Dilok Klaisataporn

Introduction: Where Do We Stand?

Invesco’s QQQ (NASDAQ:QQQ) is an exchange-traded fund that tracks the tech-heavy Nasdaq-100 index. After a scintillating summer rally off of June lows, tech stocks and equity markets, in general, have resumed their downtrend. The last time I wrote on QQQ was back in early June, and here’s what I said at the time:

In the near term, I see QQQ running up to the $320-330 range, but over the medium term, we are likely to decline to $250-260. These targets are based on fundamental, quantitative, and technical analysis shared in today’s note. With a near-term upside of 3-8% and a medium-term downside of ~20-25%, I’m not too fond of QQQ’s risk/reward here. Therefore, I am neutral on QQQ at current levels.

Source: Is QQQ A Buy Or Sell During The Dip? It’s Complicated

After initially dipping to ~$270 by mid-June, the QQQ went on a smashing rally to reach the $335 level by mid-August. On 15th August 2022, I wrote the following in my newsletter:

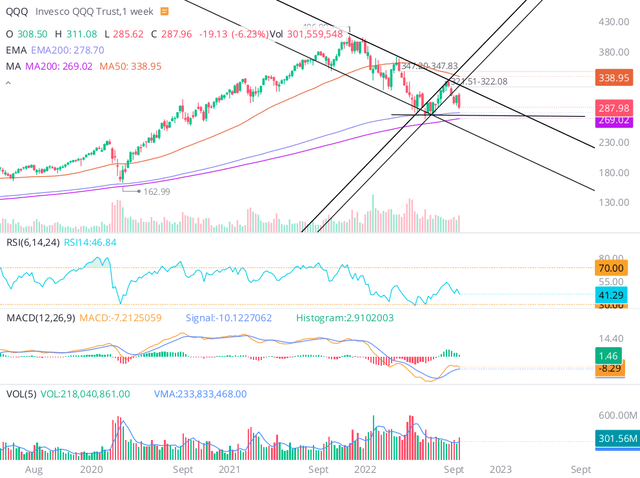

A series of higher highs and higher lows seem to reflect a strong bullish reversal; however, below-average trading volumes are unnerving. We are close to a resistance zone in the $335-345 range, and on the weekly chart, QQQ is testing the top end of the falling wedge pattern we have traded in for the last nine months. A rejection from this zone could quite easily trigger a retest of June lows.

Source: TQI Weekly – Issue #5: A New Bull Market Or Just Another Bear Market Rally

QQQ’s chart as of mid-August (WeBull Desktop)

Now, I am not sharing this history to showcase some extraordinary ability to predict the stock market. Instead, I strongly believe that nobody knows where the market is going in the near term. All we can do is analyze the fundamental, quantitative, and technical data to get a better understanding of what could happen in the market. And then orient our investing operations to benefit from this probabilistic understanding of the market environment.

Sticky inflation, rising interest rates, hawkish monetary policy, and slowing economic activity do not portend strong equity market returns for the foreseeable future. On Tuesday, the CPI inflation print came in hotter-than-expected at 8.3%, surprising market participants betting on a drop off in inflation. However, on the ground, inflation is slowing down [e.g., prices at the gas station are down significantly in recent weeks, home prices are declining, used auto prices are way off their peak, and there are many other instances]. Now, the lagging rents data (~30-40% of CPI) is set to make the headline inflation numbers look bad for some time to come.

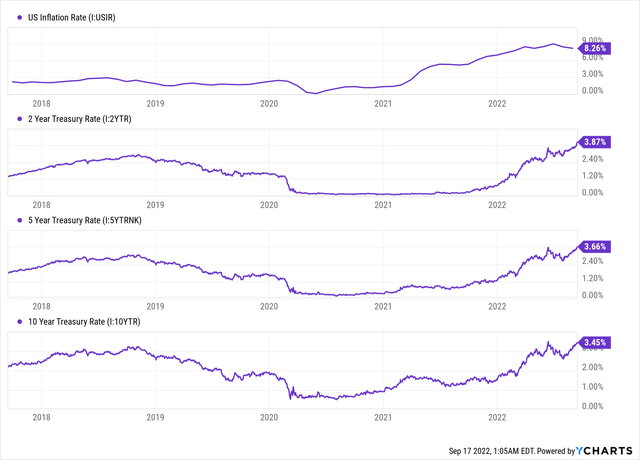

While renowned investors like Ray Dalio and Jeff Gundlach called out the rising probability of a recession during this week (and predicted another 20-25% decline in S&P500), the Fed seems to be focusing on countering inflation – moving full steam ahead with its quantitative tightening program. The expectations for the Fed’s September meeting (on 21st and 22nd) are now pointing toward a 75-100 bps hike in the federal funds rate, and the bond market seems to be pricing in more hawkishness from Fed chair Jay Powell, as treasury rates continue to shift up rapidly.

Legendary investor Warren Buffett’s quote comes to mind:

Interest rates are to asset prices what gravity is to the apple. When there are low interest rates, there is a very low gravitational pull on asset prices. The most important item over time in valuation is obviously interest rates.

