Vitalii Pasichnyk/iStock via Getty Images

Quantum computing is currently expected to be the next great generation-defining wave of computing. When sufficiently mature, it is expected to enable major breakthroughs (read: disruption) and potentially save or create millions, if not billions, of dollars of value in industries such as travel, logistics, healthcare, and many others.

The field is extremely new and competition is fierce in this rapidly evolving landscape. Quantum Computing Inc. (NASDAQ:QUBT), or QCI, is a rapidly emerging standout, thanks to its unique approach that has insulated it from much of the development risk and financing risk exhibited by most of its peers. While QCI continues to lose money, we believe it is the company that is closest to achieving meaningful revenue growth thanks to its recent major advancements. In consideration of its derisked nature, recent successes, and substantially discounted valuation, we believe QCI has the greatest risk/reward ratio available in any publicly traded quantum computing company today.

What Is Quantum Computing?

For decades, classical computing has been the gift that has kept on giving. They have undeniably continued to advance every single aspect of our lives year after year, all thanks to the well-known Moore’s law, where computing power doubles every one to two years, and perhaps the realest and truest expression of the power of compound interest. Unfortunately, Moore’s law is quickly approaching its end, and chip manufacturers are quickly approaching physical limits where transistors cannot get any smaller.

We have also discovered problems that are impossible for classical computers to solve. Known as NP-hard problems, you may have heard of a few famous examples such as the “traveling salesman” problem. These problems involve lots of interconnected variables, which lie at the heart of most complex tasks such as portfolio analysis, drug discovery, and flight scheduling. Being able to solve these problems efficiently would enable major scientific progress, and potentially save or create millions to billions of dollars across various industries such as healthcare, logistics, and finance.

It turns out that quantum computers are really good at solving these complex problems. This is why quantum computing is one of the fastest growing markets in tech today, expected to grow to $65 billion by 2030 at a compound annual growth rate of 56%. This is because analysts predict that quantum computing will create a competitive advantage for 25% of the Fortune Global 500 by 2023.

If you’re looking to grasp a better understanding of the total impact quantum computing will have, I urge you to read this article, which discusses the arms race taking place in quantum computing. It’s cowritten by the former head of U.S. Cyber Command and the National Security Agency.

Who Is Quantum Computing and What Makes It Unique?

Quantum Computing is a quantum computing company based in the United States. Unlike many of their peers, they are intensely focused on making quantum computing accessible, both from an accessibility and usability standpoint.

QCI’s flagship product is Qatalyst, a “quantum application accelerator” that enables businesses to tackle computational complex problems with a combination of classical and quantum computing techniques. Qatalyst is being applied in highly competitive markets such as retail, finance, supply chain, healthcare and more.

QCI has secured strategic partnerships with Amazon Web Services (AMZN), Splunk (SPLK), IPQ Analytics (pharma), Meraglim (risk analysis), and many other industry leaders working to solve complex problems in logistics, portfolio optimization, and drug discovery, among others. To give you a better glimpse of the problems they are working on with subject matter experts, consider this excerpt from QCI’s shareholder letter:

Examples include the following use cases:

• Fraud Detection. We are working with a large global data firm to identify fraud for credit cards, security risks for illicit activity, and physical access to secure sites. This project focuses on how to address current and future cyber risks using quantum technologies in community detection.

• Global Pipeline Logistics and Supply Chain. Working with a global oil company to optimize their logistics and supply chain and pipeline security.

• Intelligent Routing. Working with a large global manufacturer exploring quantum opportunities in intelligent routing for vehicles, devices, and products.

• Optimizing Complex Computations. We are working with an integrator to optimize business critical data analytics and complex computations for their clients.

• Robotics. This is an opportunity to automate in-warehouse robotics for order fulfillment optimization.

There are three factors that make QCI unique and stand out.

