ipopba

By Robert Hughes

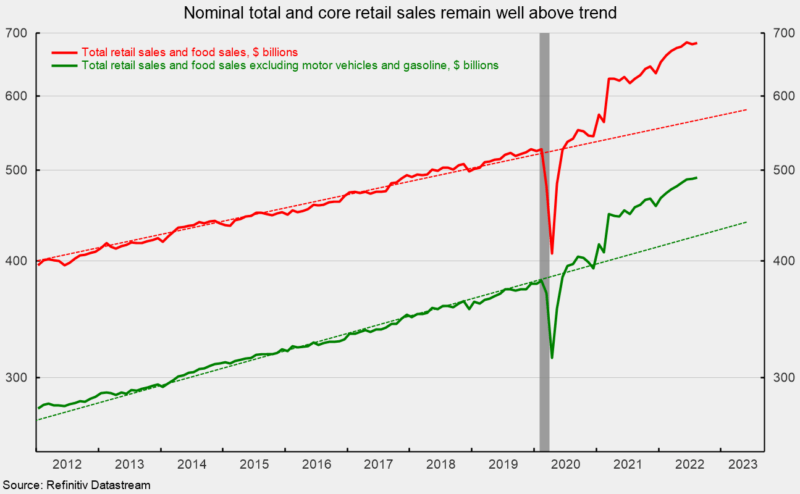

Total nominal retail sales and food-services spending rose 0.3 percent in August, following a 0.4 percent decrease in July. From a year ago, retail sales are up 9.2 percent and remain well above the pre-pandemic trend (see first chart).

Nominal retail sales excluding motor vehicle and parts dealers and gasoline stations – or core retail sales – rose 0.3 percent in August, matching the 0.3 percent gain in July. From August 2021 to August 2022, core retail sales are up 7.6 percent. As with total retail sales, core retail sales remain well above the pre-pandemic trend (see first chart).

