCENT, the first pivotal phase 3 study under collaboration with AbbVie, was already active and screening patients at this time. Current clinical plan is to submit a Biologics License Application (BLA) to the FDA in 2024 based on two pivotal studies as well as ongoing ATMOSPHERE trial. Partner AbbVie’s deep involvement and commitment to creating a gene therapy franchise in lucrative eye indications is readily apparent. ASCENT study is quite aggressive compared to what I’ve seen so far in the gene therapy arena, with goal of enrolling 465 patients across two dose arms and the aflibercept control arm. Primary endpoint is non-inferiority to aflibercept based on the change from baseline in Best Corrected Visual Acuity (BCVA) at one year.

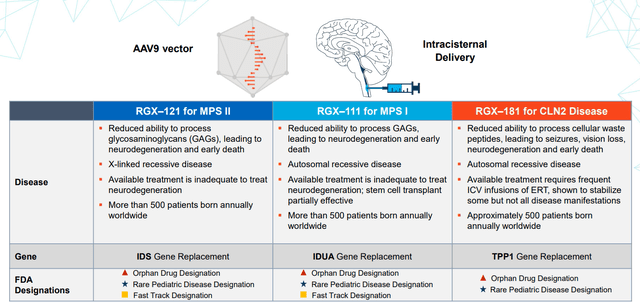

Moving on to February 9th, the company announced promising clinical data for rare disease programs in MPS I and MPS II (Hunter Syndrome). For the latter, additional data from Cohorts 1 to 3 continued to demonstrate dose-dependent reductions in CSF trajectories (up to two years) and Cohort 3 was expanded to include patients dosed with commercial-scale cGMP material. Of particular importance was that RGX-121 continued to be well tolerated across all cohorts with no drug-related serious adverse events in 13 patients. Improvements in neurodevelopmental function and Caregiver Reported Outcomes in Cohorts 1 and 2 were encouraging, including three patients who acquired skills and remained within two SD of the normative mean on the cognitive, expressive language, and fine motor subtests at the last time point available following RGX-121 administration. Patients also demonstrated positive trends in toileting skills, reduction in maladaptive behaviors, and improved sleep breathing following RGX-121 administration.

For MPS I, this was the first data presentation and so far RGX-111 was well tolerated with emerging evidence of CNS biomarker activity and improvements in neurodevelopmental function, which suggest biological activity in the CNS following one-time administration. Here as well, there were no drug-related serious adverse events and the patient dosed with RGX-111 under the single-patient IND demonstrated a decrease from baseline in HS in the CSF at 59 weeks after dosing. IDUA enzyme activity in the CSF, which was at undetectable at baseline, was detected following RGX-111 administration. As for early neurodevelopmental data, early assessments from the two patients under the age of six years old demonstrated continued skill acquisition within two standard deviations of the normative mean at last assessment on the BSID-III cognition, expressive language and fine motor subtests. One patient in Cohort 1 who entered the trial at the age of 13 years old demonstrated neurodevelopmental improvements as measured by the WASI-II and six of the nine scales of the VABS-III at one year after RGX-111 administration. As for market opportunity, over 1000 patients are born annually worldwide with MPS I and MPS II.

Figure 5: Neurodegenerative disease franchise (Source: corporate presentation)

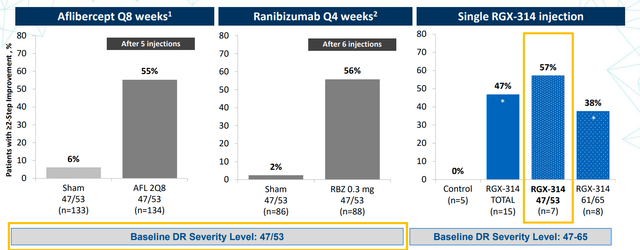

On February 12th, the company announced positive interim data from the ongoing phase 2 ALTITUDE study of RGX-314 for the treatment of diabetic retinopathy without center-involved diabetic macular edema using in-office suprachoroidal delivery. As for safety, two serious adverse events were reported (neither considered drug-related) and there were no cases of intraocular inflammation observed. At 6 months of 15 patients dosed in Cohort 1, 47% demonstrated a two-step or greater improvement from baseline on the Early Treatment Diabetic Retinopathy Study-Diabetic Retinopathy Severity Scale (DRSS), the primary endpoint, compared to zero of the five patients (0%) in the observational control group. One patient (7%) continued to demonstrate a four-step improvement. Encouragingly, the percentage of Cohort 1 patients dosed with RGX-314 achieving at least two-step improvement at six months (47%) increased from the previously reported three-month results (33%). This is important, as a 2-step improvement in DRSS has been accepted as a pivotal endpoint by the FDA for DR clinical trials.

Figure 6: Comparison of outcomes at 6 months to frequent injections of FDA-approved anti-VEGF agents (Source: corporate presentation)

On June 9th, the company announced opening of its new Manufacturing Innovation Center gene therapy manufacturing facility. In-house manufacturing capabilities will allow the company to rapidly transition production processes across product lifecycle and progress candidates through clinical studies as well as be ready for commercial launch. The GMP facility will enable them to manufacture AAV vectors at scales of up to 2,000 liters and makes the company one of only a few with such capacity.