1. QCI is hardware agnostic.

Think of the early days of quantum computing like the format wars, like laserdisc vs. video tape, and HD DVD vs. Blu-Ray. You can view each competing quantum computer design as a different type of media format – while they’re all trying to accomplish the same thing, they’re all at risk of going defunct when a clear winner stands out. QCI avoids this entire situation entirely by actively working with quantum computing leaders in both hardware and software, using AWS Braket to connect to quantum computers including Rigetti (RGTI), D-Wave and IonQ (IONQ) to run applications. We believe this hardware agnostic approach greatly rewards users by removing hardware risk and providing the flexibility to pick the best quantum computer for their needs.

2. QCI has made onboarding quantum computing fast and accessible.

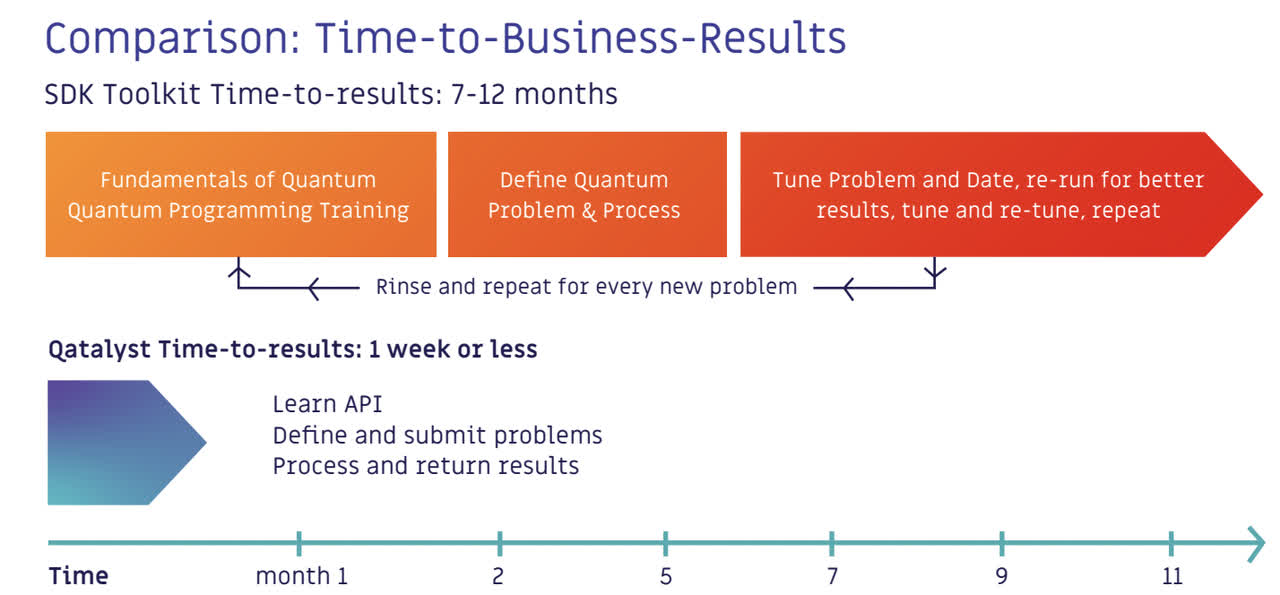

Forget making a quantum computer, just using one is a daunting task in and of itself. It can take months for subject matter experts, who are pros at solving these problems on a classical computer, to get up and running on a quantum computer. Using quantum computers today typically requires intimate knowledge of how quantum computers work, how problems get “embedded” into the quantum computer, etc.

QCI had the brilliant insight and technical know-how required to abstract away the idiosyncratic complexities of using quantum computers, drastically shortening the time required to receive useful results from quantum computers.

Quantum Computing Inc.

Source: QCI Brochure

3. QCI’s applications are best in class, performance-wise.

QCI’s applications, or the underlying solvers they’ve designed to power their applications, actually improve the performance of the quantum computer they are being run on. I’d go as far as to say that until QCI came onto the scene, most experts in the quantum computing scene almost entirely discounted the value of quantum computing software, electing to blindly view hardware performance as the only source for performance.

