peterschreiber.media

Currently, I am not really bullish about many stocks (although we might see at least a rebound over the next few weeks). Most stock markets around the world are (extremely) overvalued, but there are sectors and individual companies which are fairly valued or might be even a bargain. One of the companies I have been rather bullish about in the last few quarters is Reckitt Benckiser (OTCPK:RBGPF).

My last article about Reckitt Benckiser was published on February 24, 2022, and when looking at the performance in U.S. dollar, the stock lost about 20% in the meantime and underperformed the S&P 500 (SPY). However, Reckitt Benckiser is a British corporation, and we should look at the performance in the national currency (my opinion).

And when looking at the performance since the beginning of 2022 (in Great British Pound), we see Reckitt Benckiser and the S&P 500 perform similar in the first quarter, but in April Reckitt Benckiser started to outperform and while it has also lost a few percentage points year-to-date it was a much better investment than the S&P 500. And as I will argue in the following article, I still see Reckitt Benckiser as one of the companies that can be bought right now.

Quarterly Results

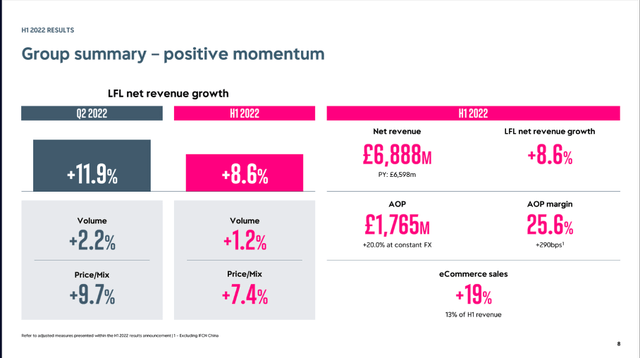

As usually, we start by looking at the last reported results (in case of Reckitt Benckiser the half-year results for fiscal 2022). In the six months ended on June 30, 2022, Reckitt Benckiser reported GBP 6,888 million in net sales and compared to GBP 6,598 million in H1/21 this is reflecting 4.4% year-over-year growth. We could also compare to sales excluding IFCN China results (GBP 6,274 million in H1/21), which is resulting in 9.8% year-over-year growth. And not only revenue increased, but Reckitt Benckiser is also profitable again. In the first half of 2021, the company reported an operating loss of GBP 1,828 million and in H1/22, it reported an operating profit of GBP 1,745 million. The bottom line also switched from a diluted loss of 241.7 pence per share in H1/21 to diluted earnings per share of 187.8 pence in H1/22. Adjusted earnings per share in H1/22 were 178.6 pence and compared to the first half of fiscal 2021 this is resulting in an increase of 25.2% YoY.

Reckitt Benckiser H1/22 Presentation

When looking at the results in more detail, eCommerce sales increased 19% (like for like) and are now representing about 13% of the group’s total revenue. Free cash flow, however, was only GBP 727 million. Compared to the first half of 2021 this is an increase of 39.8% YoY, but cash conversion was only 57% on adjusted net income and lower than expected (the reason was an adverse working capital movement of GBP 592 million).

Reckitt Benckiser H1/22 Presentation

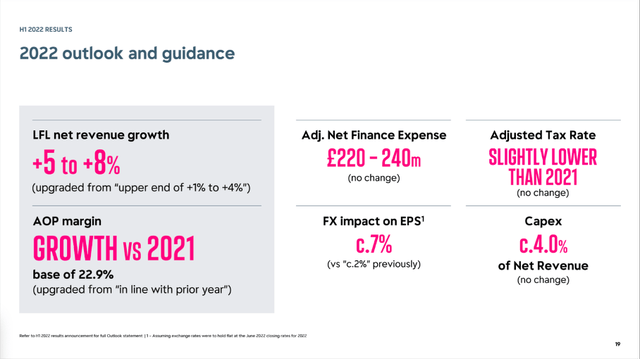

And finally, management also increased expectations for full-year 2022. Like-for-like net revenue growth is now expected to be between 5% and 8% and adjusted operating profit margin is now expected to improve compared to fiscal 2021 (previous guidance saw it in line with prior year). And when looking at consensus estimates of analysts, they are now expecting net revenue of GBP 13,838 million, adjusted operating profit being GBP 3,170 million and earnings per share are now expected to be 318 pence.

Business Is Improving

Right now, it is often argued that revenue growth is just a result of the high inflation (which is a dumb statement as inflation per se does not lead automatically to higher revenue). But of course, we cannot ignore that increasing revenue is often not enough for businesses right now as expenses are also increasing – especially for energy, transportation, and logistics.

And as a result, several businesses see declining operating income and declining net income despite top line growth. In case of Reckitt Benckiser the picture is a little different. Cost of sales also increased 3.7% year-over-year for the business, but the expenses grew with a slower pace than revenue. And operating expenses – excluding gains/losses on assets held for sale and disposable of goodwill and brands – declined from GBP 2,443 million in H1/21 to GBP 2,271 million in H1/22. As a result, the adjusted operating margin could improve to 25.6% – 290bps higher than the previous quarter. Of course, there are some one-time factors contributing to the improving margin as Jeff Carr explained during the earnings call:

Let me explain some one-off temporary factors also included in these results. First, we have a gain of £59 million from the sale of surplus land in Asia, and that has an 85 basis points benefit to the group margin in the half. And second, our profit margins for our Nutrition business unit are abnormally high due to the high volumes, delivering significant leverage across the BEI and other costs.

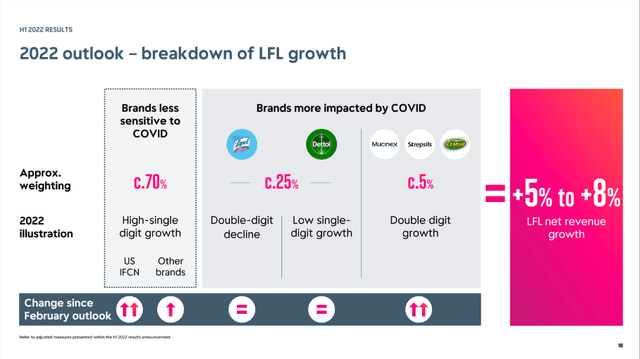

And we also see that growth is stemming especially from two business segments – Nutrition (we will get to this) and Health – while Hygiene is lagging. Hygiene reported like-for-like net revenue decline of 6.0% in the first half of 2022. And many are arguing that Reckitt Benckiser is just profiting from the COVID-19 pandemic, we see that Lysol sales are still about 50-65% above pre-COVID levels. And when looking how broad-based the company’s growth is, it is hard to make the argument that just COVID-19 is responsible for Reckitt Benckiser’s growth. Brands less sensitive to COVID-19 are also expected to grow in the high single digits.

Reckitt Benckiser H1/22 Presentation

And like people are arguing that the great performance for the Hygiene segment was just a temporary effect due to COVID-19, we could also argue the great results for Nutrition are just a one-time effect. Jeff Carr explained during the last earnings call:

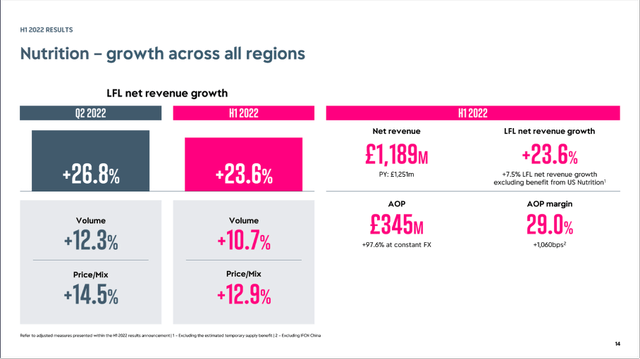

As I look at nutrition, like-for-like revenue growth was up 26.8% in the quarter, partly driven by the market conditions in the U.S., but we also saw healthy growth in LATAM and ASEAN. Now if we were to adjust for the impact of the U.S. Infant Formula market disruption, we estimate that group like-for-like net revenue growth would have been up 8.6% in the quarter and 6.2% in the half. In the period, net revenue grew by 9.8% at actual exchange rates or 7.5% at constant rates to £6.9 billion. Now last year’s numbers have been adjusted for the disposal of IFCN China, but not the smaller disposals such as Scholl and E45.

