Ca-ssis/iStock via Getty Images

If you want to tell people the truth, make them laugh, otherwise they’ll kill you. ― George Bernard Shaw

Today we take a deeper look at a life sciences concern that currently is trading for under the net cash on its balance sheet after a big decline in its shares. With a new CEO and some recent insider buying, it merited further investigation. An analysis follows below.

Company Overview:

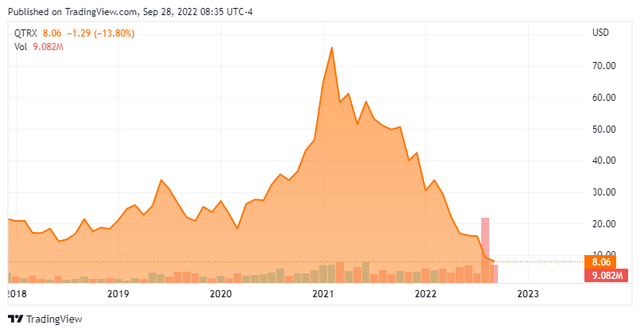

Quanterix Corporation (NASDAQ:QTRX) is a Billerica, Massachusetts based commercial-stage life sciences concern focused on the development and sale of ultra-sensitive digital assay platforms that detect protein biomarkers for research and clinical use. It also provides contract research services utilizing its platforms through its CLIA-certified Accelerator Laboratory. At YE21, the company boasted 1,120 customers, including 22 of the 25 largest biopharmaceutical concerns. Quanterix was formed in 2007 and went public in 2017, raising net proceeds of $65.6 million at $15 per share. After trading as high as $92.57 a share in February 2021, the stock trades just above eight bucks a share now, translating to a market cap just south of $310 million.

Technology

The company’s Simoa platform is based on enzyme-linked immunosorbent assay (ELISA) bead-based technology, which has been the standard method for detecting proteins for the past 40 years. Other analog approaches include mass spectrometry, Western blotting, chromatography, surface plasma resonance, immuno-PCR, and bio-barcode assay, amongst others. Like conventional bead-based sandwich ELISA, Simoa requires two antibodies: one for capture, which is applied to the beads; and one for detection. However, unlike ELISA, which runs the enzyme-substrate reaction on all molecules in one well, Simoa can trap individual molecules in tiny microwells, 40 trillionths of a millimeter, that are 2.5 billion times smaller than prior ELISA wells.

As such, whereas ELISA (and other detection systems’) analog measurements increase in intensity only as the concentration of the sample increases, Simoa’s digital measurements are not contingent upon sample concentration, providing unprecedented sensitivity. In other words, its instruments have the ability to detect substantially more of the ~10,000 proteins in the blood than conventional methods – significant, considering that only 22 proteins comprise 99% of the protein mass in plasma. One of the benefits of this advance in technology is early detection of low-concentration proteins that are early biomarkers for disease. Furthermore, Simoa’s platforms maintain single-plex precision while multiplexing (i.e., simultaneously measuring multiple proteins in a single assay), whereas most other platforms lose sensitivity when multiplexing.

