Bet_Noire/iStock via Getty Images

Timken (NYSE:TKR) is trading at a discount to its industrial peers. It has good long-term growth prospects and serves desirable end markets. I own shares, and I am eager to add to my holdings at or below $60 per share. I would also consider selling a cash-secured put to generate an income if it drops below $60.

Timken Serving Attractive End Markets

Timken makes essential products that reduce friction and help transmit power across a wide range of products and applications. Timken sells products to two broad industries – Mobile and Process industries. Products in its Mobile Industries segment target off-highway (agricultural, mining, and construction markets) equipment and on-highway vehicles (passenger cars, light trucks, rail cars, locomotives, and others). Both segments have shown growth over the past few years after excluding revenue from acquisitions except for the COVID-hit 2020. For example, the Process Industries segment saw year-over-year sales growth of 15.3% in 2021, and it grew by 3.5% in 2019 after excluding revenue from acquisitions. The Process Industries has a higher EBITDA margin – 23.4% in FY 2021- than its Mobile segment, which had a 12.2% EBITDA margin in 2021.

Timken saw revenue growth of 13% in FY 2021 compared to FY 2020. Its revenue saw growth of 10% year-over-year in the fourth quarter and it delivered a record revenue of $4.1 billion in 2021, surpassing the previous high watermark set in 2019. Its renewable energy segment saw a fourth consecutive year of double-digit revenue growth. The company is forecasting a 10% revenue growth in 2022. Product volume will account for 7%, and price accounting for about 4% of the revenue increase. The company does see foreign exchange headwinds contributing to a decrease in revenue of 1%.

Inflation Continues to Eat into Margins

Prices lagged cost increases in 2021, leading to a 280 basis points decline in margin and a 7% decline in earnings per share. Inflation is hurting Timken’s business and may continue to do so for the foreseeable future. But, the company has begun instituting price increases, and it expects price increases to reduce the impact of inflation in 2022 significantly. Timken delivered diluted earnings per share [EPS] of $4.79 in 2021 and a diluted EPS of $3.72 in 2020. That is an increase in diluted EPS of 28.7%. It is forecasting an EPS of between $5.00 and $5.40 in FY 2022.

End of Globalization and Acceleration of Green Investments

Recently, Larry Fink said Russia’s invasion of Ukraine had ended the era of globalization. The Economist had argued that, well before the war and COVID, the global trade had entered a “slowbalization“, where trade had slowed between countries. We have entered a new era where governments are beginning to invest more in infrastructure and manufacturing capabilities to increase their self-reliance. Nobody wants to be the next Germany, which was caught unprepared due to its over-reliance on Russian energy supplies. The Economist argues that countries should try and diversify their supplier base rather than aiming for a complete blockade of trade with authoritarian regimes.

The end of globalization and the increased investment in localized manufacturing should benefit Timken. Countries may also want to develop local products suppliers, which could lead to more competition for Timken. But, developing local manufacturing and competition is an expensive proposition that could drive costs higher, reduce economies of scale, and increase inflation.

The drive towards renewable energy should also benefit Timken and bring good revenue growth for years to come. Arthur Chiao Yu-cheng, CEO of Taiwan-based semiconductor company – Winbond ($3.5 billion in revenue), said that his company is making investments in electric vehicles and smart agriculture products. I cannot agree more; both those industries present long-term growth prospects due to the urgent need to tackle global warming. There may be turbulence in renewable energy investments in the short term, but long-term prospects are strong. Watch this video about how Timken’s bearings are used in wind turbines.

Finally, companies are facing persistent labor shortages. Many companies have turned to increased automation to reduce their reliance on human labor. Timken should benefit from this trend for years to come.

Debt, Dividend, and Share Repurchase

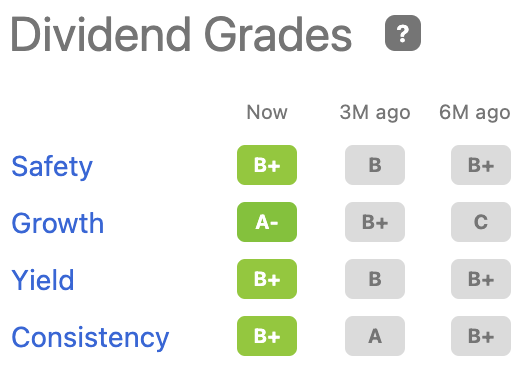

The company has a net debt to adjusted EBITDA ratio of 1.7x. This low debt ratio gives the company options to deploy capital in the future for more acquisitions or more capital return to shareholders. The company spent $93 million, $49.3 million in stock repurchase and paid cash dividends of $92.2 million and $87 million in FY 2021 and 2020. Even after spending millions of dollars on share repurchase, the company’s outstanding shares increased from 76.4 million in FY 2020 to 77 million in FY 2021. The stock currently yields just 1.95%, greater than the 1.32% yield offered by the S&P 500 index. At this time, even the Vanguard Total Bond Market ETF provides a higher yield of 2.28% than both Timken and the S&P 500 index. Timken’s payout ratio is a meager 24%. The company can increase its dividend, but it tries to stave off further dilution in outstanding shares by doing share repurchases. Seeking Alpha gives the company good dividend grades across safety, growth, yield, and consistency (See Exhibit 1).