But as it is becoming obvious, the segment would also have grown – even without the U.S. Infant Formula market disruption. Like-for-like revenue growth excluding the benefits from US Nutrition would still be 7.5% year-over-year, which is a solid growth rate.

Reckitt Benckiser H1/22 Presentation

In my opinion, it is too easy to claim that Reckitt Benckiser is just profiting from one-time effects. And COVID-19 was a tailwind for Hygiene like the U.S. Infant Formula market disruption is a tailwind for Nutrition. But one must try hard to overlook the positive business trends and growth rates Reckitt Benckiser would have reported even without these two factors.

Resilient Business

And not only are we seeing signs for improvement and Reckitt Benckiser growing again, we are also dealing with a great and resilient business. And although we should not believe management blindly, the outgoing CEO made a strong statement for Reckitt Benckiser’s business model during the last earnings call:

And thirdly, our resilient business is driven by a strong earnings model. We operate in categories with a significant runway for long-term growth. We have trusted market-leading brands. Our performance-driven ownership culture builds on our past and is evolving to support us in our future. We, therefore, have a business, which, through our transformation, is well invested in, competitive and resilient.

And while we should see managements’ statements with caution, I am also convinced that Reckitt Benckiser has a great long-term business model. In my first article about the company, I pointed out the wide economic moat the company clearly has:

Reckitt Benckiser clearly has a wide economic moat around its business, that is based on its brand names. For a huge part of its product portfolio and for many of its brands, the company has pricing power (…)

Aside from the strong brand names, Reckitt Benckiser – as one of the major players – is also profiting from cost advantages. And the long-standing relationship with retailers are also worth mentioning as the brands get shelf space as well as the distribution capacity, that other companies simply can’t have. Especially small start-ups will face difficulties competing with the major players.

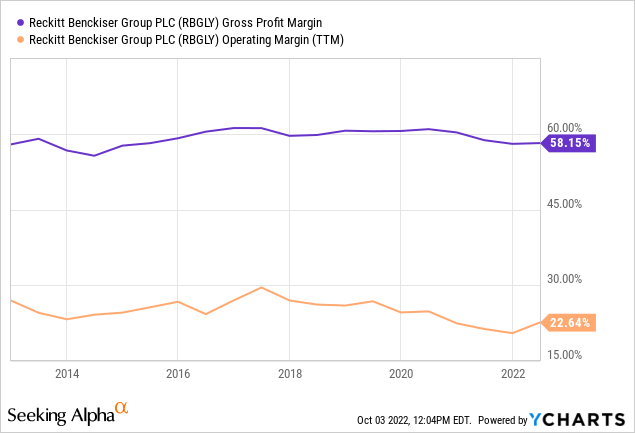

And not only are 55% of Reckitt Benckiser’s core category market units by revenue either gaining or holding share on a year-to-date basis. The gross as well as operating margin is still stable for the business, which is a good sign.

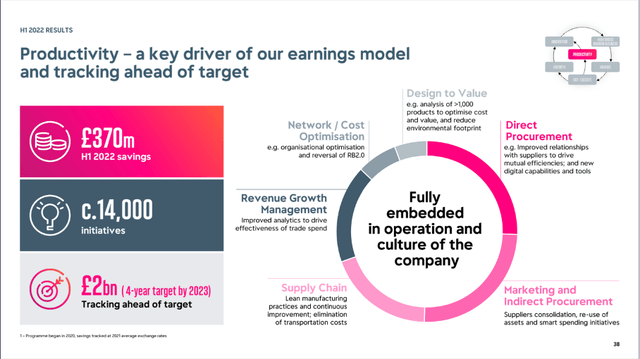

And in the years to come, the company might be able to improve margins further as the business is also focusing on improving its productivity. In the first half of fiscal 2022, the company has delivered over GBP 370 million in savings and management is confident it can reach its GBP 2 billion target already by 2023 (a year earlier than previous anticipated).

