Nuthawut Somsuk/iStock via Getty Images

By Padhraic Garvey, CFA, Antoine Bouvet, Benjamin Schroeder

The shoot above 2% brings the US 5/10yr closer to an inversion

As the 10yr shot above, we’re increasingly at risk of the 5/10yr flattening out, and even inverting, before we get to the 16 March FOMC meeting. It’s a little over a month away, but it can’t come fast enough from the Fed’s perspective. The 2yr got hit again, now at 150bp above the Fed funds rate; that’s hot and discounts some serious hiking ahead. The 5yr is cheap to the curve, so the flattest segment on the 2/10yr is the 5/10yr. The 5yr itself is now in the 1.95% area, and so also knocking on the door of 2%.

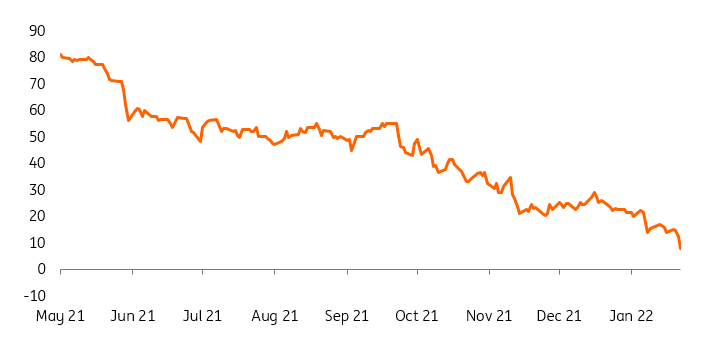

The 10yr has broken above, and the 5yr will follow closely behind. The 5/10yr spread is now at under 10bp (vs 50bp 3 months ago). If it flattens out, it is bond market confirmation that the Fed is really behind the curve. This would be quite a different inversion to one on the 2/5yr. An inversion on the 2/5yr would be the precursor to a recession. But here, an inversion on the 5/10yr tells us that we are at the beginning of some serious rate hiking, and is thus indicative of the complete opposite of the recession. It’s indicative of a boom.

The 5/10yr spread (bp) is heading for inversion, but there’s no recession here…

US 5/10yr Bond Spread (bp) (Macrobond, ING estimates)

In terms of other segments, there has been a clear reduction of duration exposure ongoing in the investment corporate space, with large outflows in long end corporate funds. High yield too saw net outflows in the past week. In emerging markets the bulk of the outflows have been from blend funds (mix of credit and rates), while local currency funds continue to see offsetting moderate inflows, and hard currency only saw moderate outflows. Far larger proportionate outflows were seen in corporates (both Investment Grade and High Yield).

ECB has little at hand to prevent a spillover of tightening expectations

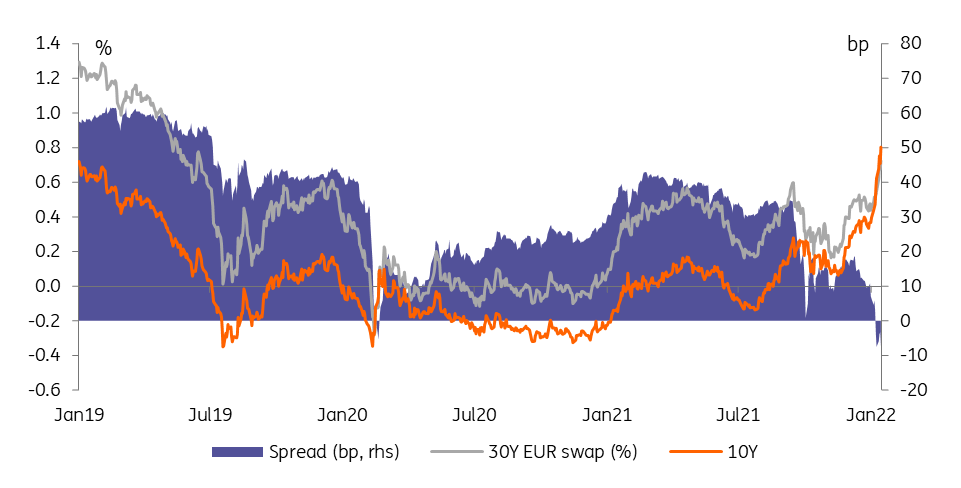

Eurozone rates have shot higher in the slipstream of US market post CPI. The 5Y to 10Y area on the curve led the way higher with the 10Y Bund yield stopping only just shy of the 0.3% mark. 10s30s flattened further, and in swaps where the curve had even inverted after the ECB press conference we are closing in on the -10bp seen back then. Our fears that eurozone periphery bond markets were most exposed to an accelerated ECB tightening time line have materialised again. The benchmark spread of 10Y Italian government bonds over Bunds has widened to above 160bp yesterday.

Record CPI prints are sending a loud and clear message. As much as the European Central Bank likes to stress that the nature of inflation in the eurozone is different than what the Fed is facing, the tightening pressure is clearly spilling over.

EUR 10s30s swap curve has remained inverted since the ECB hawkish turnaround

EUR 10s30s Swap Curve (Refinitiv, ING)

ECB President Lagarde warned that hiking rates too quickly could risk choking off the economy in an interview this night. Such calls for caution indicate that the ECB is starting to feel uncomfortable with the market running ahead. But it seems there is little that the dovish ECB camp can do at this point to dispel markets expectations that central banks will withdraw stimulus faster than anticipated. ECB Chief Economist Lane, true to his role as arch-dove, made the case again in a blog post yesterday for a more cautious policy approach. Amid higher uncertainty he sees merit in waiting out inflation developments and laid out in detail the underlying dynamics in supply chains, energy and labor markets that also shape the forecast. It is just that even some ECB officials appear to lose faith in these models amid these unprecedented times.

Today’s events and market view

Data wise the spotlight remains on the US and the sentiment amid rising price pressures. The University of Michigan consumer sentiment report is seen only subtly lower, but the surveyed inflation expectations will also be of interest.

In the eurozone supply will come from Italy which taps 3Y, 10Y and 20Y bonds for a total of up to €7.75 billion. Looking into the next week, rising supply could put stressed markets to the test again. While the focus is shifting towards more medium term issuance – at least of scheduled auctions – it does include a new 10Y bond from the Netherlands. But in the past, this time of the year also saw longer dated syndicated deals from Belgium.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Be the first to comment