Editor’s note: Seeking Alpha is proud to welcome Bernhard Kainz as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Timon Schneider/iStock Editorial via Getty Images

Investment thesis

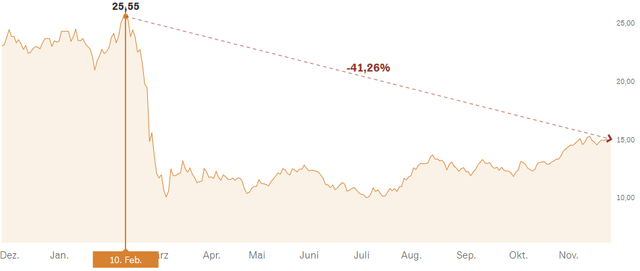

The deterioration in the share price of Raiffeisen Bank International (OTCPK:RAIFF), or RBI, in 2022 due to the conflict in Ukraine is not supported by how the bank’s business is performing. While the stock is down more than 40% YTD, both revenue and income have improved significantly this year with a 42% increase in net interest income and a 99% increase in net commission income.

The share price might not move upwards until a resolution to the Ukraine conflict is visible, so investors need patience. There is a possible significant reward ahead though; the share price could double if it just went back to where it was before the start of the conflict.

Overview of the Bank

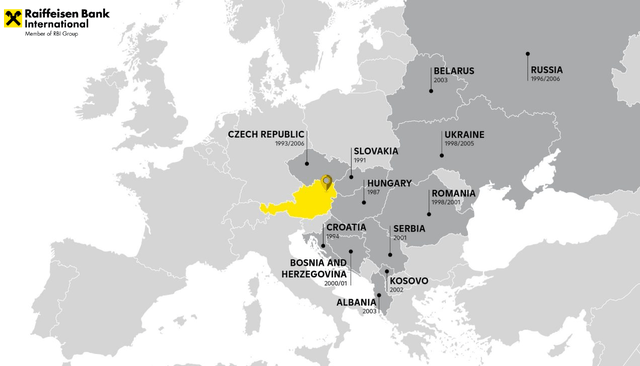

RBI is headquartered in Austria and considers Austria, where it is a leading commercial and investment bank, and Central and Eastern Europe, as its home market. 14 countries in the region are covered by subsidiary banks. RBI provides corporate, retail and investment banking services. The Group also includes numerous other financial services companies, especially in leasing, asset management, and insurance. It has around 17.2 million customers and 44,000 employees. Over the past years, Russia in particular has been something like the cash cow of the Group. This has depressed the share price even before the Ukraine conflict due to the perceived currency risk.

RBI markets in Central and Eastern Europe (Raiffeisen Bank International)

Ukraine conflict has adversely affected the share price

RBI shares have dropped 60% in the immediate weeks after the war in Ukraine started. They have since recovered somewhat, moving upwards with the market in recent months, but are still down more than 40% since February:

Raiffeisen Bank International (OTCPK:RAIFF) (Data: Handelsblatt) Raiffeisen Bank International (OTCPK:RAIFF) (Data: Handelsblatt)

Revenue and profit have grown very positively though

While the war in Ukraine and the situation in Russia have affected the share price, they did not have a negative impact on RBI’s business so far. On the contrary, Q1-Q3 2022 profit was EUR 2,801 million, a 165% YoY increase over the same period in 2021. Without Russia and Belarus, and a one-time gain from the sale of Raiffeisenbank Bulgaria, Q1-Q3 profit was EUR 822 million.

