Dilok Klaisataporn

Introduction

I recently started monitoring the Human Resource and Employment Service Industry as I think it offers an interesting and always updated point of view on the labor market and, more in general, on the development of the economic cycle. Given the attention investors are paying to any sign of a possible economic slowdown and an eventual recession, many are trying to figure out the ifs, whens and hows of this upcoming part of the economic cycle. Companies in the HR and the ES are among the first ones to understand the underlying economic trends. I covered both Adecco (OTCPK:AHEXY, OTCPK:AHEXF) and ManpowerGroup (NYSE:MAN) in the past quarter pointing out how the two had seen quite a sell-off from their highs. However, while Adecco seemed to me to have reached a bottom, trading at its 2009 and 2020 lows, my valuation for ManpowerGroup was that the company was trading at its fair value in case of no recession in the future years. The possibility of a recession, in my opinion, was still not fully priced in.

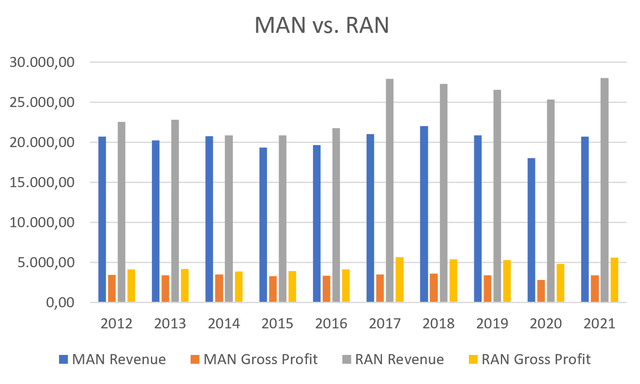

Now, this time I would like to turn to Dutch Randstad (OTCPK:RANJY, OTCPK:RANJF), that just reported its Q2 2022 earnings. I will run my analysis by comparing it to ManpowerGroup’s recently reported earnings, in order to get a feeling of how the industry leaders are faring. Until a few years ago, ManpowerGroup was the industry leader until the beginning of the last decade, but Randstad has managed to surpass it and keep on growing, while the first one, as I already outlined in my previous article, stopped growing. A key point was the 2016 acquisition of Monster Worldwide by Randstad. However, this added only approximately $650-700 million in yearly revenue while we see that from 2017 Randstad’s revenue and gross profit sped up, leaving ManpowerGroup (and Adecco) behind.

Author, with data from Seeking Alpha

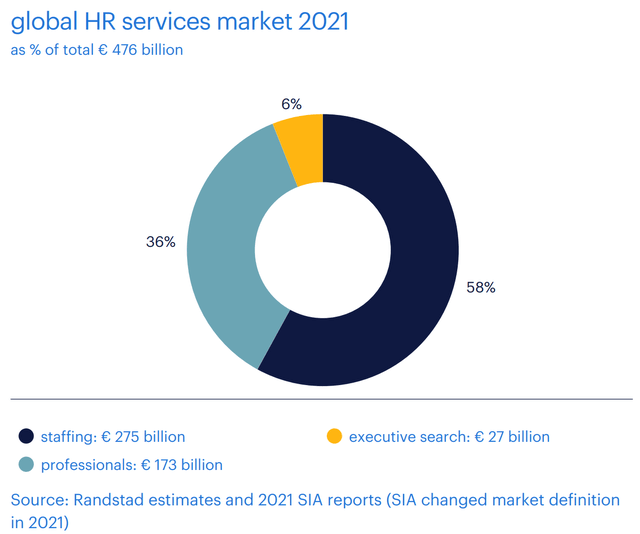

The Market

The addressable market is huge and it is estimated to be a little less than half a trillion, as shown in the graph below. More than half focuses on staffing, which is the most sought for service by many companies as it enables them to have a flexible workforce always on par with their real needs.

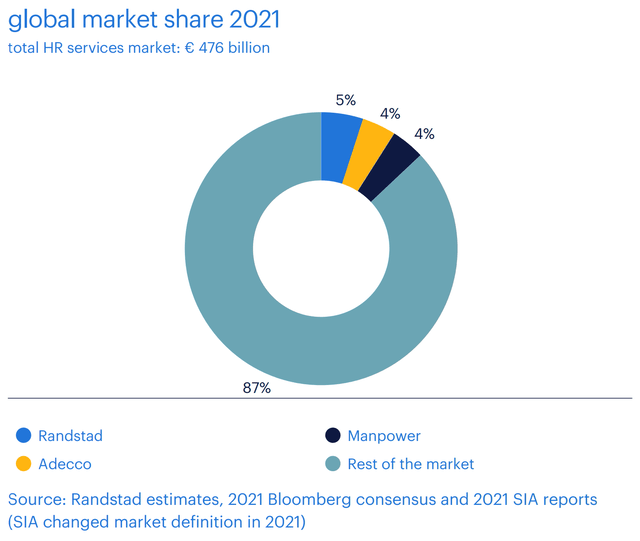

Another characteristic of the market is that it is high fragmented as the three main competitors only hold together a 13% share. This is due to the fact that there is really no real entry barrier that prevents new and local competitors from springing up as most of the business is run through employees who know their territory and the companies in it and know how to deal with the local labor market.

