Claire Tuner/iStock via Getty Images

RCI Hospitality (NASDAQ:RICK) is one of the most unique companies listed on the NASDAQ with its focus on the build-out of a portfolio of adult nightclubs and a military-themed chain of restaurants and bars called Bombshells. The business, whilst unorthodox, is profitable, cash generative, and has maintained an uninterrupted trend of rising quarterly revenue since the end of its fiscal 2020 third quarter ending June 30. The Houston, Texas-based company has been adept at building a profitable enterprise around the base concept of chicken wings, cocktails, and lust. It’s done so since 1995 when it went public and has since seen its market cap grow to just above $800 million, a 3.31x price to trailing 12-month sales multiple. The company has grown to 53 clubs in 13 states including Texas, New York, and Colorado with plans to add more in an unending search for profitable growth.

What is the long-term bull thesis? That the business will continue to use its balance sheet to roll up highly cash-generative adult nightclubs in great locations. Critically, these are protected on a local level by restrictive licensing regimes which place barriers to the entry of new clubs. RCI is the leading company in its niche and has identified at least 500 other clubs out of 2,200 around the US that meet its roll-up criteria. This paints a vivid picture of future growth as the market exists for a nearly 10x increase in its current portfolio. Indeed, the company recently closed on the acquisition of a 5-stage, 23,000-square-foot nightclub in Texas for $9 million. RCI also thinks it can grow the Bombshells concept to between 80 and 100 units, up from what’s currently 11 company-owned restaurants.

Tons Of Free Cash And Bumper Revenue Growth

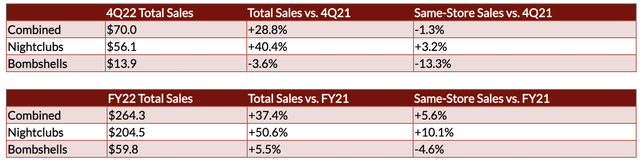

RCI is set to report earnings for its fiscal 2022 fourth quarter ending September 30 in less than 3 weeks but has pre-released some of the financial figures for its final quarter.

The company is set to bring in revenue of $70 million for the quarter, up nearly 29% from the prior year-ago figure on the back of a 40.4% growth in nightclubs. This was only partially offset by a 3.6% decline in Bombshells revenue. Growth was of course driven by acquisitions, but same-store sales from nightclubs also grew by 3.2%.

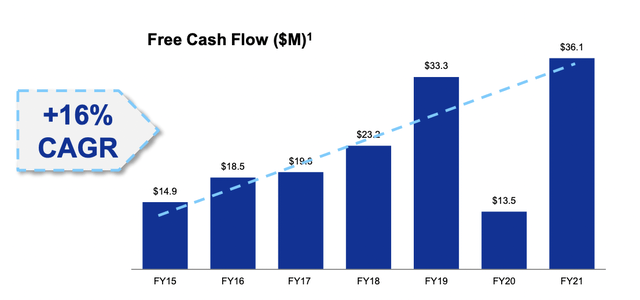

Free cash flow has grown by a 16% compound annual growth rate from $14.9 million in fiscal 2015 to $36.1 million in fiscal 2021. FCF year-to-date stands at $44.4 million and is set for a record year of growth when fourth quarter earnings are released.

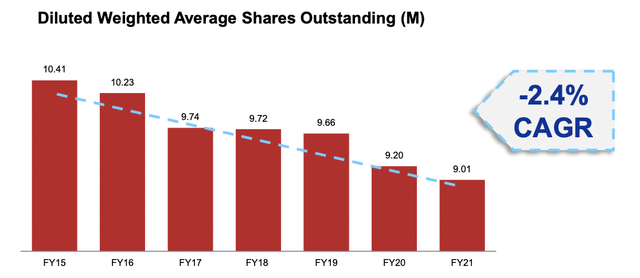

Critically, the company had become adept at returning cash to shareholders through share buybacks designed to reduce its outstanding common share count. This forms a core tenet of the company’s bull case; a highly cash-generative business aggressively buying back shares for the foreseeable future. Against this, and whilst there is no directly relevant peer comp, the company’s 13.7x price to forward FCF looks cheap with FCF growing at double digits.

Wings, Cocktails, And Lust

RCI CEO Eric Langan, who has been leading the company since the 90s, is very active on Twitter and regularly engages with shareholders. This is undeniably very unconventional from a public company CEO and has been flagged as a risk by bears.

But it is important to note that the company has a strong and active retail investor base who appreciate the transparency and ability to communicate directly with the management of their investment. I think it would be great for more lines of communication between shareholders and CEOs to open up and Langan’s eccentricity is somewhat refreshing against this.

That said, the company faces the same difficult macroeconomic backdrop going into calendar 2023 as rising interest rates weigh down on the economy. Adult nightclubs are not recession-proof and RCI will likely see footfall weaken for its clubs if forecasts for a recession in the second half of the next calendar year come true. Bulls would be right to also flag this as a potential opportunity with struggling nightclub owners more likely to sell their clubs. However, the rising rate environment would pose some barriers to this. The company partially leans on debt for its acquisitions, with 55% of the recent purchase of Heartbreakers being partially financed by a 15-year 6% real estate seller financing note. Hence, net debt at the end of its last reported quarter of $190 million is likely set to rise.

Whether RCI will make a good investment depends on the extent to which the company is able to maintain its cash-generative revenue growth against the coming economic malaise. That common shares have recorded year-to-date gains of around 10% in a period that has mostly brought capital loss to most investors is a vote of confidence in the company’s execution. Understandably, RCI would not form a comfortable holding for those unattracted to the idea of investing in the owner of adult nightclubs.

Fundamentally, RCI’s capital allocation strategy is extremely shareholder-friendly with share buybacks and FCF growth in a strong relationship. This heightens the potential of the company to continue to deliver positive returns over the long term.

Be the first to comment