IURII BUKHTA/iStock via Getty Images

By Antoine Bouvet, Benjamin Schroeder, Padhraic Garvey, CFA

US CPI to make the Fed’s hawkish communication less effective

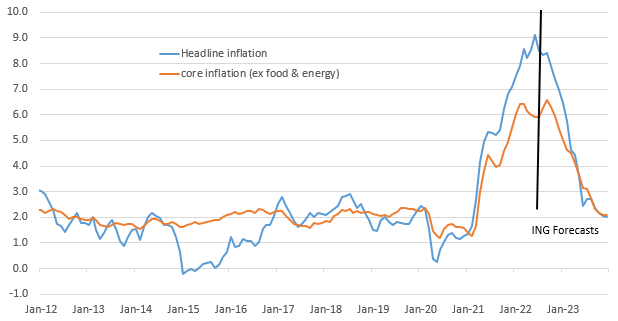

A generous helping of caution is necessary when drawing the conclusions of a single economic release, but the July US CPI report suggests that the peak in headline inflation is now behind us. The fall in gasoline prices, in particular, should ensure that the August print drops to 8.3% annualised according to our economics team, from 8.5% in July and 9.1% in June. This is all well and good, but core could spike again in the coming months before also heading lower. From the point of view of the Fed, in short, it is too early to sound the all-clear. More hawkish rhetoric likely lies ahead.

US Inflation Should Drop Over The Coming Months (Macrobond, ING)

Of course, the more interesting question for our readers is whether financial markets will listen to another barrage of hawkish comments. Ultimately, the Fed has the ability to push long-end rates however high it wants, but the question is whether it would do so at any cost. For instance, an acceleration of QT beyond the increase already planned for September should, in theory, push Treasury yields up. The Fed, however, may be reluctant to use anything else than the Fed Funds rate. Firstly because it signalled that it is its marginal tool, and secondly, because it would add risks to a QT process already fraught with perils. Finally, there is no guarantee that faster QT, if it causes financial stability risk, would push Treasury yields up for long.

With signals around the Fed Funds rate being its main communication tool, one can reasonably question whether more hawkish comments have the power to move long-term yields much. Even with a Fed signalling that it will rely on backward-looking inflation data (which itself is a lagging indicator of the economic cycle), markets need to price what the Fed’s decisions will be months, and even years, in advance. Fast forward one year, with much slower economic growth, inflation on its way back to target, and Fed Funds way above neutral, we don’t blame the curve from pricing rate cuts. Today’s Fed doesn’t need to acknowledge that for the curve to price it with a high degree of conviction.

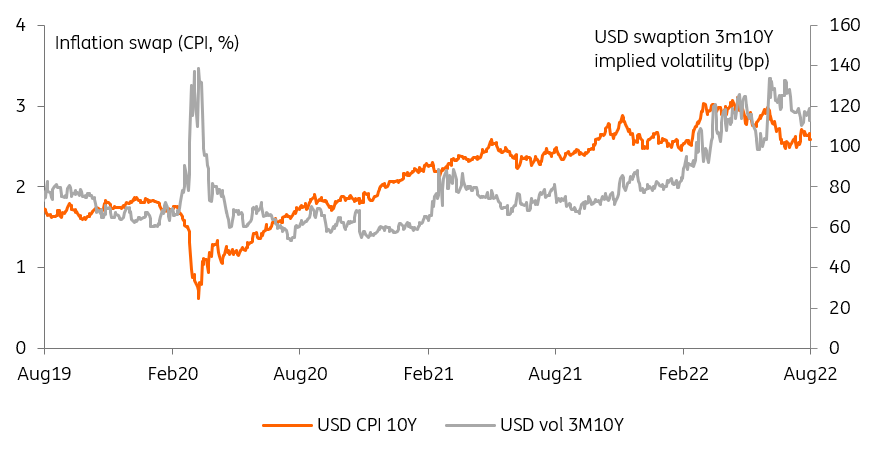

Inflation Swaps Are In Check And Implied Volatility Is Declining, Both Helping Treasury Demand (Refinitiv, ING)

10Y yield set to drop to 2%, as fundamentals are improving

Another unknown in this equation is how demand for Treasuries evolve in the coming months. We have highlighted the fall in inflation expectations removing in recent weeks, one key brake on Treasury demand, but another factor is pointing in the direction of better investors sentiment towards Treasuries. Implied volatility, and so the perceived riskiness of bonds, is also on the decline. All else being equal, this is an encouraging sign that more investors will be willing to return to this market, and that functioning overall is improving, despite summer trading conditions.

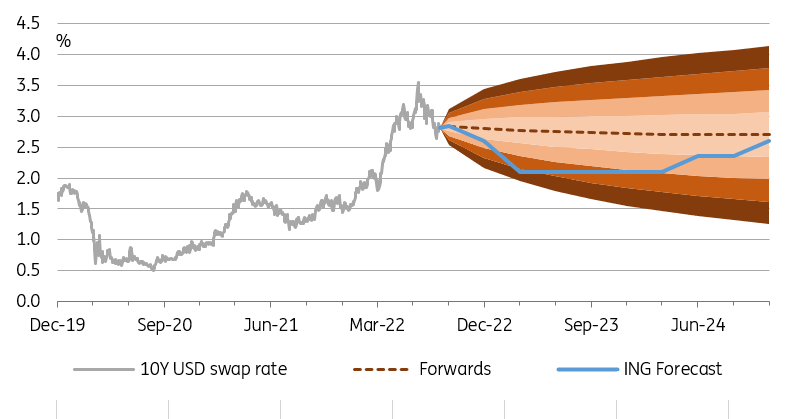

We Expect 10Y US Rates To Bottom Out In 1Q 2023 (Refinitiv, ING)

In summary, 10Y Treasury yields may well test the 3% level in the coming sessions, but this increasingly feels like a ceiling. Our forecast for 1Q 2023 is for yields to converge to 2%, before climbing back to 2.5% later in the year. A 2% forecast can seem incongruous when inflation is still above 8%, but this is a backward-looking measure if there ever was one. Swaps suggest inflation will return to similar levels, and temporarily negative Treasury real yields shouldn’t surprise anyone if the US finds itself in the midst of a recession.

Today’s events and market view

Hot on the heels of yesterday’s US CPI, US PPI is also expected to cool both on the annual headline and ex-food and energy measures. Given that this slowdown is already expected by consensus, and that yesterday’s release saw a significant re-steepening of the US yield curve, we think PPI will prove less momentous than CPI. This is all the more true if the barrage of hawkish Fed speakers continues, although today sees no scheduled appearances.

In that regard, post-CPI Fed speakers seemed to sing from the same hymn sheet. Neel Kashkari and Mary Daly both repeated that it is too early for the Fed to declare victory after an encouraging inflation report. Although the former pushed back against the idea of rate cuts next year if inflation is still elevated, the latter said a slowdown to a 50bp hike in September is her base case, subject to data published until then.

The Treasury concludes this week’s supply slate with a 30Y auction worth $21bn.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Be the first to comment