shutter_m/iStock via Getty Images

Year-over-year, real GDP rose by 1.8 percent.

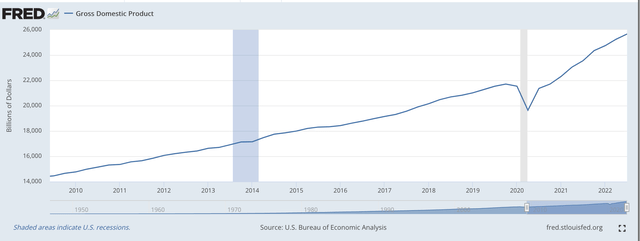

Gross Domestic Product (Federal Reserve)

The year-over-year results for the past year are as follows:

- 2022: Q3 1.8%

- 2022: Q2 1.8%

- 2022: Q1 3.7%

- 2021: Q4 7%

You can see why analysts might be having some trouble declaring that the United States is in a recession.

Take a look at the chart.

The Covid-19 recession took place in February and March of 2020.

As can be seen, the general “trend” is upward.

I think that this picture of the world and the fact that many are trying to define the current period as one of recession just further shows what a peculiar state of affairs the world is in these days.

As I have been trying to show and discuss in my blogs these days, the world is not what it once was.

The world is in disarray, in disequilibrium, in a mess.

As a consequence, things do not go together as they once did.

What the economy faces right now is for the various markets, sectors, and regions to face up to their disarray and disequilibrium and work their way back into a more stable environment.

This will take time and we cannot really predict what the results are going to be.

We are in an era of radical uncertainty and things are just going to have to work themselves out.

What we are seeing right now is the “mess” that everyone and everything is in, the “mess” that we are going to have to recover from.

And, it is important to stress that the makers of fiscal and monetary policy have played a big part in creating this environment, and they will be playing a role in getting us out of this “mess.”

Policymakers

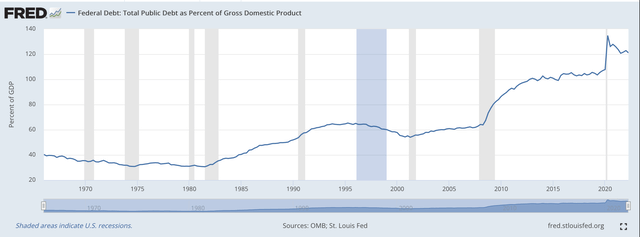

The makers of fiscal policy have put the United States in a position that it has not seen except for during World War II.

Take a look at the disequilibrium that has been created in the area of public debt since the beginning of the Great Recession. Take a look at what was added during the spread of the Covid-19 pandemic.

Total Federal Debt as Percentage of GDP (Federal Reserve)

Right before the Great Recession the Total Public Debt in the U.S. totaled a little more than 60 percent of Gross Domestic Product.

Notice that in the mid-teens, the percentage rose to about 100 percent.

Beginning in 2020, the total public debt as a percentage of Gross Domestic Product jumped up to more than 120 percent.

The massive amount of federal debt pumped into the economy has definitely changed relationships and changed positions of equilibrium.

What should this ration be? Note that it was below 40 percent up until the early 1980s. Then it jumped to around 60 percent until the Great Recession. And, then it doubled in the next seven years or so.

Yet with all this government debt flooding the financial markets, interest rates remained ridiculously low.

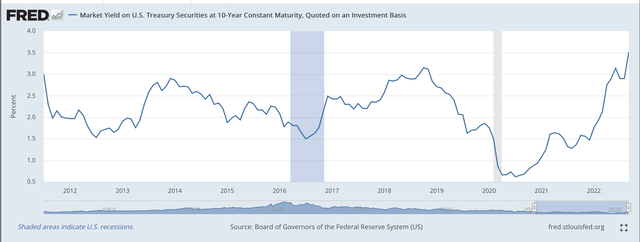

Yield on 10-year U.S. Treasury notes (Federal Reserve)

Note that in 2012, the 10-year yield was around 2.00 percent. Then it was there in 2016. But the yield varied around this number during the rest of the time.

The spread of the Covid-19 pandemic hit.

The 10-year yield fell to around 0.60 percent and stayed below 2.00 percent until early in 2022.

So, we had federal debt first hitting 120.0 percent of GDP and then 120.0 percent of GDP during the pandemic, and the yield on the 10-year U.S. Treasury note remained between 2.00 percent and 3.00 percent.

Something is out-of-equilibrium here?

What was going on?

Furthermore, inflation was staying at rock-bottom levels.

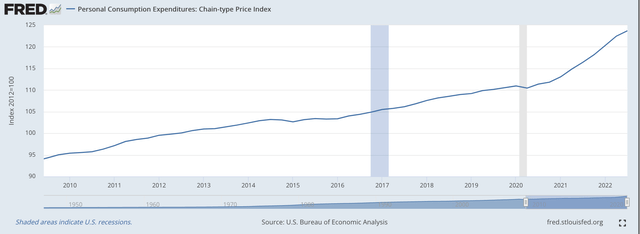

Personal Consumption ExpendituresGDP (Federal Reserve)

Note that in July 2009, at the beginning of the new economic expansion, the Implicit Consumer Price Index was around 95.0.

This measure was around 105.0 toward the end of 2016. The level of 110.0 was not reached until the middle of 2019.

Inflation was very slow during the 2010s, roughly showing a compound annual rate of about 2.3 percent.

One sees inflation picking up only after the Covid-19 Recession.

But what was happening to monetary policy during this time period?

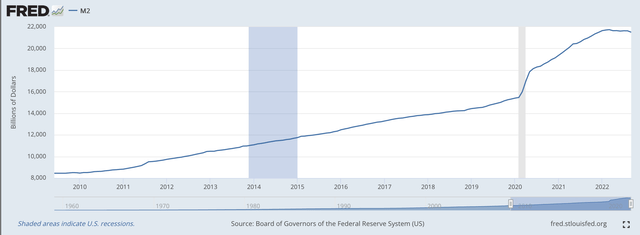

Here is the record on the M2 money stock.

M2 Money Stock (Federal Reserve)

From July 2009, the first month of the new period of economic expansion, until July 20019, the M2 money stock grew at a compound annual rate of 5.7 percent.

Not a bad overall picture of monetary policy for this time period. ‘

But, everything hit the fan in the spring of 2020.

M2 money stock growth was only 6.7 percent from December 2018 to December 2019.

The next twelve months M2 money stock growth exploded to 24.9 percent.

Then from December 2020 to December 2021, M2 money stock growth dropped back to 12.5 percent.

From August 2021 to August 2022, M2 monetary stock growth was 4.1 percent.

Obviously, if inflation is at every time, everywhere a result of monetary behavior, well, then there is room here to argue that money supply growth was excessive during the 2020 through 2021 period.

Monetary growth has slowed down in 2022, but, money stock growth from August 2021 to August 2022 could not be considered at a constraining level.

And, that is what the Federal Reserve is now facing.

But, given the statistics just reviewed, it is still the point of this argument that what the Federal Reserve and what the federal government did in the recent past has really created an environment of disequilibrium.

Firms, markets, sectors are not settled. Furthermore, a lot of searching is going to have to go on to fine results that produce a more settled environment.

Furthermore, given the radical uncertainty that exists in the world right now, the pathways to obtain the new, more stable equilibriums are not obvious, neither for the policymakers in the federal government and in the Federal Reserve nor for the people who run businesses.

And, this is causing all the confusion going on.

Are we in a recession right now?

I don’t know.

Are we heading for a recession?

I think so.

What should the Federal Reserve be doing?

Restricting monetary growth.

What should the federal government be doing?

The federal government, in my mind, should be much less stimulative and issue much less debt.

I believe that there is a lot of work still to be done. And, I believe that there is a lot of pain that will be experienced.

We have a mess on our hands and it is not a very pretty sight.

Be the first to comment