Lastly, on August 3rd REGENXBIO announced its intention to file a BLA in 2024 using the FDA’s accelerated approval pathway for RGX-121 for the treatment of Hunter Syndrome (MPS II). Regulatory filing would be supported by endpoints in pivotal program including changes from baseline of glycosaminoglycans (GAGs) in the cerebrospinal fluid (CSF) at four months. GAGs in the CSF have the potential to be considered a surrogate biomarker that is reasonably likely to predict clinical benefit in MPS II disease, as buildup of GAGs in the CSF of MPS II patients correlates with clinical manifestations, including neurodevelopmental deficits. The company also plans to share new data at the Society for Study of Inborn Errors of Metabolism Annual Symposium on August 31st. A regulatory green light for this program would be significant considering $500M market opportunity (conservatively) as contrasted to current EV of $800M.

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $682M as contrasted to net loss of $68M. Revenues rose by over 50% to $32M, while research and development expenses rose significantly to $61M. G&A costs came in slightly elevated at nearly $21M. Management continues to guide for operational runway into 2025. Accumulated deficit since inception is just $161M, which I consider to be highly promising and a sign of management’s savvy in inking high value collaborations and taking advantage of milestones & royalties to offset operating costs of internal development.

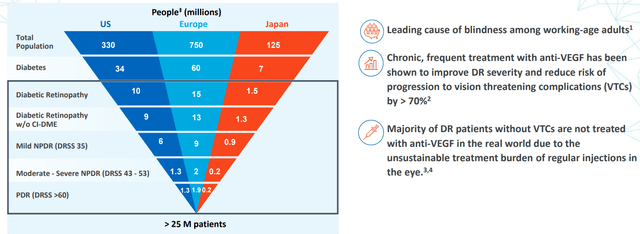

As for the DR indication & associated opportunity, consider that it is a complication of diabetes and is the leading cause of blindness in adults between the age of 24 and 75 worldwide. An estimated 27 million patients are affected by this debilitating disease worldwide. It’s a slowly progressing condition that can lead to vision-threatening complications, including diabetic macular edema or DME and neovascularization that can lead to blindness. It’s very similar to wet AMD in that patients are treated with anti-VEGF therapy and REGENXBIO’s goal is to reduce treatment burden via a one-and-done solution. Current phase 2 study has primary efficacy endpoint of proportion of patients achieving at least a two-step improvement in DR measured by the DRFS scale at one year. 6 month data from Cohort 1 showed 47% improvement versus 0% for observational control (quite convincing to my eyes), so the key hurdle will be if they can get safety & tolerability profile right for FDA to look favorably on (risk/benefit ratio always the key concern).

Figure 7: Sizeable opportunity in DR, majority of patients not treated with VEGF due to treatment burden (Source: corporate presentation)

As for institutional investors of note, Redmile Group lightened up on its position and owns 4.4% stake. It seems like more generalist investors own the larger positions here such as JPMorgan Chase with 11.7% stake and BlackRock with 15.4% stake.

As for insiders, over the past year I see a steady stream of sales and awards, but next to nothing in terms of purchasing behavior. Founding President and CEO Kenneth Mills owns over 1.5M shares (nice to see he still has significant skin in the game).

As for leadership lineup, Chief Scientific Officer Dr. Olivier Danos prior served as SVP Cell and Gene Therapy at Biogen. He also co-founded Lysogene, a NAV technology licensee developing gene therapy candidates for MPS IIIA. Chief Operations and Technology Officer Curran Simpson served prior as Head of North American Supply Chain and Interim Chief Operating Officer and Integration Lead at GlaxoSmithKline. SVP Commercial Strategy and Operations Ram Palanki has highly relevant prior experience at Santen where he was SVP of Commercial for all the Americas.

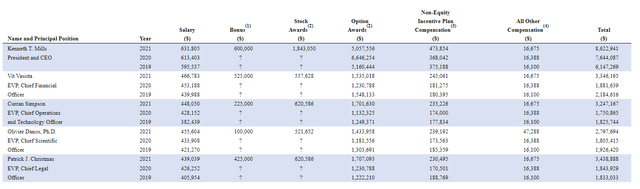

Moving into the related area of executive compensation, combined cash portion of salary plus bonus is still in the reasonable range (a bit elevated for CEO bonus of $600,000). Stock and options awards are in a reasonable range and again, as we reflect on the low accumulated deficit since inception, it’s evident management on the whole is a good steward of the company’s resources.