Exhibit 1: Seeking Alpha Dividend Grade for Timken

Seeking Alpha Dividend Grade for Timken (Seeking Alpha)

Financial Performance, Valuation, and Technical Indicators

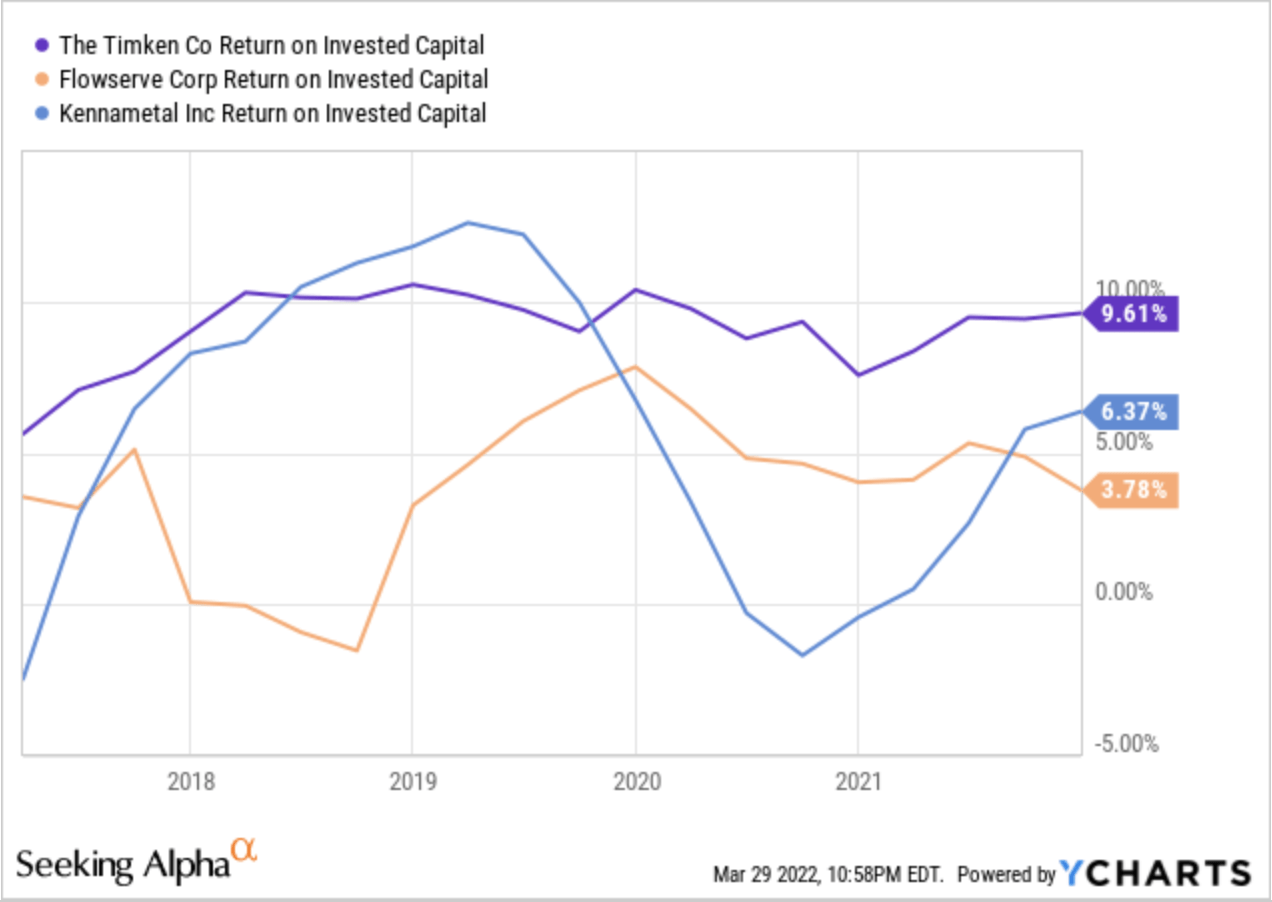

Timken has good returns on invested capital [ROIC] and equity [ROE]. Timken’s return on invested capital is close to 10%, and its return on equity is close to 16.5%. These returns are much higher than other industrial players like Kennametal (KMT) and Flowserve (FLS) (See Exhibit 2).

