grandriver

A couple of weeks ago, Range Resources (NYSE:RRC) released its results for the third quarter of 2022. Earnings were slightly better than expectations and the market reacted positively with the stock recording a +10% in the following two days. In this article, I will provide an overview of Range Resources Q3 results, and I will explain the reasons why I believe Range Resources is still a BUY opportunity. If you are interested in other oil and gas stocks, you can have a look at my last article on Reconnaissance Energy.

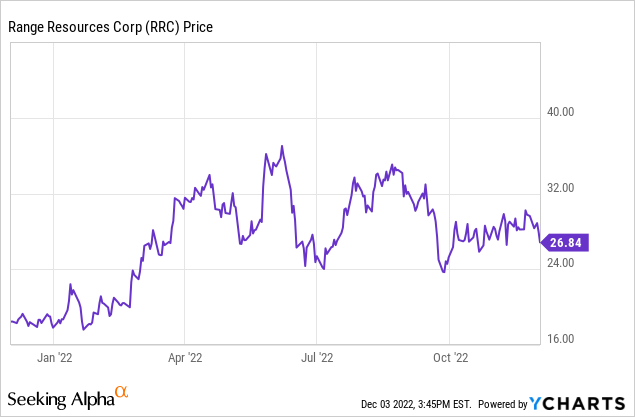

Stock performance

Range Resources is currently trading at $26.84/share, equivalent to a market cap of $6.27bn. As with several other oil and gas stocks, Range Resources is currently up 51% year-to-date and up 45% year-on-year. The 52-week minimum is $17.62/share, recorded on January 21st, 2022, while the 52-week maximum is $37.02/share, on June 7th, 2022.

Q3-2022 production volumes, sales, and costs

Revenues for Q3-2022 were $1.1bn, up 268% (or $808M) versus the same quarter of the previous year (Q3-2021) but down 9% if compared with the three precedent months ($1.2bn in Q2-2022). Sales of natural gas, oil and NGLs accounted for $1.4bn (+69% year-on-year), sales from brokered natural gas were $132M (+26%) while the impact of hedging was -$457M (-30% year-on-year). Comparing Q3-2022 vs Q2-2022, one can see that total revenue decreased by 9% mostly due to a heavier impact of hedging (-$457 M$ in Q3-2022 vs -$239M in Q2): excluding hedging, sales would be up 7%.

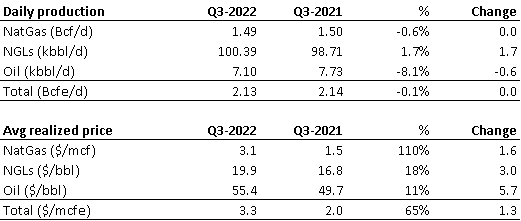

The year-on-year increase in revenues is mostly explained by higher average prices across all products with the average natural gas price increasing by 110% from $1.5/mcf in Q3-2021 to $3.1/mcf in Q3-2022, NGLs price increasing by 18% and oil by 11%. On the contrary, production volumes were stable with the average daily production for Q3-2022 at 2.13 Bcfe per day, just 0.1% more than the previous year. Notably, Q3 production was 3% higher than Q2-2022 and could have been even higher without some unexpected maintenance on some third-party midstream infrastructure.

Range Resources

Total operating expenses for Q3-2022 were $677M, in line with the same quarter of the previous year. The key items are “transportation, processing and compression” costs that increased by 9% to $323M mostly because of higher electricity and fuel prices. The cost for brokered natural gas was $127M, 20% higher than Q3-2021 and resulting in a net brokered natural gas margin of $5.8M or 4.4%. Other relevant costs were general and administrative expenses (4% of total OpEx) and D&A (13% of total OpEx).

Net income was significantly improved year-on-year with Q3-2022 earnings at $373M (vs a $350M loss in Q3-2021). However, the revenue reduction quarter-on-quarter and the stable OpEx means that Q3-2022 earnings are ca 17% lower than Q2-2022.

Cash flows and debt

Cash flow from operations was $1.2bn, ca $750M more than in the same quarter of the previous year (+164%) and was mostly driven by high commodity prices. Cash flow from investing was negative at -$374M mostly due to the addition of natural gas properties (-$351M) and acreage purchase (-$24M). Cash flow from financing was -$934M with Range Resources that carried some debt restructuring initiatives:

- Issuance of senior notes due 2030 for $500M (4.75% interest)

- Prepayment of senior notes due 2026 for $850M

- Repayment of senior notes due 2022 for $217M

At the end of Q3-2022, Range Resources has a cash and cash equivalent position of $157M and a total debt of $2.35bn resulting in a net debt of $2.2bn, 35% of the market capitalization. Despite net debt being reduced by $0.2bn quarter-on-quarter, Range Resources’ top management wants to further reduce the indebtedness and is targeting a $1.0-1.5bn debt level.

Buyback and dividends

In October, Range Resources’ board of directors approved the increase of the stock repurchase program by $1bn bringing it to a total of $1.5bn. The company’s top management believes that the stock is currently undervalued and therefore, a buyback program represents a compelling investment.

During Q3, 5.7M shares were repurchased at an average price of $29.41/share, equivalent to $167M. So far, 20.8M shares have been bought back for a total consideration of $343M.

Moreover, in September, Range Resources started the payment of a quarterly dividend of $0.08 per share ($19.5M) and I believe that the distribution could slightly increase in the next quarters.

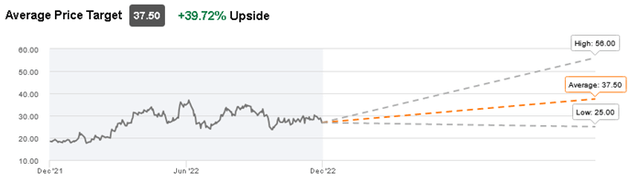

Wall Street consensus overview

Range Resources is currently covered by 25 analysts with 13 recommending a HOLD position and 10 analysts giving a BUY/STRONG BUY recommendation. However, it is worth mentioning that the consensus moved from HOLD to BUY after Range Resources released its Q3 results. The average target price is $37.50/share which would represent a ca 40% upside versus the current stock price.

Range Resources is BUY

The company has a robust financial position and is following a well-defined path to further reduce debt and bring leverage down to more reasonable levels in line with peers. The assets in the Marcellus Shale allow the company to maintain constant production at least for the next ten years thus providing the basis for a strong FCF generation. Overall, my view on Range Resources is positive and I believe that $26.84/share is an entry price that gives the possibility to capture further upside movements.

Be the first to comment