Susan Vineyard/iStock via Getty Images

RNGR Is Attractively Placed

Ranger Energy Services (NYSE:RNGR) deals in well completion support, well maintenance, workover & re-completions, and plug & abandonment. Its primary operations include providing high-spec rigs and wireline services. Over the past few quarters, RNGR’s revenues and operating profit margin inflated massively following the acquisition of Basic Energy’s well-servicing assets and PerfX and XConnect’s wireline services assets. Its primary target markets of well-servicing and wireline businesses can grow by 20%-30% in the medium term.

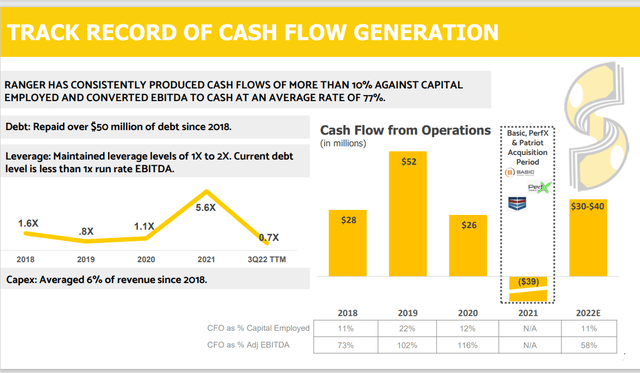

RNGR has repaid over $50 million in debt since 2018. Its current debt level is less than 1x run-rate EBITDA. Its balance sheet remains robust, despite the cash flow crunch in 2022. The stock is relatively undervalued at the current level. Investors might want to buy it with expectations of upside potential in the medium term.

The Growth Prospect

RNGR’s November 2022 Investor Presentation

RNGR is a modest-sized oilfield services player in a fragmented and competitive environment. Its current strategic focus revolves around strengthening the balance sheet, including debt repayment and deleveraging. It will also look for an inorganic growth route through appropriate consolidation in the medium-to-long term. It plans to increase shareholders’ returns by gaining additional scale and financial flexibility. According to the EIA, more than 150,000 horizontal wells are utilized by US producers who may require high-spec services rigs and workover equipment.

Ranger’s November 2022 Investor Presentation

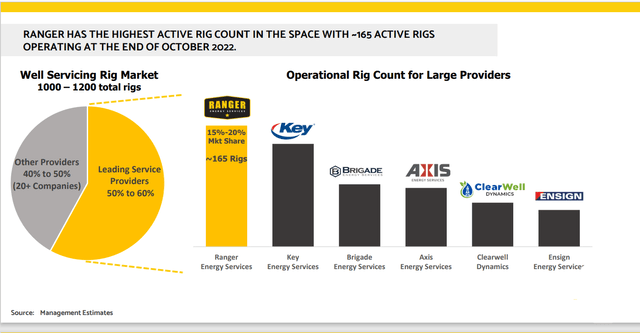

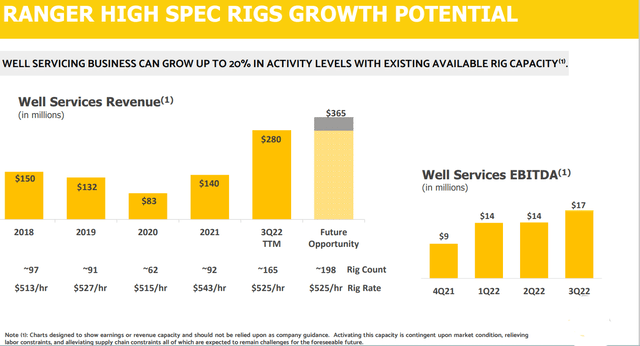

Since 2014, the average well laterals have more than doubled. According to its management estimates, Ranger holds the highest market share in this growing market, with 15%-20% of the active service rig market. The management estimates that its well-servicing business can grow to 20% in activity levels with the existing available rig capacity. The wireline business can increase by 30%, assuming the same utilization level.

Acquisitions And Growth Limitations

In October 2021, RNGR acquired Basic Energy Services (BAS) well servicing, fishing and rental, and coiled tubing operations. Earlier in July, it acquired PerfX, which helped expand the existing wireline business into production-related services. The acquisition also enabled RNGR set foot in the perforating gun system market through equity ownership in the XConnect Business. Even before this acquisition, RNGR, through the acquisition of Patriot, a provider of wireline evaluation and intervention services, had made its presence felt.

Although some of RNGR’s customers might have exhausted the capex budget, its management expects demand and pricing resilience because of market tightness in early 2023. The fear of a recession casts a shadow over the demand in the medium term. Despite that, we will likely see growth opportunities throughout 2023. As estimated by Baker Hughes, the US rig count has gone up ~34% year-to-date, which augurs well for RNGR’s performance.

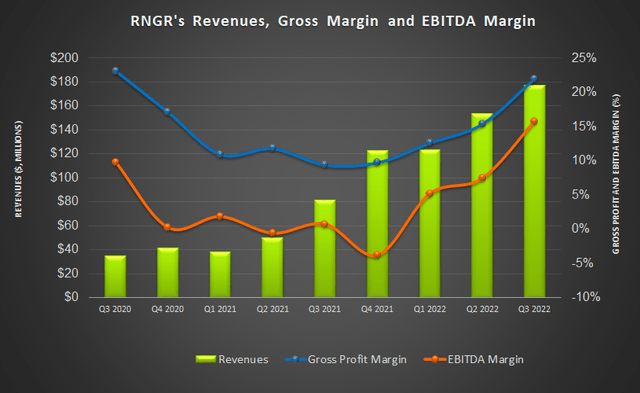

The FY2022 Guidance

According to the most recent update, in FY2022, RNGR’s management expects to generate $618 million in revenues (at the guidance mid-point), which would be 111% higher than FY2021. This would also be higher than the previous guidance for the year. The adjusted EBITDA margin of 13% aligns with the previous guidance.

However, in Q4, the company’s topline and operating profit may get adversely affected by seasonality and holiday impacts. The adjusted EBITDA margin may contract to 15% in Q4 compared to 17% in Q3. So, compared to Q3, revenues could decline by “mid-to-high single-digit” percentages.

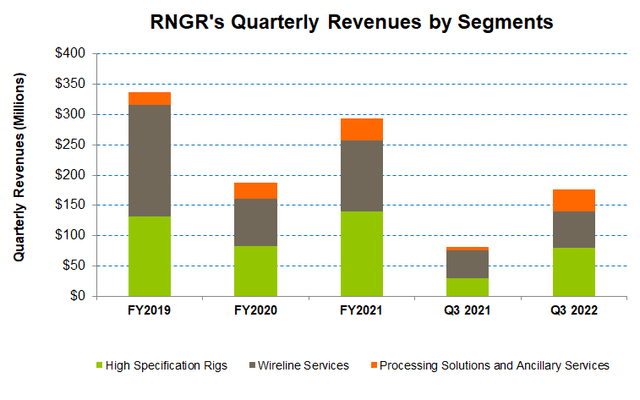

Explaining Q3 Segment Performance And Outlook

In Q3, the High Specification Rigs segment performed strongly compared to a year ago (revenues up by 167%). Rates on a blended basis had an impressive run in Q3 compared to the past few quarters. As a result, the segment generated a $9.2 million operating profit versus zero profit in Q3 2021. The management expects rates to remain stable, which can result in additional revenue generation in 2023. The operating margin also expanded compared to Q2 2022 because the company eliminated some unplanned charges it incurred in Q2.

The Wireline Services segment saw 33% year-over-year revenue growth, while its operating loss, incurred a year ago, turned to an $8.6 million loss in Q3 2022. It benefited from leadership changes, improved service quality, and asset redeployment. In Q4 and early 2023, the segment performance can be adversely affected by the northern operations’ seasonality. However, after Q1, industry activity can pick up, and the company’s wireline assets may see growth and utilization.

In the Processing Solutions and Ancillary Services segment, revenue witnessed tremendous growth year-over-year in Q3 2022, while the operating margin improved equally impressively. Sharp increases in the coiled tubing, rental and fishing businesses were firm in Q3. The gains from the company’s acquisition in 2021 contributed to improved results in this segment.

Cash Flows And Leverage

Ranger’s November 2022 Investor Presentation

RNGR’s debt-to-equity was 0.17x as of September 30, 2022. Its debt-to-equity ratio declined in Q3 as it focused on managing working capital and sold surplus assets. Its liquidity was $35.7 million as of September 30, 2022. So, with low leverage, the financial risks are down in the short term.

In 9M 2022, the company’s cash flow from operations (or CFO) decreased by 21% compared to a year ago due to an increase in contract assets. So, its free cash flow (or FCF) nearly halved in the past year.

Target Price And Relative Valuation

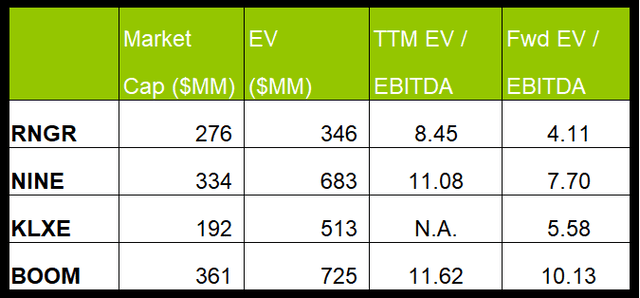

Two sell-side analysts rated RNGR a “buy” over the past 90 days, while two recommended a “Hold.” None recommended a “Sell.” The stock’s return potential using the sell-side analysts’ expected returns is 45% at the current price.

RNGR’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is steeper than peers. This typically results in a higher EV/EBITDA multiple than the peers. The company’s EV/EBITDA multiple (8.5x) is lower than its peers’ (NINE, KLXE, and BOOM) average. So, the stock is undervalued versus its peers at this level.

What’s The Take On RNGR?

Over the past few years, RNGR added capacity through asset and business acquisitions without making significant capital outlays. It also strengthened its wireline services through the PerfX and XConnect acquisitions. It has the highest active high-spec rig count in the US in the wells servicing space. Since 2021, its revenues and operating profit margin inflated massively following Basic Energy’s well servicing, fishing and rental, and coiled tubing acquisition.

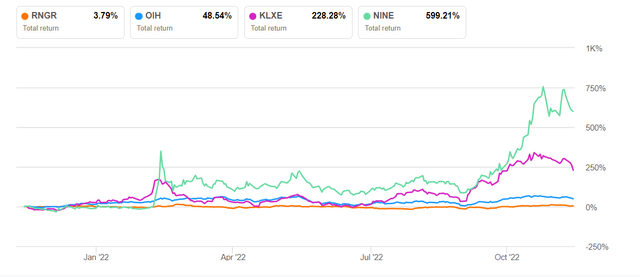

Although cash flows fell in 9M 2022, its debt-to-equity ratio is relatively low, thus alleviating any financial concerns. However, operators’ capex budget constraints, economic recession, and seasonality in the US operations can slow growth in Q4 and early 2023. So, the stock underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. Nonetheless, given the low relative valuation, investors can expect steady returns from the stock in the medium term.

Be the first to comment