Reckitt Benckiser H1/22 Presentation

Intrinsic Value Calculation

And when looking at the valuation multiples Reckitt Benckiser is currently trading for, it is difficult to argue that Reckitt Benckiser is an extreme bargain. But when taking the expected earnings per share for fiscal 2022, the stock is trading for a P/E ratio of 18.5 and when you know my past writings you also know I don’t consider a P/E ratio close to 20 as a bargain or extremely cheap.

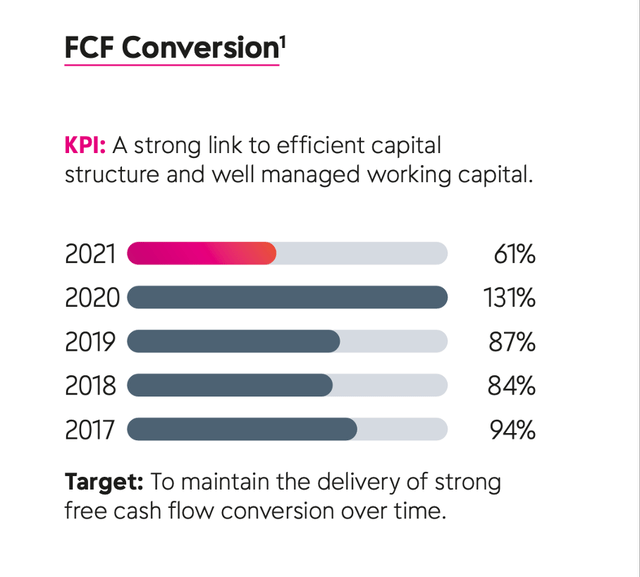

However, when using a discount cash flow calculation to determine an intrinsic value for Reckitt Benckiser, we can still make the argument that the stock is a solid buy. As basis for our calculation, we assume the same free cash flow for fiscal 2022 as the company reported in the last four quarters (which was GBP 1,465 million). But as I have already mentioned above – cash conversion was rather low in the last few quarters. And for the following years I assume a high FCF conversion again: To be cautious let’s assume 80% FCF conversion in the years to come (still below the average of the last five years). When taking the estimated net income of GBP 2,418 million for fiscal 2023, we get a free cash flow of GBP 1,934 million.

Reckitt Benckiser 2021 Annual Report

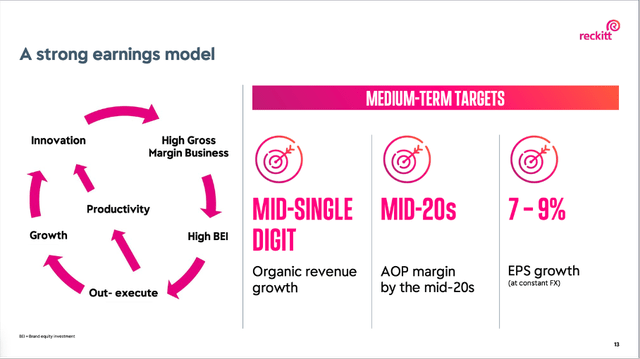

And for the years following fiscal 2023, we assume 7% growth (which is the lower end of the company’s own medium-term targets) till fiscal 2032 followed by 6% growth till perpetuity. When using these assumptions (as well as 716 million in outstanding shares and a 10% discount rate) we get an intrinsic value of GBP 67.31 for Reckitt Benckiser.

Reckitt Benckiser CAGNY 2022 Presentation

We could also be a little more optimistic and assume a FCF conversion rate of 90% from 2023 going forward as well as 8% growth for the years until fiscal 2032, which would lead to an intrinsic value of GBP 80.36 for Reckitt Benckiser.

Conclusion

Reckitt Benckiser is not a screaming buy. However, it is a solid pick in a difficult market environment. The stock seems undervalued right now, Reckitt Benckiser is on its path to solid growth and the business is rather recession-resilient making it a good pick right now.

Be the first to comment