ThitareeSarmkasat/iStock via Getty Images

The recent selling in just about everything has been painful for many investors. 401(k) values are plummeting, and those with poor (or no) risk management strategies are likely seeing massive amounts of red every time they open their brokerage account. This kind of selling can present opportunities, however, and right now, I believe there is an opportunity in the Global X Funds – Global X NASDAQ 100 Covered Call ETF (QYLD).

I’ve covered QYLD before, most recently back in July 2021, when I said it was an alternative way to gain exposure to frothy tech stocks. Today, the situation is altogether different; investors are dumping anything and everything, and once again, I see QYLD as an attractive asset to layer into as a result, but for different reasons.

QYLD – A reminder of the strategy

QYLD is a covered call ETF, meaning it owns underlying stock, and sells at-the-money, or ATM, calls on its positions. I covered this in more detail in my prior pieces on QYLD, so I won’t go through all of it again. If you’d like more detail, the funds covered call primer is a great place to spend a few minutes.

Basically, the fund gives up the upside potential of its positions by selling ATM calls, which generate income. That income is then distributed each month, and has some important benefits in exchange for selling your upside.

For one, QYLD produces better returns than the index during sideways periods and selloffs. There is no downside protection, per se, but the income generated each month does provide some additional cash over and above what you’d get by simply holding the index.

Second, you receive monthly income that is not only quite meaningful at ~1% per month, but it’s reliable. QYLD’s distributions are based on a variety of factors, but one of the bigger ones is certainly volatility. As volatility rises, option premiums increase, and therefore, QYLD reaps bigger rewards for selling ATM calls. More on that in a bit.

Finally, QYLD allows you to execute this strategy without having to do it yourself, which would be time consuming and potentially difficult. If you’re looking for a hands-off way to generate income, that’s where QYLD shines.

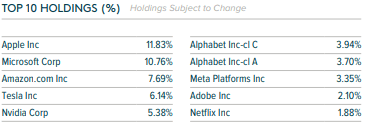

QYLD doesn’t hold the index itself, but it does replicate the index via owning the underlying stocks, which you can see below.

The names on here are no surprise, as QYLD owns them on a market cap-weighted basis, so the usual suspects appear. Despite the indiscriminate selling we’ve seen in recent weeks, I happen to think all of these names have durable business models with long-term upside, so I’m okay with these being the top holdings. If you don’t want to own a bunch of big tech, QYLD isn’t for you, and you should buy something else.

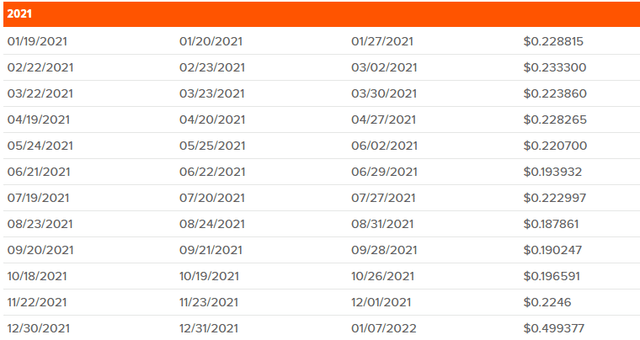

Let’s now take a look at the income generated by QYLD over the full year of 2021. Remember that QYLD pays a distribution every month, so the sum of the columns on the right side is the total distribution for the year.

The sum is $2.86 per share, with a large year-end distribution helping to juice that number. But even if we assumed a normalized distribution for December, we’re still looking at ~$2.60 per share, and on a share price in the $22s, that’s nearly a 12% yield. That’s what you are buying QYLD for, because you can reinvest the proceeds and generate more distributions next month, or you can live off the income.

