Christian Feldhaar/iStock via Getty Images

I must confess I made a mistake in my prior article about Quipt Home Medical (NASDAQ:QIPT). Specifically, I argued that the major headwinds the company faced in 2021 were behind them, and QIPT had “good times ahead.” While I was correct that the company, fundamentally speaking, has been demonstrating that good times are ahead, I overlooked what I now believe is one final hurdle the company faces related to its stock price: convertible debentures.

I was, of course, aware of these convertible debentures in the back of my mind, but I underestimated the impact their existence would have on the stock price. I thought the company was so significantly undervalued and had shown so much progress in its business that these debentures would not be a big deal. In hindsight, it is clear I underestimated the power of institutional hedging around these types of derivative situations. This hedging allows institutions to make money on the stock by artificially pulling down the share price, and then to make money again on the way back up.

For those who might be thinking that I am just “making excuses” for QIPT share price performance, I can understand the initial skepticism. But let me say that any other explanation of the recent share price nosedive makes little sense from a fundamental valuation standpoint. Furthermore, if this hedging is not the reason for the precipitous share price drop, then it is a strange and unlikely coincidence that QIPT shares dropped to the EXACT conversion price on the EXACT date of the possible forced conversion-roughly 50% below 52-week highs-all while the company’s financial performance is better than ever and highly likely to continue improving!

In any case, I will discuss in this article the convertible debenture situation, but more importantly why I believe this artificial pressure on shares offers one of the most attractive opportunities in the market at this time. Given QIPT’s continued business progress and some recent acquisitions in the home healthcare space that provide some guideposts for valuing QIPT, I believe returns on QIPT from current share prices could be as much as 385% over the next few years. Further, I believe the downside, outside of some catastrophic event, is likely limited to the debenture conversion price of CAD $5.20/share, or less than 10% down from current prices.

QIPT’s Continued Business Progress

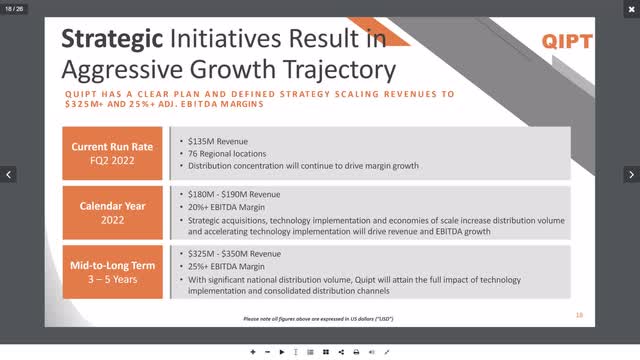

As of their most recent 1Q22 report, QIPT noted they were on a $135M annual revenue run rate. For perspective, this compares to QIPT having posted $102.4M in revenue for their fiscal year 2021. In other words, the company is quite easily on the path for 35%+ revenue growth for FY 22. But it gets better: QIPT is projecting to end calendar year 2022 on a $180-190M revenue run rate, with adjusted EBITDA (AEBITDA) at a $38-43M run rate. It should be noted that I am not aware of QIPT ever missing their guidance, so these numbers are highly probable expectations.

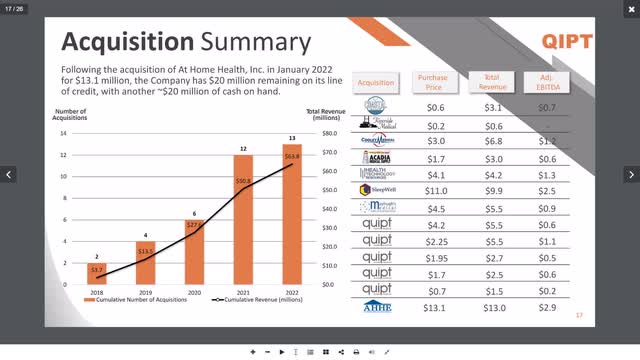

The company is able to grow at such an impressive rate because of its acquisition pipeline. While many may initially look at QIPT and view them as a classic “roll up” company, I believe this overlooks what QIPT is truly accomplishing, and dismisses how the company views itself. While it is true the company is growing primarily through acquisitions (in addition to expected 5-10% organic growth), it should be noted this is the only sensible way for companies in this space to expand. This is because a home healthcare company cannot simply set up shop in a new state and start doing business, as most companies in other industries can do. Home healthcare companies cannot be profitable without insurance contracts. And obtaining contracts in a state new to the company can take years and years-with no assurance it will ever happen. It simply makes no sense, then, to set up shop in a new state. The best way to expand geographically is to acquire an existing business with those insurance contracts already in place.

