Alandan/iStock via Getty Images

Typically, the largest investment of most investors is something like Amazon (AMZN) or Alphabet (GOOG, GOOGL): a mega-cap stock that’s part of the S&P500 (SPY).

My largest investment is RCI Hospitality Holdings, Inc. (RICK), a small-cap that specializes in the ownership and management of strip clubs. I invest so much in it because I think that it has a clear path to rapid growth as it acquires high-quality strip clubs at very low multiples.

It has $40 million of cash on hand and access to relatively cheap capital via seller financing and traditional debt as it adds mortgages on the real estate that it buys with the clubs.

Its cost of capital is below 10% but it is acquiring assets at 3-5x cash flow. The accretion is very significant and it has allowed the company to grow at 20%+ per year we expect this rapid growth to continue as they acquire additional clubs. It has acquired 15 of them over the past year, bringing its portfolio to over 50 clubs, and it is still just getting started!

With a path to 20%+ annual free cash flow (“FCF”) growth, RICK is a bargain trading at just ~7.5x FCF, and we think that it offers a realistic path to quadrupling your money over the coming 5 years.

If you missed our last article on RICK, I would recommend that read it before you get into today’s update.

RCI Hospitality

I am today writing this follow-up because RICK recently announced yet another club acquisition.

This deal is especially interesting because it is large in size, very accretive, and it nicely highlights RICK’s smart approach to structuring deals.

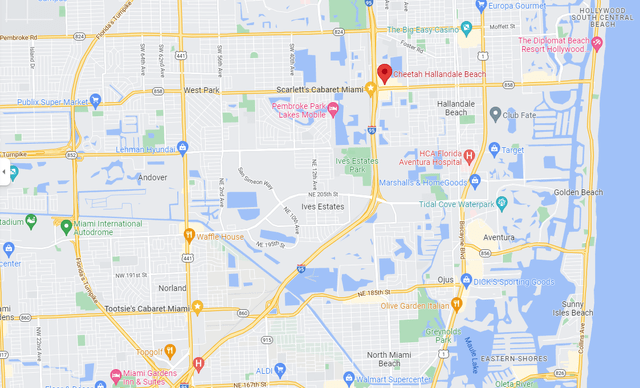

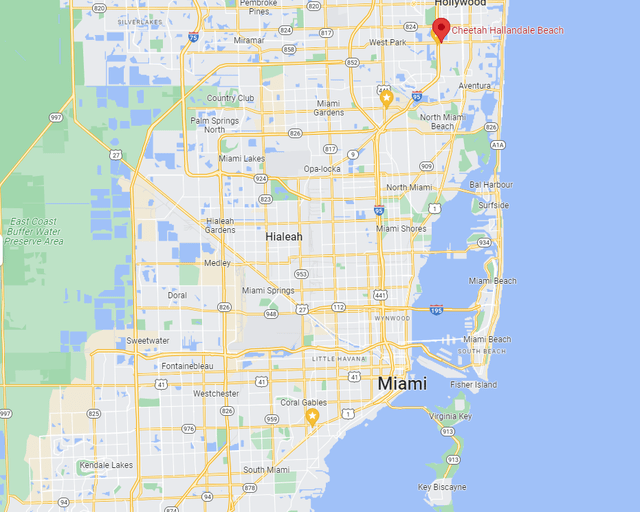

The club that they are purchasing is Cheetah Hallandale Beach, located in Hallandale Beach near Miami. It is one of the biggest clubs in the area and RICK’s management knows it particularly well because it is located near three of its biggest clubs:

- Scarlett’s is just across the street!

- Tootsies, the nation’s largest club, is just a 10-minute drive away.

- And Playmates Club is 30 minutes down south.

So Cheetah is the 4th club in this area. Ed Anakar, President of RCI Management, said that:

“Cheetah fits perfectly with our renowned Miami area brands, each of which appeals to different market segments – the Tootsie’s Cabaret mega club in Miami Gardens, the Scarlett’s Cabaret party club in Pembroke Park, and the hot Playmates Club of Coral Gables.”

The Cheetah is a 14,000-square-foot building and it sits on a 2.2-acre property at the intersection of the busy 95/858:

Below, I share a few pictures of the club itself:

RCI Hospitality

RCI Hospitality

The purchase price is $25 million and it includes the real estate, which is probably worth half of it alone.

