Justin Sullivan

Qualcomm Incorporated (NASDAQ:QCOM) will release its Q4 results on the 2nd of November after market hours. Here are a few important themes to be noted before the big event.

What Do The Headline Estimates Look Like?

Investors will likely be sanguine ahead of the Q4 results, particularly as QCOM has a long history of beating street estimates on the bottom line front; to expand on this, note that over the last 20 quarters, not once has the company come out with non-GAAP EPS numbers that fell short of street estimates. On the other hand, the track record with the topline hasn’t been as pristine as the EPS, and there have been four separate instances over the past 5 years where QCOM has come up short here.

Nonetheless, for the upcoming Q4, consensus revenue stands at $11.37bn, whilst consensus EPS (non-GAAP) stands at $3.15. There’s potential for QCOM to overshoot those numbers once again, as they are both still only within the mid-point of the management’s guidance provided last quarter (not at the upper end). During the Q3 results, QCOM management had guided to a Q4 revenue range of $11-$11.8bn and a non-GAAP EPS range of $3-$3.3.

Also note that If QCOM were to meet the average consensus estimates you’d be looking at a sequential slowdown in the revenue (22% YoY) and EPS growth rates (24% YoY), as the Q3 revenue growth had come in at 37%, whilst the EPS (non-GAAP) growth had come in at 54%.

Themes To Note

Whilst QCOM looks well-poised to do well on the headline numbers, there are some other sub-plots to keep an eye on.

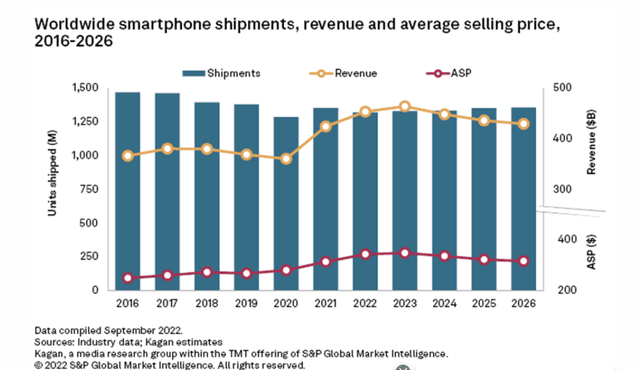

I’d be curious to learn about how different segments in the handsets space are faring. Hitherto, things have been held up by the premium-tier segments, but this support too is likely to have eased off in Q4. Investors could feel a lot better about QCOM if it could speed up the rate of transition away from the smartphone segment. This is crucial, as, over the next few years, industry-wide shipments of smartphones will likely be very underwhelming, growing at a CAGR of less than 1% through 2026 (Source: S&P Global).

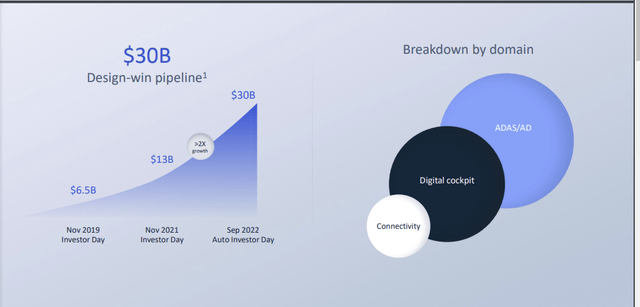

One of the segments that will likely be an integral part of QCOM’s future (and will likely be talked about a lot on the upcoming earnings call) is the automotive segment. Q3 was a record quarter, and I won’t be surprised to see them top that again. Qualcomm’s Snapdragon Digital Chassis will no doubt be a vital cog in the broad digital transformation of the automotive industry, and the who’s who of auto OEMs continue to gravitate to this offering. Just for some context, last year QCT auto-based revenues contributed less than a billion of revenue, by the end of this year, it could be closer to $1.3bn. By the end of FY26, you could be looking at around $4bn of revenue, implying a solid CAGR of over 32%!

What was particularly interesting to note was the pace at which the “design-win” pipeline continues to scale up; in Nov-2019 they were staring at a pipeline of just $6.5bn, and now it is almost 5x that level. Interestingly enough, a little over a month ago, they had it pegged at $19bn, but since then they’ve beefed it up by another $11bn. Expect some big conversions going forward. The Arriver acquisition completed in Q2 this year may be putting some pressure on QCOM’s current cost base (last quarter management spoke about a 6-8% increase in OPEX), but there’s no doubt this has enabled the company to flourish in the Advanced Driver Assistant System (ADAS) space. The bulk of the pipeline involves opportunities in ADAS/AD.