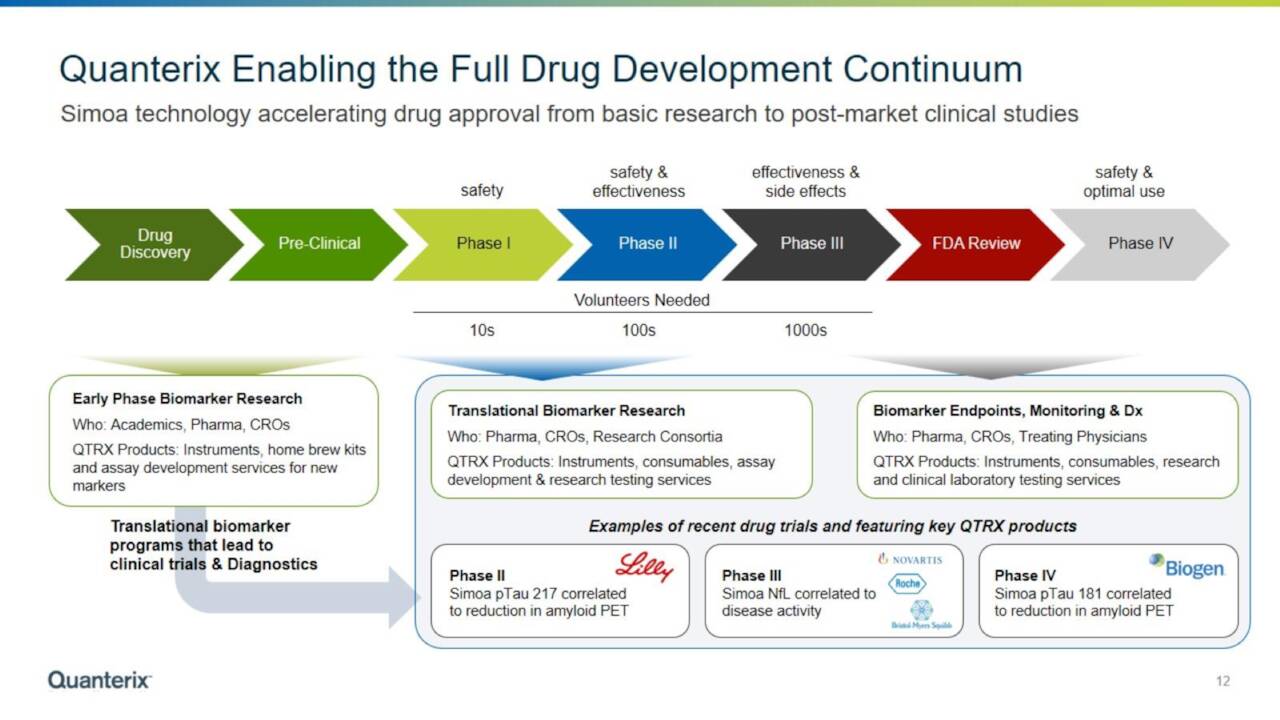

August Company Presentation

The first Simoa instrument was launched in 2014 and Quanterix now offers three products (HD-X, SR-X, and SP-X), which are among the most sensitive multiplex detection platforms currently on the market. The company employs a razor-razorblade model, with each of its machines coming with a line of consumables, including assays that address ~518 immunonocology, neurological, infectious disease, and other protein biomarkers secreted in the blood or cerebrospinal fluid. In addition to its installed base of 798 instruments, the company receives revenue by providing contract research services that employ its Simoa technology, completing more than 1,800 projects for ~430 customers worldwide. Performance of these services sometimes act as a catalyst for additional product placements. Currently, approximately one-quarter of Quanterix’s revenue is derived from instrument sales, one-half from consumables, and one-quarter from contract research services.