To use a metaphor, it would be like declaring the winner of a car race after just looking at the highest-spec car, when, in reality, it’s often an incredible driver that makes all the difference. QCI provides that incredible driver to these incredible high spec machines, but don’t take my word for it – three entire divisions at Los Alamos National Laboratory wrote an entire research article about QCI’s outperformance, stating, “This work stimulates the development of software to assist in the utilization of modern quantum annealers.”

How Has QCI Jumped Out of the Pack?

We initially liked QCI for its nimble and thoughtful approach. We now believe QCI has taken a tentative pole position in quantum computing thanks to two recent events.

- QCI’s performance breakthrough with QAmplify

- QCI’s acquisition of quantum photonics company QPhoton

QAmplify Reveal

Earlier last month, QCI truly turned some heads when they revealed the astounding performance boost delivered by QAmplify, their newest suite of quantum software offerings:

In benchmarked tests, QAmplify improved the size of a problem that a gate model quantum computer could solve by 500% or 5x and the size of a problem that a quantum annealer could solve by 2000% or 20x.

To put this into context, one of the biggest reasons why quantum computers aren’t used for business today is that they just don’t have enough Qubits to be useful. While many manufacturers engage in chest pounding and boast about the number of Qubits their latest and greatest quantum computer has, the reality is that all of the qubits lack perfect connection with each other, leading to quite a bit of wastage when trying to “embed” a problem into the quantum computer.

In the release linked to above, QCI disclosed the following:

QAmplify algorithm was recently used in the 2021 BMW Group Quantum Computing Challenge for vehicle sensor optimization, where it expanded the effective capability of the annealer by twentyfold. to 2888 qubits and that a D-Wave annealing computer with QAmplify could solve an optimization with over 4,000 variables, versus the current limit of 200 for a dense matrix problem set.

For additional context, consider D-Wave’s rate of improvement, where in five generations from 2011 to 2020, they have gone from 128 qubits to 5640 qubits. Strictly speaking, similar to Moore’s law, D-Wave has doubled the amount of qubits available every 2-3 years.

If these results continue to hold, this means that QCI’s QAmplify is capable of advancing the performance of a quantum computer by at least nine years or has advanced the timeline to business-ready quantum computing by nine years. In other words, QCI’s software now provides the equivalent of hundreds of millions of dollars in hardware R&D by itself. This is enough merit by itself to firmly establish it as a leader in not just quantum computing software, but quantum computing as a whole.

QPhoton Acquisition

In the same month as its QAmplify announcement, QCI completed the acquisition of Qphoton, a quantum photonics hardware company. In doing so, QCI evolved and emerged as a full-stack, software and hardware company. According to the release:

QPhoton is a quantum photonics innovation company. It develops and commercializes powerful quantum nanophotonic technology and systems to transform critical areas of industry, including healthcare, cybersecurity, finance, environment, and computer vision. QPhoton maintains a growing and diverse portfolio of patented nanophotonic and quantum technology, covering quantum sensing, imaging, information privacy, authentication, data analytics, and quantum photonic computing.

From what we understand, QPhoton has a series of quantum computers they call Quantum Photonic Systems (QPS). These QPSs seem to be highly specialized for specific classes of problems, such as a QPS for optimization or having a QPS for machine learning. What intrigues us is QPhoton’s claim that these QPSs are capable of operating stably at room temperature, which should eliminate a lot of the cost, size and complexity associated with owning and maintaining a quantum computer.

While these claims seem too good to be true, we’re somewhat reassured by QPhoton’s founder’s credentials. Dr. Huang is the Gallagher Associate Professor of Physics at Stevens Institute of Technology and the founding Director of the Center for Quantum Science and Engineering. In the past few years, Dr. Huang has garnered $18 million of investment from multiple government agencies, including the DoD, the National Science Foundation and NASA. His research has led to the development of practical quantum and photonic technologies ranging from quantum networking, quantum biomedical imaging, and quantum processing on a chip to quantum remote sensing.

QCI indicates that these QPSs should be significantly more affordable than current mainstream quantum computers, whose costs run into the tens of millions. We’re particularly excited for the possibility of an ultra-optimized version of QAmplify running on the QPSs, in order to potentially push it above the specs of every other quantum computer. This could quickly lead to QCI being the first to deliver a broadly accessible and affordable turnkey quantum solution for business use.