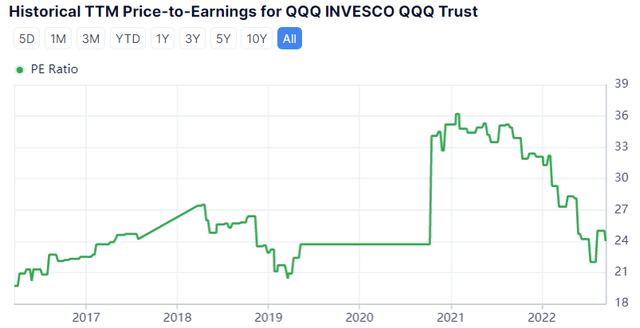

As interest rates have shot up in 2022, equities have been getting re-rated lower, and after a 28% YTD decline, the P/E ratio for Invesco’s QQQ ETF (QQQ) [an ETF tracking Nasdaq-100 index] has come down to ~22-23x. Looking at historical data from the past ten years, the QQQ seems like a no-brainer buy at around 20x earnings.

However, persistently-high inflation, rising interest rates, and slowing economic activity (amidst waning consumer confidence) are significant threats to corporate earnings and the valuation multiples attached to these earnings. Honestly, earnings may be the next shoe to drop in this market cycle, and Q3 & Q4 could bring a lot more volatility to the equity markets.

A Look At Some Recent Market Action

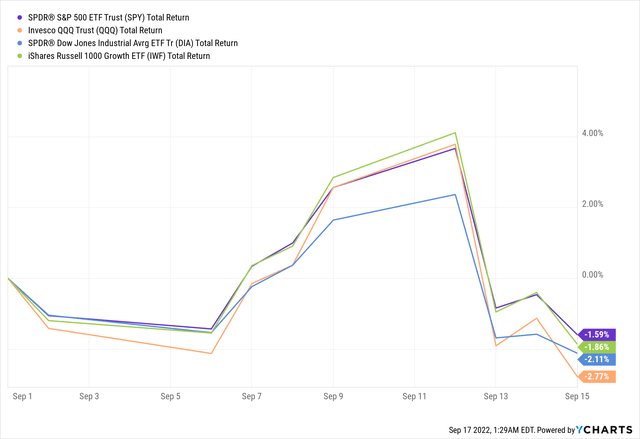

Broad market indices [S&P500 (SPX), Nasdaq-100 (NDX), and Dow Jones Industrial Average (DIA)] got off to a strong start in September; however, volatility returned to Wall Street last week. On Tuesday, stocks took a tumble (SPY down ~4%, QQQ down ~5%) as inflation data came in hotter-than-expected – raising expectations of a 75-100 bps rate hike by the Fed at its September meeting and even more hawkishness from the Fed. After a couple of benign days on Wednesday and Thursday, the sell-off resumed on Friday, with all major indices closing in the red. With the Fed tightening into a slowing economy, the fears of an economic recession are growing.

At my recently launched marketplace service, The Quantamental Investor, we saw our GARP & Buyback-Dividend portfolios experience a negative ROIC of -1.42% and -1.54% over the last two weeks, with a big chunk of weakness coming from a sell-off in large to mega-cap tech stocks. Interestingly, the performance of small to mid-cap (higher growth) companies was superior to that of their larger counterparts. As of the close on Friday, TQI’s Moonshot Growth portfolio had an ROIC of +3.76%, which was better than iShares Russell 1000 Growth ETF’s (IWF) return of -1.86%.

| Portfolio | Return On Invested Capital (%) | Portfolio Return to Date (%) |

| GARP | -1.42% | -0.75% |

| Buyback-Dividend | -1.54% | -0.79% |

| Moonshot Growth | +3.76% | +1.84% |

At TQI, our playbook for this bear market is –

Build long positions slowly and manage risk proactively.

If equity prices continue to fall over the coming weeks and months, then our dollar cost averaging plan will prove to be an effective risk management strategy. At TQI, we started our core portfolios with a 50% cash position, which we intend to deploy in a staggered way over the next ten months.

Where Is The Market Headed Next?

I don’t know where the market will be a week, a month, or a quarter from now. However, considering valuations and technical charts, I think a retest of QQQ’s June lows of ~$270 is very likely in the near term.

If we fail to hold these levels, QQQ may be in for a decline to the $215-235 range. And I say this because the tech generals (largest components) in QQQ – Apple and Microsoft – have a potential downside of ~30-40% each. Read my latest articles on this subject to understand my reasoning for this call:

We are getting closer to the Q3 (fall) earnings season, and that’s when we could see a resolution on either side of the ~$270 level. With rising interest rates, the P/E trading multiples on QQQ are unlikely to expand in the foreseeable future (unless the earnings drop off, in which case the price will likely follow). Overall, I am not too fond of QQQ’s medium-term risk-reward from current levels.

Final Thoughts

The Fed is hawkish as ever, and its balance sheet roll-off has just started. At some point, the Fed will break something in the economy, and then we will see yet another pivot. However, investors may have to undergo a lot more pain in equity markets before this happens. As the old adage goes –

Don’t Fight The Fed.

And we are abiding by this rule in all of TQI’s core portfolios by running our investing operations with ~50% in cash and deploying this cash slowly in a staggered fashion over a long period of time.

Over the near term, the QQQ is likely headed to June lows of ~$270, which is a downside of -7%. With the near and medium-term risk/reward being unattractive, I continue to rate QQQ ‘Neutral’ at ~$290.

While broad market [QQQ] is not enticing, there are loads of individual stocks offering asymmetric risk/reward opportunities. Being selective, contrarian, and right could yield spectacular returns for investors buying during periods of heightened volatility like the one we are experiencing today. I’ll leave you with this thought – “Invest actively and manage risk proactively.”

Key Takeaway: I am neutral on QQQ at current levels.

Thank you for reading, and happy investing. Please feel free to share any questions, thoughts, or concerns in the comments section below.

Be the first to comment