rancho_runner/iStock via Getty Images

Introduction

I haven’t written a Raytheon Technologies (NYSE:RTX) article since December of 2021. Now, it’s time to update the long-term bull case for dividend investors like myself. We need to discuss recent market developments, outperformance in times of (commercial) aerospace weakness, the war in Ukraine, the company’s huge role in modernizing the US military, and the many factors that make this defense contractor one of the best sleep-well-at-night dividend stocks. Over the past few months, I have gradually added to this stock, reinvesting dividends and other cash flows. In this article, I will share my thoughts on the company and give you a detailed breakdown of the things I just listed.

In other words, I’m going to justify a very bullish article and explain why I have 5.5% exposure in Raytheon – and growing.

So, without further ado, let’s get to it!

A Solid & Fast-Growing Business Portfolio

The sleep-well-at-night factor

I have to admit that “sleep well at night” has lost all meaning to me. It’s really hard to define a stock that falls in the “SWAT” category. For example, some people sleep well knowing they hold a stock with a high yield and a stable income. More often than not, these companies offer little growth. That’s fine, but being overweight these investments would keep me awake. I don’t mind owning cyclical companies – even if it sometimes comes with somewhat steep drawdowns. What I need is a healthy mix of growth and value.

That’s exactly where Raytheon comes in. With a market cap of $140 billion, it’s the world’s largest defense aerospace & defense company.

After the 2020 merger between United Technologies and Raytheon, we’re dealing with a company that engages in both commercial and defense aerospace.

Its total defense exposure is close to 50% (including ALL segments). That’s terrific news as it means the company is less prone to pandemic-related commercial weakness and it is not entirely dependent on government contracts.

The company operates four business segments:

- Collins Aerospace Systems

This segment is extremely well-diversified. It produces aerostructures, avionics, interiors (even commercial airline toilets), power and controls, mission systems, mechanical systems, and everything related to aviation.

This segment alone has roughly 68 thousand employees with close to 40% international sales. Thanks to the high-tech and advanced nature of this segment, it benefits from modernization in commercial aerospace. The company has twice as many products in current generation airplanes compared to older planes.

By 2025, the company could double its exposure again in its strongest segment, single aisles planes. Collins benefits from new models like the A320NEO, 737MAX, A220, and the fact that the post-pandemic world (so far) favors shorter-distance airplanes.

In defense markets, the company has parts in more than 40 thousand allied aircraft. This includes every single major defense program like the F-35, KC46 tanker, T-7 training jet, and the famous AH-64 helicopter.

Between 2020 and 2025E, the company aims to grow sales by at least 6% per year with 27% to 30% in annual operating profit growth. Bear in mind that this includes secular and cyclical growth – 2020 was pretty much the bottom in aerospace after a devastating pandemic-related implosion. It’s also the first year of the new post-merger company.

- Raytheon Intelligence & Space (“RIS”)

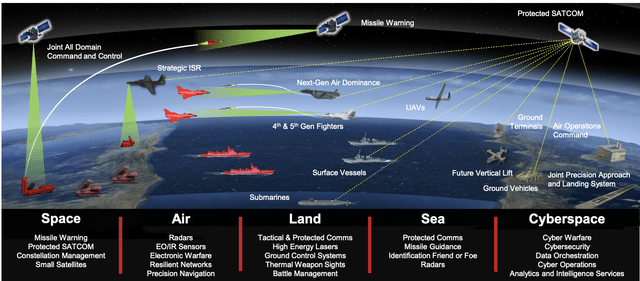

This segment employs roughly 37 thousand people and it includes 5,500 programs. Essentially, this segment is engaged in:

Developing advanced sensors, training, cyber and software solutions — delivering the disruptive technologies our customers need to succeed in any domain, against any challenge.

What’s interesting is that roughly 80% of orders are from government-related agencies. 60% of contracts are flexible price contracts, which helps in times of high inflation.

RIS is key in turning the US and allied defense forces into a well-connected, multi-domain attack and defense force. The overview below shows some of the company’s applications and the way these are supposed to communicate and operate in sync with each other. Multi-domain warfare is basically the next step of innovation as it connects already high-tech technologies like 5th-generation fighters, ships, satellites, and related. It’s a bit like modernizing an industrial supply chain where all parts communicate. However, in this case, it’s a bit more serious.

Raytheon Technologies

Moreover, this segment also aims to grow its commercial footprint as defense applications can be used in civil industries as well. For example, surveillance and security applications can be based on existing defense services. The same goes for weather and climate monitoring through satellites and quick communication.

While this segment is not expected to keep up with Collins in terms of growth, it is still expected to see 4-5% annual revenue growth until 2025 with 7% to 10% annual operating profit growth.

- Raytheon Missiles & Defense (“RMD”)

This is the segment most people think of when they hear the name “Raytheon”. With 30 thousand employees, 15 thousand engineers, and locations in 28 countries, RMD is one of the strongest defense businesses anywhere in the world.

Especially in times of the war in Ukraine and Chinese threats toward Taiwan, the world is watching defense spending again. Not only that but next-gen defense applications that that manpower alone cannot win wars. The devastating war in Ukraine is an example of that.

RMD is home to the Patriot system and its successor, the LTAMDS system. It also produces interceptor applications for conventional rockets and hypersonics. In the case of hypersonics, the company was just awarded a huge deal together with its peer Northrop Grumman (NOC).

Reuters

Raytheon Technologies Co and Northrop Grumman Corp have won U.S. contracts to continue developing missiles to intercept hypersonic weapons, the Pentagon said on Friday.

[…] In November, the three companies were awarded separate contracts totaling about $60 million to develop an interceptor guided by a constellation of satellites and sensors to intercept a hypersonic missile inside Earth’s atmosphere as it glides towards its target.

The contracts will reduce the number of companies developing the systems to just two.

While next-gen applications will not account for more than 15% of sales in 2024, annual growth rates in that segment are expected to be higher than 15% per year.

Overall, this segment sees 3-4% annual sales growth until at least 2025, with 4-6% operating profit growth. Again, this is well-below Collins. Yet, this segment is not influenced by commercial demand (no pandemic-demand impact) and is well-aligned with the US defense budget.

I have to say that this segment is quickly becoming one of my favorite segments as I’m fascinated by advanced aerospace engines and the fact that Raytheon is doing so well in this competitive industry.

The breakdown of this segment is roughly 20% P&W Canada, 40% large commercial engines, and 40% defense engines (or as Raytheon calls it “military” engines).

Moreover, close to 40% of sales are aftermarket sales, which provided stability in the pandemic and it’s a huge win in the long term as the number of active engines rises.

This segment is home to the PW1000G Geared Turbofan (“GTF”) engine, which is used in airplanes like the Airbus A320NEO. P&W also produces engines for the A220, and Embraer A195, which are all single-aisle planes. This, too, is a huge benefit in a world recovering from COVID as this market recovered much faster than wide-body long-haul demand.

P&W also produces the famous F135 engine, which powers Lockheed Martin’s (LMT) F-35 jet.

Between 2020 and 2025, average annual sales growth is expected to be 9% to 10%. Operating profit growth is expected to be no less than 44% per year. Again, please note that this is based on a very low basis of just $400 million in adjusted operating profit in 2020.

In 2020, the global revenue-passenger miles were 1.8 trillion. That’s down from 5.4 trillion in 2019. It is likely that 2024 will see a new high at 5.7 trillion. 2025 is estimated to be 6.1 trillion. In other words, the five years after 2020 could see 30% annual growth but an overall improvement of just 13%. So, please keep that in mind when these expected growth rates seem “too high”.

What This Means For Shareholders

Dividends & Buybacks!

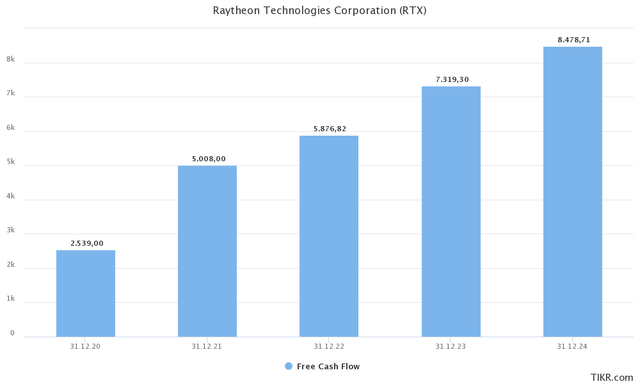

If there’s one number I care about, it’s $10 billion. That’s how much Raytheon expects to do in free cash flow in 2025. The company announced this target in 2021 for the first time.

What matters is that this number was confirmed again in June of this year. Especially because supply chain issues continue to be a drag on the company.

This is what the company commented in June on long-term targets:

[…] we’re on track to meet our 2022 commitments, as well as our longer-term 2025 commitments that we put out to investors in The Street back in May of 2021. There’s a lot of headwinds. There’s some tailwinds. And I think net-net, we see upside as we look forward in our businesses, albeit some of that out in the beyond 2022 years, but still a really good backdrop for both sides of our businesses.