Approach

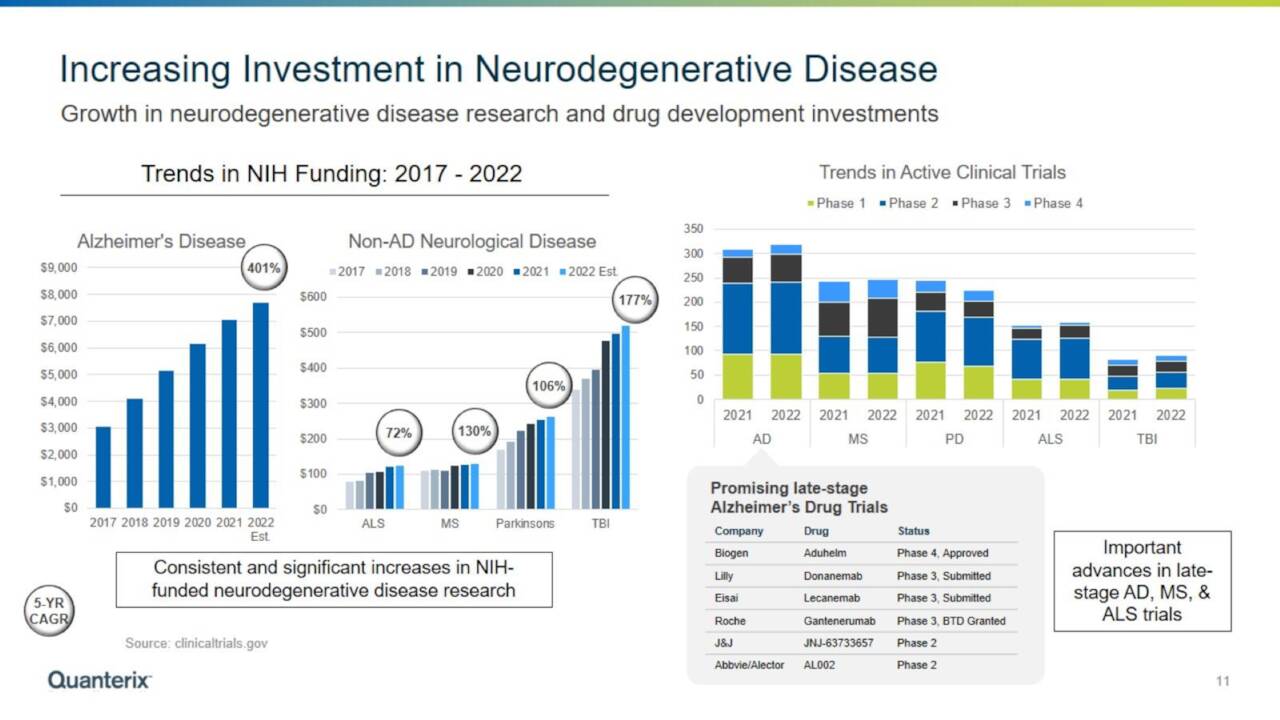

Until very recently, the company’s strategy involved initially targeting the research and drug trial markets, which it dubs ‘translational’ – an opportunity management believes will grow to $12 billion by 2025. This foray was to be followed by an expansion into diagnostics and precision health screening arenas, where it could leverage its immunoassays to monitor biomarker levels from a routine blood draw to provide early detection of disease.

Currently on the translational side, Quanterix is targeting the neurodegenerative disease segment, receiving some validation through a collaboration with Eli Lilly (LLY) to advance diagnosis, monitoring, and treatment of Alzheimer’s disease [AD] – announced in March 2022 – as well as the granting of Breakthrough Therapy designations from the FDA for its Simoa phosphor-Tau 181 blood test for AD in October 2021 and neurofilament light chain [NFL] plasma test as a prognostic aid in assessing the risk of disease activity in patients with relapsing-remitting multiple sclerosis in April 2022. Furthermore, the economics make sense for a biopharmaceutical concern conducting an AD clinical trial: $100 for a Simoa blood-based patient screening assay versus $5,000 for a PET scan.

August Company Presentation

It should be noted that NfLs, which are released in higher-than-normal amounts when neuron cells are under stress, are not solely Quanterix’s domain. Labcorp (LH) launched an NfL blood test to identify signs of neurodegenerative diseases and brain injury in July 2022, with Siemens’ (OTCPK:SIEGY) NfL technology already on the market. Quanterix also competes with protein discovery products from publicly traded concerns such as Bio-Techne (TECH), Luminex (OTCQX:LUMIF), NanoString (NSTG), Seer (SEER), SomaLogic (SLGC), Merck’s (MRK) MilliporeSigma, Bio-Rad Labs (BIO), and Thermo Fisher Scientific (TMO), while its service lab competes with offerings from Covance, Q2 Holdings (QTWO), and Myriad RBM, amongst others. Management believes that the total market opportunity for protein discovery products, which includes research, clinical trials, diagnostics, and precision health screening will reach ~$100 billion by the end of the decade.

