DNY59/E+ via Getty Images

By Matt Wagner

When times get tough, it pays to allocate to quality companies that can weather the storm.

But what’s a quality company?

To some, quality is represented by a basket of securities like those of the Dow Jones Industrial Average – blue chip, brand-name companies broadly representative of the U.S. economy.

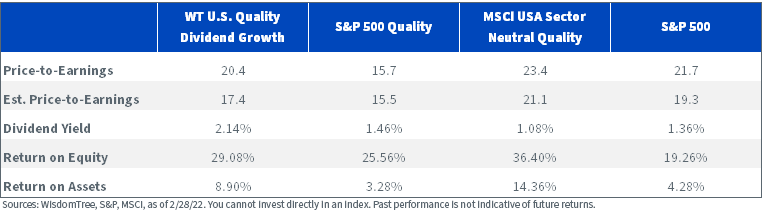

To factor investors, quality in its purest sense has been measured in academic research by profits over equity (return on equity), or over assets (return on assets).

To enhance this quality definition, some quality indexes include metrics like dividends, financial leverage, earnings accrual ratios, and earnings volatility in their selection.

These different quality metrics can often show subtle distinctions, resulting in broadly similar quality screens. Of greater importance in evaluating factor indexes are:

- The starting universe

- How securities are weighted

- Sector constraints and/or holding caps

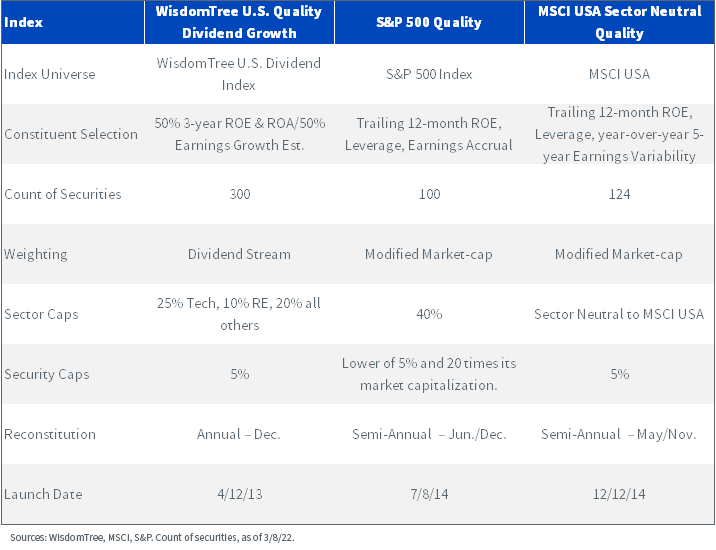

Here’s an overview of select indexes targeting quality.

Methodology Overview

WisdomTree, MSCI, S&P 500, Count of Securities

Starting Universe

Most quality indexes start with a broad universe of large- and mid-cap securities.

WisdomTree’s Quality Dividend Growth family (WisdomTree Quality) starts with a more refined universe of large- and mid-cap companies paying regular cash dividends.

Why dividends? A consistent dividend payment is a signal of corporate health and cash management discipline that aligns with the goal of building a quality portfolio.

Weighting

Both the MSCI USA Sector Neutral Quality Index (MSCI Quality) and the S&P 500 Quality Index (S&P Quality) use a modified market cap-weighted approach. Constituents are weighted by a combination of market cap weights and a quality factor score.

The WisdomTree Quality Indexes weight constituents based on Dividend Stream, or regular cash dividends paid. This approach gives greater weight to companies paying greater cash dividends.

This reinforces the concept that a dividend is a signal of quality, with the added benefit of producing a basket with a typically higher dividend yield and lower price-to-earnings ratios.

