assalve/E+ via Getty Images

Hastening the EV transition continues to form a core tenet of the push by policymakers to reduce oil demand. This has most recently seen the European Union endorse a framework to end new internal combustion engine vehicle sales by 2035. This places the union on a long list that includes the United Kingdom, Norway, South Korea, and California. The objective is clear, destroy oil demand directly to address climate concerns. An objective bolstered if the electricity then comes from renewables, nuclear power, and lower-carbon natural gas.

REE Automotive (NASDAQ:REE) is developing a rolling chassis for commercial electric vehicles. This will include the REEcorner, an integration of all critical vehicle components (steering, braking, suspension, and powertrain) into the arch of the wheel. REE is essentially offering OEMs a platform they can use as a foundation for their EVs. The company sees itself as a pick-and-shovel play on rising EV demand from commercial customers. This comes on the back of growing pressure on companies to embed greater sustainability into their operations. By using REE as a platform, these companies can reduce their time-to-market, comply with zero-carbon regulations, and lower their total cost of ownership.

Going Public To Ride The EV Wave

REE went public through a merger with a blank check company in July of 2021. The fledgling EV company did so to raise $288 million of gross proceeds in a transaction that was completed at a $3.1 billion valuation.

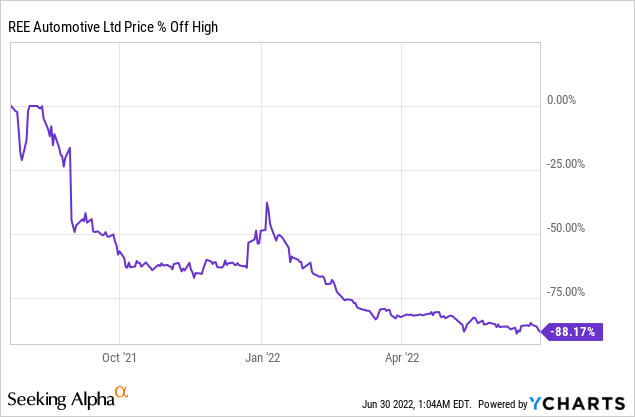

The valuation has since declined by 88% from all-time highs to $418 million as the unrestrained euphoria that defined the EV SPAC boom has given way to a more pragmatic consideration of the pre-revenue EV company. And whilst REE has somewhat of a niche strategy to target the wave of decarbonization sweeping across the world, its management maintains that they are targeting a $700 billion total addressable market. The strategy to market an EV platform directly to OEMs is unique amongst its commercial EV SPAC peers. Other recently public commercial EV companies like Arrival (ARVL), Cenntro Electric (CENN), and Lion Electric (LEV) are all building their own EV models to sell directly to the same customers being targeted by REE.

The company recently announced earnings for its fiscal 2022 first quarter and mostly shared operational updates in its push toward full commercialization. REE continued to build relationships with new partners including EAVX with whom REE is jointly developing a walk-in step van prototype. The class 5 vehicle prototype is expected to begin customer evaluations this summer with the Start of Production and deliveries on track for 2023. GAAP net loss was $23.0 million in the first quarter, up from $12.6 million first quarter of 2021.

REE reiterated its fiscal year guidance for operating expenses to total between $100 and $120 million, mainly driven by engineering and technology expenses related to its commercialization efforts. The company’s free cash flow for the quarter was negative at $38.4 million, up significantly from $6.5 million in the year-ago period. This is to be expected as the company starts to ramp up its testing and the expansion of its market footprint as it advances towards its 2023 commercialization timeline. Sentiment in the space has turned south with dwindling cash balances and going concern risk now being more widespread than in 2021. The bankruptcy of Electric Last Mile has reverberated throughout the sector, highlighting the importance of a large cash balance in helping these upstarts survive the expected economic difficulties.

REE held cash and equivalents of $239 million, down sequentially from $275.8 million in the preceding quarter as cash burn more than doubled over the same period. Taking the base assumption that this rate of burn remains constant, the company has a runway that extends beyond a fiscal year. REE is unlikely to have started generating positive cash flow in 6 quarters but its runway is still comparatively long. This bodes well for potentially raising cash in an environment where sentiment has improved.

Demand Destruction While Maintaining Economic Growth

There is undeniably a long-term shift in transportation happening across the globe as ICE vehicles are replaced by their EV alternatives. This is creating a substantial decarbonization wave that could drive demand for REE’s platform technology in the years ahead. REE is targeting a large and expansive market with a unique strategy that sets the company up as a pick-and-shovel play on the growth of this macrotrend.

That said, the competition is highly capitalized and also ramping production to meet expected demand. This creates some uncertainty around whether the commercial EV market will be able to support all these companies in its critical early stage. REE is one to add to your watchlist and could be considered a buy only when they establish strong commercial traction.

Be the first to comment