ZargonDesign/E+ via Getty Images

Introduction

This is a take on the high inflation that we see and the fear of a recession that comes from the Fed trying to control that inflation.

If there is one thing that I have learned over time, then it is that our opinions should always be held lightly. Not even the Fed, which has a ton of data that we don’t have, can predict the future accurately.

This is not ‘true’ or ‘false’. I look at the data and form my opinion around the data, but nothing says that I am right or that you are right if you have a totally different opinion. But I think we can both learn from listening to each other’s opinions.

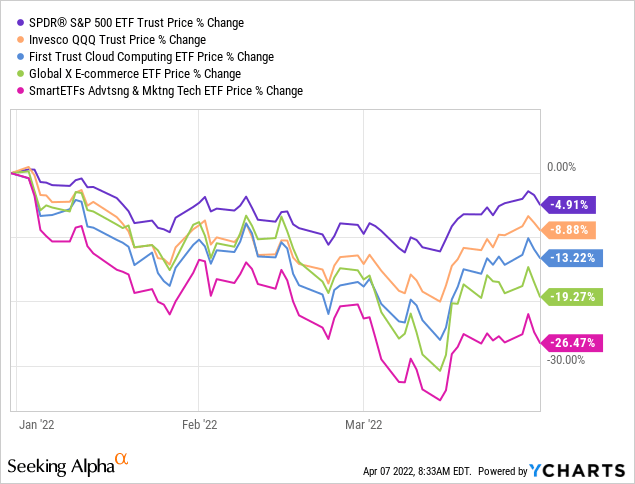

Stocks have gone down substantially in Q1

We have wrapped up Q1 2022 and it will not go into the books as a great quarter for stocks, which is an understatement. While the S&P 500 (SPY) was down just 5% and the Nasdaq (QQQ) about 9%, many sectors are down much more. I added cloud computing (SKYY), e-commerce (EBIZ) and ad tech (MRAD) ETFs here.

As you can see, the end of the month was already up quite a bit from the (temporary?) bottom around mid-March.

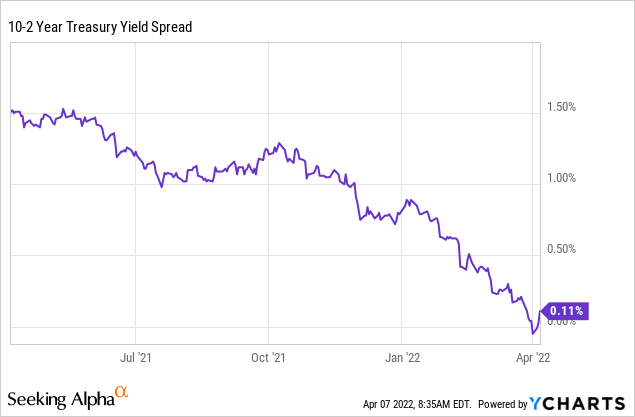

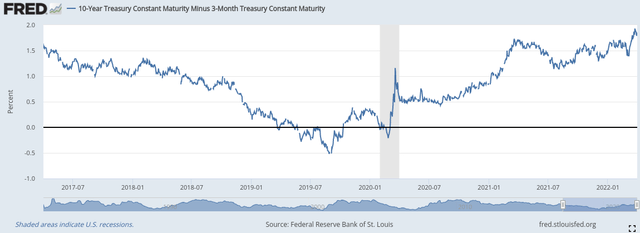

The negative 2-year/10-year spread

The uncertainty among investors remains high. For the first time in a while, the 2-year treasury yield was higher than the 10-year, the so-called inverted spread. That’s why this spread is negative (10yr yield minus 2-year yield).

As you can see, the spread has just briefly touched negative territory (very briefly) and it’s already up again, but it got a lot of investors worried, nonetheless. An inverted yield curve means that investors are more worried about the short term than the long term. Some claim that the negative spread is a predictor of a recession. The last time it happened (but only barely negative for a short while) was mid-2019. And yes, there was a recession, of course, because of the pandemic. There is no way to know if this signal would have been correct then without Covid.

There are many inversions (20 years and 30 years, for example) and not all lead to a recession. But no recession has come without an inverted yield. But it could be up to two years later.

Fed Chair Jerome Powell said that he focuses on treasury yields out no more than 18 months. However, there are no warning signs there yet and some pundits claim that the massive amount of treasuries that the Fed has bought is a cushion for any yield level, especially those of the longer-term like the 2/10 years spread.

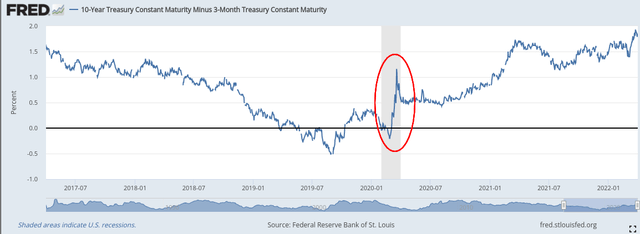

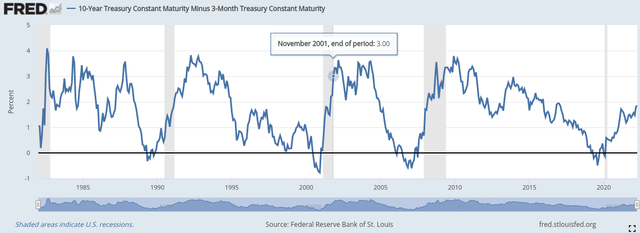

The official barometer of the Fed is the 3-month/10-year curve. That’s also the one it publishes on its site. If you want to know why you can read this extensive paper.

As you can see, the curve went negative in mid-2019. The reason back then was the worries about the Chinese-American trade war. But to be honest, I wouldn’t say that the traders could predict the Covid crash.

As you can see, that one is an excellent predictor of recessions.

But note something else as well: the very short time frame of the 2020 Covid recession. In just three weeks, the spread went from negative to higher than it had been in more than almost 2 years.

Fed St. Louis, red circle by the author

Do you want to take the 3-month/10-year yield spread as your signal to trim some or raise some more cash? I can understand that. But just to make it clear again, this has not happened yet and as you see on the chart above, it’s not even close, not at all. If it would happen, it could take months and may be up to two years before a recession sets in. If it sets in because you never know for sure.

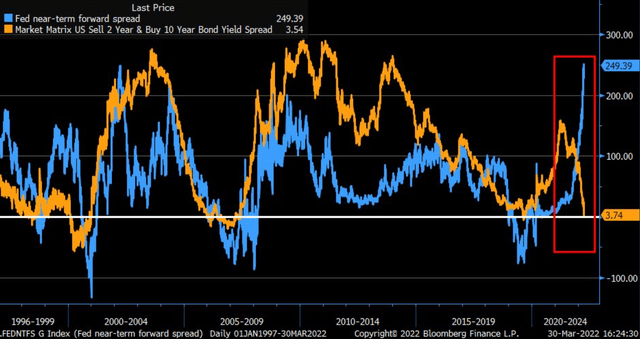

Interestingly, while a few yield curves are inverted, the most important one, the 3-month vs. 10-year, is still climbing. Just look at this chart.

The short inversion in the 2-year/10-year yield spread is probably a signal that the Federal Reserve rate hikes worry the market and that it expects that the rate hikes could cause a recession. But the 3-month/10-year spread shows something else: that the market thinks that the Fed won’t be able to raise rates as aggressively as it has projected. In general, this yield curve has proven its reliability more than a negative 2/10 spread, so I wouldn’t be too worried for now, even though I know that there are a lot of screaming headlines out there.

The next Fed meeting is in May and when you look at the swap market, it sees a 75% chance of a 0.50% rate hike in May. Of course, the Fed will use the inflation numbers to evaluate what it has to do. And that brings us seamlessly to the next part.

Inflation data

Last week, the core PCE numbers for March came in. PCE stands for Personal Consumption Expenditures and it measures all goods and services, while the CPI (Consumer Price Index) stands for everything consumers pay out of their pocket. Now, beware of “core” because the highest costs right now, with most inflation, are taken out: food and energy.

Nevertheless, the numbers were a tiny bit better than expected. Mind you, not good, but less bad than anticipated. Core PCE came in at 5.4%, while 5.5% was estimated. Still high, for sure but maybe a first sign of the conditions getting a little bit better? We’ll have to wait and see.

If we look at the job claims, they are very low. The continuing claims came in at 1.31M, the 2nd lowest since 1969. This shows that the economy is still doing great. Of course, unemployment is a lagging factor, not a predictor, but the fact that it is that low probably gives some room even if there would be a short recession.

Is inflation already slowing down?

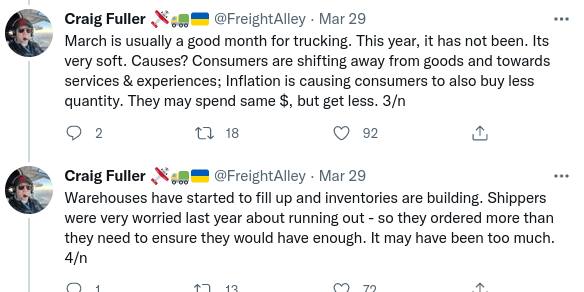

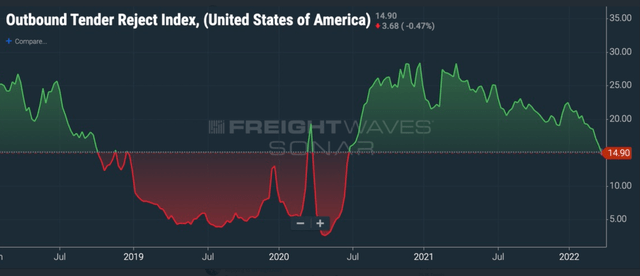

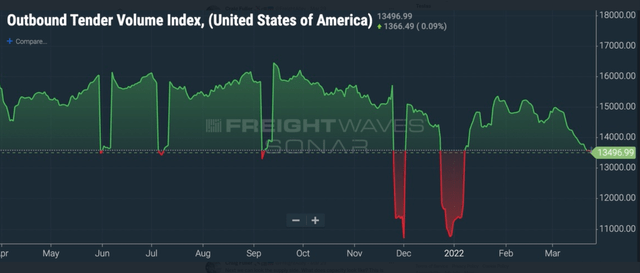

There are already some alternative signs that inflation could slow down soon. This is a great Twitter thread by Craig Fuller, a transportation and supply chain specialist on how trucking numbers can lead you to that conclusion.

We are seeing the lowest demand for trucking now in a year, while March is usually a good month (the big drops are holidays, so you can ignore them).

Fuller continues.

Twitter

Fuller then shows that the number of trucks has followed the demand and even surpassed it and he continues.

Twitter

Now, what does this mean? It could mean several things, but one of the most obvious ones is that the high inflation we see now could indeed be transitory, as the Fed predicted. Don’t expect this to set in the next month or so; such trends need time to play out, but I wouldn’t be surprised to see that inflation goes down much faster than most seem to expect now. Maybe in Q3 or Q4 of this year. That would mean fewer rate hikes, of course, which could be good for (the perception of) our stocks.

What to own in inflationary environments?

I see a lot of ‘risk-off’ comments now. The reasoning behind that is more or less like this: “High inflation means high-interest rates and those mean less risk appetite.” This reasoning definitely makes sense, but I think that in this case, it could maybe not work properly. There are no high interest rates yet and I really don’t believe that the Fed will raise rates to, let’s say, 5% or higher. And as long as rates don’t go too high, stocks will still do well in my opinion.

The reason is that theory is just theory. Interest rate hikes come in times of economic strength and higher growth can often offset the negative effect of higher rates. The switching point is around 5%, though. Then there is not enough compensation anymore for higher earnings because of the strong environment.

As to which kind of stocks to own in such a high-inflation environment, in his 1983 shareholder letter, Warren Buffett answered this question.

Any unleveraged business that requires some net tangible assets to operate (and almost all do) is hurt by inflation. Businesses needing little in the way of tangible assets simply are hurt the least. And that fact, of course, has been hard for many people to grasp. For years the traditional wisdom – long on tradition, short on wisdom – held that inflation protection was best provided by businesses laden with natural resources, plants and machinery, or other tangible assets

Asset-heavy businesses generally earn low rates of return – rates that often barely provide enough capital to fund the inflationary needs of the existing business, with nothing left over for real growth, distribution to owners, or the acquisition of new businesses.

In contrast, a disproportionate number of the great business fortunes built up during the inflationary years arose from ownership of operations that combined intangibles of lasting value with relatively minor requirements for tangible assets. In such cases earnings have bounded upward in nominal dollars, and these dollars have been largely available for the acquisition of additional businesses.

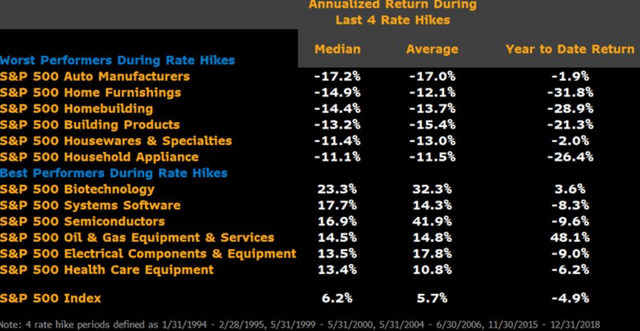

That was 1983, and Uncle Warren was right then, and he is right now. Still too many people got this wrong. Asset-light businesses are the best in an inflationary environment on the condition that they are not in heavy debt and can fund their own growth. If you look at this chart, you can see that The Oracle Of Omaha was right.

As you see, what Buffett says holds, with one exception, oil & gas equipment and services. But if you see how much that asset class has already shot up now, also influenced by the attack on Ukraine by Russia, I think that most upside has already been built in.

Conclusion

Even though some act now as if a recession is unavoidable, there is simply not enough data yet to conclude this with any kind of certainty. Everybody is entitled to have an opinion, of course, but you should always take opinions with a grain of salt and even more if it is your own opinion.

As to answer which kind of stocks to own in this environment, the data show that asset-light industries do much better. As these have fallen the most recently, you might benefit from going against the conventional wisdom right now.

In the meantime, keep growing!

(This article was published

Be the first to comment