QYLD – Price action and volatility

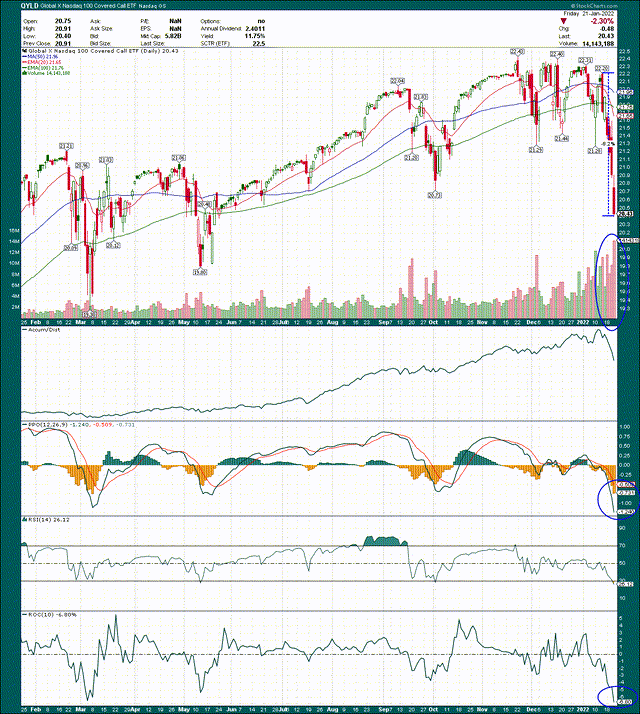

Now, as I mentioned earlier, the fund simply sells upside; it does not protect against selloffs. You can see here just the past couple of weeks has put a nearly double-digit correction on QYLD, and its chart looks every bit as ugly as that of the QQQ/Nasdaq 100.

I won’t go through the chart other than to say the ETF is extremely oversold, but that it could certainly go lower. I don’t see anything that indicates the selling is done, and even when we get a bounce, it is likely to be just that and nothing more. In other words, I think we’re going to see a period of consolidation after the next bounce, so you needn’t rush out and buy this today, unless you’re layering in.

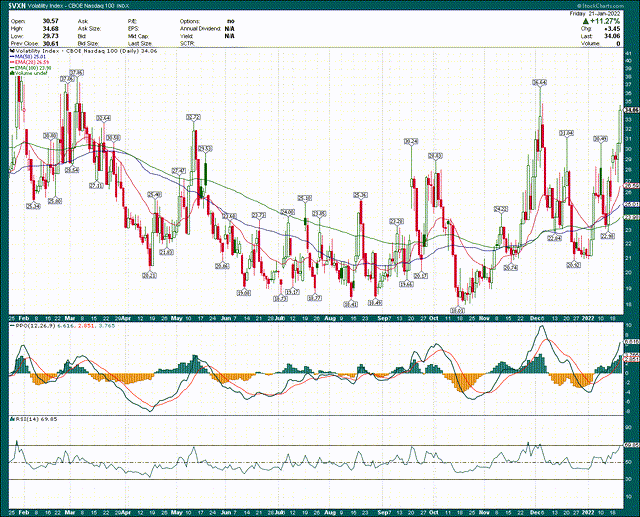

One reason to potentially move a bit quicker than otherwise, however, is the move in volatility we’ve seen. This is the VXN, which is the volatility index for the Nasdaq 100. It’s the same thing as the VIX is for the S&P 500, just Nasdaq 100-specific. It’s also highly relevant to the discussion for QYLD since this largely drives the premiums the fund can collect from the calls it sells.

The VXN hit 35 on Friday, and is almost certain to move higher than that this week with economic news and a slew of big earnings reports due out. This indicates a massive amount of fear in the market, and it drives options prices through the roof.

QYLD is taking advantage of that with its short call positions, so I suspect the January, February, and possibly even March distributions will be larger than normal. We could easily see distributions in the area of 25 cents per share or higher for this period given the move up in volatility, so QYLD’s distribution yield will briefly be higher than normal. Looking further out, selling episodes like what we’re experiencing now tend to have lasting impacts on options prices as volatility gets priced in for months. Again, this will benefit QYLD’s ability to generate premium, and return it to unitholders.

The bottom line on QYLD is that if you’re looking for ways to benefit from this correction, this fund is a great option. My outlook at the moment is that we’ll see a bounce, followed by a rejection at resistance, and then more selling, so QYLD should outperform in such an environment. The only time the index itself is a better choice is during bull markets, and we’re a long way from one of those at the moment. QYLD is a great option in markets such as this, and I like it over the index for that reason.

Be the first to comment