Stock Price Performance

With its potentially disruptive technology and plenty of positivity from the Street, shares of Quanterix skyrocketed to unsustainable valuations. Even after the company raised net proceeds of $269.7 million at $70.00 a share in an early February 2021 secondary offering, its shares continued to soar, peaking at $92.37 later that month, representing a 30.0 multiple on what would be FY21 revenue of $110.6 million, which was up only 28% over FY20. Furthermore, Quanterix was losing money at an alarming rate (-$1.60 a share in FY21 (GAAP) vs -$1.07 a share in FY20 (GAAP)) as gross margins were a tepid 56% in both FY20 and FY21. As the market began to sell anything related to biotech in 2H21, shares of QRTX began a protracted decline, but still managed to close YE21 at $42.40 a share.

The first indication that its valuation was still overinflated occurred when the company provided its first-ever sales guidance, the midpoint of which was $128 million for FY22, on March 1, 2022. This projection meant its stock was trading at 6.7 times FY22E revenue (net of cash at that time), which represented only a 16% improvement over FY21. As the market digested this news, as well as a transition to a new CEO, its stock lost an additional 45% (from $33.74 to $18.50 a share) entering its 1Q22 financial report, which provided another signal that something was awry at Quanterix. Despite besting top-line consensus by 2% with 1Q22 revenue of $29.6 million, gross margin was woeful at 49.3%, which was blamed on “inventory management and quality processes.”