And that is exactly what QIPT has been doing. In the process, rather than acting as a classic debt-fueled roll up pursuing nothing more than scale, QIPT has been acquiring rather low-margin home healthcare businesses focused primarily on sleep and respiratory and has been transforming them into rather high-margin (20%+ AEBITDA margin) businesses. And, to date, they have done this without debt, except the rather small amount of convertible debentures I will discuss in more depth below. For perspective, you can review QIPT’s acquisitions and see the company is purchasing other companies for 2-4x the normalized, post-acquisition AEBITDA.

Acquisition Integration

Unlike what is seen in a classic roll up, QIPT does not immediately go in and cut acquired company expenses. In fact, QIPT quite often keeps the acquired company’s key employees, most of whom have important relationships with the local healthcare representatives who may refer patients to QIPT for their home healthcare needs. What QIPT does instead is increase revenue and create efficiencies in operations and back-office expenses.

QIPT is able to increase revenue in two key ways: (1) the company is able to quickly expand the acquired company’s product offerings. For example, when QIPT purchases a company focused on sleep products, they are able to easily add on their respiratory services, and vice versa; (2) QIPT’s data analytics ensure patients are enrolled in their re-supply program, which alerts patients when their insurance will pay for new supplies. The companies QIPT acquires usually are not big enough to adopt this type of technology and so they simply respond to patients when the patient reaches out to them for re-supply. QIPT, on the other hand, is proactive, which is how they are able to attain a 77% recurring revenue model.

In terms of creating efficiencies, QIPT’s scale allows them to decrease the cost of goods sold due to their higher purchasing volume. QIPT is also able to optimize billing and collections through their data analytics programs, which again, the smaller acquired companies are not able to accomplish due to the relatively high up-front cost of implementing that type of technology.

Acquisition Pipeline and Management Discipline

According to QIPT management on their recent 4Q21 conference call, the company’s acquisition pipeline remains robust. My own research indicates that the company likely has at least a dozen companies on its relatively near-term radar for possible acquisition. This would certainly align with QIPT’s guidance to grow another $45-55M in revenue run rate by EOY 22.

On the 4Q21 call, in response to an analyst question, management noted that one of their potentially larger acquisitions, which they had previously announced had moved into the non-binding letter of intent (“LOI”) stage, had not yet closed. The reason cited was further diligence being done with respect to the company’s “quality of earnings.”

I want to highlight this situation for one simple reason: it publicly displays QIPT management discipline. While a classic roll up focused on achieving ever greater scale would likely power through even non-accretive deals, QIPT’s approach shows much higher selectivity. QIPT’s management actually operates the acquired businesses and, therefore, conducts deep due diligence on each acquired company. CEO Greg Crawford has historically resisted a growth at all costs-type model. Rather, he and CFO Hardik Mehta are looking for businesses they can seamlessly integrate and operate profitably long-term.

This situation with the previously-announced LOI shows that the company is not only disciplined behind the scenes, but even after they were compelled to announce this rather significant LOI (the company announces any LOI where, upon actual acquisition, the company’s revenue would increase by 10% or more). Put simply, while some QIPT investors and analysts would undoubtedly love to see this revenue hit QIPT’s books sooner than later, QIPT management remains committed to acquiring said revenue only at a price and under conditions that makes sense operationally, post-acquisition.

For additional insight into QIPT’s current acquisition pipeline, including some interesting data points my colleagues and I have found online, I recommend you listen to my most recent 10-Minute Podcast with Breakout Investors.

Convertible Debenture Overhang

Although I will discuss this more in the “Valuation” section below, I want to highlight that QIPT management is projecting an AEBITDA run rate of $38-43M by EOY 22. The company is currently valued by the market at an enterprise value (“EV”) of around $145M. This is roughly a forward EV/AEBITDA of only 3.5x, which would usually be considered a very low valuation. It hardly seems reasonable based on recent acquisitions in the home healthcare space that I will discuss below. And it also seems out of line for normal valuations of a company growing at 35% or more annually! So, why is the company sitting at such a low valuation?