Fundamentals

WisdomTree, S&P, MSCI

Constraints/Caps

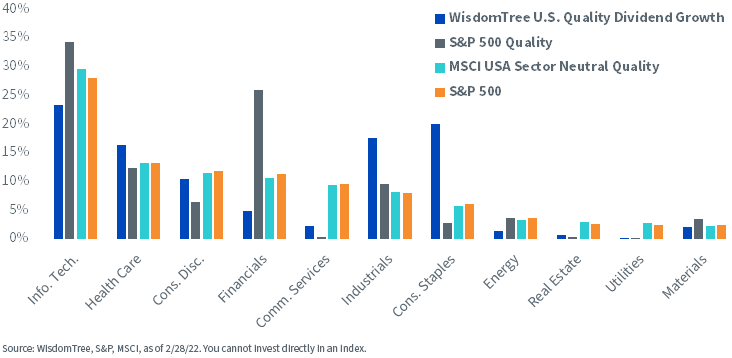

MSCI Quality is sector-neutral to the MSCI USA Index, with very little sector deviation from the S&P 500.

A by-product of this neutrality is that MSCI Quality typically has greater weight to lower-quality sectors like Communication Services, Real Estate, and Utilities than either S&P Quality or WisdomTree Quality.

Both WisdomTree Quality and S&P Quality take more significant active sector bets. WisdomTree Quality caps the Information Technology sector at 25%, Real Estate at 10%, and all other sectors at 20%. S&P Quality caps sector weights at 40%, allowing for a top weight of 35% to Information Technology.

Sector Weights

WisdomTree, S&P 500, MSCI

At a constituent level, each index caps holdings at 5% at rebalance. With Apple (AAPL) and Microsoft (MSFT) each at over 6% weights in the S&P 500, this cap forces each index to have modestly under-weight allocations in those names.

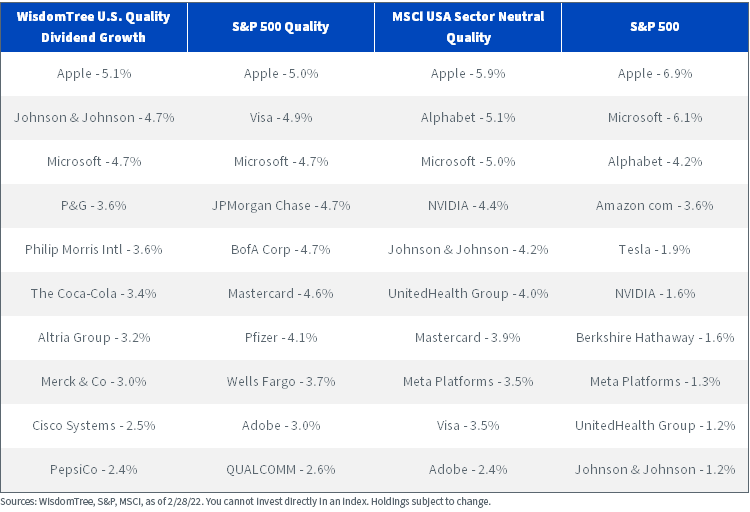

Top 10 Holdings

WisdomTree, S&P 500, MSCI

COVID-19 and 1Q22 Sell-offs

With all the different definitions of quality and approaches to index construction, how have these indexes fared amid recent market volatility?

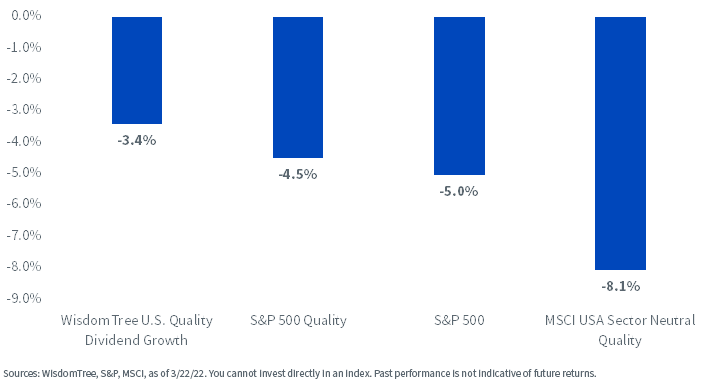

So far in 2022, the S&P 500 Index is down over 5%, bouncing off its lows in recent weeks. The WisdomTree Quality and S&P Quality indexes have provided over 150 basis points (bps) and 50bps of downside protection, respectively, relative to the S&P 500.

MSCI Quality is the outlier, down over 300 basis points more than the S&P 500.

2022 YTD

WisdomTree, S&P 500, MSCI

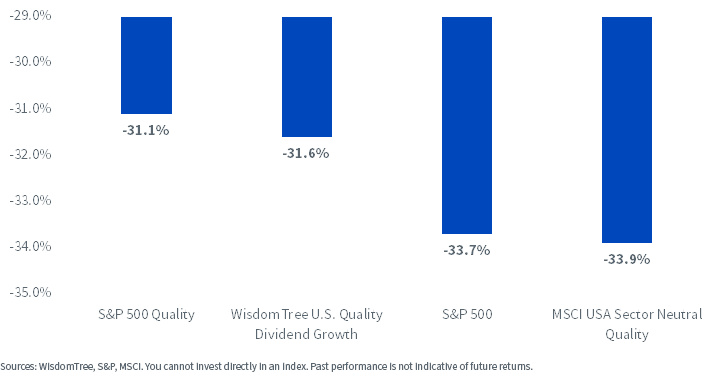

During the sell-off sparked by COVID-19 in spring 2020, there was not as great dispersion in returns across these indexes. MSCI Quality was down roughly in line with the market, whereas S&P Quality and WisdomTree Quality each provided over 200 basis points of downside protection.

COVID-19 (2/19/20-3/23/20)

WisdomTree, S&P 500, MSCI

Conclusion

There are several ways to tap into quality companies. WisdomTree’s approach to targeting a universe of dividend payers gives it an over-weight allocation to Consumer Staples and an underweight allocation to Information Technology, an attractive combination in a volatile year when high-growth tech stocks have lagged steady dividend payers.

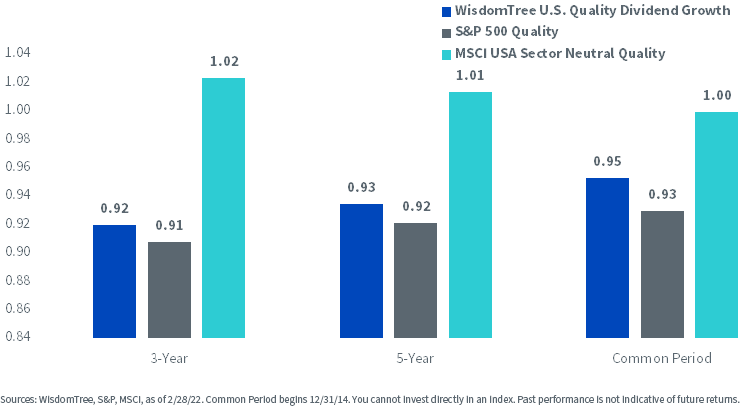

We think the WisdomTree Quality approach provides a compelling option for investors that may be aiming to lower their equity beta and hedge the multitude of risks – geopolitical, Fed rate hikes, inflation, COVID-19 – that market participants currently face.

Beta versus S&P 500

WisdomTree, S&P 500, MSCI

Matt Wagner, CFA, Associate, Research

Matt Wagner joined WisdomTree in May 2017 as an Analyst on the Research team. In his current role as an Associate, he supports the creation, maintenance, and reconstitution of our indexes and actively managed ETFs. Matt started his career at Morgan Stanley, working as an analyst in Treasury Capital Markets from 2015 to 2017 where he focused on unsecured funding planning, execution and risk management. Matt graduated from Boston College in 2015 with a B.A. in International Studies with a concentration in Economics. In 2020, he earned a Certificate in Advanced Valuation from NYU Stern. Matt is a holder of the Chartered Financial Analyst designation.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment