krblokhin

The Russian-Ukraine conflict seems to be nowhere close to ending, with Vladimir Putin recently announcing a “partial mobilization” of the population to bolster flagging manpower for Russia’s “special military operation” in the Donbas region. Frankly, when the war began earlier this year, very few thought that it could drag on for so long. The memories of Crimea annexation were fresh in minds of many, and probably Russian war strategists too underestimated Ukraine’s will and ability to resist invaders. Over the past several years, with the help of U.S. aid, Ukraine has upgraded its military equipment and capabilities.

With Russia continuing its aggression and even threatening a nuclear strike, the geopolitical situation is dire. This war has also put a spotlight on the need for the U.S. and its allies to upgrade and increase their military arsenal. As a result, we are seeing an increase in military budgets or at least talks of increasing military budgets in several countries across the globe. This bodes well for U.S. defense companies.

Now, investors should keep in mind that the impact of these increased geopolitical tensions and increased military budgets is not something which will show up immediately in the financial results of defense companies. It takes some time for the budget increase to get implemented and then these orders enter the backlog. It can further take a few years for these backlogs to get delivered and results to show up in a company’s top and bottom line. Nonetheless, one thing which we can say about the current situation and its impact is that it has improved the longer-term outlook for defense companies meaningfully.

One of the issues which I face buying defense companies during times of geopolitical conflicts is that the valuations of these companies tend to be on the higher side. So, one needs to be careful not to pay too much for a stock. I was facing a similar problem early this year. However, the recent stock market correction has resulted in many of these companies being available at attractive valuations compared to where they were a few months back.

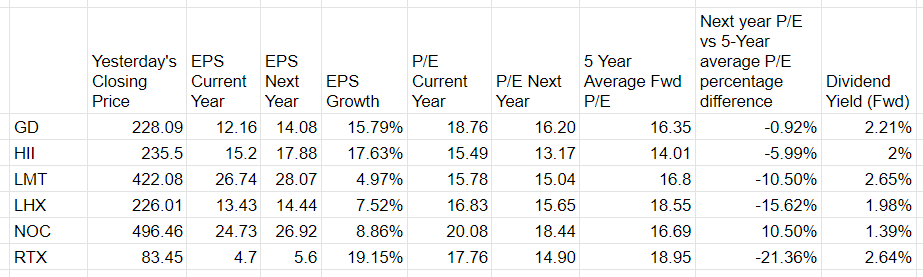

I looked at six major defence companies – General Dynamics (GD), Huntington Ingalls (HII), Lockheed Martin (LMT), L3Harris Technologies (LHX), Northrop Grumman (NOC) and Raytheon Technologies (NYSE:RTX) – to find out the best pick in the sector with good growth prospects and reasonable valuations. Below is the table comparing the growth, valuations and dividend of these companies using consensus estimates.

Defence Companies’ Valuations and Expected Growth (Seeking Alpha, Consensus Estimates)

One company which stands out among this group is Raytheon. It is expected to show an EPS growth of 19.15% next year which is the highest in this group. Also, if we consider FY23 P/E, it is available ~21.36% below its 5-Year average forward P/E which is the highest discount among the group. It also has the second highest dividend yield among the group and its next year P/E is the second lowest in the group. I believe the stock offers one of the best buying opportunities among the defense stocks given its good earnings growth prospects, lower valuation compared to its historical average and good dividend yield.

The company has faced some challenges this year given the supply chain disruptions and issues with labor availability. This is adversely impacting its revenues and, last quarter, the company reported revenues of $16.31 bn which, while up 2.7% Y/Y, missed consensus estimates by $300 mn. While the company maintained its full-year revenue outlook of $67.75 to $68.75 billion, management indicated that FY22 revenues are likely to come closer to the lower end of the guidance range. One interesting thing is that despite these revenue headwinds, the company was able to post better than expected EPS last quarter. The company’s Q2 Non-GAAP EPS of $1.16 bettered consensus estimates by 5 cents helped by strong cost controls.

The challenges that Raytheon is facing are not unique to it. Almost every industrial company has faced similar supply chain and labor-related issues in the first half of this year. The good news is that these challenges are expected to recede in the second half of this year and beyond as covid-19 related disruptions wane and the labor market softens following the Fed rate hikes. Last quarter, the book-to-bill ratio of the company’s defense business was over 1.35x indicating strong demand. While this strong demand has not yet resulted in strong sales given the production disruptions and the longer lead times for converting orders into sales in the defense business, I believe this will eventually show up in the sales and EPS growth numbers over the coming years.

The company’s medium to long-term prospects looks appealing. Last year, management shared its long-term targets with investors where they talked about 6% to 7% sales CAGR from 2020 to 2025, 550 to 650 bps adjusted segment margin improvement in the same period and $10 bn+ FCF (excluding R&D tax credit impact beginning in 2022) by FY2025.

