Vladimir Agapov/iStock via Getty Images

In this piece, we look at a market pattern that has occurred only four times in the last 40-years and which has preceded stock market rallies every time.

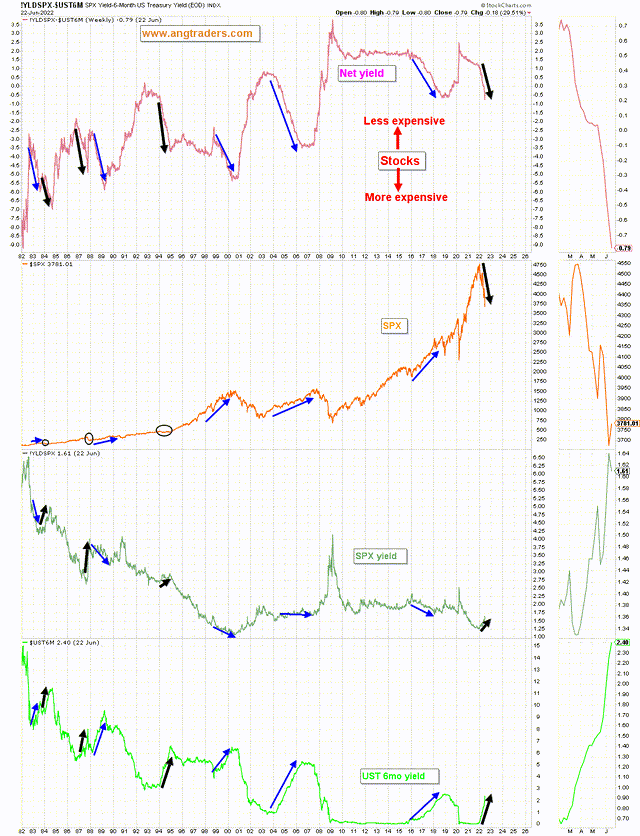

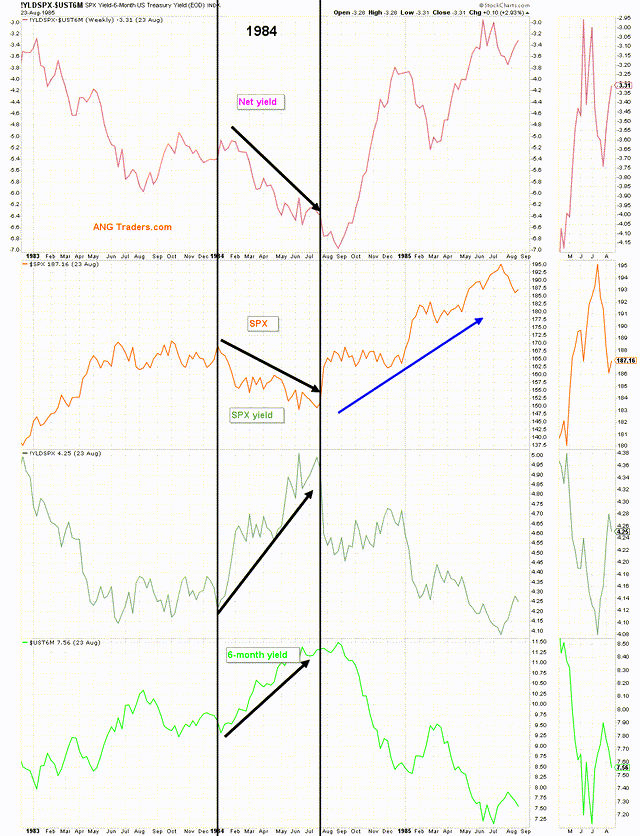

Our preferred method of measuring stock market valuation is the net-yield of the SPX (SPX dividend yield minus the 6-month Treasury yield); the higher the net yield, the less expensive stocks are relative to risk-free Treasuries.

Normally, when the 6-month Treasury yield increases, the stock market as measured by the SPX also increases, while the SPX dividend yield decreases (blue-arrows on the chart below). (Note: the net-yield always decreases, making stocks look more expensive relative to risk-free T-securities).

In the last 40-years, we have found only four instances — 1984, 1987, 1994, 2022 — when the opposite happened; the 6-month yield increased, but the SPX dividend yield increased, while the SPX decreased (black-arrows on the chart below).