Given this kind of market composition, Randstad is very active on M&As and from September 2021 the company has already announced 4 acquisitions:

- Cella Inc. in the U.S.

- Hudson Benelux in Belgium

- Side in France

- Finite Group in Australia and New Zealand

In the meantime, ManpowerGroup completed only the acquisition of ettain group.

Q2 2022 Results

Let’s take a look at how the two competitors are currently doing.

Randstad

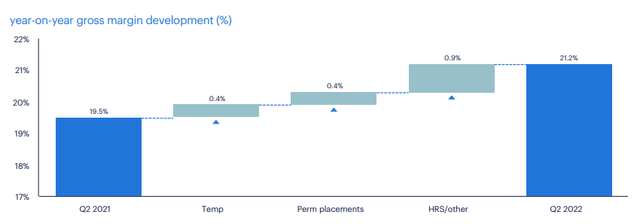

The Netherland-based company posted good and improving results for the quarter and for the first half of the year. Its quarterly revenue increased by 9% from €6.01 billion to €6.89. Along with an increased revenue, which is a data that, with the current economic environment could just be boosted by inflation, Randstad was able to increase both its EBITA and its profit margin, showing a company that is able to retain a larger part of its revenue, reaching thus the goal of increasing its free cash flow. As we can see from the slide below, Randstad was able to increase its gross margin on all three of its main branches (temporary placement, permanent placement, HR services) which is a sign of a healthy overall business.

Randstad Q2 Results Presentation

As reported, Randstad’s EBITA increased organically by 13% YoY to €308 million. EBITA margin reached 4.5% in the quarter, 0.2% above Q2 2021. Overall, Randstad achieved a 28% organic incremental conversion on a last four quarter basis in Q2 2022.

As we will see also with ManpowerGroup, Randstad has been affected by currency effects with a larger than usual impact. However, with the strengthening of the USD, Randstad was positively impacted as its currency is the EUR. For example, currency effects had a positive €51 million impact on gross profit compared to Q2 2021.

Randstad’s adjusted net income was up 21% YoY to €230 million with EPS up to €1.25 from €1.03 YoY. There was also a small decrease in the outstanding shares which, at the end of Q2, were 183.7 million compared to last year’s 185.0 million.

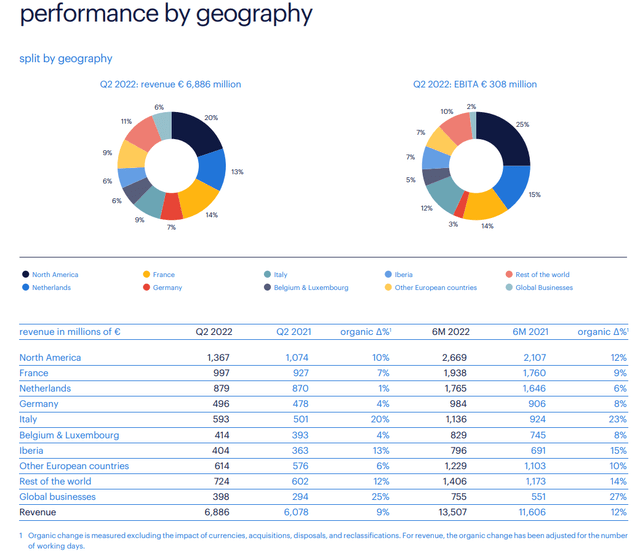

Let’s take a look at Randstad’s geographical diversification. The company doesn’t rely for more than 20% on any particular country, with the U.S. being the source of 20% percent of the revenue and 25% of the EBITA. The Netherlands and France come in very close together at second and third place. The real surprise is Italy, which, for Randstad, is a more important country than Germany, both from a revenue perspective (9% vs. 7%) and, even more, from an EBITA one with a 12% vs. 3%.

The company did point out this strong performance which is being recorded since the late 2020, as shown below.

Randstad Q2 Results Presentation

At the moment, Italy is for Randstad the country with the highest margin, higher even than the U.S. and the Nordic countries, which are usually known for higher margins. This situation can be explained by the strong economic recovery that Italy saw last year (2021 GDP +6.6%) after the pandemic which is still running across many sectors. I don’t know if this situation will last, but the strong rebound in tourism and the European Recovery and Resilience Plan should support the country even in case a recession.