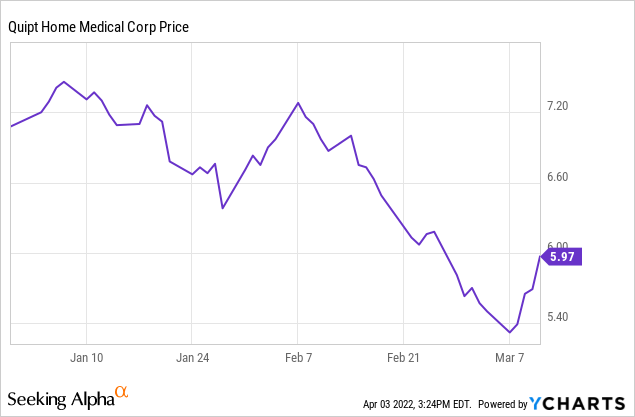

I asked myself this also as I continued to watch the stock drop from early February through early March, before finally hitting a current 52-week low of $4.03/share on March 7, 2022. In reviewing QIPT’s financials, the apparent answer stuck out like a sore thumb: the convertible debentures.

Before explaining the precise details of these convertible debentures, let me note that, as with any derivative product (e.g., warrants), institutions will regularly “hedge” against these derivatives to “protect” their position. More cynical people might say that what the institutions are actually doing is profiting when the stock goes down artificially (i.e. because of their hedging, and not because of normal market participants driving the price down), and then again profiting when the stock naturally goes back up after the artificial hedging is removed. A person could write an entire article on the dynamics of this situation and how institutions move the price of the stock via this type of hedging. For my purposes, suffice it to say that we have already seen this type of dynamic at play with QIPT. You can read about this in more detail, as well, in a previous article where I discussed QIPT’s warrant overhang.

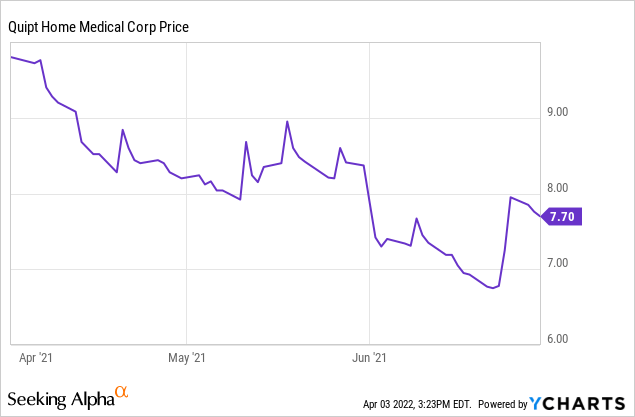

In that situation, QIPT warrants were priced at CAD $6.40/share (QIPT used to report in CAD, but recently switched to USD; all of my price references are to USD unless specifically noted as CAD). Remarkably, despite being valued at CAD $9.00/share about six weeks before the warrants were due, QIPT shares dropped swiftly towards the warrant price, bottoming out at CAD $6.44/share during the week of warrant expiration (6/29/21 was the expiration date). As I explained, this was likely due to the hedging related to the warrants.

In our current situation, we do not have warrants, but convertible debentures. Convertible debentures represent debt that can be converted to common shares of QIPT. In reviewing QIPT’s financials, I noted that QIPT can force conversion of these debentures on March 7, 2022. The conversion price is CAD $5.20/share. To force conversion, shares must trade for 20 days consecutively at a volume-weighted average price (“VWAP”) of CAD $6.48/share. Six weeks prior to this forced conversion date of March 7, QIPT shares traded as high as CAD $7.27/share. But just as with the warrants mentioned immediately above, the conversion/strike price of the underlying derivative acted like a magnet. To wit, shares drifted down precipitously, bottoming out at CAD $5.14/share, just barely below the CAD $5.20/share conversion price of the convertible debentures (they quickly recovered and closed just above the CAD $5.20 conversion price).

I suppose it is possible that these two circumstances of the warrants and convertible debentures are entirely coincidental, but that seems improbable to me, especially given the dynamics I mentioned in my previous articles related to derivative hedging, plus the fact that the strike prices acted like a magnet for the shares. The bad news is that I did not believe, even with these dynamics, that QIPT shares could sink so low, to a 3.5x forward EV/EBITDA level. And because they did, and because QIPT has been my biggest position for some time, I have some significant paper losses in the name. The good news is that these convertible debentures are the final derivative product on QIPT’s balance sheet. With that in mind, and with there being no real value in hedging below that CAD $5.20/share price, I believe absent a catastrophic or surprising turn of events with the company, that the CAD $5.20/share (roughly USD $4.10/share) likely marks the near-term downside. That downside is only about 10% off current prices. As I will show in the “Valuation” section below, there is outsized upside given this rather seemingly limited downside.

Risks

A few risks to QIPT’s business are worth mentioning, as well as what I believe are mitigating factors.