This is what CEO Greg Hayes commented on supply chain issues on July 18, 2022:

“I think we’re not going to see the end of the supply chain and the people challenges this year. I think it’s the end of 2023 and going into 2024,” the head of the airplane maker and defense contractor Raytheon told CNBC.

Hayes noted that “demand is out there” for the firm’s airplanes but that a “really difficult” manufacturing environment keeps the company from fulfilling all the potential business available. The Raytheon CEO said that the labor shortage had the biggest impact on its ability to meet demand.

“It is direct labor, it is skilled labor, that is the hardest thing to get right now,” he said. “There’s a lot of things we can’t get done because we can’t get the people.”

He also said something else that I have been talking about a lot: demand destruction.

On inflation and interest rates, the Raytheon CEO argued that “we have to do something to slow down the economy” in order to get price increases under control. As a result, he predicted that the Federal Reserve will have to increase the central bank’s key rate above at least 2.5%.

What he is saying here makes total sense for many reasons. We are dealing with significant supply chain issues, labor shortages, energy shortages, (related) high inflation, and geopolitical issues. The Federal Reserve cannot solve supply-side problems. At least not directly.

In order to combat inflation, the Fed will have to “crush” demand to a point where supply isn’t in shortage anymore. That sounds harsh, but it’s the situation we’re in.

People asked me why he would say something like that – even if it’s true, he still doesn’t need to comment on it. However, Raytheon remains in a good place. First of all, 50% of its sales are NOT dependent on commercial demand. Second of all, its commercial sales are often long-term sales based on i.e., airlines’ long-term spending plans. Yes, the Fed crushing demand will hurt commercial demand, but it won’t be enough to derail Raytheon’s business – not even close.

With that being said, Raytheon is a cash machine. Next year, the company is likely to do $7.3 billion in free cash flow. That’s 5.2% of the current market cap. If this number rises to $10 billion in 2025, we’re dealing with an implied FCF yield of more than 7.0%.

TIKR.com

These numbers indicate a few things.

First of all, the dividend is not only safe but prone to keep rising at a fast clip on a longer-term basis. Raytheon currently pays a $0.55 quarterly dividend. That’s $2.20 per year per share. This translates to a 2.3% dividend yield.

In my book, that’s a very decent yield. Why? Because it comes with strong dividend growth. These are all post-merger dividend hikes:

- April 2022: 7.8%

- April 2021: 7.4%

That’s not “extremely” strong dividend growth. However, it’s decent as 2021 was in the midst of pandemic-related aerospace turmoil. 2022 saw significant supply chain problems.

To remain flexible, Raytheon engaged in high buybacks. This year, the company is looking to repurchase shares worth $2.5 billion. The company bought $750 million worth of RTX shares in the first quarter. $2.5 billion is 1.8% of its market cap, that’s not too bad for a challenging year.

Moreover, the company continues to stick to its $6.0 billion FCF target this year. That’s above consensus estimates.

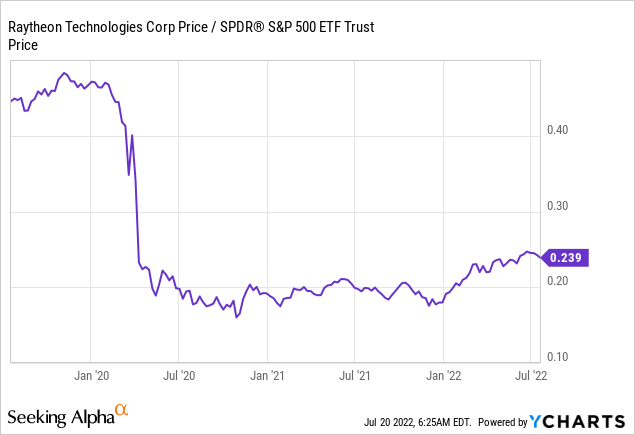

This is still not everything. I’m glad that the RTX share price confirms what I have been talking about for roughly two years now. Despite supply chain and commercial-demand challenges, RTX is outperforming the market.

Excluding dividends, RTX has consistently outperformed the market since the pandemic scare in early 2020. It even managed to keep up with the market when tech stocks fueled a strong rally in both 2020 and 2021. If I had included dividends, this outperformance would be even more significant.

Needless to say, I expect this outperformance to continue for a number of reasons (but not limited to):

- Commercial demand is just starting to gain momentum. In 1Q22, Collins and P&W saw 11% and 13% organic growth, respectively. This is happening despite pandemic-related travel fears and restrictions in China as well as huge labor shortages at international airports.