Now, getting back to Randstad as a whole, investors should know that the Group usually generates its strongest revenue and profits in the second half of the year, while the cash flow in the second quarters is usually negative due to the timing of payments of dividend and holiday allowances. This is why we see Randstad posting a decrease in its FCF for the quarter from €78 million to €55 million. However, if we combine the first two quarters of the year together, FCF is up from €82 million to €188 (+129% YoY). Usually, Randstad and its peers tend to have the strongest cash flow in the second half of the year, so we can expect outstanding results by the end of the year, given the fact that during the earnings presentation, Randstad management said that it is seeing a strong July and still sees the problem of talent scarcity across many industries.

We should also keep in mind that in case of a mild recession, staffing companies could actually see an increase in their revenue due to the need for flexible workers that many companies may have. It is, in fact, likely that, instead of hiring permanent workers, in an environment of uncertainty, many companies may actually choose to postpone hiring while addressing their productivity needs with temporary solutions.

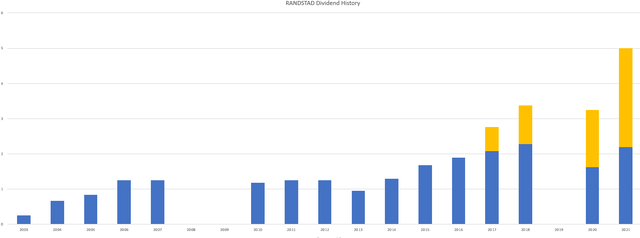

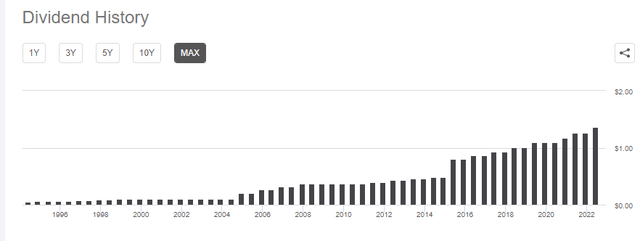

But, let’s get back to FCF. Randstad has a policy that aims at rewarding shareholders both through dividends and, sometimes, through share buybacks. As many European companies, Randstad is not mainly focused on keeping its dividend stable and growing. As we can see, during the financial crisis, the company suspended it in order to preserve cash. In the same manner, it suspended its 2019 dividend that was supposed to be paid in 2020 in order to face the Covid-19 crisis. However, over the long term, we see a dividend that is indeed growing (from €0.25 in 2003 to €5 this year) and that, in the last five years, has become semi-annual with an ordinary dividend paid in April and a special dividend paid in October. Non-Dutch investors should, in any case, know that the Dutch dividend tax is 15%.

Author with data from Randstad Investor Relations

ManpowerGroup

On the other side, ManpowerGroup’s earnings must be understood from a currency perspective. In fact, since the company’s currency is the U.S. dollar, and given the fact that most of its revenue comes from outside the U.S., the results were greatly affected by the rally of the dollar in the recent months, which clearly decreased the revenue coming from non-USD regions.

The revenue for the quarter declined by -3.8% YoY coming in at $5.07 billion versus $5.28 billion last year. The operating profit was $180 million, up 6.3% YoY. Net EPS were also up YoY at $2.29 from $2.02.

From a geographical perspective, while the revenue from U.S. was up 43.7% YoY, Europe saw a slowdown, with southern Europe down 8.1% and northern Europe down 13.7%. However, on a constant currency basis, southern Europe would have been up 4.1%, while northern Europe would have been down only by 2.4%. The countries with the best operating profit for ManpowerGroup are the U.S. with $64 million (70% operating profit) and Italy which contributed with $35 million (12% operating profit, 27% constant currency. The other geographies were either down or flat, given the appreciation of the dollar.

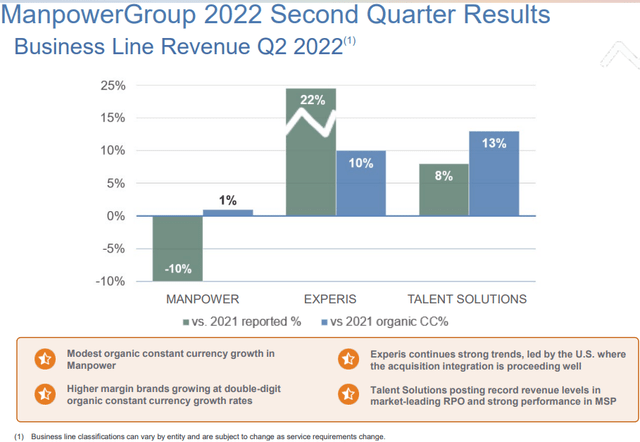

As we can see from the slide below, on constant currency ManpowerGroup did grow YoY in all its three main branches, even though ManpowerGroup registered only modest growth.

ManpowerGroup Q2 2022 Results Presentation

However, since the U.S. dollar appreciated very rapidly against the euro and other currencies, ManpowerGroup saw its revenue greatly chopped, resulting in a -10% for ManpowerGroup and a 12% decrease for Experis, whose revenue could have reached a +22% instead of the actual 10% it did.

As expected, this was one of the main themes discussed in the recent Q2 earnings call.

Jack McGinnis, ManpowerGroup’s CFO, explained this quite clearly:

Due to the significant strengthening of the dollar, particularly against the euro, year-over-year foreign currency movements had a much bigger impact than usual on our results. This drove an almost 10% swing between the U.S. dollar reported revenue trend and the constant currency related growth rate. After adjusting for the negative impact of foreign exchange rates, our constant currency revenue increased 6%.

I think the decline in revenue and operating profit can’t be blamed on poor performance of the company, since it is clear that it comes from FX dynamics ManpowerGroup can’t control. Furthermore, we are still seeing very strong U.S. performance which made the company state during its last earnings call that it still sees a very healthy labor market. Furthermore, some news were given regarding wage inflation which seems to be more stable. This could possibly be another sign that we have reached the peak and that now inflation should come slowly down.

the U.S. economy is very strong. Labor markets are very strong, but as you will have noted as we discussed in our last earnings call, wage inflation appears to be sitting around 5% and not moving higher in any discernible way.

Furthermore, ManpowerGroup confirmed what many are seeing: pent-up demand is somewhat a protection against a mild recession as it spreads out work, revenue and earnings across a wider timespan, producing consistent and reliable results in the next quarters for many companies:

many of our clients are quite concerned about the economic outlook on the one hand, but when we ask them how they are feeling about their own business, they are saying that they are still working through the pent-up demand from the pandemic that they are looking for more talent, they are looking for our help in more ways than we were able to provide them even before the pandemic.

Now, from a dividend point of view, ManpowerGroup is clearly an American company with a stable and growing dividend that has been paid in every economic condition, as shown from the graph below.

Valuation

After the 2Q results I confirm my valuation of ManpowerGroup, considering it at fair value in case we think five years of constant economic expansion. If we do incur into a recession, technical or deep it may be, I don’t think the stock is still discounting it fully, not giving me a margin of safety I am comfortable with. This is why I rate it once again as a hold. ManpowerGroup has an advantage over Randstad: its dividend history. In case of a recession, investors might want to turn to the company’s reliability in order to build a constant stream of income.

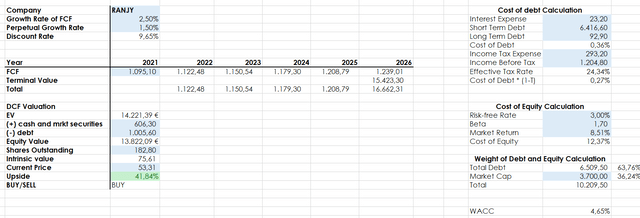

Regarding Randstad, here is my discounted cash flow model.

Starting from the 2021 FCF I projected the next five years with an expected growth rate of 2.5%. I think this is conservative, given the strong results Randstad is posting. However, things may indeed slow down and, given the industry we are talking about and the needs to consolidate a leadership position through acquisitions, I am not expecting FCF to grow at a staggering pace for five years. Randstad’s WACC is around 4,65%. I usually start from here and then charge an additional 5% to get my discount rate.

I think that, as we can see from the model below, it is the most undervalued company among the three industry leaders, with a 41% upside in case of no recession.

Author, with data from Seeking Alpha

To this results investors should keep in mind that Randstad is any case yielding just shy of 10%. For investors who haven’t hold Randstad this spring and have thus missed the regular dividend, in October Randstad is planning on distributing a special dividend of €2.81 which is still a 5.2% yield for this year. The dividend has been proposed, but it is still to be approved. However, Randstad has usually been able to pay all the special dividends that were proposed in the past years.

As with ManpowerGroup, Randstad, too is subject to a tightening economic cycle that could slow down needs for employees and HR services. However, as said before, in some case a recession could benefit Randstad in case employers still see economic activity but are not willing to hire permanently. In this case, the need for flexibility should support Randstad’s results.

Conclusion

While I keep my hold rating on ManpowerGroup, I rate Randstad as a buy, as the company is the one that is committed the most on growing and consolidating the industry, while driving up its industry leader margins.

Be the first to comment