Reimbursement Rates

When I initially mention QIPT to investors not familiar with-or who often avoid-the healthcare space, they cite concern over reimbursement rates, and the possibility that those rates could be cut. That certainly is a risk. However, it is important to note that this risk with QIPT is minimal. On the 4Q22 conference call I linked above (and numerous prior calls), CEO Greg Crawford addressed this issue head-on, mentioning several factors that actually serve as tailwinds with respect to reimbursement rates. Specifically, he noted:

- CMS made the decision to cancel the 2021 competitive bidding program for 13 product categories. The cancellation of this program “has provided us a clear margin outlook across our product mix…for the foreseeable future.”

- In September 2021, Medicare finalized a national coverage determination for oxygen that will expand home oxygen coverage and “potentially reduce some of the administrative load.”

- CMS recently announced a 5% plus CPI adjustment for DME in 2022. According to Crawford: “Typically, the consumer price index increases for DME have been in the 1% to 3% range.”

- Legislation has been passed to delay a 2% cut in Medicare payments that was created under sequestration prior to Covid-19.

- Congress has also delayed a 4% cut to Medicare reimbursements triggered by the pay-as-you-go law until 2023.

Crawford, concluding his thoughts about reimbursement rate tailwinds, stated: “The importance of the home medical industry has never been more prevalent, and we are pleased to see these continued positive regulatory developments.”

Acquisitions

Any time a company is making acquisitions, there is the risk that they will make one or more that significantly hurts the company. This could happen for numerous reasons, including poor integration of the acquired company or because the acquired company misrepresented itself. The risk of a bad acquisition increases if the company feels pressured to close a certain number of acquisitions to reach an arbitrary goal or timeline.

With respect to QIPT, I am comfortable that management has proven their discipline and that their model does not involve taking risks with acquisitions. QIPT has a proven track record of seamlessly integrating acquired companies. The fact that QIPT is generally acquiring companies 10% or less the current size of QIPT (so called “tuck-ins”) reduces the risk of integration issues. Finally, the situation I mentioned earlier about the previously-announced LOI allays fears that QIPT does not conduct proper due diligence or feels pressured to close a deal for the sake of appearances.

Capital Raise

Another commonly-expressed concern about QIPT is the risk of a capital raise. This is certainly a legitimate concern investors should weigh, especially given the fact that QIPT is likely trading at such a low valuation multiple because of previous raises with attached warrants and then the convertible debentures. It should be noted, however, that QIPT is a much different company now than it was a couple of years ago when those raises were needed to firm the balance sheet. The warrants are now in the rearview mirror, and the convertible debentures should be fairly soon as well. In the meantime, outside of those debentures, QIPT has no debt and $30M of cash on hand (as of 12/31/2021). Furthermore, the company has a line of credit of $20M, which they noted on the 4Q21 call could easily be increased to $100M, if needed. In short, QIPT should not require any capital raise absent a massive acquisition, which seems unlikely to happen (there are few companies in their space that large, who are not themselves also acquiring companies). And even if such a raise became necessary, it would almost certainly become immediately accretive, and would definitely not include derivatives such as warrants given QIPT’s operational and financial strength at this time.

Debenture Overhang

Until the convertible debentures have been converted to common shares, it is possible this overhang could weigh on the stock. Having analyzed the various ways institutions might hedge this situation, I am of the belief that it is more probable than not that the stock will not be weighed down for more than another six months, at an absolute maximum. In fact, it is quite possible that this overhang will subside prior to that. In any case, I firmly believe that once the stock stays above CAD $6.48/share (the price at which QIPT can force conversion) for 20 days (the point at which QIPT can force conversion), QIPT will trigger the forced conversion and the stock will no longer have artificial downward pressure. That should then lead to the stock having more freedom to attain its fair value, which I will discuss below.

Valuation

I have already stated above that QIPT’s EOY 2022 run-rate AEBITDA guidance is $38-43M. The company continues to reiterate that outlook, and as I noted, they rarely miss their targets. If anything, the surprise is normally to the upside.

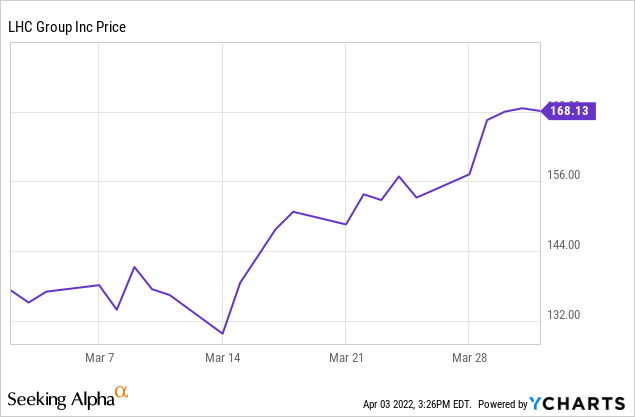

Recent acquisitions in the home healthcare space can give us a good idea of how QIPT should be valued. Most recently, on March 29, UnitedHealth Group announced it was buying LHC Group (LHCG), a provider of healthcare services at home, for $5.4B in cash. UnitedHealth stated: “Demand for home healthcare over clinic-based services has increased in the United States, especially during the COVID-19 pandemic as patients and caregivers increasingly prefer to access vital services from the safety of their homes.” Clearly, some large players in healthcare are taking notice of this growing trend of patients preferring home healthcare, when possible.