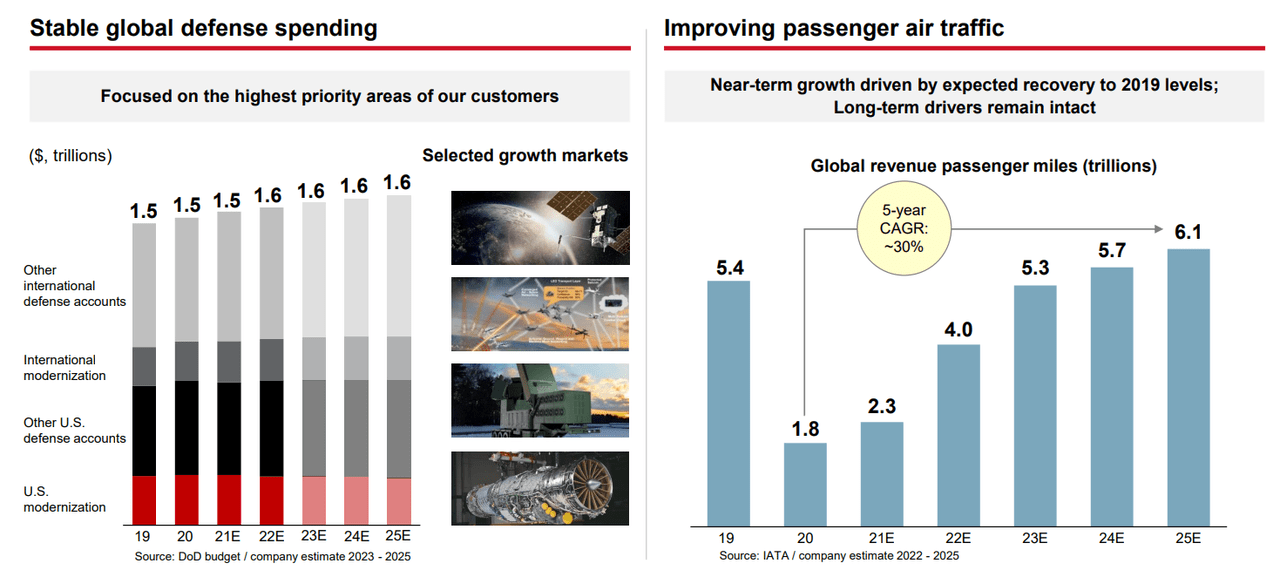

The company derives ~65% of sales from the defense end market and 35% from the commercial end market. Management cited stable to slowly growing defense spending and recovery in air travel as the main drivers of its revenue growth. This was before Russia-Ukraine was started. Clearly, the defense spending outlook has meaningfully improved across the globe since then. So, my conviction in the company’s outlook has also increased.

RTX Global Defense and Air Travel Outlook (RTX Investor Day Presentation)

One thing interesting about the company is that it should be able to do well even if there is a broader macro slowdown. Defense spending is more driven by the current geopolitical needs while we are recovering from a very low base in commercial business. So, even in a recessionary environment, I expect both of these end markets to continue growing.

On the margin front, management is taking various structural cost reduction and procurement improvement initiatives which should benefit the company. In addition, merger synergies from the United Technologies (UTX) aerospace business along with operating leverage from recovery in commercial business should also improve margins.

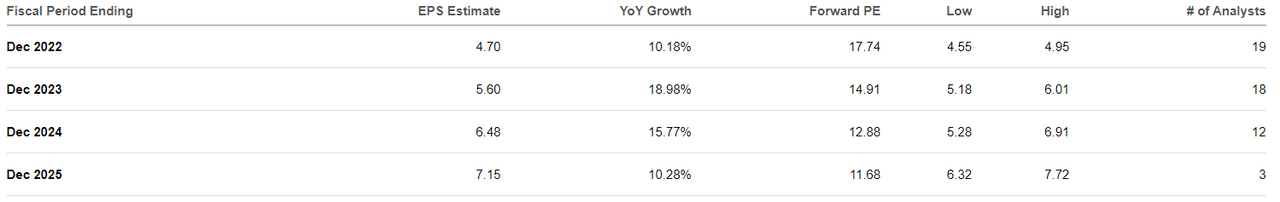

If we look at the current sell-side estimates, analysts are expecting double-digit EPS growth for the company over the next few years which I believe is achievable.

RTX Consensus EPS Estimates (Seeking Alpha)

I believe the company’s good growth prospects, supportive environment for defense spending, good dividend yield of 2.64% and a history of returning cash to shareholders through buybacks makes it an attractive long candidate. The stock is currently trading below its pre-Russia-Ukraine war levels and while the company’s business was impacted in the first half of this year by supply chain and labor scarcity issues, I believe long-term investors can look beyond these short-term headwinds (which are already receding) and consider buying the stock at the current levels.

Be the first to comment