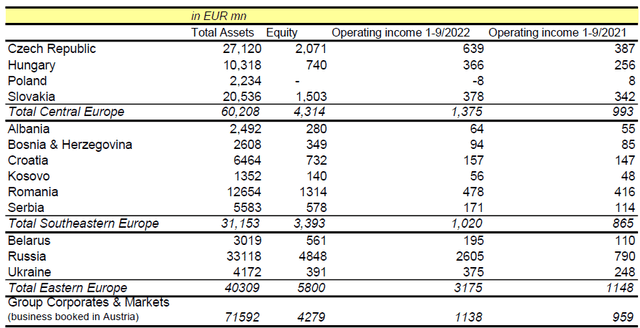

After record results in Q2, RBI again outperformed in Q3 2022. Q3 quarterly profit was EUR 1.1 billion (Q3 net profit in the previous year was EUR 443 million), clearly exceeding market expectations. This was driven by increases in net commission income (NCI) and net interest income (NII) in all markets, but there was an extremely strong contribution from the Russian subsidiary. Guidance for 2022 is for the positive development in the first 9M to continue in Q4. The data in the table below is assembled from the Q3 report:

Q1-Q3 Assets, equity and income across the 14 countries (Raiffeisen Bank International)

Some notes on the numbers in the table:

- RBI uses the following geographic segmentation for reporting: Central Europe (Czech Republic, Hungary, Poland, and Slovakia), Southeastern Europe (Albania, Bosnia & Herzegovina, Croatia, Kosovo, Romania, and Serbia), Eastern Europe (Belarus, Russia and Ukraine) and Group Corporates & Markets (which stands for the business booked in Austria).

- In Poland, RBI exclusively renders services related to the portfolio transferred from the operations of former Raiffeisen Bank Polska S.A., following the sale of its core banking operations to BNP Paribas in 2018. The portfolio is mainly comprised of foreign currency retail mortgage loans. No deposit taking or new customer business is offered or conducted.

- Seven of the 14 countries are EU members (Austria, Czech Republic, Hungary, Poland, Slovakia, Croatia, and Romania). About 60% of the equity is here. Two countries (Serbia and Albania) are EU membership candidates. They are going through the negotiation process of joining the EU, but this can still take a few years to complete. Two more countries (Kosovo and Bosnia & Herzegovina) are designated as ‘potential EU candidates’. For them EU membership could be more than 10 years away and is not assured. Together the four countries which are in process of joining the EU have around 7% of the Group equity.

- This leaves the free Eastern Europe countries Russia, Belarus, and Ukraine with around 33% of Group equity. (RBI management has clearly stated that under all circumstances they want to continue the business in Ukraine.)

Valuation – RBI seems undervalued

RBI seems very cheap, and I think this becomes apparent when a few data points are considered:

- The current share price of EUR 14.99 (as of December 3, 2022) compares to a Q1-Q3 profit of EUR 8.31 per share. Annualized, the PE ratio would be 1.3 including Russia and Belarus, and 4.6 without those two countries (and a one-time gain from the sale of the subsidiary in Bulgaria).

- As of September 30, 2022, the book value per share was EUR 50.76. The current share price is less than a third of the book value per share. This again seems very low. The share price would still be less than 50% of book value if equity in Russia is discarded.

- The Russian equity includes EUR 1,420 million that cannot be distributed in the form of dividends due to current Russian regulations. This is around EUR 3.7 per share, almost 25% of the current share price.

Options for the future of Raiffeisenbank Russia

But there is the Russian situation and RBI management says that they are assessing all strategic options for the future of Raiffeisenbank Russia. This includes what they call a carefully managed exit. RBI management have been saying this for all of 2022 now, without any tangible outcome so far. My hypothesis is that RBI is reluctant to do anything now and is waiting for relations with Russia to normalize so that business can continue. Given how strong the Russian business is performing, this is probably not such a bad idea. There is currently no political or media pressure in Austria on RBI to do anything drastic. Personally (disclosure: I am Austrian), I do not see this coming, unless there is a significant deterioration of the situation in Ukraine. RBI cannot make any move now anyway due the regulations and restrictions in Russia, which do not allow ownership change for foreign-owned banks.

I therefore think that there is a fair chance that the wait-and-see strategy will work.

What is the situation of the Russian business?