Exhibit 2: Return on Invested Capital for Timken, Flowserve, and Kennametal

Return on Invested Capital for Timken, Flowserve, and Kennametal (Seeking Alpha)

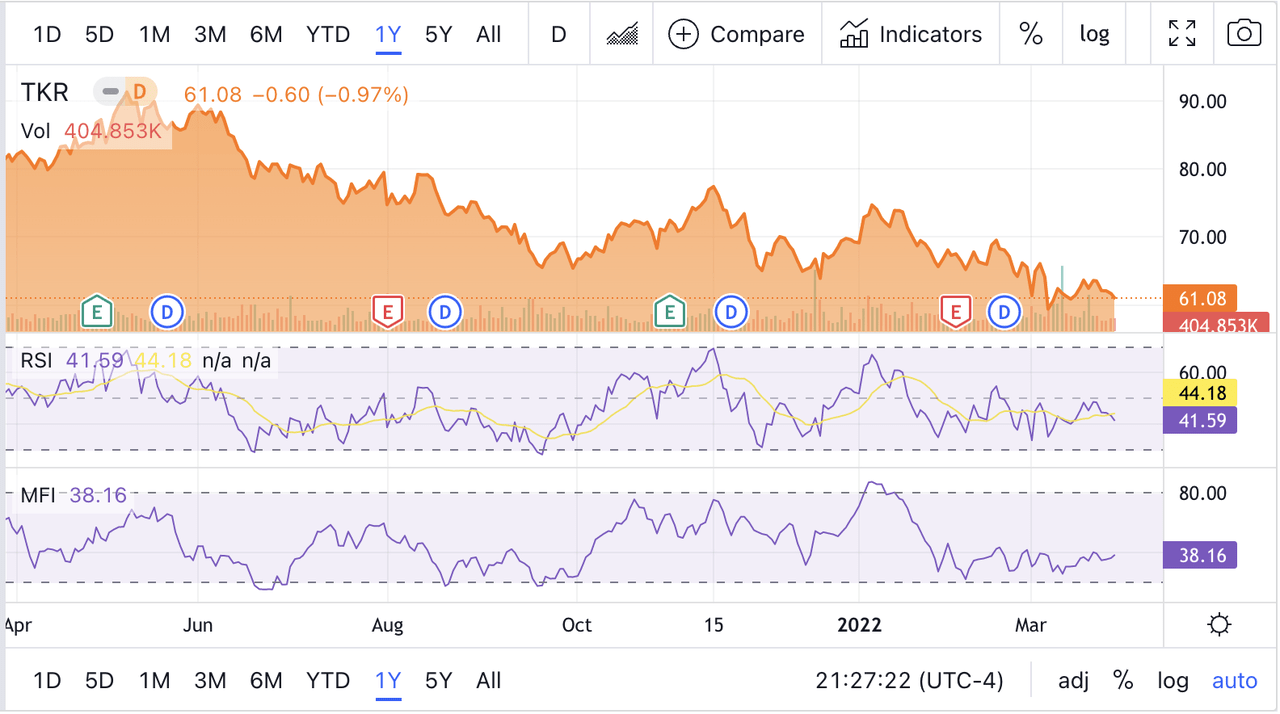

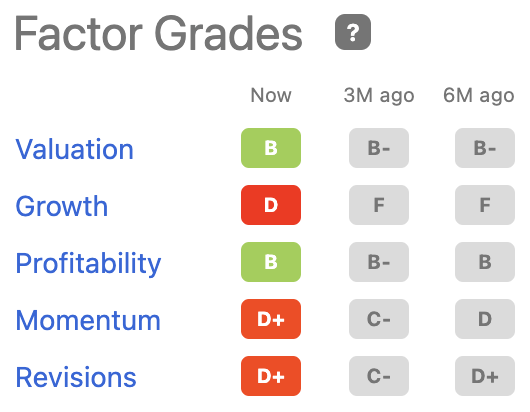

The company is trading near its 52-week low of $59.20. I own shares at an average unit cost of $66.73. I am eager to add to my position if the stock drops below $60. The RSI and MFI technical indicators are near 40, and it has been between 30 and 40 for the past few weeks (See Exhibit 3). Timken is trading at a GAAP PE of 11x compared to the sector median of 19x. Timken has averaged a PE of 13.9x over the past five years. Seeking Alpha factor grades (See Exhibit 4) gives the company an undervalued grade of “B.” Wall Street analysts have an average price target of $84.30, implying a 33% return from its current price of $63.28.

Exhibit 3: RSI and MFI Technical Indicators for Timken

RSI and MFI Technical Indicators for Timken (Seeking Alpha)

Exhibit 4: Seeking Alpha Factor Grades for Timken

Seeking Alpha Factor Grades for Timken (Seeking Alpha)

Selling Cash-Secured Puts

I would sell a cash-secured put to generate income from time to time. In Timken’s case, I was looking to sell a May 20 cash-secured put at a strike price of $55. At $55, the stock would yield 2.18% and trade at about 10x earnings. I would gladly own 100 shares of Timken for the long-term at $55. But, the puts are not yielding a good premium, the bid-ask spread is too wide, and these contracts are not actively traded.

I plan to hold Timken for the long-term, and I would add to my position if the price drops below $60. I will also consider selling a cash-secured put to generate extra income if the price drops below $60. The company’s financial returns and growth prospects are good. Its buyback program seems to serve management more than it serves shareholders. That is negative for the company and the stock. But, there are no perfect companies in this world. Timken’s products cover many industries and offer good growth prospects for years to come.

Be the first to comment