jaturonoofer/iStock via Getty Images

Investment Thesis

Ready Capital (NYSE:RC) is a REIT that operates with residential mortgage loans, construction loans, and MBS collateralized. The company’s stable and high dividend yield policy with limited risk is a primary catalyst of the stock. The company has completed a strategic merger with Mosaic Real Estate Credit TE, which will have a positive effect on the company’s earnings in the coming quarters. I believe the company’s dividend yield is attractive, and I assign a buy rating on the stock.

Company Overview

Ready Capital is a real estate finance business that develops, acquires, finances, and services residential mortgage loans, construction loans, MBS collateralized mostly by SBC loans, and other real estate-related investments. The typical loan amount from the company is up to $40 million, which is utilized to buy real estates such as multifamily, office, retail, mixed-use, or warehouse assets. The business, a commercial mortgage REIT, seeks to offer shareholders appealing risk-adjusted returns primarily through dividends and capital gains. It has a policy of paying investors 90% of post-tax net profits in dividends. The company generated revenue from the operation segment: SBC Lending and Acquisitions, Small Business Lending, and Residential Mortgage Banking.

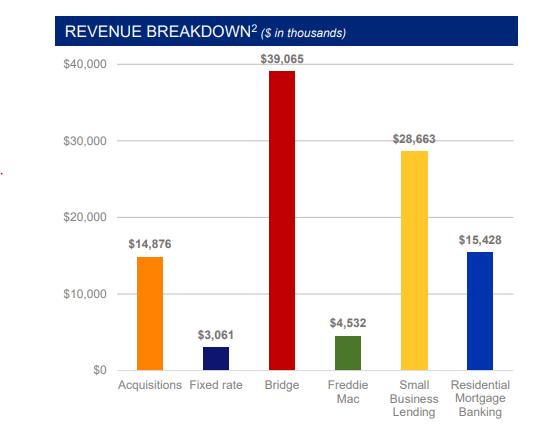

SBC Lending and Acquisition: Through its subsidiary, ReadyCap Commercial, the company originates SBC loans using a variety of loan origination channels secured by stabilized or transitional investor properties. These newly created loans are typically kept for investment purposes or added to frameworks for securitization. This section includes the origination and servicing of multifamily loans made through the Small Balance Loan Program of the Federal Home Loan Mortgage Corporation (Freddie Mac and the Freddie Mac program). These originated loans are kept in escrow until Freddie Mac purchases them. The business also provides temporary and long-term funding, principally through Red Stone tax-exempt bonds, for building and preserving affordable housing. This segment contributes more than 56% of the company’s operating revenue.

Small Business Lending: Owner-occupied loans that are SBA-guaranteed are acquired, originated, and serviced by the corporation under this segment. These originated loans are either sold, put into securitization frameworks, or kept for investment. Additionally, the business purchases future receivables. This segment generally generates more than 27% of the total income.

Residential Mortgage Banking: Through its subsidiary, GMFS, the corporation runs the residential mortgage loan origination division under this section. This subsidiary creates residential mortgage loans that the Federal National Mortgage Association is willing to buy, guarantee, or insure. Then, these loans that were originally produced are sold to third parties, typically agency lending programs. This segment contributes more than 14% of the company’s total revenue.

Investor Presentation: Slide No. 6

Stable And High Dividend Yield

The company is a real estate finance REIT that distributes 90% of post-tax net profits in the form of dividends to shareholders. The stock is currently trading at $12.65 and paying an annual dividend of $1.68 per share, which is an outstanding yield of 13.65% as per the current share price. The company has a long history of high dividend payments without any price volatility.

In the above chart, we can clearly see that the stock price has always been stable. Only at the time of Covid-19 the share price has shown a sharp decline, but as we can see, the share price has almost reached the pre-pandemic levels. I believe this stock is a golden opportunity to earn a stable return of 13.67% on investment with very low risk. In the current rising interest rate scenario, the question that will come to everyone’s mind is the sustainability of the income and dividend payment. I believe the dividends are sustainable in the coming period as most of the lending agreements of the company are long-term and efficient hedging strategies of the company. I think this rising interest rate scenario two years down the line acts as margin expansionary for the company. Furthermore, I believe the company’s stock price will not gain any movement, but the shareholders can expect stable dividend payments in coming quarters.

Merger With Mosaic Real Estate Credit TE

Recently, Ready Capital announced the completion of its merger with Mosaic Real Estate Credit TE. The merged company will operate a business under the same title, “Ready Capital Corporation”, and will be available to trade on the New York Stock Exchange. After the merger, the designee of the Mosaic Manager, Julius W. Erving, was appointed as the board of director of RC. The company has acquired a market-leading commercial real estate investment platform which focuses on providing differentiated capital solutions to all entities of the middle market sector with this merger.

Thomas Capasso, Ready Capital Chairman and Chief Executive Officer, stated,

We believe that this transaction is a compelling opportunity for Ready Capital to acquire a market-leading commercial real estate investment platform focused on providing differentiated capital solutions across the middle market sector with an emphasis on construction lending. We are excited to integrate the Mosaic team and origination platform and we believe the diverse portfolio of construction assets with attractive portfolio yields will further differentiate Ready Capital’s financing solutions for borrowers and investors.