For our purposes, it is important to note that just prior to the acquisition, LHCG announced annual AEBITDA for 2021 of $265.5M. In other words, UnitedHealth is paying 20x trailing AEBITDA to acquire LHCG. It should be noted that LHCG revenue had grown 7.6% to $2.22B for FY21. This is much more revenue than QIPT currently produces, but obviously a much smaller growth rate.

Another fairly recent acquisition was announced on January 10, 2022. In this acquisition, Owens & Minor (OMI) bought one of QIPT’s largest competitors, Apria (APR), for $1.45B. Unlike LHCG, APR’s growth had stalled. While they grew revenue at 3.3% for FY 21, most of that growth came in the first half of the year, with growth nearly flat-lining in the final two quarters. APR’s AEBITDA for FY 21 was $136M. So, APR was acquired for a trailing EV/AEBITDA multiple of roughly 10.5x.

In my most recent prior article, I used a 10x forward EV/AEBITDA to value QIPT. Based on the acquisition multiples I just noted above, I believe that multiple is too low. While I am using a forward valuation for QIPT versus the trailing valuation multiples I mentioned above, QIPT has a much higher growth rate, and the forward-looking numbers are “annual run rate” numbers, meaning that it would only take one year with no growth for QIPT to attain those numbers on a trailing basis.

Based on these factors, I believe I am being reasonable using a 12x EV/AEBITDA valuation for QIPT’s projected run-rate numbers. In addition to that, I should note that my calculations below include adding an additional 2,107,525 shares to QIPT’s current shares outstanding to account for the convertible debentures being converted into common stock (192.31 common shares per CAD $1,000 in debentures).

I have provided a summary below for projected one year revenue and AEBITDA, as well as the company’s stated three-year goal of $275M in run-rate revenue. I am calculating the AEBITDA on that revenue at 23% AEBITDA margins, which the company has indicated is a reasonable estimate.

One-Year Projections

| One Year Revenue Run Rate | $185 |

| Forward EBITDA | $40.5 |

| Forward EBITDA Multiple (12x) | $486 |

| Share Price (“Fair Value”) | $13.71 |

| Current Share Price | $4.40 |

| Implied Return | 211.5% |

Three-Year Projections

| Three Year Revenue Run Rate | $275 |

| Forward EBITDA | $63.3 |

| Forward EBITDA Multiple (12x) | $759 |

| Share Price (“Fair Value”) | $21.41 |

| Current Share Price | $4.40 |

| Implied Return | 386.5% |

As you can see, these potential returns are quite impressive. I will conclude this section by emphasizing two things: (1) the 12x EV/AEBITDA valuation multiple I used is based upon recent acquisitions in the home healthcare space (i.e. I believe the valuation multiple is, therefore, entirely reasonable); and (2) in my previous articles, I clearly did not fully appreciate the drag of these derivative overhangs, and most especially this final balance sheet overhang of the convertible debentures. I say this because, as I outlined above with the strike dates and prices, I do not think it is a coincidence that QIPT has been trading at such a depressed valuation. But, those overhangs could soon be out of the way and, presumably, the stock should be more free to move to a reasonable and fair valuation.

Conclusion

Although QIPT shares held up well through the initial January small cap correction, the stock appears to have ultimately fallen under the weight of the convertible debenture overhang. I believe I presented a compelling argument that hedging-related activity to this event, as well as to previous derivative overhangs with QIPT, is likely the best explanation for share price weakness. If that is the case, once this overhang subsides, I believe QIPT shares can show impressive returns, with a triple even possible over the next year. The valuation I used to reach these numbers is based upon recent acquisitions in the home healthcare space, including with one of QIPT’s largest competitors. On the opposite side, given that QIPT trades at such a low valuation currently, and based on the fact that any hedging activity loses its impact at less than a 10% decrease from current prices, I believe the current downside in shares remains quite limited. Simply put, QIPT’s convertible debenture overhang provides investors with an incredible opportunity to buy low on a company firing on all cylinders.

Be the first to comment