Figure 8: Executive Compensation Table (Source: Proxy filing)

The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

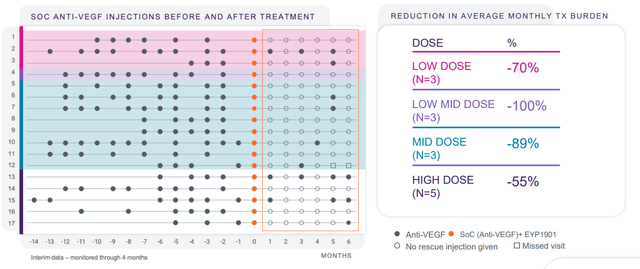

As for competition in wet AMD, my recent article on Ocular Therapeutix (OCUL) reminds readers to pay attention to the company’s data presentation for OTX-TKI at AAO September 30th (their goal is to move standard of care from 3 months between injections to 6-9 months between injections). Likewise, EyePoint Pharmaceuticals’ (EYPT) EYP-1901 seeks to extend duration between doctor’s visits to up to 6 months. Importantly for the wet AMD space where bar for safety and tolerability is set very high, there were no ocular SAEs reported and majority of adverse events were both mild and expected (have to wonder how risk/benefit profile of gene therapy can compare to that).

Figure 9: EYP-1901 phase 1 DAVIO data shows 79% reduction in treatment burden at 6 months (Source: Proxy filing)

Moving onto useful nuggets from members of the ROTY community, I felt that Biotech.Phoenix gave me a crash course on the wet AMD space last year. Here are a few of his remarks from November 2021:

RGNX was the current leader. EYPT now matches them on 6-month efficacy, wins on safety/tolerability profile and administration (Injection vs. Surgical procedure). The approach across EYPT, OCUL,, ADVM and RGNX are basically the same to provide a long-acting base of therapy to complement the PRN mAbs. Although they each use slightly different technologies. EYPT just established themselves as the current leader. EYPT – 1901 data at AAO sets the bar with efficacy comparable to RGNX’s AAV without the need for a surgical procedure and associated better AE profile. ABBV just paid $370 M upfront for US co-promote and Ex-US rights. The current market is limited to short acting PRN therapies. However, I think it will likely transform similar to other markets like insulin and asthma where you combine a long-acting agent with a short- acting PRN rescue agent. The players in the long-acting space are EYPT, OCUL, and RGNX. EYPT was a compelling buy and underpriced prior to data but now post data and financing is now more or less fairly valued with regard to the competition.

As for prior financings, in January 2021 the company raised over $200M at $47/share (50% higher than current levels).

As for IP, patent portfolio covers all aspects of NAV Technology Platform and includes 18 issued US patents and 6 European patents relating to AAV7, AAV8, AAV9 and AAVrh10 vectors and their uses (these expire as late as 2026, without patent term extension). For RGX-314, they have issued US patent that expires in 2037 and additional pending PCTs that would expire between 2037 to 2040. As for neuromuscular disease franchise starting with RGX-202 in DMD, they have pending PCT for which any issued patents would expire in 2040. For RGX-121/111, they have patents expiring 2034 and 2037 as well as pending PCTs which would expire between 2034 to 2041. For RGX-181, they have two pending PCTs that would expire in 2038 or 2039. Company also has key patents covering all aspects of manufacturing processes which support large scale, increased yield and purity of AAV vector products.

Final Thoughts

To conclude, it’s evident that management continues to be a good steward of the company’s resources as milestones and royalties from partnered efforts help foot the bill for the internal pipeline. I like the structure of the deal with AbbVie in the highly competitive eye space, offloading much of the risk to them while still retaining substantial economic upside and participation. There’s significant optionality with wholly-owned rare disease programs such as in Hunter’s Syndrome or DMD, where differentiation versus existing peers is apparent.

On the con side, with innovators such as EyePoint Pharmaceuticals and Ocular Therapeutix also making headway in the long-acting wet AMD race, I remain skeptical of the risk/benefit profile gene therapy brings to the table when the bar for tolerability & safety is set so high for this indication. At the same time, we should not underestimate the potential appeal of “one and done” treatments and burden of proof is on pivotal trial data to convince the skeptics and prove that RGX-314 is an approvable program. Also, efficacy in DR looks quite good to my eyes and if they are able to repeat in phase 3 with similar safety, I don’t see why this would not take at least a decent share of the market versus bi-monthly Eylea or monthly Lucentis.

Lastly, I note that as is always very important with gene therapy companies, REGENXBIO owns and controls its in-house manufacturing capabilities which creates high strategic value as they are able to prepare for possible product launches in a few years’ time.

For readers who are interested in the story and have done their due diligence, RGNX is a Buy and I suggest accumulating dips in the second half of this year.

From an ROTY perspective (focus on next 12 months), I’m not likely to enter a position in the near to medium term. However, I will keep an eye on share price in case there’s a pullback to low $20s and would look to revisit this story in 2023 at some point.

Key risks include disappointing clinical data, particularly in ocular disease indications where the bar is quite high for both efficacy and especially safety/tolerability. Competition is increasingly fierce with companies including big pharma that have much stronger balance sheets to be able to move more aggressively forward. Investors would do well to keep an eye on mid and then late-stage readouts for other emerging players in the long-acting eye space such as Kodiak Sciences, Ocular Therapeutix and EyePoint Pharmaceuticals. Dilution is not a risk in the near to medium term, owing to the company’s strong cash position and manageable burn rate.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. I look forward to your thoughts in the comments section below.

Be the first to comment