The effects of this merger were visible in the results of the last quarter, and I believe the positive impact of this event will push the company’s revenue in the coming quarters.

Financials

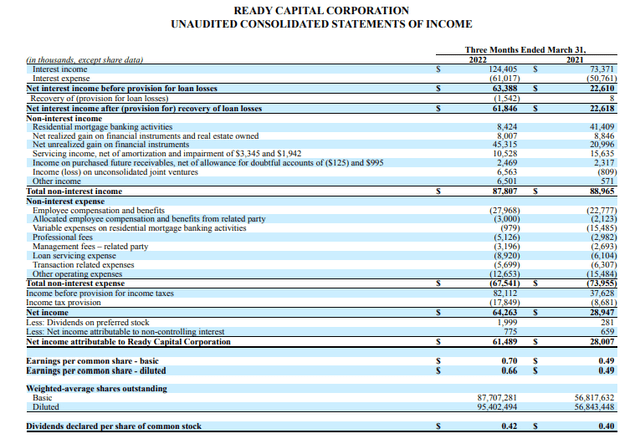

Ready Capital reported Interest Income of $124.5 million in Q1 2022 compared to $73.37 million in Q1 2021, a stellar 70% increase. This increase in the interest income from the merger of Mosaic was the main reason behind the overall profitable quarter for the firm. The net interest income was $61.84 million, a 173% jump from the year-ago period. This increase was driven by a minimal increase in the interest expenses as compared to the interest income over the period of time. The non-interest income reported was flat at $87.8 million compared to $88.9 million. The primary cause of this decline was a drop in income from residential mortgage banking activities. Overall, the total net income saw a jump of 122% to $64.26 million compared to $28.94 million in the corresponding quarter. The rise in interest income was the main driver of this growth. The company reported diluted EPS of $0.66. The company declared a dividend of $0.42, a 63.6% payout ratio of net income. The company plans on increasing the payout ratio in future to maintain its REIT status. Overall, the company reported solid Q1 earnings with a positive outlook for the coming quarters.

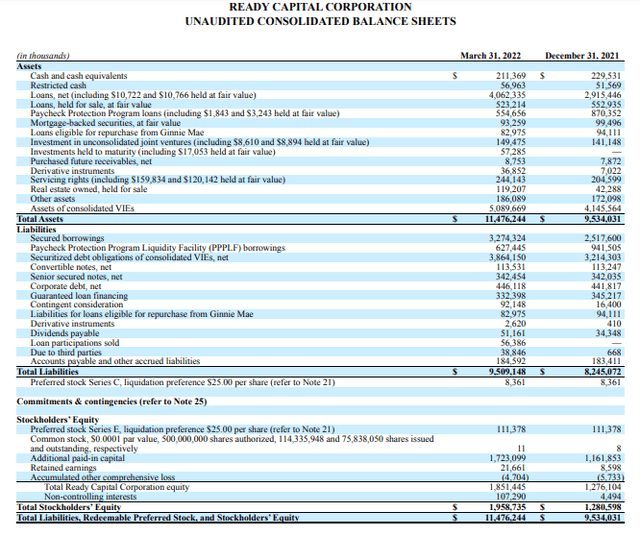

The company reported cash and cash equivalent of $211.3 million, which is on a lower side. The company has secured borrowings of $3274.3 million. Overall, the asset quality of the firm looks good, but the liquidity is a cause of concern, which the management needs to address.

Risk Factor

Rising Interest Rates: The United States has seen a record level of rising interest rates in the past few months, and with inflation around, the interest rates don’t seem to be going down anytime soon. The higher interest rates increase the borrowing rate, putting stress on the profit margins. The speculation over the possible recession adds to the trouble. A recession would result in job losses, which is reflected in the Fed data; unemployment is currently at the highest level in the past decade. This will result in loan defaults. This might have some negative effects on the liquidity of the firm. In the short term we might see effects of inflation on the results of the firm, but in the long run the company is well positioned in the industry to manage these risks. Ready Capital has managed to mitigate these risks till now by employing effective hedging strategies, and I believe it will continue to do so even in the future.

Valuation

The company has a market cap of $1.43 billion and is currently trading at a price of $12.31. The company has seen a YTD decrease of 23.49%. The main reason for this decline is the overall market sentiment, which is currently not favorable at a macro level. Ready Capital is trading at a P/E multiple of 6.57x. I believe the firm is fairly valued at the current price level.

I believe Ready Capital is an excellent bet for investors looking for stable dividend income. The company is known for its price stability while consistently giving out a 10%+ dividend yield over the years. At the current dividend yield of 13.65%, with a scope of increased dividend payout in future, I think Ready Capital is a great investment opportunity.

Conclusion

My final thoughts on Ready Capital are that it’s an excellent stock for investors looking for high dividend yield with favorable risk-reward profile. Dividend yield of 13.65% with fair stock valuation makes me recommend this stock for long term investors. After considering the risks and analyzing the financials of the firm, I believe Ready Capital is a great investment opportunity and I assign a buy rating for the stock.

Be the first to comment