Michael Vi/iStock Editorial via Getty Images

Investment Thesis

QUALCOMM Incorporated (NASDAQ:QCOM) stock has been battered recently as semiconductor stocks came under significant pressure. These companies have been managing potentially weaker end-demand due to surging inflation, exacerbated by the Russia-Ukraine conflict. However, the severe COVID lockdowns in China since March 2020 have intensified tensions further, and investors became even more fearful. Consequently, QCOM stock has retraced close to 30% at writing from its January highs.

But, we think Qualcomm’s market position has continued to strengthen from FY21 as it diversified further into the premium Android smartphone SoC. It has also enhanced its penetration into crucial growth segments in IoT and automotive (including autonomous driving). Also, its non-smartphone networking chips remain critical across its portfolio, given increased digitization and connectivity requirements. And should we also remind investors about a recent report detailing Meta’s (FB) decision to stick with Snapdragon XR for its AR/VR projects? We think Qualcomm’s leadership in AR/VR is another underestimated prowess that has not been fully appreciated yet, given its early innings.

Underpinned by its highly GAAP and FCF profitable business model, we believe the recent stock battering offers investors another excellent opportunity to add exposure.

As such, we reiterate our Buy rating on QCOM stock.

Why Are Investors So Fearful Of China’s Lockdowns?

China just released (April 18) another grim set of numbers that corroborated some of the worst fears of investors. The ongoing COVID lockdowns have significantly impacted the economy and discretionary spending in March. Furthermore, unemployment rates have also risen, adding more pressure to the calls for easing the lockdowns.

Bloomberg reported that China’s consumer spending recorded its most significant decline, coupled with the “worst unemployment rate,” since COVID started. Notably, retail sales fell 3.5% YoY, and the jobless rate surged to 5.8%, the highest since May 2020.

However, the weakness masked a decent Q1 GDP growth rate that also validated our previous observations that the Chinese economy has been recovering. Notably, China reported healthy GDP growth of 4.8% in Q1, as the government seeks to achieve its 5.5% full-year GDP growth target.

However, the worsening COVID outbreaks complicated by spreading full-blown lockdowns across several cities concurrently have hampered the recovery momentum. Bloomberg Intelligence also emphasized (emphasis added):

Forget the first-quarter GDP data showing a pickup in growth. The March activity data tell the real story: China’s economy is in the worst shape it’s been since early 2020 when the pandemic first slammed growth.

A sharp deceleration in production and a tumble in retail sales in March underline the initial damage from Covid-19 lockdowns in major cities including Shanghai. April’s data will probably reveal more weakness. – Bloomberg

Will Qualcomm Be Hit?

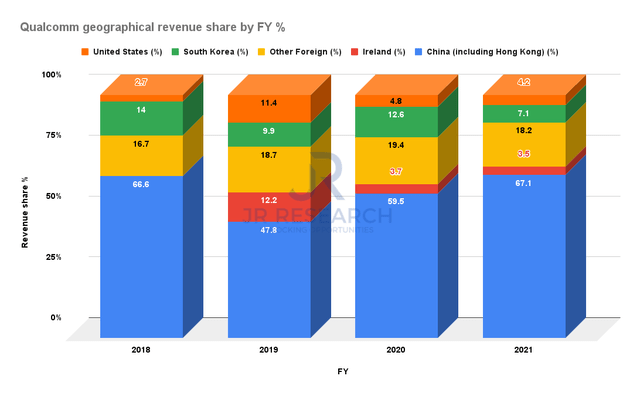

Qualcomm revenue share by geography % (Company filings)

We think there should be no doubt that the weakness could impact Qualcomm’s revenue. Qualcomm has consistently derived a significant percentage of its revenue from the Chinese Android smartphone makers, as seen above. Therefore, the de-rating by the market over the recent uncertainty seems justified.