According to management, this could be as soon as Q4 of this year. At the same time, QCI’s management has stated that they will stick to its nimble risk-averse approach of being hardware agnostic with its software business.

What’s a Fair Valuation for QUBT?

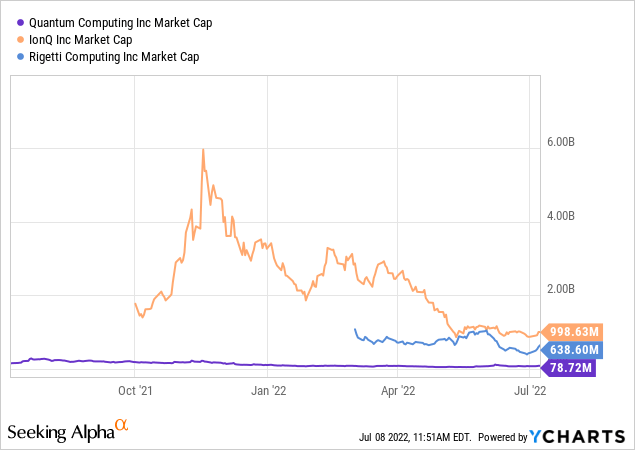

To be completely honest, we believe QCI trades at an absurdly unfair discount relative to its quantum computing peers. This could not be clearer, especially when considering that IonQ trades at 13x QCI’s valuation, even after their major haircut following the Scorpion Capital short report.

While QCI has nowhere even close to the massive coffers of cash held by IonQ ($422M vs, $11.5M as of Q1 2022), it still means that IonQ trades at an enterprise value nearly 9x greater than QCI.

It’s clear that the future growth and opportunity present within quantum computing have been baked into the valuation of IonQ and Rigetti. Unfortunately, QCI has not yet had the same benefit. This could be the result of lack of investor awareness, poor naming sense, or general dread surrounding early-stage micro-/small-cap companies.

On the basis of merit and position in the quantum computing market as a whole, we believe QCI is in a commanding position and deserving of a higher valuation. It is currently too early to tell exactly how large the quantum computing market will be, making it impossible to fairly model out what QCI should be valued at. That said, we believe QCI’s significantly reduced exposure hardware risk and outright software dominance across all platforms puts it on the same level, if not higher, business-wise and risk/reward-wise as its pure-play quantum peers. Even discounting its distinct lack of cash, we believe fair valuation for QUBT lies above at least $200 million or around $7.00/share.