I would also be hoping for some clarity on the legal tussle with ARM Holdings, who sued QCOM last month, on grounds of trademark infringement and breach of license agreements. I’d be curious to see how QCOM plans to address this, as it also looks like, after 2024, ARM does not plan to license its CPU designs to the former. If QCOM loses its positioning in the server value chain (since it can no longer license design and IP, and OEMs will likely obtain licenses directly from ARM) that would be a cause for concern.

In QCOM’s IoT space, consumer-related weakness (40% of revenue) has been well-publicized, but it would be interesting to see if this has also afflicted other diversified areas such as industrials which contributes 20% of IoT revenue, and which the company has been previously talked up.

What Do The Forward Valuations Look Like?

The last time I wrote about QCOM, I’d touched upon how consensus estimates for September 2023 had come off quite a bit. After likely witnessing significant double-digit growth on the topline and bottom line in September 2022, next year it looked like one would only see revenue growth of 6.4% and EPS growth of 4.2%. Interestingly enough, over the last few months, estimates have been scaled down even further for September 2023, so much so that you’re only likely to see annual EPS growth of 2.4% on revenue growth of 5.4%.

However, given that the drop in the share price has been a lot more pronounced than earnings revisions, forward P/E valuations still look very tasty, coming in at just 9.29x.

However, I would also direct investors to the forward PEG ratio, which brings a different dimension to the valuation narrative. At a P/E of 9.29x and EPS growth of only 2.4%, the PEG is quite heightened at close to 4x! This is substantially higher than QCOM’s long-term forward PEG range of 0.5-1.1x.

QCOM’s yield angle tends to be an ancillary motivation for those who pursue the stock, but for those interested, do note that at 2.52% it is still lower than the 5-year average forward yield of 2.87%.

What Do The Technicals Look Like?

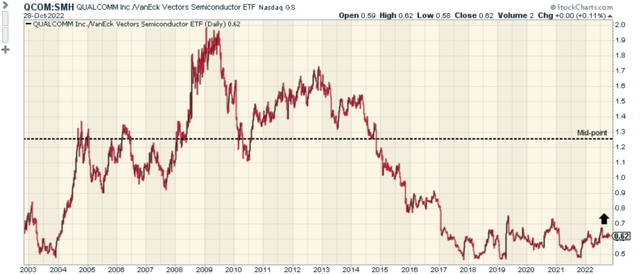

As noted in my previous article on QCOM, the stock may well be one of the prime candidates for rotational opportunities within the semiconductor space. A relative strength ratio comparing QCOM and its peers from the VanEck Vectors Semiconductors ETF (SMH) is still at rather low levels of 0.62, a long way from the mid-point of the range.

If I shift focus to Qualcomm’s long-term chart, one can see that it no longer looks overbought; for much of the last two decades, it had traded within the boundaries of a slight ascending channel. QCOM had broken out of this channel after the pandemic, but that breakout is now in danger of being completely negated, with the stock on the cusp of falling back into its old channel. It would be interesting to see if some buying momentum kicks off at these levels, and helps the stock stay above its channel. Nonetheless, it’s worth noting that the 14-period ATR which previously averaged around the sub-10 levels has more than doubled and is currently at lifetime highs. You ideally want to see a dip in the ATR, closer to more normalized levels (indicative of some stability) before getting in.

How Are The Sell-Side And Institutional Communities Positioned?

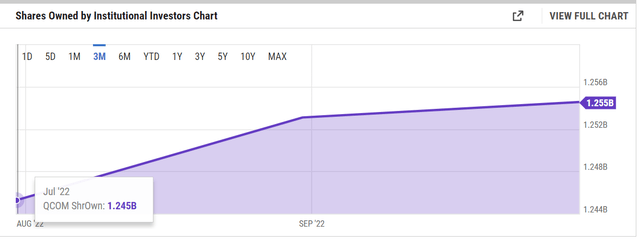

After losing over a third of its value in 2022, the smart-money battalion appears to be warming up to the QCOM stock. After “10” straight months of reducing their net ownership stake in the QCOM stock, institutional investors have started purchasing it once again; Net shares owned by these institutions have begun creeping up over the past two months. It isn’t a drastic swing, just only around 80bps higher from what it was at the start of August, but it may be the start of something bigger.

A large part of this may likely be driven by what the sell-side community feels about QCOM, and how they’re peddling the stock. On this front, it appears that the positioning is largely bullish. Just for some context, out of the 33 sell-side analysts who cover the stock, 21 of them have either a ‘Buy’ or ‘Outperform’ rating, with the rest comprising ‘Hold’ ratings; crucially, there are no ‘Sell’ ratings whatsoever. Also, the average price target works out to an elevated figure of $176, implying a potential upside of ~48% from current levels!

Be the first to comment