- Global defense spending has entered a new era. NATO is more committed to spending (more than) 2% of its GDP in defense, Asian countries are preparing for high tensions, and Europeans know that the post-Ukraine war world will be different.

By year-end, Stoltenberg said they will have invested “well over” $350 billion extra since the group’s Defense Investment Pledge in 2014. This refers to NATO’s agreement for its allied members to spend at least 2% of gross domestic product on defense within a decade. – CNBC

- The global economy will remain shaky. Supply chain problems aren’t fading soon. Central banks will remain aggressive. Hence, investors want safety and companies in their portfolios they can rely on.

In other words, and to come back to my sleep-well-at-night comments. RTX offers stability, but not without having to give up long-term growth, dividend growth, buybacks, and financial stability.

Speaking of financial stability:

Valuation

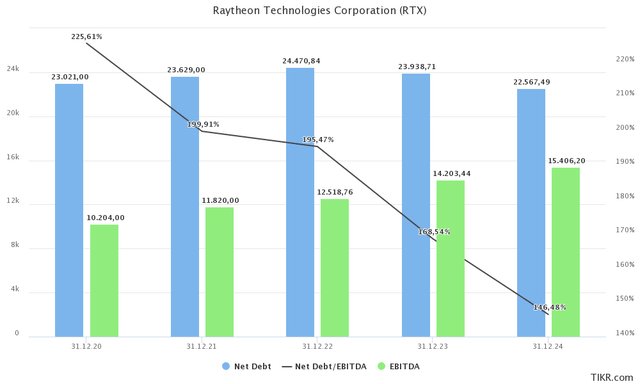

Raytheon has $31.3 billion in gross debt. Roughly all of it is long-term debt. The average maturity of its debt is 15 years, which is good news given the current (mid-term) surge in rates. The biggest single portion of long-term debt on its balance sheets is $3.5 billion in notes due 2042. The yield on this is just 4.50%, which is a great deal.

When incorporating cash (equivalents), the company is expected to end this year with $24.5 billion in net debt. That’s less than 2.0x EBITDA (indicating low leverage). Next year, net debt is likely to be close to $24.0 billion as high buybacks make fast debt reduction unlikely. Yet, as EBITDA is set to rebound, the net-leverage ratio could drop to 1.7x. This opens up the door to more aggressive cash distributions – after all, the balance sheet doesn’t need priority treatment.

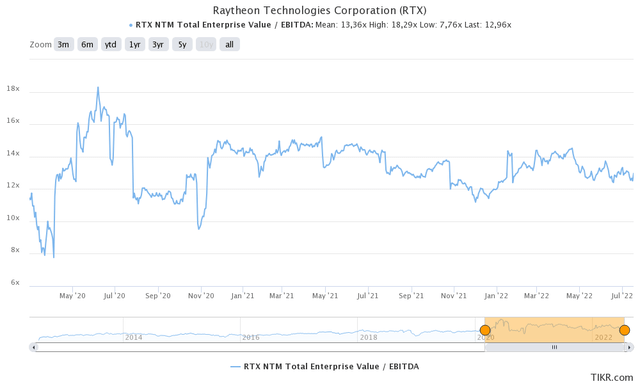

TIKR.com

When adding the $140 billion market cap to $24.0 billion in expected net debt, $1.6 billion in minority interest, and $7.7 billion in pension-related liabilities, we end up with an enterprise value of $173.3 billion.

That’s roughly 12.2x next year’s EBITDA estimate.

This valuation is more than fair and it opens up new opportunities to either add exposure to existing positions or initiate a position.

TIKR.com

Takeaway

In this lengthy article, I explained why I am a firm believer in the long-term potential of Raytheon. This company offers opportunities for both dividend-growth investors and yield-oriented investors thanks to a decent yield, satisfying dividend growth with more upside potential, and a business model that provides high (and growing) free cash flow.

The company has a healthy balance sheet and business segments that provide stability in tough times thanks to 50% defense exposure as well as long-term growth thanks to high-tech commercial solutions and products and consistent growth in defense industries.

Moreover, despite ongoing challenges, the company sticks to its 2025 targets and significant buyback volumes.

Additional good news is that this also comes with expected outperformance as RTX delivers long-term growth, stability in current (turbulent) times, and protection against an aggressive Fed. It also helps that NATO and related allies are ramping up defense spending.

So, long story short, while it is hard to say if this is the bottom, I happily buy more Raytheon. The risk/reward is good thanks to the current valuation and on a long-term basis, I happily use S&P 500 bear markets to buy quality companies.

(Dis)agree? Let me know in the comments!

Be the first to comment