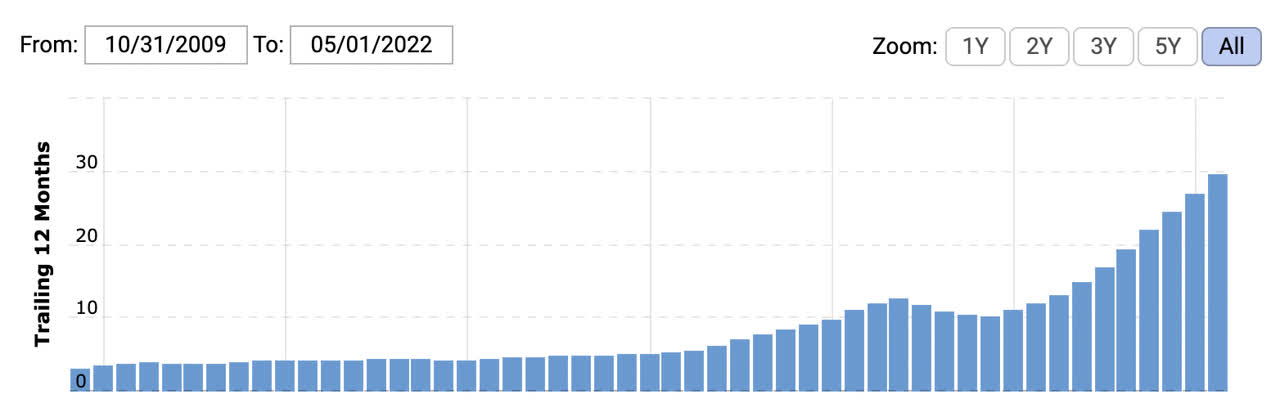

Keep in mind that we’re still taking baby steps in quantum computing. We are marching toward a critical day where quantum computing will no longer be a luxury hobby for curious mega-corporations, but a business necessity to stay competitive across nearly every industry. When this point emerges, the change will be obvious. We think it’ll look just like the chart below. It’s a chart of NVIDIA’s revenue as data centers began to realize just how important GPUs were for machine learning, AI, and general computing throughput.

Macrotrends

Source: Macrotrends

What Are the Risks?

Needless to say, QCI is an early-stage company, operating in an early-developing market. So all the usual risks are doubly amplified here, and a lot can go wrong. Major red flags include running out of capital, quantum computing somehow being an unachievable pipe dream, inability to gain customers, and the emergence of a dominant startup, among others. Given the company’s small size and cash position, any of these could affect the company dramatically.

Liquidity Risk

QCI is a small-cap company, and insufficient liquidity might hinder your ability to enter or exit a position as quickly or as smoothly as you may like. QCI still lacks the mainstream investor attention required for sufficient liquidity to handle smooth trading. Fortunately, this should only be an issue for investors to prefer to take large positions. QCI’s average volume should actually be in the top 10% of companies that trade under a $100 million valuation.

Liquidity should also further improve over the near future, as QUBT recently joined the Russell Microcap Index, effective June 27th. The company was also recently spotlighted on Bloomberg Radio, which should help develop its growing investor base.

Financing Risk

Financing risk might be the most salient risk for investors to consider here. QCI raised over $18 million during 2020. As of Q1 2022, the company currently sits on $11.5 million in cash, while this might indicate burn of approximately $1 million per quarter, recent filings suggest that the burn rate is accelerating, which is to be expected as the company continues to grow. Assuming burn rate continues to grow at this pace, and that the company is not able to do enough revenue to offset cash burn, QCI may need to raise additional cash in 2023. If share price continues to stagnate, the financing may not be done at terms favorable to current investors.

Competitive Risk

The market is new, but expectations are already sky high, fueling an interesting, ultra-competitive landscape where tech giants are also competing to make a name for themselves. The frenetic interest in this space opens the door for out-of-the-blue innovations that may render many players’ offerings obsolete. That said, we believe QCI is well-positioned due to its hardware agnostic approach that is hedged by its bet on QPhoton’s QPSs. In conjunction with its software dominance, we believe that QCI is currently the shark in the software pond.

Technology/Too-Early-to-Tell Risk

Although most experts believe that quantum computing represents the next wave of computing disruption, this may not be the case. New innovative ways of achieving computing power may somehow be discovered, or it may be discovered that late-stage quantum computing is simply not possible with our current technology. We find this scenario unlikely given that Amazon, Microsoft (MSFT), and Google (GOOG) have placed big billion-dollar bets on quantum computing. However, if this scenario were to occur, it would be lights out for QCI.

Main Takeaways

There’s a lot to take in here, but for investors with an appetite for emerging markets, this could be a slice of heaven. QCI boasts a rock bottom valuation relative to its peers, is significantly derisked on a lot of fronts relative to its peers, has a near unassailable lead in quantum computing software, and has a big bet on its newly acquired hardware division.

It fits all the right boxes for us, which is why we’re shareholders and think it’s worth at least $7.00/share. The two biggest potential risks here are the quantum computing market collapsing due to some impossible physical limitation or from trying to raise money a few quarters down the line in a potentially really bad market environment.

We believe QCI is the company that is closest to generating meaningful revenue out of all its peers, thanks to its new software breakthrough that essentially puts quantum computing nine years ahead of R&D schedules – frankly, that’s reason alone for us. If you do invest, just make sure to set a Google Alert for quantum computing to stay abreast of any breaking quantum computing news.

Be the first to comment