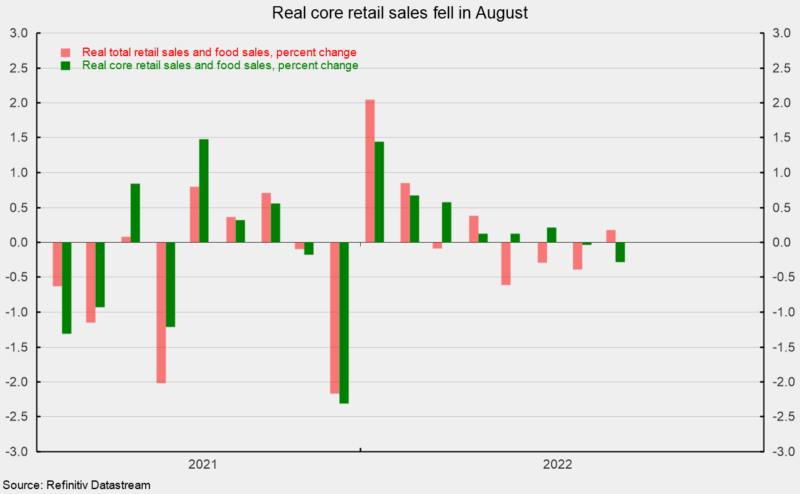

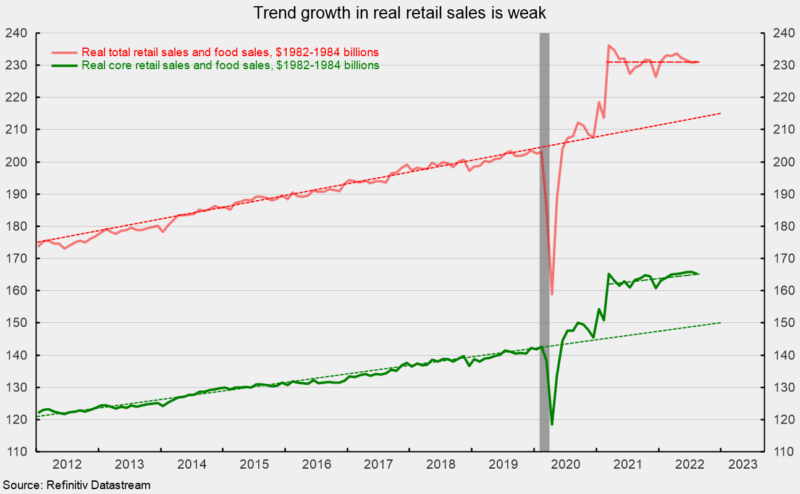

However, these data are not adjusted for price changes. In real terms (adjusted using the CPI), real total retail sales were up 0.2 percent in August following a 0.4 percent decrease in July, a 0.3 percent drop in June, and a 0.6 percent decline in May (see second chart). From a year ago, real total retail sales are up 0.8 percent versus a ten-year annualized growth rate of 2.5 percent from 2010 through 2019. As with nominal retail sales, real retail sales remain well above their pre-pandemic trend, but since March 2021, they have been trending essentially flat (see third chart).

Real core retail sales posted a 0.3 percent decline in August after declining less than 0.1 percent in July (see second chart). Over the last twelve months, real core retail sales are up 1.2 percent versus a ten-year annualized growth rate of 2.2 percent from 2010 through 2019. While real total retail sales have been trending flat recently, real core retail sales have been trending higher at a rate of 1.2 percent per year (see third chart).

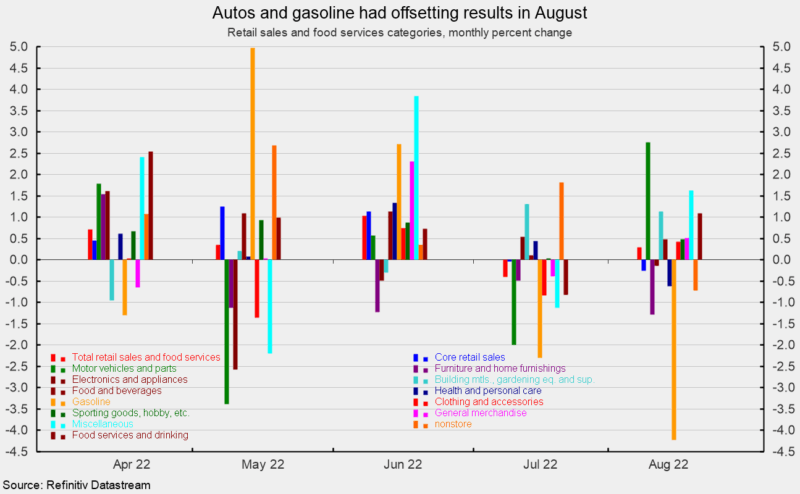

Categories were generally higher in nominal terms for the month, with eight up and five down in August (see fourth chart). The gains were led by motor vehicles and parts retailers, up 2.8 percent for the month, followed by miscellaneous retailers (1.6 percent), building materials, gardening equipment and supplies (1.1 percent), and food services and drinking places (1.1 percent).

Gasoline spending led the decliners with a 4.2 percent drop. However, the average price for a gallon of gasoline was $4.21, down 11.8 percent from $4.77 in July, suggesting price changes more than accounted for the drop. Other declines came in furniture and home furnishings (-1.3 percent), nonstore retailers (-0.7 percent), and health and personal care stores (-0.6 percent).

Overall, nominal total and core retail sales remain well above trend. However, rising prices are still providing a significant boost to the numbers. In real terms, total retail sales rose slightly following three consecutive declines and have been trending flat since March 2021. Real core retail sales posted a second consecutive monthly decline but appear to have a modest upward trend, though the growth rate is well below its pre-pandemic pace.

Sustained upward pressure on prices is likely affecting consumer attitudes and spending patterns. As more and more consumers feel the impact of inflation, real consumer spending may be under additional pressure. Furthermore, an aggressive Fed tightening cycle may lead to significant demand destruction. Both phenomena raise risks for the economic outlook. In addition, the fallout from the Russian invasion of Ukraine and waves of lockdowns in China remain threats to economic expansion. The outlook is highly uncertain. Caution is warranted.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment