Joey Ingelhart/E+ via Getty Images

Range Resources Corporation (NYSE:RRC) is one of the largest producers of natural gas and natural gas liquids in the United States. This has generally been a good place to be over the past year or so as natural gas prices have surged substantially along with crude oil prices. We can certainly see this in Range Resources’ stock price, which has surged a tremendous 125.69% over the past twelve months. This is perhaps even more remarkable given the weakness elsewhere in the market.

Fortunately, this is not likely to be a short-term thing, either, as the fundamentals for natural gas are quite strong and generally support rising prices over time. We can see the impact of these high natural gas prices as Range Resources’ first-quarter earnings results were quite solid, although the company did post a fairly large derivative-related loss. Overall, though, there are still a lot of reasons to either add Range Resources to your portfolio or continue to hold an existing position, particularly considering the company’s incredibly attractive valuation.

About Range Resources

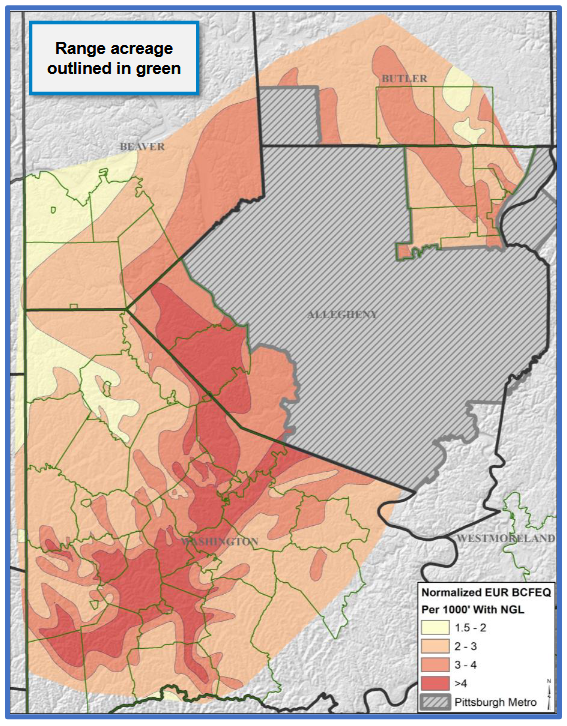

As stated in the introduction, Range Resources is one of the largest producers of natural gas and natural gas liquids in the United States. The company is one of the few pure-play producers of these resources, which could make it attractive to someone looking to make a bet on natural gas specifically, without worrying about crude oil. There may be some reasons to do this because natural gas has much stronger fundamentals than crude oil, which we will discuss later. Range Resources operates exclusively in Appalachia, which is also somewhat unique:

Range Resources

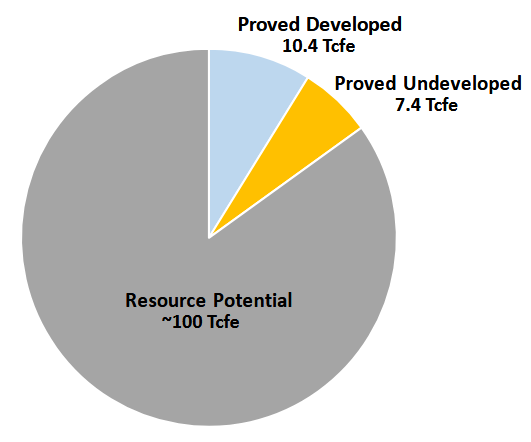

As we can see, Range Resources controls approximately 460,000 acres in the Southwestern Pennsylvania counties surrounding Pittsburgh. This is a good place to be as it is some of the most mineral-rich acreages in the Marcellus natural gas trend, which was estimated to contain about 148.7 trillion cubic feet of natural gas by the United States Energy Information Administration. The wealth of this acreage is clearly shown in Range Resources’ reserves. As of the end of 2021, Range Resources boasted proved reserves totaling 17.8 trillion cubic feet of natural gas equivalent, although its acreage may contain substantially more natural gas than that:

Range Resources

An energy company’s reserves are something that is often overlooked but they are critically important. This is because the energy industry is an extractive one by its very nature. After all, these companies obtain their products by pulling them out of reservoirs in the ground. These reservoirs only contain a finite quantity of resources so the natural gas company must continually acquire new resources or it will eventually run out of product to sell. At its current rate of production, Range Resources has sufficient reserves to operate for about fifteen years. This is longer than any other company in Appalachia and is longer than many of the energy majors. This is something that should prove comforting to investors that are looking for long-term sustainable operations.

The company’s reserves also give us one indication that Range Resources is significantly undervalued at today’s price. This is because the present value of these reserves is $19.10 billion when discounted at a 10% rate, which is the standard method for valuing an energy company’s reserves. This works out to $60 per share, net of Range Resources’ debt. As of the time of writing, Range Resources trades for $34.44 so this metric appears to be suggesting that the company’s stock is 42.60% undervalued today.

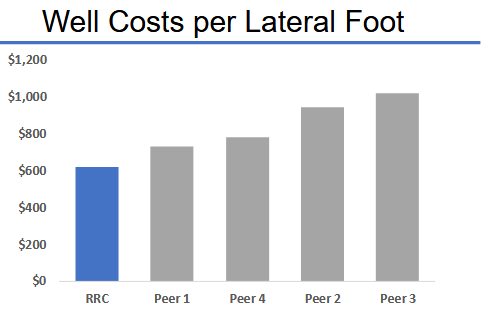

Another advantage of the high quality of Range Resources’ acreage is that it helps the company keep costs down. This is particularly true with respect to drilling costs, which tend to be a major cost of production. During the most recent quarter, it cost Range Resources about $600 per drilled foot, which is the lowest of any operator in Appalachia:

Range Resources

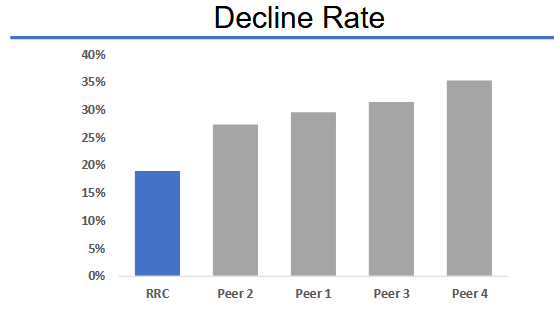

The company’s ability to keep drilling costs down is particularly important considering one of the biggest problems with North American shale production. As I discussed in various previous articles, wells drilled into these plays tend to suffer from very high decline rates. Basically, the production of any given well tends to decline very quickly after it is first drilled. This forces North American producers to continually drill new wells in order to simply maintain, let alone grow, output. This is an expensive prospect, that is one reason why the American energy industry has been one of the largest issuers of junk debt in the years since the financial crisis. Thus, Range Resources’ ability to keep drilling costs down is quite appealing. With that said, the high quality of the company’s acreage gives it another advantage over its peers. Range Resources’ wells average a 20% decline rate, which is also the lowest out of its peers:

Range Resources

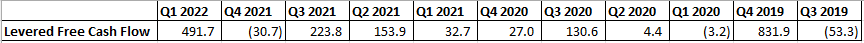

This has positioned Range Resources to have some of the highest margins out of its peer group and to be one of the only operators in Appalachia to be consistently free cash flow positive. Indeed, as we can see here, Range Resources has only failed to generate positive free cash flow in three of the past eleven quarters:

Author

This is something that is quite nice to see when we consider that free cash flow is the money that is ultimately available to benefit the shareholders. After all, this is the money that is left over from the firm’s ordinary operations after it pays all its bills and covers all capital investments. Thus, this is the money that can be used to pay down debt, buy back stock, or pay a dividend, all of which benefit shareholders.

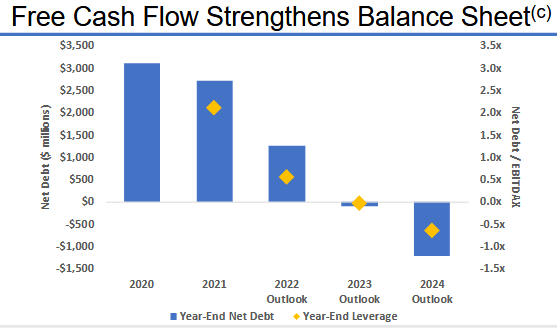

One of the things that Range Resources has been using its free cash flow to do is to pay down its debt, which could be critically important given the disruptions that we have seen in the energy markets over the past few years. We can see this by looking at the company’s leverage ratio, which is also known as the net debt-to-trailing twelve-month EBITDAX ratio. This ratio essentially tells us the amount of time that it would take the company to completely pay off its debt if it were to devote all its pre-tax cash flow to that task.

As I pointed out in various previous articles, I ideally like to see this ratio at under 1.0x for an upstream company and unfortunately, Range Resources is not quite there yet. At the end of the first quarter of 2022, the company had a leverage ratio of 1.6x based on its trailing twelve-month EBITDAX. This represents a significant improvement over the year-end 2021 figures and the company is on track to reduce its leverage ratio to well under 1.0x by the end of 2022 and eliminate its debt completely in 2024:

Range Resources

This represents a marked improvement over the company’s guidance that was provided at the end of 2021, which I discussed in my last article on the company. As we can see above, Range Resources’ free cash flow improved substantially in the first quarter of 2021 compared to any previous quarter due largely to higher natural gas prices. As we will see shortly too, there is no reason to expect gas prices to decline in the near future, which should allow the company to keep its cash flow up. This is a situation that should benefit shareholders, particularly once it pays off the debt. At that point, we may see the company reinstate its dividend, perhaps a substantial one, similar to what other energy companies such as Continental Resources (CLR) have done. Any investor should be able to appreciate this.

Fundamentals Of Natural Gas

As stated earlier, the fundamentals for natural gas are quite positive and supportive of continual high prices. This is true both domestically and abroad and is largely driven by concerns about climate change. These concerns have been incentivizing governments to take a variety of actions that are meant to reduce the carbon emissions of their respective nations. One of the most popular of these strategies is to encourage the retirement of coal-fired power plants, which are then replaced with renewables and natural gas-powered ones. In fact, as I have pointed out many times in the past (including in my last article on Range Resources), the International Energy Agency projects that this will increase the global demand for natural gas by 29% over the next twenty years.

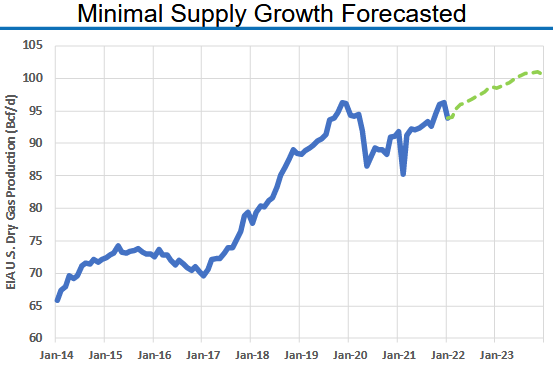

However, the global production of natural gas is unlikely to increase to that degree. The United States is one of the few regions of the world that is able to significantly increase its production of natural gas due to the wealth of regions like the Marcellus shale. Unfortunately, the United States Energy Information Administration does not project sufficient supply growth to satisfy this demand. In fact, the agency projects that natural gas production will increase only 2.4 billion cubic feet this year and 2.0 billion cubic feet in 2023, for a total increase of only five billion cubic feet per day over the 2019 to 2023 period:

Range Resources/Data from EIA

Meanwhile, the nation’s exports of natural gas have increased by 48% in 2022 alone, which easily outpaces the meager production growth. There are a few reasons for this, including the liquefied natural gas production facilities that have come online recently and growing demand from Asia due to the re-opening of many economies. We also have an increasing reluctance of American producers to boost their output. As I stated in a previous article, there are several companies, including Range Resources, that are content to simply hold production steady and maximize free cash flow instead of delivering production growth. We, therefore, have a situation in which the demand for natural gas is growing more rapidly than the supply. The laws of economics tell us that leads to rising prices. Obviously, this situation should benefit Range Resources.

Valuation

It is always critical that we do not overpay for any investment in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on it. We have already seen that Range Resources appears to be significantly undervalued relative to the value of its reserves, but there is another way to value an independent energy company like this one. That is by using a metric known as the price-to-earnings growth ratio. This is a modified version of the familiar price-to-earnings ratio that takes the company’s earnings per share growth into account. Generally, a price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to its earnings per share growth rate and vice versa.

According to Zacks Investment Research, Range Resources will grow its earnings per share at a 28.40% rate over the next three to five years. This gives the stock a price-to-earnings growth ratio of 0.26 at the current price. This alone is a sign that the stock may be undervalued at the current level. The stock also appears to be significantly undervalued relative to its peers:

|

Company |

PEG Ratio |

|

Range Resources |

0.26 |

|

EQT Corporation (EQT) |

0.54 |

|

Antero Resources (AR) |

NA |

|

Chesapeake Energy (CHK) |

1.14 |

This is a promising sign since it furthers our conclusion that Range Resources could be a good addition to a portfolio at the current price. When we combine this with the company’s stellar first-quarter results and the very promising future for natural gas, we have the makings of an excellent purchase today.

Conclusion

In conclusion, Range Resources has a lot to offer an investor today. It is one of the very few pure-play natural gas producers in the United States, which has allowed it to benefit significantly from high natural gas prices recently. The fundamentals for natural gas point to a strong likelihood of high prices going forward as the demand growth outstrips production growth, which should allow the company to continue to generate strong free cash flow. This has Range Resources now positioned to eliminate its net debt prior to the end of 2024 and the company may reinstate its dividend at that time. When we combine all this with an incredibly attractive valuation, Range Resources deserves a place in anyone’s portfolio.

Be the first to comment