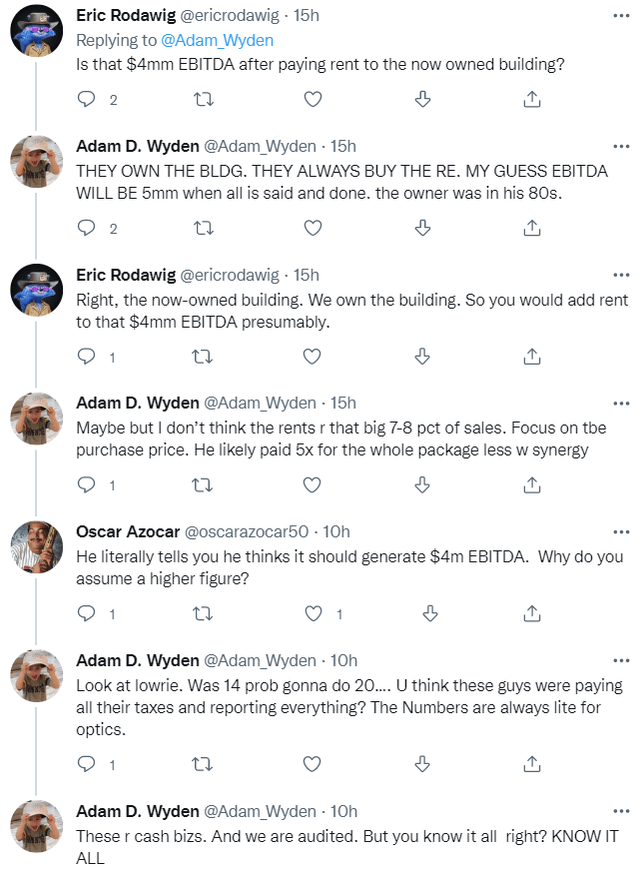

RICK’s CEO, Eric Langan, believes that the club should generate about $4 million of EBITDA based on its current operations.

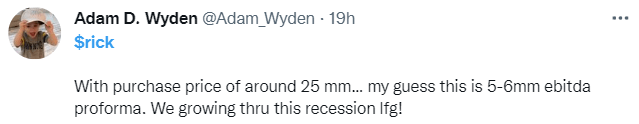

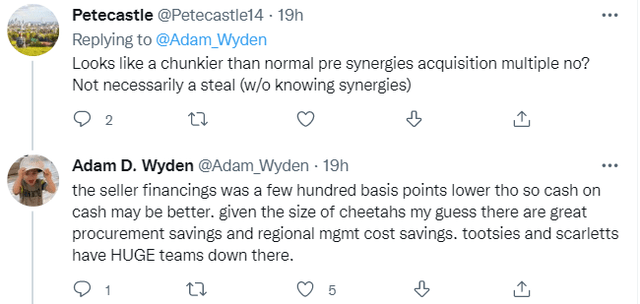

But this will rise as RICK boosts its margins by cutting costs and improving its management. Pro-forma, RICK’s biggest shareholder expects the property to generate closer to $5-6 million of EBITDA once the value-add is implemented. RICK is used to paying 3-5x EBITDA pre-value-add so the $5-6 million of EBITDA would make sense for a $25 million purchase price:

That’s massive given that RICK’s current run rate is ~$100 million of annual EBITDA. This means that this single acquisition has the potential to grow the company’s EBITDA by 5%.

And RICK can keep doing such deals over and over again given how it structures them.

This specific one included a $10 million cash payment and the remaining $15 million is seller financing with a 10-year term and a 6% interest rate. RICK is able to get such attractive financing terms because as we explain in our previous update, there simply aren’t many buyers for these clubs and since RICK is the preferred buyer, it enjoys strong bargaining power with sellers as it negotiates its financing terms.

Moreover, the sellers of these clubs would often get hit with a massive tax bill if they took the entire purchase price in cash on day 1, and therefore, they are often happy to provide seller financing in exchange of a relatively modest interest rates, especially since they see RICK as a safe borrower due to its large scale and reputation.

For RICK, it is fantastic because it means that it does not need to put much cash into its acquisition. The cash-on-cash return will be phenomenal since it is acquiring ~$5 million of EBITDA! After interest expense, the return would be 30%+ since it is only investing $10 million.

Where else can you get such returns?

An even better question: where else can you get such returns from a relatively defensive asset? (High-quality, moated, recession-resistant strip club that enjoys high margins and barrier to entry due to licenses.)

I don’t know any other investment with such an attractive risk-to-reward and this is why I like RICK so much.

And the best part is that RICK can do many of these deals since it had $40 million of cash on hand. Moreover, RICK is currently generating about $1.5 million of free cash flow each week that passes. About half of that goes into buybacks at the moment because the management believes that its share price is too cheap, but it leaves nearly $1 million each week, which will build up over time, and will allow RICK to pursue even more acquisitions.

My point here is that RICK does not need to raise any equity to grow rapidly. If it can close just a few such deals each year, RICK can grow its FCF by 20%+. Meanwhile, it is also continuing to build and franchise its Bombshells sports bar concept, it buys back stock with a very high FCF yield, and it is also developing other businesses like its own version of OnlyFans (Admireme) and its own NFT that provides perks at its clubs to attract the younger crowd. This is all additional growth.

How much are we paying for this growth opportunity?

They are exiting the year with ~$100m of EBITDA as a run rate, potentially more once you take this acquisition into account. If you remove ~$10 for taxes, ~$5 for maintenance capex, ~$8 interest expenses, and you get near ~$80 million of FCF.

The current market cap is $520 million so we are paying just 7.5x FCF.

Now imagine if they can keep growing at 20%+ for another 5 years and during the same time, its FCF multiple grows to 15x FCF. That would more than 4x your money.

Be the first to comment