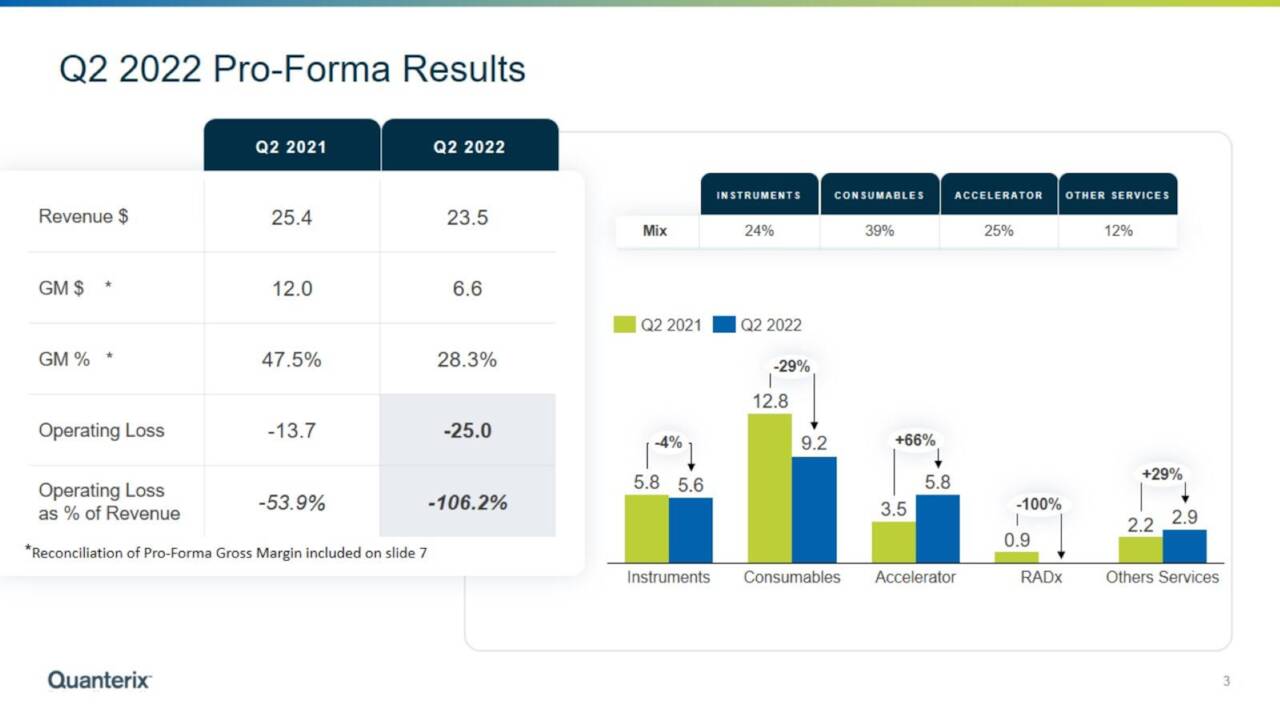

2Q22 Earnings & Revised Outlook

The market finally capitulated after its 2Q22 earnings report, released after the close on August 8, 2022. The company announced a net loss of $0.67 a share (GAAP) on revenue of $23.5 million versus a net loss of $0.33 a share (GAAP) on revenue of $25.4 million in 2Q21, representing a year-over-year decline of 7% at the top line. Furthermore, revenue missed Street consensus by $6.6 million, or 22%. Gross margins were arguably a bigger disappointment, registering 37.1% in 2Q22 versus 54.7% in the prior year period. If higher-than-anticipated freight costs were added to the mix, gross margin plunged to 28.3% versus 47.5%.

August Company Presentation

The miss at the top line was blamed on “assay quality challenges and process improvement initiatives” as revenue from consumables fell 29% year-over-year. Given that consumables are the company’s highest margin contributor, gross margin suffered. In addition to mix, poor performance in that metric was attributable to a reallocation of resources to concentrate more on its translational opportunity, which also meant the dismissal of 130 employees company wide. Included amongst the pink-slip recipients was Executive Chairman of the Board Kevin Hrusovsky, who had also held the reigns as CEO up until a few months prior.

August Company Presentation

With manufacturing issues impacting its ability to deliver assays to customers, management was compelled to revise its FY22 top-line forecast to be flat with FY21, with a return to double-digit growth not anticipated until FY24.

Already down 82% from its all-time highs prior to the earnings report, the market crushed Quanterix’s stock, revaluing it 55% lower to $7.46 a share. The equity has moved up slightly since then.

Balance Sheet & Analyst Commentary:

The one silver lining in this otherwise disastrous quarter is the company’s cash position, which stood at $361.3 million versus no debt on June 30, 2022, meaning its stock is currently trading at cash.

The only firm that had the proper call on Quanterix was Goldman Sachs, which had a sell on its stock until early March 2022, at which point it chose to upgrade its recommendation to a hold. As for the other four analysts, three downgraded shares of QTRX after its 2Q22 report, all from buys or outperforms to holds. JP Morgan remains the lone holdout, still rating the stock an outperform. The median twelve-month price objective is now $15, down from $35 prior to the earnings release.

Post-earnings, the new CEO, along with the CFO and four board members used the downdraft as a buying opportunity, purchasing nearly 619,000 shares between August 10th – 15th.

Verdict:

Another vital objective of the company’s restructuring – which should save it $25 million annually – is to set in motion an assay redevelopment program so it can manufacture and deliver high quality assays at scale, allowing it to return to top-line growth. However, this program is not expected to be completed until sometime in 2023. It is abundantly clear that Quanterix would be in significantly worse shape if not for its February 2021 secondary, which currently leaves it with ~$10 a share in cash. Despite its strong balance sheet, no return to meaningful growth is forecasted until FY24 and profitability is still a long ways off. As such, Quanterix could quite be dead money and does not seem worthy of investment until signs of a turnaround are more apparent.

I know not all that may be coming, but be it what it will, I’ll go to it laughing. ― Herman Melville

Be the first to comment