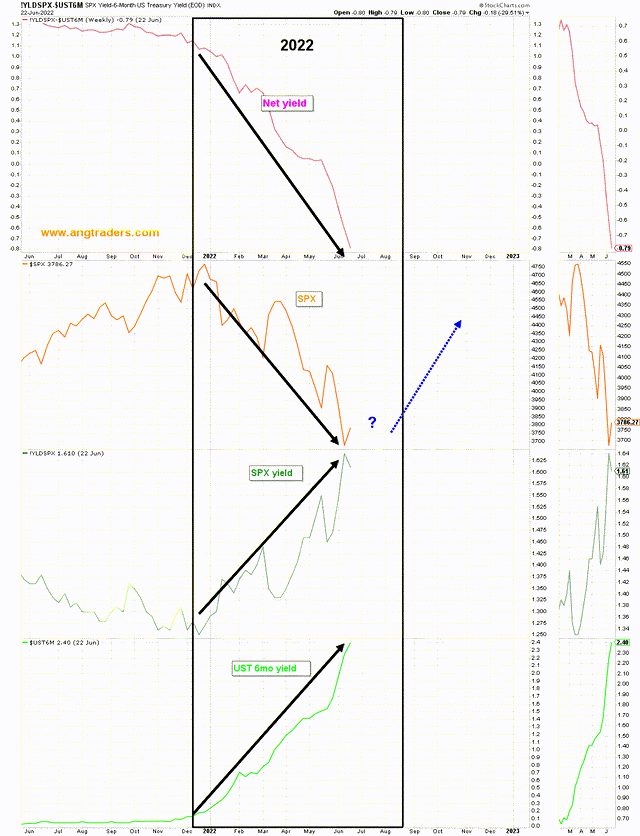

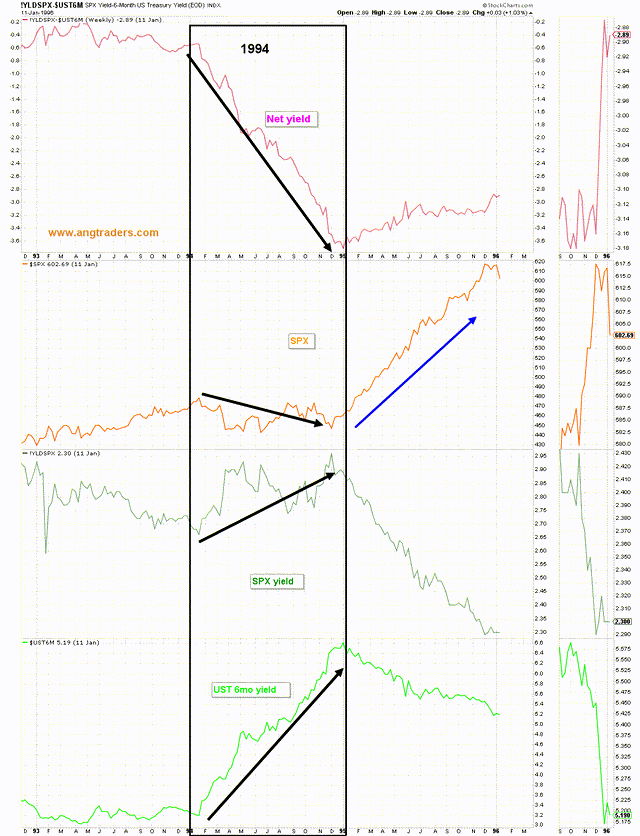

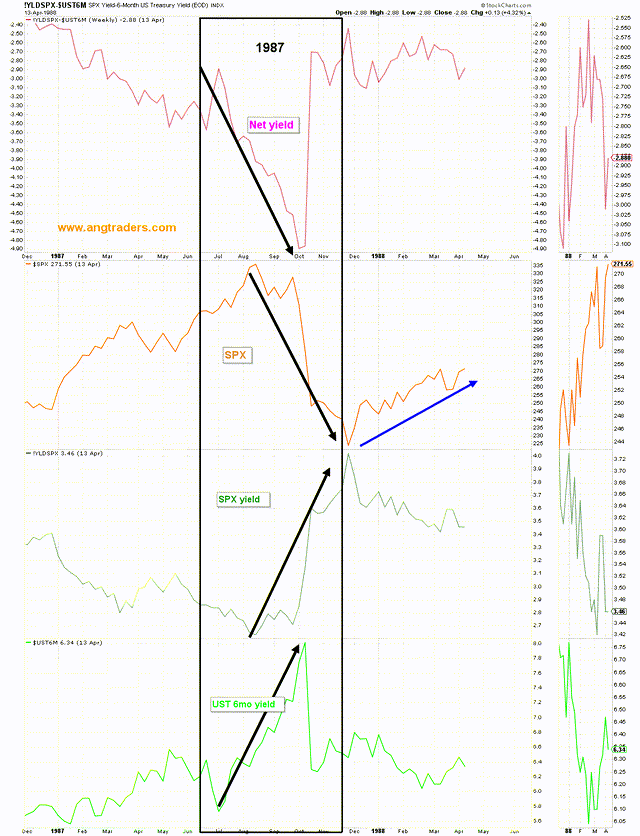

The following charts take a closer look at each of these periods, starting with the current situation:

ANG Traders, Stockcharts.com ANG Traders, Stockcharts.com ANG Traders, Stockcharts.com

Notice that the three previous patterns — 1994, 1987, and 1984 — all lasted less than one year, and that the SPX rallied after the pattern ended. The current version of this pattern is approximately six-months old and is likely to last several more months before the 6-month Treasury yield stabilizes and the SPX rallies. Investors are advised to have cash available when the SPX rally reignites (likely in Q4).

We think that the beaten-down technology sector will experience the strongest rebound rally. Some ETFs to consider buying as we progress to the end of the pattern over the next 2-3 months are: ARKK, AIQ, and QCLN.

Take advantage of our 14-day free trial and stay on the right side of the market and Away From the Herd.

“ I am SO VERY thankful for the discovery of this site, and the wisdom and knowledge I have gained ...”

” I have not seen this type of analysis anywhere else. “

“It is probably the only report of its type on the planet when you think about it.”

Take advantage of our 14-day free trial and stay on the right side of the market and Away From the Herd.

Be the first to comment