As a matter of fact, RBI is doing quite well in Russia. Raiffeisenbank Russia is the 10th largest bank in Russia in terms of its assets, and it has operated in the country since the collapse of the Soviet Union. In 2021 the American edition of Forbes named Raiffeisenbank as the best bank in Russia. In 2020, Raiffeisenbank topped a list of 100 best banks in the country according to Forbes Russia magazine.

The business in Russia is running very much independent of the Group. New business in Russia was largely abandoned due to the armed conflict with Ukraine and the resulting sanctions against Russia. RBI has no obligation or need to recapitalize; but due to sanctions, profit and dividends are also not accessible and are retained in Russia. Management says that they expect the Russian loan portfolio to remain around the current levels going forward. Risk weighted assets (RWA) decreased EUR 4.5 billion to EUR 22.6 billion in Q3/2022, largely from deposit optimization. Equity and other capital stand at EUR 5.3 billion and are increasing as profit must be retained in the country.

One interesting (I think) piece of information in this context: there are currently almost 300 open job positions on their career portal (career.raiffeisen.ru). To me this does not look like a business that is shutting down.

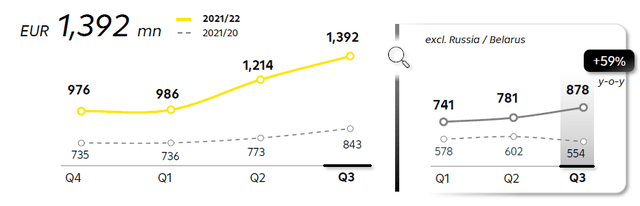

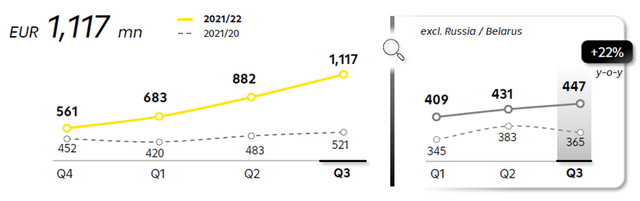

In its Q3 2022 report RBI started clearly breaking out the revenue development of the Group with and without Russia (and Belarus). This shows that 1) the Group is doing well in all its markets, and 2) that the Russian business is not deteriorating; on the contrary. Both NII and NCI are growing quite nicely across all markets:

Quarterly net interest income

Quarterly net fee and commission income

Capital and dividends are clearly above regulatory requirements in any scenario

Common Equity Tier 1 ratio rose to 14.6% in Q3 (transitional, including earnings from Q1-3/22), from 13.4% in Q2/2022. RBI also raised the outlook again for 2022 return on equity (ROE). The Group’s ROE is now expected to be around 25% this year (the previous forecast was: at least 15%).

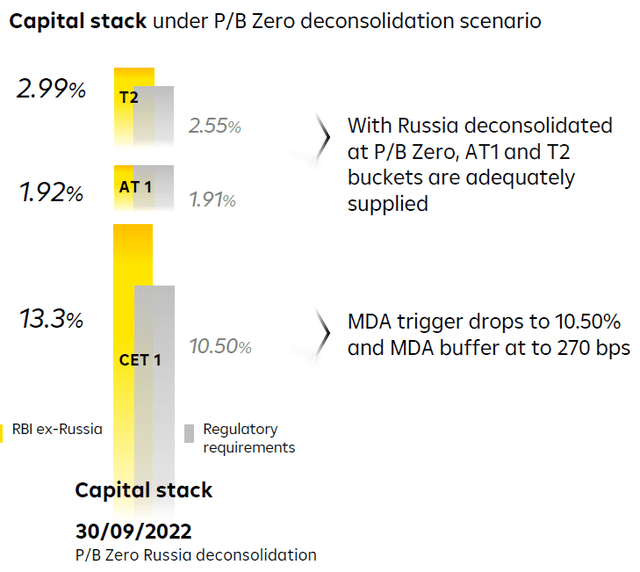

In what RBI calls the ‘P/B Zero deconsolidation’ scenario, where the Russian business is disregarded, the Group CET1 ratio would still be above 13% (as of 30/09/2022: 13.3%), clearly above regulatory requirements:

RBI management has been clear that any decision on dividends will be based on the capital position of the Group excluding Russia. That means there is still room for a dividend, albeit a reduced one. Dividends accrued in Russia can currently not be transferred to the Group. I think we should not expect a dividend of more than EUR 0.5-0.75 while the conflict in the Ukraine is ongoing, so at the current share price the yield would be around 3-5%.

If a high dividend yield is what you are after and you want to invest in European banks, there are better alternatives. In Austria, Erste Group Bank AG (OTCPK:EBKOF) and BAWAG Group (OTCPK:BWAGF) are examples, but there are currently a number of banks across Europe that offer a dividend yield above 6%.

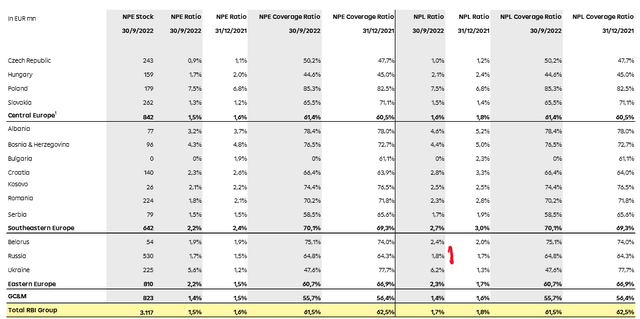

Asset quality and credit risk

Looking at the quality of assets in Russia, also gives a positive view of the business (to me). Below is an overview of non-performing loans and non-performing exposure ratios across the Group:

NPE and NPL distribution per country (Data: RBI Q3 2022 report)

All definitions are according to EBA financial reporting standards; bonds are included in the NPE ratio and excluded from the NPL ratio.

NPL ratio in Russia in only 1.8%, just 10 bps above the Group average and at a level that I consider quite good. Instead of deteriorating as one could have expected, the NPL ratio has improved 10 bps YoY (in line with the Group). I think these are supportive data points regarding the investment thesis that RBI shares are undervalued.

Risks

A deteriorating economic situation in Russia could obviously affect Raiffeisenbank Russia in a negative way. So far, we have not only not seen this, but the opposite: revenue and profit have increased. That does not mean it cannot and will not happen. Arbitrary political decisions in Russia can affect the bank in a negative way, up to a total loss of equity. This would result in the ‘P/B deconsolidation scenario’ being forced upon RBI. While I do not see this coming, it is again a possibility.

There is also a currency risk that should not be overlooked. A decreasing value of the ruble will result in a corresponding reduction in profit for Raiffeisenbank Russia, as seen from the Group point of view. The ruble has been quite stable this year, but I subscribe to the argument due to the special situation which sanctions have created.

A related, but different risk is that the Ukraine conflict goes without a resolution and leaves the situation of Raiffeisenbank Russia undecided. I think on the long run this will probably end in a situation where the market in practice will ignore the Russian business, so again the ‘P/B Zero deconsolidation’ case or something very similar.

Conclusion

The key investment thesis is that the deterioration in RBI’s share price due to the conflict in Ukraine is not supported by how well the Group’s business is performing, resulting in a buy opportunity.

The situation could stay this way though until a resolution to the conflict is visible. My hypothesis is that in case of a longer stalemate, the market will conclude that the Russian business is worthless and will move on.

Until either situation materializes there might not be a trigger that will move the share price significantly. The share price might even retreat to the EUR 10-12 range along with a general market setback, before it moves up. Investors need to have at least a one- or two-year view here. But there is a high probability in my opinion that they will get rewarded.

Be the first to comment