Furthermore, famed Apple Inc. (AAPL) analyst Ming-Chi Kuo also highlighted in early April that he observed a reduction in Android orders. He added (edited):

Major Chinese Android phone brands have cut their orders for about 170M units since the start of the year, roughly 20% of their original shipping plans. The vast majority of those order cuts use MediaTek (OTCPK:MDTKF) chips, but Qualcomm is also likely to see a downtick, as its Snapdragon processors are used in a number of handsets. – Seeking Alpha

Given the impact of the recent lockdowns, we also expect weakness in consumer spending to persist in CQ2. Therefore, Qualcomm could be carrying some unexpected headwinds for its FQ3 (ending June). As such, the uncertainties over its impact could continue to persist until the summer before the release of its FQ3 card. However, we think the market is forward-looking. Moreover, given the significant compression of QCOM stock, we believe the market has been trying to price in such weakness.

Also, we don’t expect these to be structural headwinds. Therefore, we believe these COVID headwinds will have a merely transitory impact on Qualcomm’s multi-year one technology roadmap toward its expanded $700B TAM.

Furthermore, just yesterday (April 17), Shanghai authorities disclosed guidelines for businesses to resume work/production amid the recent lockdowns, using closed-loop management. Therefore, we believe that the Chinese government is committed to minimizing the impact on its economy and businesses, despite its strict zero-COVID policies. Notably, the approach is markedly different from 2021, when the government was in a “rectification” mode over its tech businesses. We believe that the Chinese government is committed to spurring economic growth in 2022 after a “largely successful” regulatory campaign last year.

Therefore, we remain confident that the recent pessimism over China’s impact is transitory. Hence, any significant compression over QCOM stock should be regarded as an opportunity to add exposure.

Is QCOM Stock A Buy, Sell, Or Hold?

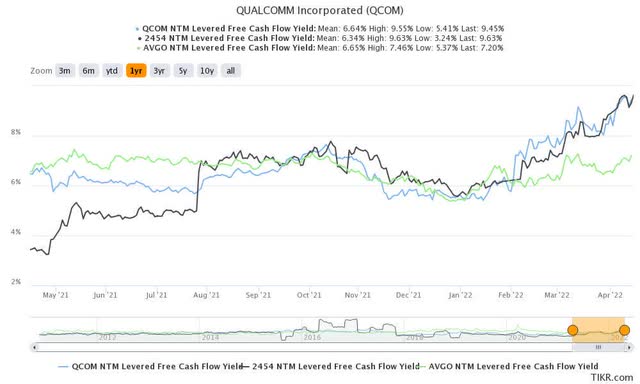

QCOM stock NTM FCF yield % (TIKR)

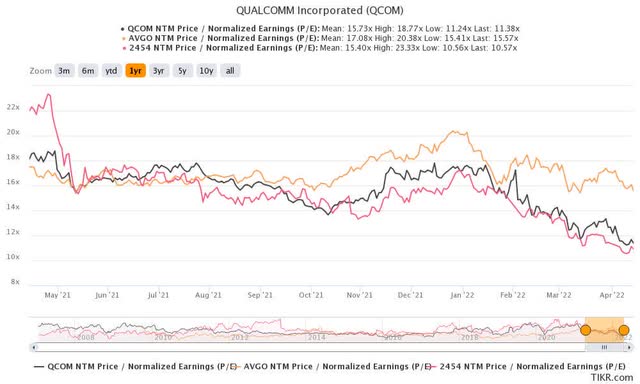

QCOM stock NTM normalized P/E (TIKR)

If we consider QCOM stock against semiconductor bellwether Broadcom (AVGO) stock, it seems the market is significantly discounting QCOM stock. But, we think this is unsurprising, given the company’s heavy reliance on handsets revenue. Therefore, the company’s execution in its diversification away from handsets would be critical to a re-rating of its valuation.

Consequently, despite Qualcomm’s highly competitive portfolio, the stock has trended closer to its smartphone SoC arch-rival MediaTek. We think the market’s “smartphone” valuation rating on QCOM stock could persist in the near term as the company scales in other segments.

But, we don’t consider its “smartphone tagging” as headwinds. We believe Qualcomm would continue to execute well, given its technological leadership. Hence, we think the opportunity for re-rating looks increasingly likely moving forward.

As such, we implore QCOM investors to capitalize on the recent fear to add exposure. Consequently, we maintain our Buy rating on QCOM stock.

Be the first to comment